With 10-plus years of historical data… 10,767 brands covered in our 425-plus company universe… And 2,777 social media posts analyzed per minute…

We’ve yet to meet a social media database that comes anywhere near our predictive power in terms of turning social media chatter into investable opportunities.

One thing that makes our system unique is that we’re constantly working to expand the universe of companies and brands that we cover to keep you ahead of the curve.

When we’re not adding names requested by our hedge fund and institutional clients, we’re initiating coverage on consumer-facing companies that might not get a lot of attention.

Because if we simply covered the same stocks as everyone else, that wouldn’t give you much of a competitive investing edge.

We’re here to inform our Derby City Daily readers about new names and up-and-coming players that could be poised for major growth.

In 2023 alone, we’ve initiated coverage on 16 companies across all types of industries: some are recognizable names while others are low-profile brands on the verge of a breakout.

From fast-casual dining to furniture makers, software providers to gym franchises…

These are three investable companies we recently initiated coverage on that stand out from the bunch as must-watch stock opportunities (plus one bonus pick)…

Must-Watch Stock No. 1: The New Better Whole Foods

Natural Grocers (NGVC) is a national chain of – you guessed it – grocery stores specializing in all-natural products and health supplements.

Customers often compare it to Sprouts or Traders Joe’s since it caters to the same type of health-conscious, organic-leaning shopper. But Natural Grocers operates on a much smaller scale than those peers with 166 stores across 21 states (Sprouts boasts 370 while Trader Joe’s operates 561).

Customers love its robust and often locally-harvested produce selection, which many tout as being better than Whole Foods Market:

We wouldn’t call Natural Grocers the “new” Whole Foods considering it has 25 years on the Amazon-owned brand (Natural Grocers launched in 1955 vs. Whole Foods in 1980).

But is it the better Whole Foods? Customers certainly think so…

Natural Grocers has seen a 4% uptick in Consumer Happiness Mentions over the last quarter, bringing brand sentiment to 75% positive while Whole Foods brand happiness has remained flat at 67% positive.

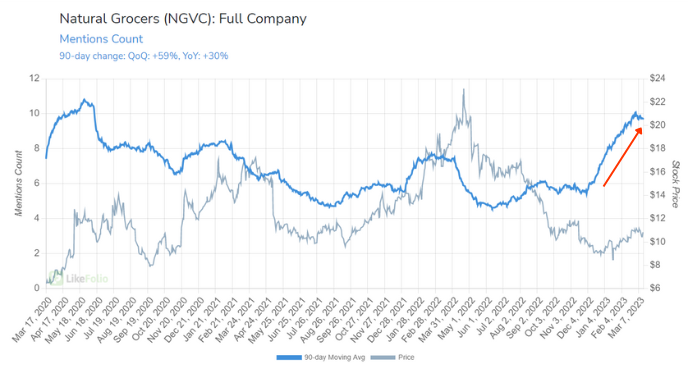

But what really caught our eye about Natural Grocers is that a “divergence” opportunity may be brewing, with buzz around Natural Grocers far outpacing its near-term share price improvements:

Mentions have climbed 59% from last quarter while Purchase Intent (PI) Mentions, measuring whether or not a social media poster actually spent hard-earned cash, have risen 13%.

Keep an eye on this grocery stock.

Must-Watch Stock No. 2: Cheap Eats in the Neighborhood

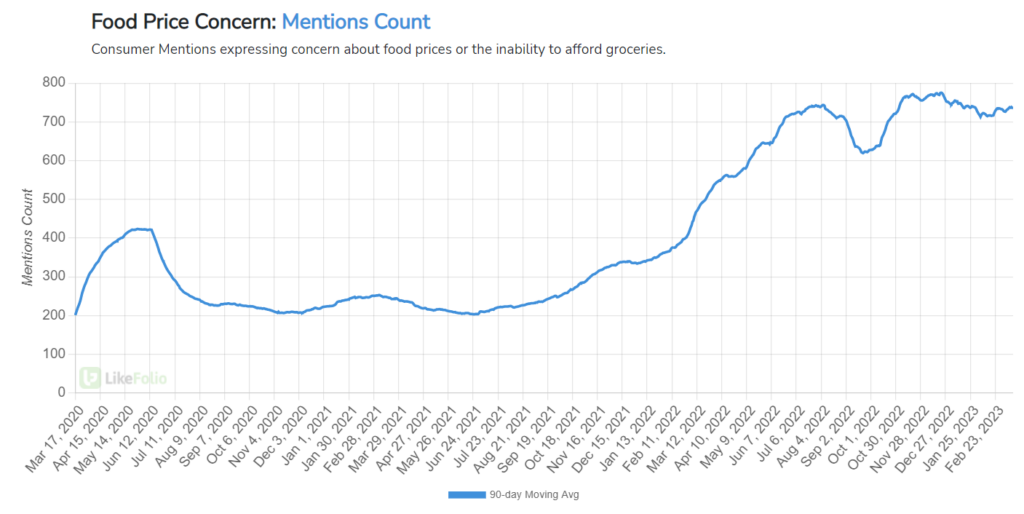

Food prices have been a driving concern for American consumers ever since inflation reached a boiling point in June. Prices have cooled since then, but not enough to buck the trend.

