The Swan Brothers have always been a bit of a package deal.

Before Landon and I teamed up to launch LikeFolio a decade ago, we were betting on Grandpa Rock’s racehorses together at the track…

Moving to Louisville to earn our degrees from Bellarmine University…

Even starting parallel careers at TD Ameritrade.

And it was there at TD Ameritrade when we first made the epiphany-level discovery that inspired LikeFolio – and led to the Derby City Insights you know today.

An assignment took us on a deep dive into Twitter, where we realized that:

- Consumers enthusiastically share the brands they purchased on social media…

- We could use that data to forecast the sales of the companies that own those brands…

- And those sales forecasts can be used to make big-profit stock picks.

We watched as consumer insights on social media spiked – and then sales followed suit. And it happened over and over again.

Once this lightbulb went off, and the link between social media chatter and purchase intent was clear, we knew we were sitting on a real edge.

We got Megan Brantley (our VP of Research) on board. We even secured an endorsement from Georgetown University with a study that proved our technology could “predict” future outcomes.

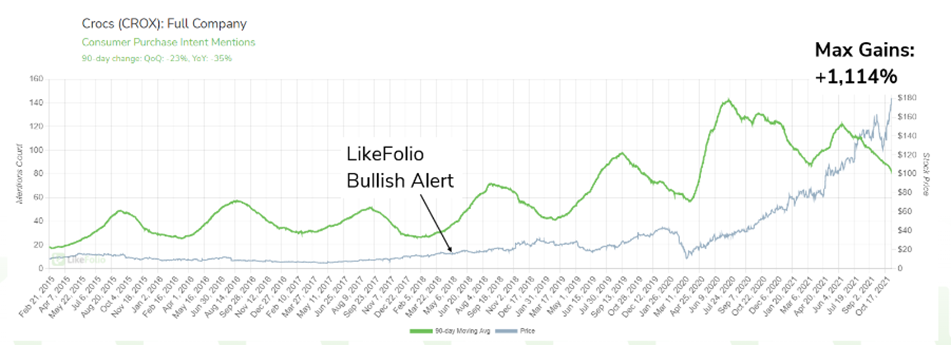

And we’ve been racking up win after win ever since – leading our followers to future moneymaking stocks like Crocs (CROX) before they skyrocket to gains as high as 1,000% (or even more).

Our secret sauce? A powerful consumer insights machine that analyzes millions of social media posts in real time to tell us when three key things line up in favor of a company:

- Strong Consumer Demand

- High Consumer Happiness

- Macro Trend Tailwinds

Finding this edge not only lets us cash in on the stock market but also helps you do the same…

Which is why today, we’re sharing three companies that hit the mark on one or all of those metrics so all our Derby City Daily readers have a shot at winning big this year.

The three names that made the cut:

For Coinbase, we’re watching a significant uptick in crypto interest following the banking crisis that rocked consumer confidence in institutions earlier this year. Through the chaos, this trusted exchange has emerged as a clear winner.

For Hims & Hers, it’s a classic “underdog” story. Compared to its more storied competitors, this up-and-comer in the telehealth and wellness industries brings in a fraction of the revenue – while delivering multiple times the growth.

And for Pinterest, we see a misunderstood social media stock that’s actually a golden AI opportunity in disguise – one that the market hasn’t even caught onto yet.

With these picks, our wins will become your wins – starting today.

Enjoy,

Andy Swan

Founder, LikeFolio

Coinbase (COIN)

⭐ Andy’s Pick

When banks started collapsing, Bitcoin (BTC) roared back from the doldrums and shot upwards of $30,000.

But it happened so fast that most folks didn’t have a chance to fully process what was happening.

Banks, which have been around 1,800 BC, have traditionally been viewed as a super-safe haven for cash.

But with the crisis, that view suddenly changed.

Banks were now risky.

