“Know your strengths” is a sage bit of life advice on its own – and one that can be applied to investing and trading, too.

I know because, with five years of earnings seasons trading under our belt (and four seasons per year), our team has figured out where the strengths lie in our data.

The verdict: Our predictive social media insights give us a significant edge with small-cap, lesser-known companies that are gaining serious momentum with consumers.

And when we pair that momentum with the millions of data points our system aggregates on consumer macro trends, we’re able to spot earnings surprises with impressive accuracy… well ahead of the market.

I’ll prove it to you today.

Because as we gear up for what promises to be the most exciting earnings season in recent memory, we tapped into our LikeFolio Long-Term Score to identify potential surprises looming on the horizon and found three names that caught our attention.

The LikeFolio Long-Term Score is basically a forward-looking version of our proprietary Earnings Score: It takes into account all of our consumer sentiment data, along with macro trends, to deliver a simple -100 to +100 metric. The higher, the better.

(And you can unlock the Earnings Scores of hundreds of companies in our coverage universe to know if you should be bullish, bearish, or neutral heading into their next report – plus, get our recommended trading strategies – by clicking here.)

Each of these names hits three promising criteria, plus offers additional upside based on relative weakness in their stock performance:

✔️ Small-cap stock trading under $10

✔️ Long-term LikeFolio score of 50+ (meaning it’s in the top 5% of all companies in our coverage universe)

✔️ Surprising demand growth

And with one of them reporting earnings next week, we knew we had to get you this analysis ASAP – here’s what you need to know…

Upside Surprise No. 1: Trivago (TRVG)

📊 Long-Term LikeFolio Score: +50

🚀 Share Price as of Apr. 6: $1.46

⏰ Earnings Countdown Clock: 26 Days (expected May 1)

Trivago (TRVG) is a travel aggregator that allows consumers to compare costs for listings from hotels, resorts, and even other online travel companies to find the best deal.

Right now, it’s riding three major consumer tailwinds we’ve been tracking in 2023: Consumers prioritizing experiences, that itch for post-pandemic travel, and inflation-driven desire to find the best deal.

And for Trivago, that’s translating to a sizable boost in both overall buzz and demand for its services in 2023:

Purchase Intent (PI) Mentions are up 47% year-over-year (YoY) for Trivago and 27% just this quarter, which could translate to real revenue when it comes time to report earnings.

The company is leaning into its deal-finding value proposition, as evident in its most recent letter to shareholders, which states:

“…in the second half of the year, we started to see first signs that travelers around the world are trying to mitigate the impact of higher hotel rates by comparing different hotel offers or searching for cheaper destinations. In this environment, we believe that the value of metasearch has increased, and we have shifted our focus to innovation in our core product and plan to improve transparency of our offering and price comparison functionality.”

Macro data suggests elevated interest in global travel (+10% YoY) serves as a tailwind for Trivago, which serves the European market and Brazil.

As consumer metrics improve, TRVG is trading near multi-year lows. And with diminished expectations, a surprise may be brewing.

Trivago is expected to report earnings on May 1, so make sure you’ll know how to access our recommended trading strategy now by watching this. (That’s where we’ll tell you everything you need to know.)

Upside Surprise No. 2: Eventbrite (EB)

📊 Long-Term LikeFolio Score: +50

🚀 Share Price as of Apr. 6: $8.20

⏰ Earnings Countdown Clock: 27 Days (expected May 2)

Eventbrite (EB), an event-management platform most well-known for locally grown entertainment, proved how well it can outperform with last quarter’s earnings report.

With higher-than-expected top-line growth (+20% YoY) and improved guidance, EB shares went 12% higher following the announcement.

LikeFolio data shows that Eventbrite hasn’t just maintained its momentum since then – demand has actually accelerated:

Consumer demand in the first quarter ended March 31 rose by 42% YoY, three points higher from levels recorded when the company had its Q4 earnings surprise.

Moving forward, demand for Eventbrite’s bread and butter live events continues to climb despite economic headwinds. And revenue in this segment is expected to increase across all core categories through 2024:

Even after the positive market reaction to its last report, EB shares are trading nearly 70% lower than they were a year ago. But strong consumer data supports a bullish outlook from here.