Consumer Mentions expressing concern about food prices or the inability to afford groceries are still up 52% year-over-year (YoY):

Still, folks need to eat – and post-pandemic, more and more want to socialize while doing it.

That’s where Dine Brands (DIN) affordable restaurant chains like IHOP and Applebee’s thrive.

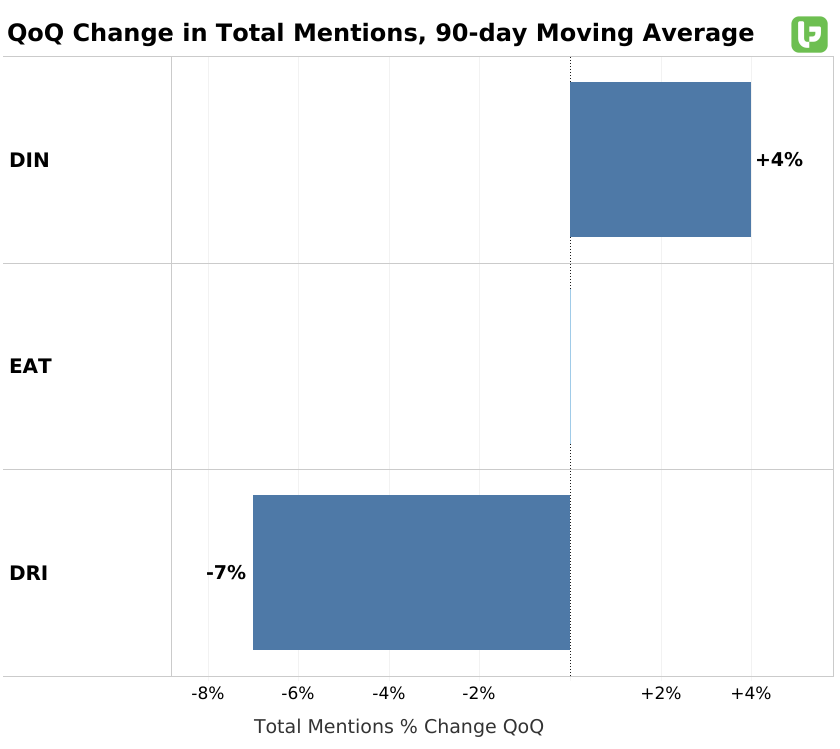

Mention volume across the full Dine Brands roster rose a modest 4% quarter-over-quarter (QoQ), putting it slightly ahead of peers like EAT (Chili’s), and DRI (Olive Garden):

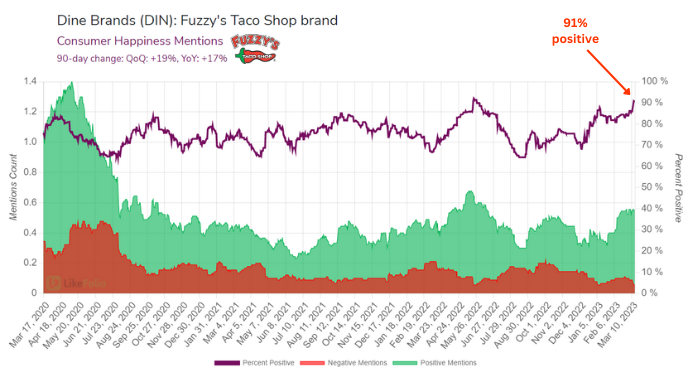

IHOP and Applebee’s are the most well-known under Dine’s umbrella but it recently added a new name with the acquisition of Fuzzy’s Taco Shop, which Dine CEO John Peyton plans to turn into a national brand.

That strategy could be just what Dine needs considering how much folks seem to love Fuzzy’s, which enjoys a tough-to-beat 91% Consumer Happiness score:

Must-Watch Stock No. 3: Everyone’s Favorite Recliner

La-Z-Boy (LZB) is much more than just the recliner your uncle falls asleep on after dinner: This furniture maker offers everything from loveseats and sectionals to home accents and kitchen and dining furniture.

The company is meshing its reputation for comfort with more upscale offerings, like a dining table made of solid New Zealand pinewood.

LZB caught investors’ attention in February with a solid earnings report driven by increasing consumer appetite for “comfortable custom furniture with quick delivery” and improved execution on the production side.

Shares popped 17% higher following the report:

La-Z-Boy has also made some notable shareholder-friendly moves over the last five years, paying out $121 million in dividends and repurchasing $217 million in shares.

Bonus Pick: The Ultimate Junk Food Collab

Social media is buzzing over news that Krispy Kreme (DNUT) will expand a test with McDonald’s (MCD) to sell three flavors of donuts in select MCD locations starting March 21.

So far, our database has picked up a 7% YoY increase in social media chatter… And Krispy Kreme’s share price is ticking higher, too – gaining 35% and counting since the start of the year:

We’ll be watching to see if this partnership can help inject new life into this iconic brand.

Is there a specific company that you’d like to see our data on? Let us know at [email protected].

All the best,

Megan Brantley

VP of Research