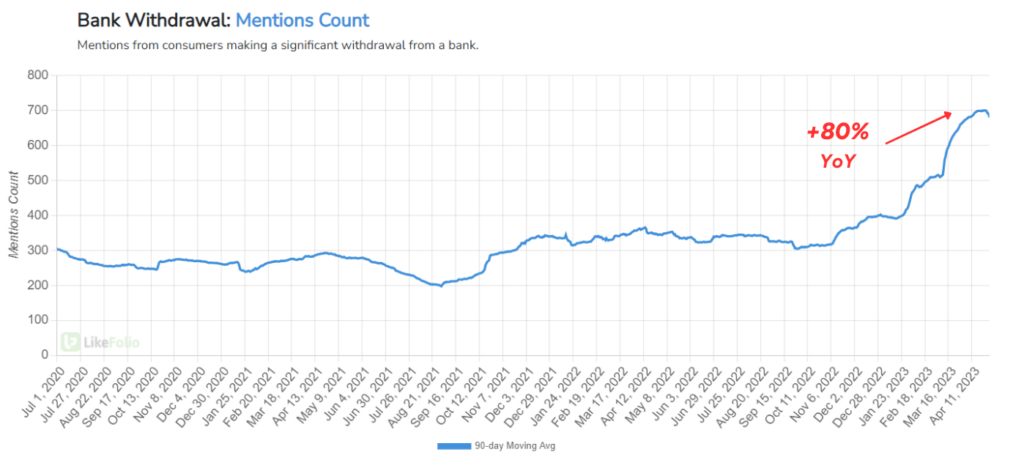

We can see the drastic shift in sentiment clear as day in LikeFolio’s consumer data – with mentions of making a significant withdrawal from a bank skyrocketing in 2023:

And in one of those ironic market moves, a digital asset that was created less than 15 years ago was suddenly viewed as a safer option.

We witnessed a “flight to safety,” from banks and into cryptocurrencies, where our database is logging hefty year-over-year ramp-ups in momentum for three adjacent trends:

- Decentralized Finance: +323%

- Trading Crypto: +42%

- Blockchain Technology: +69%

As the world’s largest publicly traded cryptocurrency exchange, we believe Coinbase is positioned better than anyone to cash in on a crypto future.

The company provides the “infrastructure” that makes global cryptocurrency trading possible, including:

- Cryptocurrency accounts, digital tools, and educational resources for individual investors…

- A crypto transaction marketplace for institutions…

- And technology that helps developers build crypto-based apps that can accept crypto as payment.

Coinbase’s exchange platform offers trading in hundreds of different cryptocurrencies with $130 billion in assets on its platform.

And because it collects a percentage on each transaction, Coinbase’s performance is directly tied to interest in Bitcoin and Ethereum (ETH)… Meaning the renewed interest in crypto here in 2023 bodes well for its bottom line.

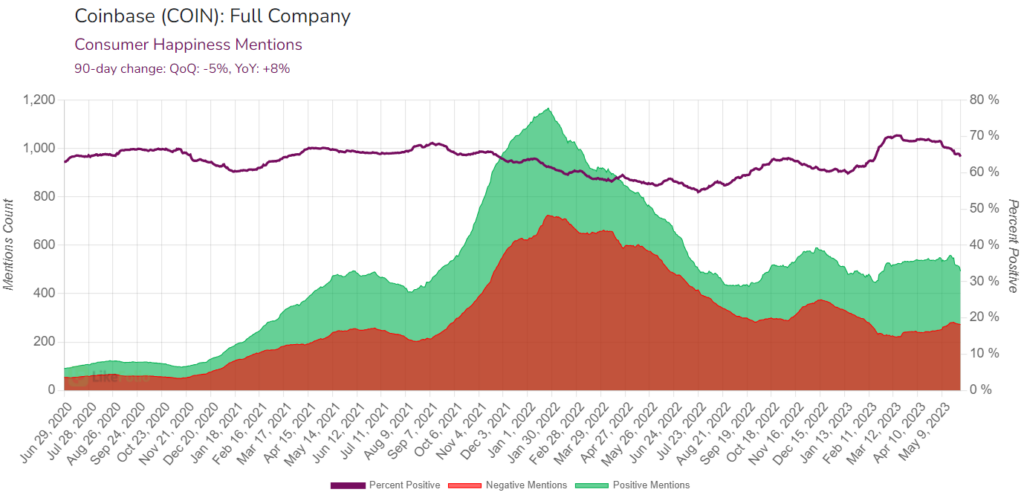

We’ve seen significant leaps in positive sentiment for Coinbase amid the banking disaster.

The company’s user-friendly interface makes it easy to attract first-time crypto buyers – and to keep the customers it already has.

Perhaps more important: Because its financial statements are audited by a Big Four accounting firm, it provides a level of transparency that no other crypto exchange is able to.

