Live Sports + AI = Moonshot Potential

In 1995, Bill Gates called the internet a “tidal wave” that “changes the rules.” He was well ahead of his time – and right on the money…

Thirty years from now, we’ll be saying the same thing about the artificial intelligence (AI) prediction he made in March as part of a seven-page manifesto:

“The development of AI is as fundamental as the creation of the microprocessor, the personal computer, the Internet, and the mobile phone. It will change the way people work, learn, travel, get health care, and communicate with each other. Entire industries will reorient around it. Businesses will distinguish themselves by how well they use it.”

As investors, we have to keep an eye on the future.

Gates understands that: Those businesses that “will distinguish themselves by how well they use it” are the investments we’re making today.

There’s no way to know with certainty who the winners of AI will be, but you can take calculated risks on “moonshots” if you know their story and the potential they could reach.

The company featured in this report aims to build “the future of live TV with AI as its centerpiece.” And right now, shares are trading under two dollars.

This story was initially published on May 6, 2023, and updated with the Editor’s Note above on May 17, 2023.

If you look at Apple (AAPL) today, you’ll see one of the world’s most successful companies.

Thanks to its market value, it’s one of the charter members of the exclusive “trillion-dollar club.” Its name is also its brand. Whether in the form of a phone, watch, tablet, computer, or set of earbuds, Apple products are everywhere. Indeed, nearly two-thirds of American households own an Apple device, and 20% have more than three.

The company’s $2.67 trillion market value is almost equal to the gross domestic product of France.

But 25 years ago, almost no one could have foreseen this rich future. Apple was 90 days from bankruptcy, shares were in a free fall, and the wolves were at the door.

The company’s journey over the past 25 years – and all the shareholder wealth it created in the process – is the literal definition of a moonshot.

Little wonder people invest so much energy in finding the next one.

We invested some energy of our own – digging around the market’s outer edges – and came away with a candidate… a “moonshot bet” for streaming.

A company called Fubo (FUBO).

Wall Street handicappers refer to companies like Fubo as “binary bets” – either a zero or a one.

We’re talking about an all-or-nothing wager: If Fubo can hook onto some powerful consumer trends, and successfully engineer a business-model transition that’s already underway, it’ll deliver a moonshot payoff; if it stumbles, or fails outright, it’ll disappear like smoke on a windy day.

But the Fubo tale is one worth listening to.

Because it has that kind of moonshot potential…

A Sports-First Mindset

The New York-based Fubo is a live-streaming TV platform for sports, news, and entertainment. Its content can be accessed from streaming devices, smart TVs, PCs, tablets, and cell phones in the U.S., Canada, Spain, and France.

The company offers live streaming at a time when more consumers than ever are bypassing traditional media platforms for online content.

And its sports-first mindset is highly promising – especially since live sporting events are a huge driver of streaming subscriptions.

That’s good stuff.

But there’s a challenge here: Can Fubo keep on top of carriage disputes while staying competitive with its peers?

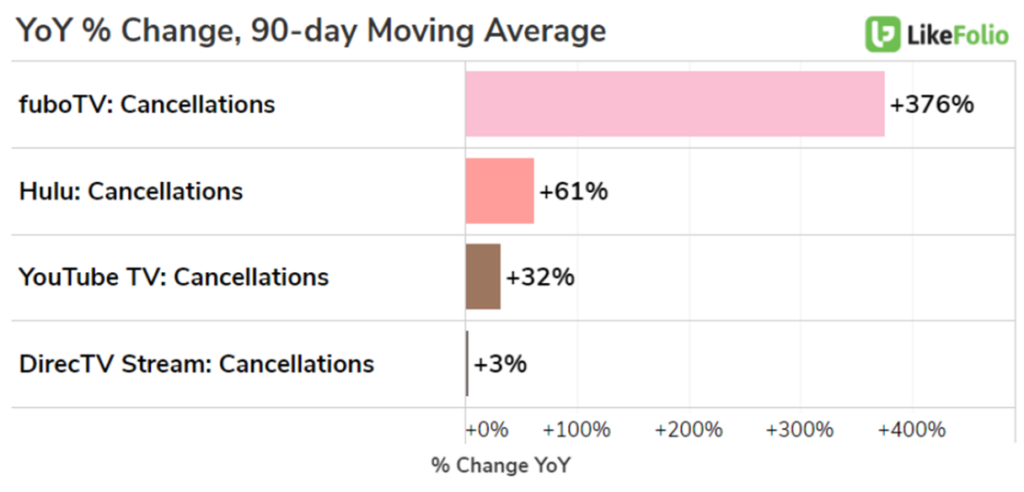

In the first quarter of this year, Fubo cancellation mentions spiked significantly above cancellation mentions for other live TV streamers like YouTube and Hulu:

Consumer buzz around canceling Fubo subscriptions is still trending 134% higher year-over-year, with many consumers citing high costs, carriage disputes, and new streaming options as top reasons for ditching the service.

