U.S. consumers dropped more than $41 billion online alone in the five days spanning Thanksgiving and Cyber Monday, up 8.2% from the same period a year ago.

In the peak hours of Cyber Monday, from 8:00 pm to 10:00 pm, consumers spent $15.8 million every minute.

E-commerce at large looks strong this holiday season. And today, we’ll take a look at the big winner from all this consumer spending: Amazon.com (AMZN).

LikeFolio named Amazon as one of our three early holiday shopping leaders, alongside Lululemon (LULU) (we saw how well that worked out) and PayPal (PYPL).

All three of these stocks have gained nice traction in the weeks since.

But today, we want to focus on what Amazon in particular is doing right…

The Mobile Shopping Destination

On a trend level, one thing Amazon has done really well is improve its mobile shopping experience, making it super easy to find and check out on its app.

That’s key: These days, consumers prefer shopping on their mobile devices rather than desktop, with 57% of online sales now made on mobile.

And it’s working.

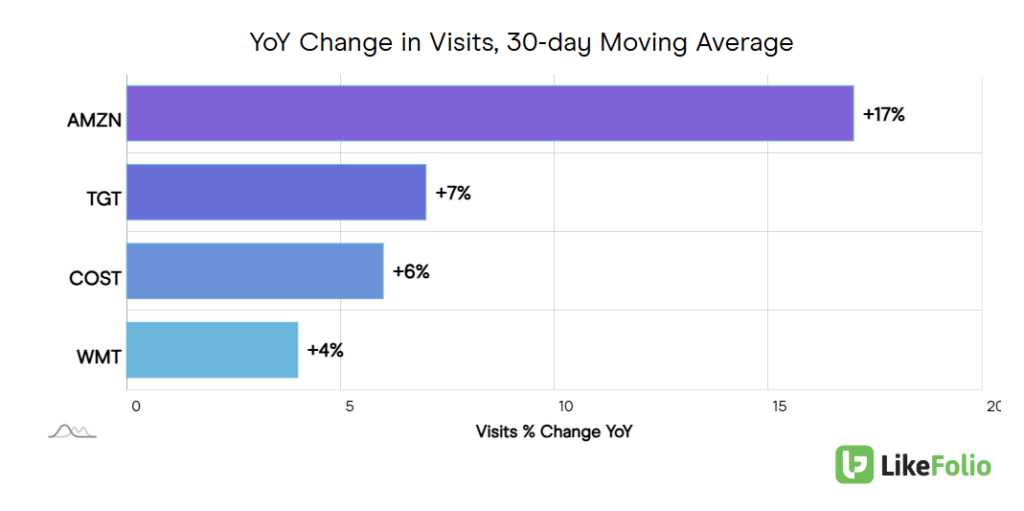

Amazon’s digital traffic is accelerating as the holiday season ramps up, outpacing other traditional retailers, even Walmart (WMT), when it comes to growth in web visits:

Prime Time for Amazon

Prime subscription growth is up significantly, too: +42%. Prime is estimated to account for more than half of U.S. paid retail membership fees, eclipsing even Costco (COST) and Sam’s Club (WMT), which clock in at 9.5% and 5.9%, respectively.

A whopping 184 million Americans – an 8% jump since 2023 – have sprung for a $139 annual membership, which includes free two-day shipping, unlimited Prime Video streaming, and exclusive sales like Prime Days.

We’re tracking more than 100 million daily active users on Amazon’s Prime app – higher compared to last year’s levels – and extremely strong adoption of its Prime Video app.

Streaming Still Dominates

Not only does AMZN benefit from e-commerce shopping ahead of the holiday season, but it is a poster child for launching live sports and incorporating ads.

It launched a strategic partnership with the National Football League (NFL) worth an estimated $10 billion over 10 years, and viewership was up 20% during just the first four games this season. In 2025, look for NBA games and Nascar races.

Amazon offers unique advertising opportunities through “audience-based creative,” allowing brands to tailor content based on access to the vast data of its nearly 200 million Prime members.

Netflix (NFLX) should take notes (and has).

AI Ties It All Together

Amazon is using the power of generative AI to improve business operations across the board.

Knowing and showing Prime members what they like and tend to buy has paid off on the e-commerce side, and the data that Amazon’s home assistant, Alexa, leverages AI to make recommendations and optimize interactions with its users.

Amazon is unparalleled when it comes to shipping and logistics – that two-day (or less!) shipping is no joke – and it’s all thanks to AI. Last year after adopting Sequoia, a new system that identifies inventory and reduces processing time, the company boasted that packages were prepared for dispatch within 11 minutes of ordering.

From there, it uses AI to plot delivery times and routes, taking into account weather and traffic conditions.

AI and machine learning are integral to Amazon Web Services (AWS), a cloud-based service that offers companies app hosting, databases, security, and analytics and contributes 18% to the bottom line.

Bottom line: With powerful macro trend tailwinds at its back, and improving LikeFolio metrics, we expect AMZN to move higher from here.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

With Executive Security in the Spotlight, Here Are 5 Stocks to Watch

Top company execs need protection – these five companies provide it…

Digital Wallet Winners and Losers: One Stock to Avoid (And Two Better Bets)

Block shares are up 53% in the last six months, but LikeFolio data suggests SQ may not be the winner Wall Street thinks it is…