And that’s translated to an 8% year-over-year boost to Coinbase’s Consumer Happiness levels:

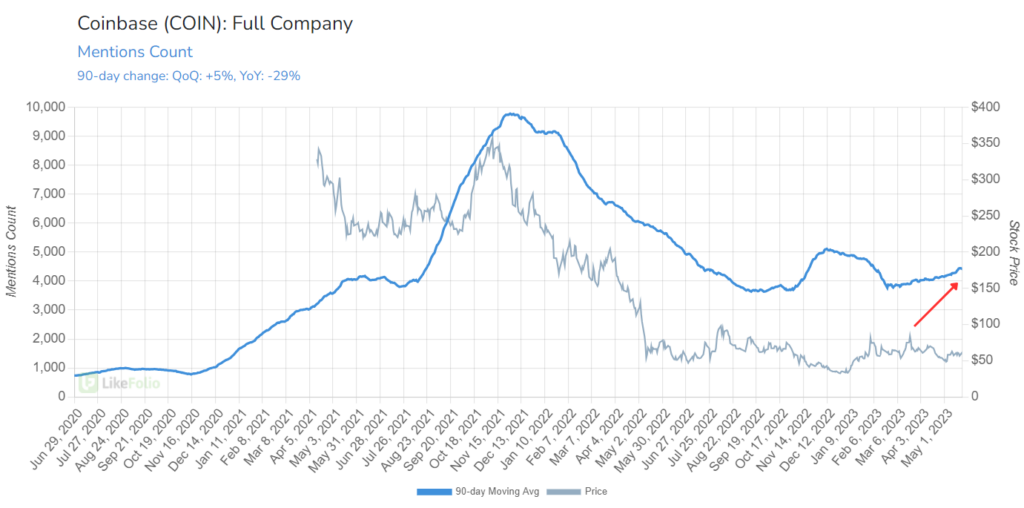

Overall buzz around Coinbase is gaining steam again too, up 5% quarter-over-quarter:

Just remember that where there’s crypto, there’s volatility. And that makes Coinbase an inherently risky play.

In June, the U.S. Securities & Exchange Commission (SEC) sued Coinbase, alleging that the company was acting as an unregistered broker and exchange.

The move is ironic and hypocritical, to say the least. The SEC approved Coinbase’s IPO based on the same business model just two years ago.

While the SEC’s lawsuit against Coinbase may seem like a setback, history has shown that increased regulation can actually create moats of invulnerability for established players.

By navigating these regulatory challenges, Coinbase could solidify its position in the market, making it harder for new entrants to compete.

We don’t know how things will shake out.

What we do know is that COIN is up 93.89% year-to-date – and we plan to keep making money.

Hims & Hers (HIMS)

⭐ Landon’s Pick

Head to your local CVS or Target, and there’s a good chance you’ll find one of these endcaps featuring wellness products for everything from skincare to hair loss to dietary supplements…

That’s Hims & Hers, whose sleek packaging stands out among the typically overcrowded, chaotic shelves of most drugstores – where most products scream with never-ending ingredient lists, gaudy colors, and outdated fonts.

Hims & Hers over-the-counter (OTC) products are available in over 11,400 retail locations – other than CVS and Target, you’ll find them at Walmart, Walgreens, Bed Bath and Beyond… Head to your Amazon.com app and you can buy products there, too.

The branding is on point, with trendy, monochrome packaging that speaks to the Millennial and Gen Z factions.

But its products cater to the needs of any age group, with treatments for once-thought-to-be embarrassing ailments like hair loss, erectile dysfunction, and acne, just to name a few – all wrapped in its “No stigma, just treatment” messaging.

While Hims & Hers has bolstered its brand awareness by putting its OTC products in tens of thousands of brick-and-mortar retailers across the country, it also offers prescription drugs through its website. You can book online consultations with its vast network of physicians for as little as $39.

We’re talking everything from birth control to anti-depressants – making Hims & Hers a true one-stop shop for health and wellness.

Even better? Sticking to its “No stigma, just treatment,” mantra, Hims & Hers delivers everything to your door in discreet packaging.

We believe Hims & Hers has the goods to be a long-term player, especially considering the powerful macro trend tailwinds pushing it forward…

Coming out of the pandemic, Americans are “on the go” once again – getting outside, socializing, and overall looking for ways to get healthy, be active, and look and feel good.

And according to LikeFolio mention data, they’re increasingly interested in:

- Digestive/Gut Health: +26%

- Mindfulness: +38%

- Improving Sleep: +5%

- Brain-Boosting Supplements: +32%

- Health and Wellness Coaching: +15%

…all things Hims & Hers offers a solution for.

We also know consumers are clamoring for these products.