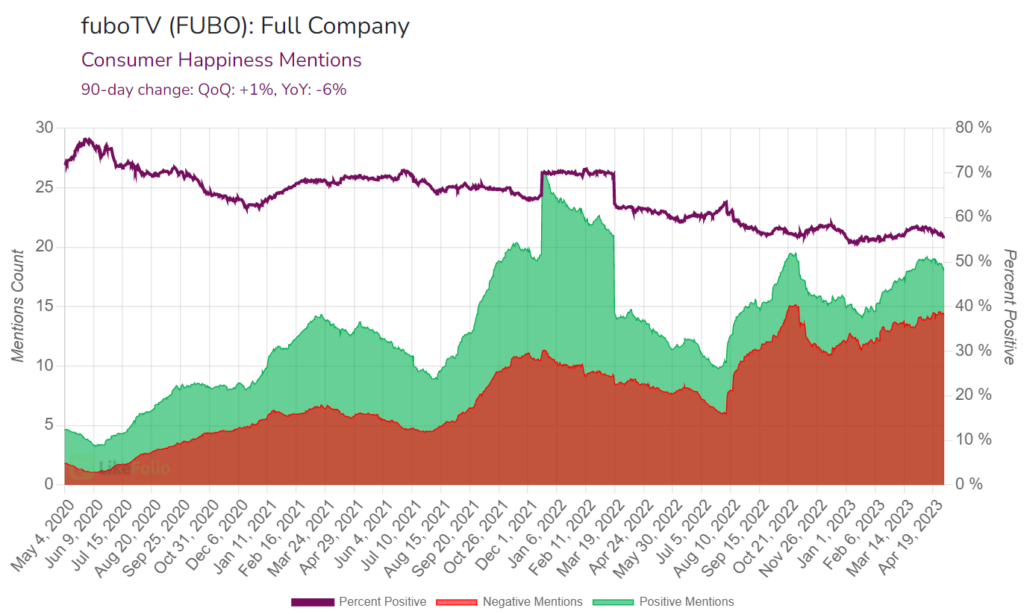

That has translated to relatively low Consumer Happiness for the streamer. On a year-over-year basis, Fubo sentiment has slipped by six percentage points to 56% positive:

Viewers of live sporting events – especially when watching their favorite teams – quite naturally have high expectations. So these folks react in a very strong way to any delays, lapses in coverage, and other programming errors.

And price increases on regional sports channels are taking a painful toll.

Getting this all sorted out will take time – and will create uncertainty in the near and intermediate terms.

Coverage of the World Cup last fall helped to drive new users to the platform. However, Fubo doesn’t seem confident this growth is sustainable in its “rest of world” subscriber outlook for 2023, where it expects a 4% year-over-year decline (unless it excludes the impact of the 2022 World Cup, in which case it expects single-digit subscriber growth).

The bottom line: For better or worse, live sports coverage will probably lead to volatile jumps in the company’s user base as folks join to watch a single big game, only to cancel as soon as it’s over.

