Meta Platforms (META) is riding one heck of a tech resurgence wave.

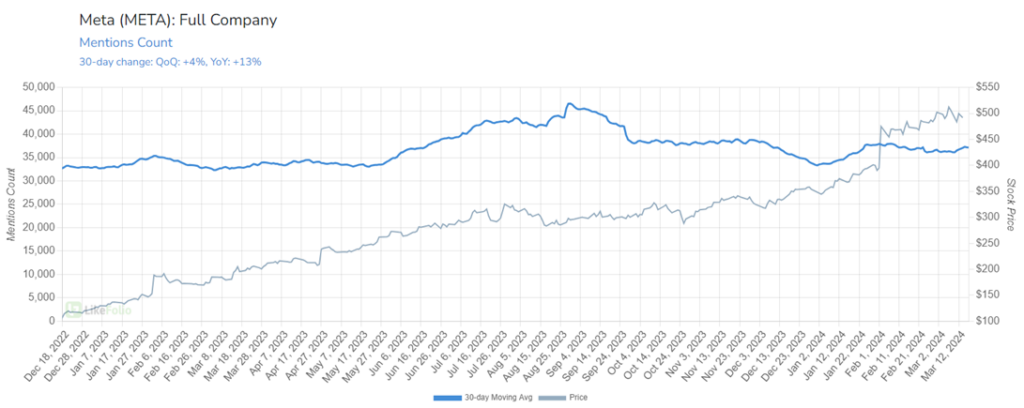

Shares of the social media empire are up more than 400% from 2022 lows – and +40% in 2024 alone.

We haven’t always been quite as enamored with META as Wall Street. As recently as November, LikeFolio data simply wasn’t supporting the hype.

(Though we did deliver a 114% profit opportunity to our MegaTrends subscribers.)

But data trumps all here at LikeFolio. And with the narrative on Main Street finally shifting in Meta’s favor, we’re changing our tune.

This latest LikeFolio data corroborates Meta’s gains and even paints a bullish story from here…

Reason No. 1: TikTok’s Loss Is Meta’s Gain

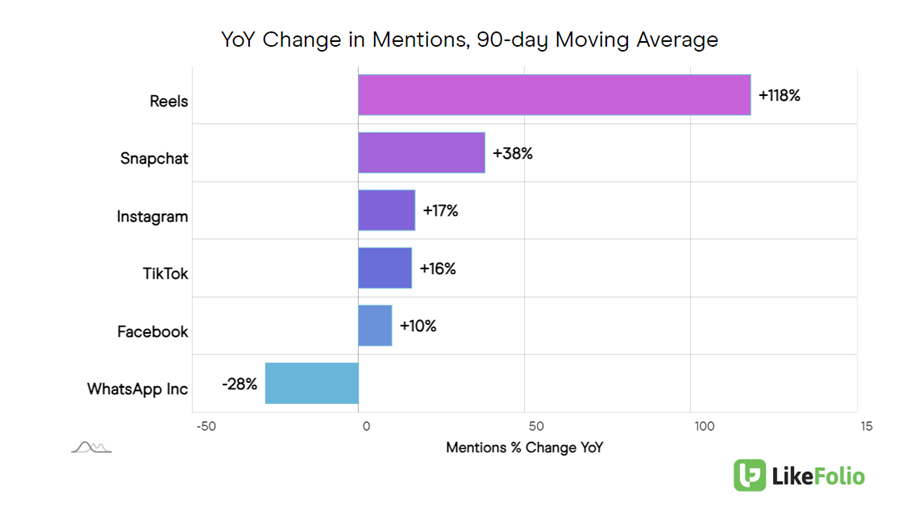

Mention buzz is accelerating 13% on a year-over-year basis, largely driven by consumer adoption of Reels, Meta’s answer to TikTok.

Earlier this month, the U.S. House of Representatives passed legislation that could lead to TikTok being sold or banned, addressing national security concerns over data privacy. However, a sale wouldn’t completely solve data security issues, and the proposal faces significant challenges, including ownership and antitrust concerns.

TikTok might have lost that battle, but data suggests META is already winning the war for consumer eyeballs, regardless of TikTok’s availability in the U.S.

Reels mentions are up by triple digits (+118%) year over year, besting TikTok growth and continuing to chip away at market share:

If there’s anything Meta is good at, it’s copying app designs and pushing it through to the billions of users already on one of its social platforms. Meta claimed 3.07 billion monthly active users last quarter alone.

Reason No. 2: Ad Spend Recovery Underway

The battle for eyeballs is really a proxy for advertising spend.

Last quarter, much of this spend came from overseas, with China-based advertisers like Temu and Shein accounting for 10% of sales as they try to break into the U.S. market.

META will benefit as the ad market at large recovers.

No. 3: Quest VR Finally Gets Its Moment

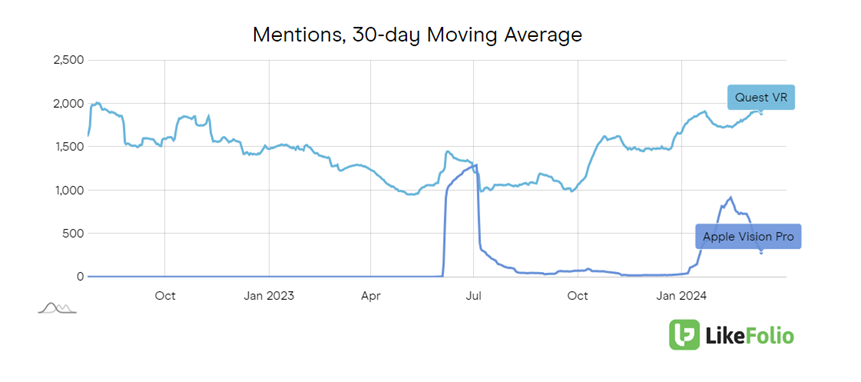

Aside from advertising, META may prove the near-term winner when it comes to artificial intelligence (AI) headsets.

Though Apple’s (AAPL) Vision Pro was impressive, the world wasn’t quite ready for it… yet.

You can see on the chart above: Apple’s Vision Pro drop actually served as a catalyst for META’s Quest VR headset, which has wider immediate use cases/applications right now.

Quest VR mentions are now up 48% year over year after two years of decline.

Revenue for Meta’s Reality Labs division, which encompasses its VR devices, exceeded $1 billion last quarter, despite the virtual reality unit incurring losses of $4.65 billion. We expect continued improvement on this front.

No. 4: Reined in Expenses

Lastly, it looks like META has expenses under control.

The company laid off 22% of its workforce in 2023 and decreased its expenses by 8% in the fourth quarter. These moves, coupled with stronger ad spend, more than doubled its operating margin.

Bottom line: META is finally proving competent at battling competition from giants like TikTok and even AAPL. If the company can continue to make improvements on the AI front and rake in ad dollars, it likely still has gas in the tank.

Until next time,

Andy Swan

Founder, LikeFolio

The Latest Free Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s hot this week…

What to Know About Reddit’s IPO: The Inside Scoop

Why the social media company’s public debut matters – and trading it from here…

Add These Stocks to Your Radar Before Major Catalysts Hit

Get ready for an eventful spring and summer as catalysts drive consumer interest in two big names…