Our data shows demand for Hims & Hers is up by 53% from last year:

That’s reflected in the numbers: Hims & Hers reported an impressive first quarter, bringing in $190.8 million in revenue.

Compared to a more storied telehealth competitor like Teladoc (TDOC) bringing in $629.2 million, that might not look like a lot.

The thing is, for HIMS, that represented 88% year-over-year growth. Teladoc’s growth: 11%.

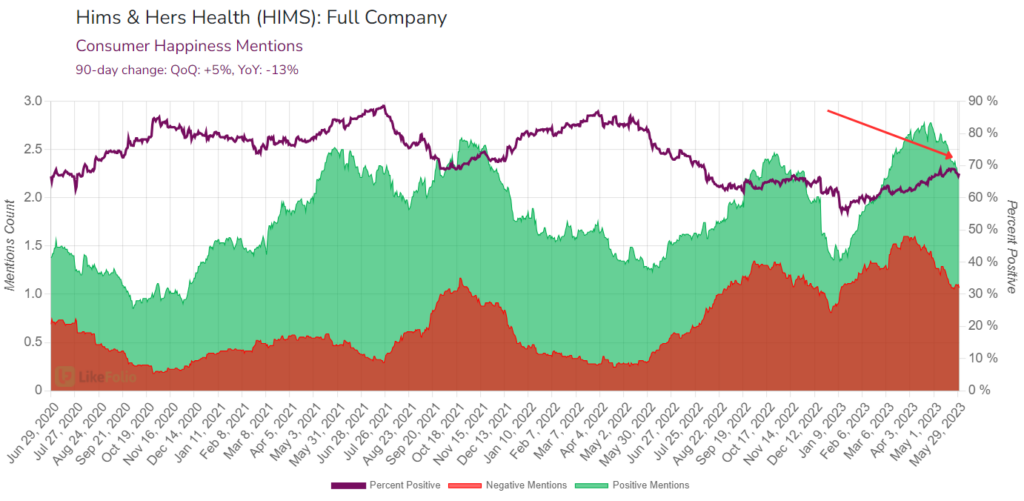

The only caveat is that right now, Hims & Hers Consumer Happiness is hovering around 66%:

What we really want to see to check the box on high Consumer Happiness is for the percentage of positive mentions to be at or above 70%.

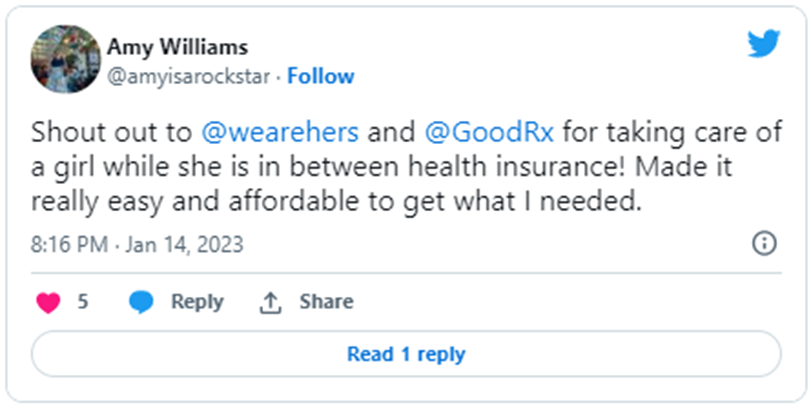

Some customers are decidedly happy with their service.

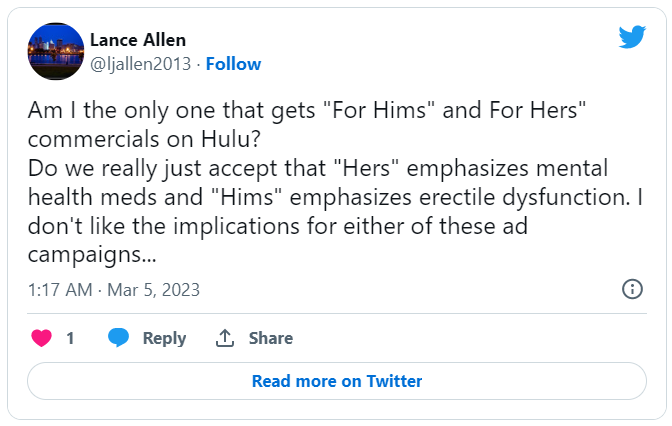

Others have grumbled about the company’s choice of advertising, which has rubbed some folks the wrong way.

