Abercrombie’s Post-Earnings Plummet Could Be a Golden Opportunity

All eyes are on Nvidia (NVDA) today – and for good reason. The $3 trillion AI superstar is the S&P 500’s top performer this year, gaining 150% ahead of today’s highly anticipated earnings report.

We’re tuned in to NVDA with the rest of the market. Earnings Season Pass subscribers have our recommended earnings trade in hand.

But over the last two years, one surprising stock has even outperformed NVDA.

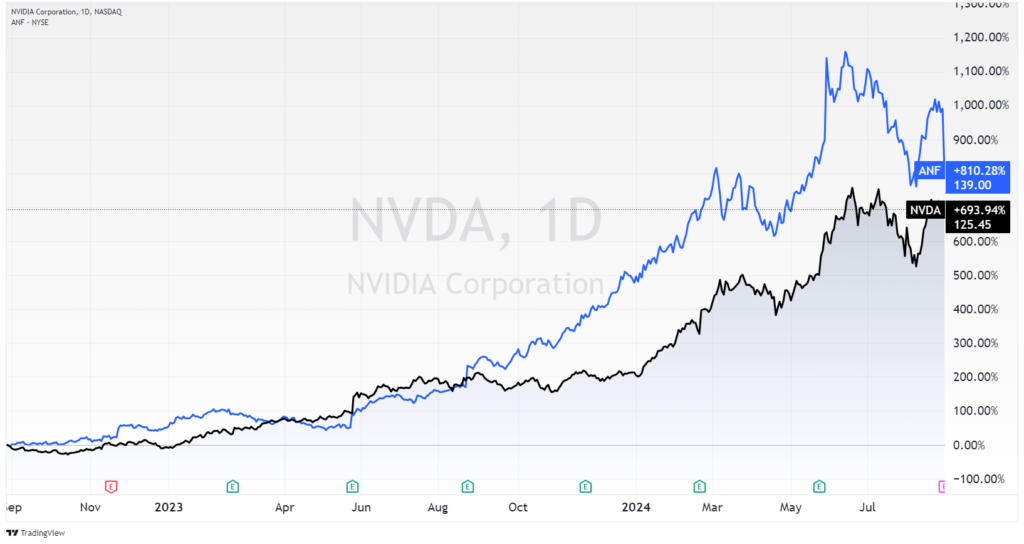

Take a look at the chart below to see what I’m talking about…

The black line is NVDA. As of this writing, the GOAT in AI tech has delivered a nearly 700% gain since 2022.

Now, pay attention to that BLUE line. It represents a teen fashion retailer whose stock is up more than 800% in the same time frame: Abercrombie & Fitch (ANF).

ANF’s Comeback of the Century

Over the last decade, Abercrombie has transformed its brand image and financial performance dramatically, outpacing its competitors with remarkable vigor.

ANF hit a rough patch in the early 2000s due to controversial marketing and a disconnect with evolving consumer values. This was back in the days when going to the mall was still the thing – I can still smell the spicy scent of Abercrombie cologne wafting out of those dimly lit stores.

The company got a bad rap for its discriminatory practices, including its dress code. At one point, it would only hire “attractive” people using a loophole that called employees “models.”

It got so bad that in 2016, Abercrombie was ranked the “most hated retailer” in America, according to the American Customer Satisfaction Index.

Thankfully, Abercrombie shed any toxic elements that once marred its reputation while retaining its appeal among the younger crowd. This strategic shift not only rejuvenated the brand, but also solidified its “cool” status, a feat that many of its contemporaries are still striving to achieve.

It was the comeback of the century – at least, until today’s earnings report sent ANF plummeting more than 15%…

Is this turnaround story over? Or is ANF’s pullback a golden opportunity for long-term investors?

Here’s why we believe this could be an incredible opportunity…

Buy the Dip

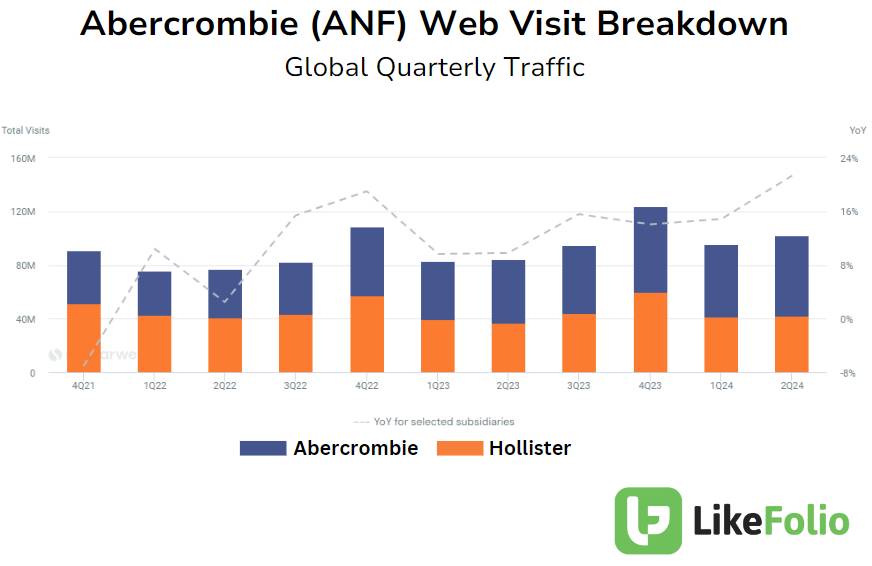

According to LikeFolio insights, ANF global traffic growth hit the highest level ever recorded for its two main brands, Abercrombie & Fitch and Hollister, in the second quarter:

Digital traffic is increasingly important, comprising 60% of sales.