Upside Surprise No. 3: Sportsman’s Warehouse (SPWH)

📊 Long-Term LikeFolio Score: +55

🚀 Share Price as of Apr. 6: $8.02

⏰ Earnings Countdown Clock: 7 Days (expected April 12)

Now, here’s the one you want to pay attention to for next week: Sportsman’s Warehouse (SPWH), a company that specializes in all things you may do outside.

We’re talking hunting, shooting, fishing, camping, boating… This place outfits just about any hobby you can imagine that would make a city slicker flinch.

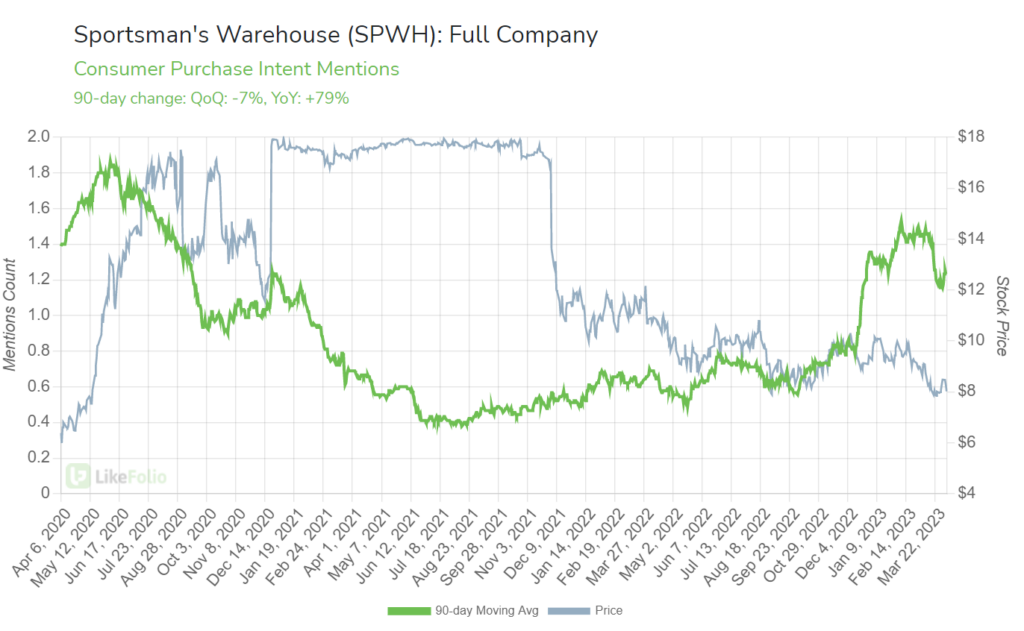

And as consumers go all-in on their outdoor hobbies, Purchase Intent Mentions for SPWH have increased by nearly 80% on a year-over-year basis:

Initially following its last earnings report, SPWH shares plunged on soft guidance and lower-than-expected demand for firearms coming out of the pandemic.

But looking ahead, the company is focused on expanding its footprint:

“As we look ahead, our funnel of real estate remains robust and we are moving with discipline and rigor to accelerate the growth of our store footprint. Our funnel as we sit here today is well over 100 locations and we see a path to our target of 190 to 210 total stores in the fleet by the end of fiscal 2025.” – Jon Barker, CEO

While this growing footprint is helping to expand Sportsman’s consumer base and drive demand higher, it does increase costs. And near-term dips in Consumer Happiness – some of which is politically motivated – give us some pause.

But demand growth over the long term suggests the bar may be low enough for an earnings surprise.

The fact is, it doesn’t matter whether we’re bullish, bearish, or neutral on a company heading into an earnings event – the right strategy can deliver you a hefty payoff time and time again.

We’ll show you how our hand-picked earnings season trade recommendations allow you to take on an appropriate, clearly defined (and limited) amount of risk – without having to go long or short on a stock.

Go here now to see for yourself just how magical the risk/reward calculus of earnings season can be.

Until next time,

Andy Swan

Co-Founder