Whether or not complaints about one specific ad campaign will have any lasting impact remains to be seen, but the comments above could indicate more of a short-term stumble.

Hims & Hers has plenty of catalysts lining up in its favor that have us feeling bullish on this underdog.

The stock has gained 30% so far in 2023 and we expect plenty more where that came from.

Pinterest (PINS)

⭐ Megan’s Pick

Even though it’s often lumped into the social media stock category, what Pinterest provides is more like the ultimate vision board.

It allows users to curate new recipes, fashion trends, wedding ideas, crafting inspiration, home design, organizational tools… pretty much anything you can think of.

Remodeling your kitchen? Head to Pinterest to get inspired, build your vision board, and buy what you need without ever leaving the app – no popups or 30-second forced video ads needed (looking at you, YouTube).

The company realized the importance of seamlessly blending content and ads where people weren’t even really able to tell where one began and the other ended. Way back in 2015.

For an undisclosed figure, Pinterest bought the recommendation engine tech startup Kosei, which could recognize “400 million relationships between 30 million products.”

With Kosei’s tech, Pinterest can help match content recommendations people want to see while also connecting what people are searching for with relevant advertisements.

In June 2022, Pinterest signed a definitive agreement to acquire The Yes, an AI-powered shopping platform that enables people to shop a personalized content feed of styles, sizes, and brands.

And the company recently garnered praise for its new partnership with LiveRamp, which helps Pinterest’s advertising clients better understand what is and isn’t working so they can better target consumers.

Pinterest is an advertiser’s dream, boasting a 2.3x more effective cost-per-conversion than ads on other social media sites.

But consumers love it too.

Of all the social media companies we track, Pinterest has the highest Consumer Happiness by far at 75%:

Compare that to Snapchat’s (SNAP) 58%, Instagram’s 65%, and Facebook’s 56%.

Pinterest’s AI-powered recommendations are doing such a good job that it doesn’t even feel like people are bombarded with ads or feel like they are being hit over the face to buy something.

It works. A stunning 85% of its weekly U.S. pinners have made a purchase from a pin they saw from a brand.

And between 2020 and 2022, even though Pinterest’s average annual userbase grew by a moderate 4% as usage tapered off from its pandemic-era boom, the company was still able to grow its annual revenue by 65%.

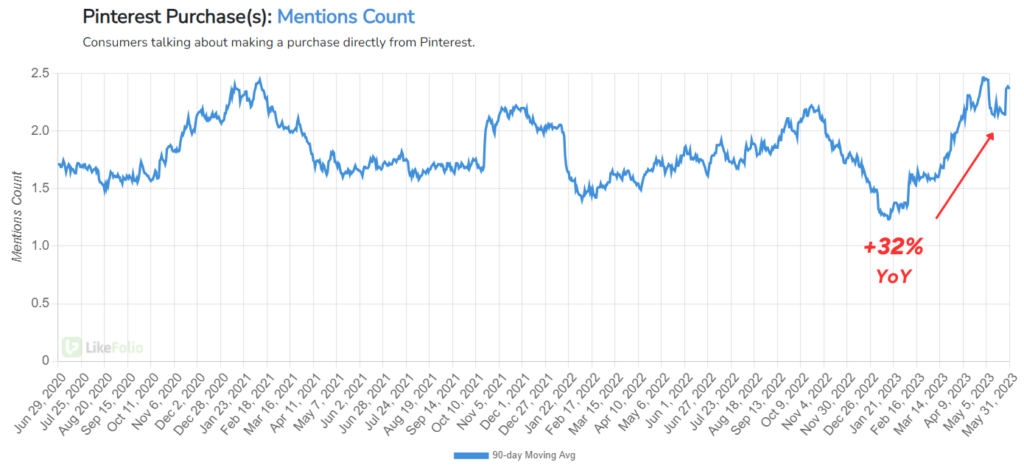

So far this year, LikeFolio data shows consumers talking about buying products from a brand they discovered on Pinterest looking strong, on pace to best last year’s mark by 32%:

After Wall Street all but left this social media stock for dead – shares started the year at just $23.16, which was down more than 70% from their 2021 highs – it looks like we’re in the early stages of a comeback.

PINS is up 11% year-to-date, as of this writing.

The Bottom Line

Thanks to LikeFolio data, we have a real-time read on perceived value that allows us to spot diamonds like COIN, HIMS, and PINS.

The market may have overlooked or tossed these winners aside… but as you can see, LikeFolio data suggests each of these picks is poised for one heck of a bounce back.