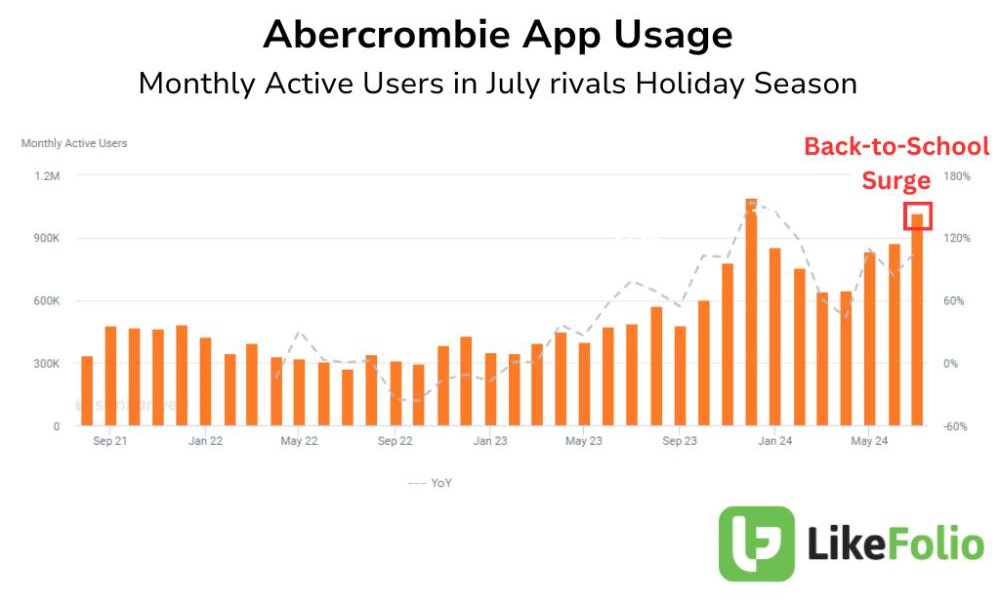

We also found that Abercrombie’s app visits rivaled holiday-level interest in July, driven by a massive back-to-school shopping surge.

Hollister app stats couldn’t even be displayed on the same chart, they were so dramatic during the summer. Clearly, its promotional “Feel Good Fest” featuring live performances by Gen-Z artists and shoppable social media posts was a smashing success.

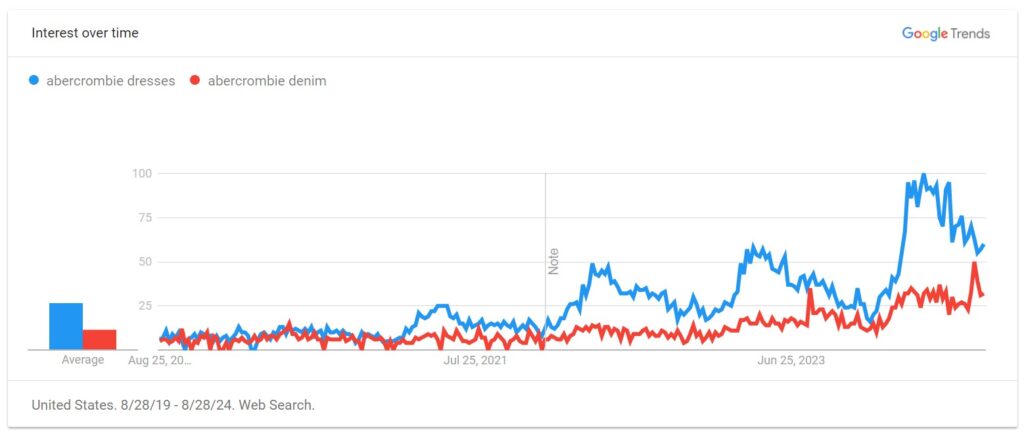

Abercrombie’s merchandising improvement has made it more responsive to quickly changing consumer fashion preferences. Consumer searches for dresses surged in the summer months. And heading into fall, the same can be said for Abercrombie’s trendy, relaxed denim styles.

Look, expectations were sky-high going into today’s earnings report. But in reality, the results were glowing.

ANF revenue was up 21% year over year to $1.13 billion, besting last year’s 16% growth and leading Abercrombie to up its guidance for the year. Earnings also beat expectations at $2.50 per share compared to the anticipated $2.22.

Bottom line: LikeFolio data suggests Abercrombie’s growth is still well underway. And we think this overdone post-earnings dip could be a perfect opportunity for investors to pick up shares for the long-haul… with one caveat.

With Nvidia earnings sure to swing the market, some traders may opt to wait to pick up ANF until NVDA’s report plays out this week – just in case a negative reaction brings the market down with it.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

From AI to FOMO: Apple Is Riding 3 Enormous Tailwinds into September

Here’s why next month will be critical for the company – and its investors.

The Next 3 Stocks to Watch After Walmart’s Earnings Triumph

These consumer favorites could be the next to soar…