Growth Drivers Ahead

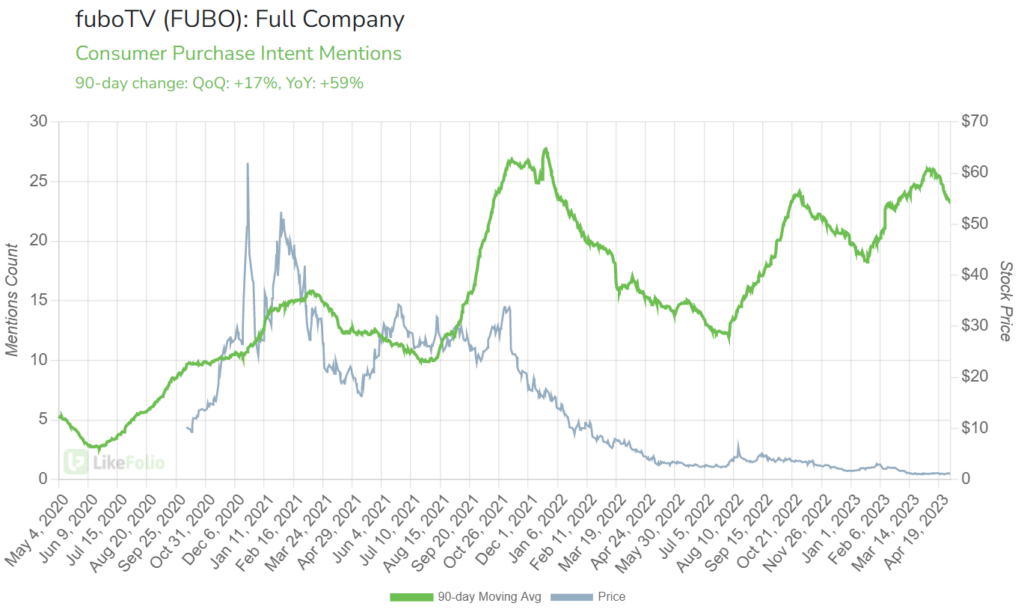

The good news here is that despite seasonal volatility, Fubo demand continues to rise.

Purchase Intent (PI) mentions are currently pacing 59% higher year-over-year as the company expands its coverage and programming and consumers increasingly make the jump from traditional cable to streaming live content:

In one intriguing move that doubles down on its “sports-first” positioning, Fubo recently added Bally Sports’ portfolio of regional sports networks (RSNs).

(We labeled this as “intriguing” because Fubo had previously dropped Bally Sports – back in January 2020, when other streamers were dropping Bally’s content too.)

The RSN move is boosting subscriber growth and driving local sports fans to the platform. With approximately 35 RSN channels, Fubo can deliver at least one regional sports network to nearly every U.S. subscriber.

It’s also the only streaming platform that can claim it offers channels for all four major sports leagues: NFL Network, MLB Network, NBA Network, and NHL Network.

Back in November, Fubo made another big move when it launched on Amazon’s (AMZN) streaming service Freevee, bringing its total available devices to 155 million…

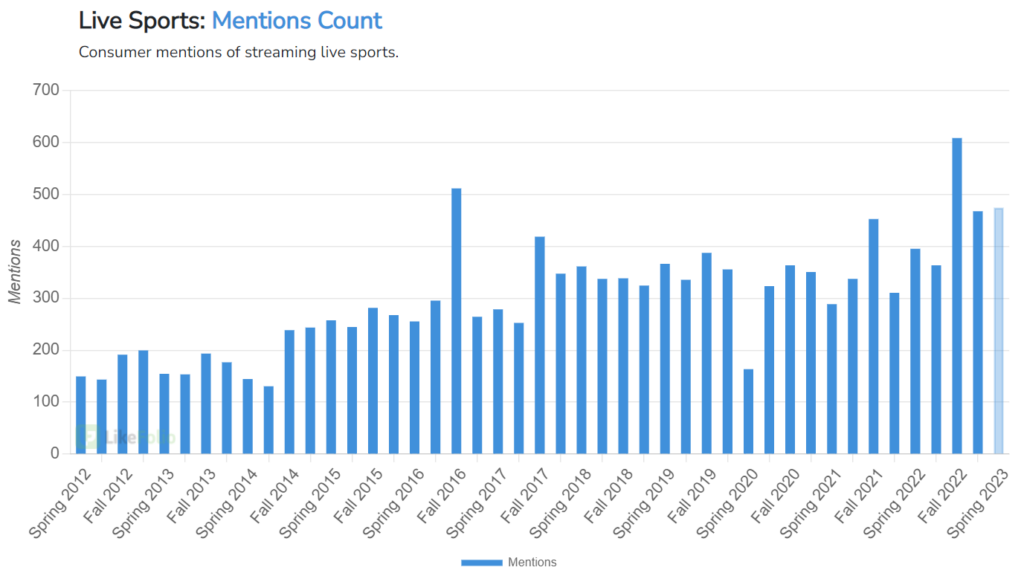

Live sports content should be a big growth driver, considering consumer mentions of streaming live sports have jumped 33% from last year:

The demand growth there is beating demand for other types of streaming, including streaming movies, syndicated TV, and even original content.

Fubo’s positioning in the live sports market initially helped to attract new users to the platform – and the company is now executing creatively.

In response to “a growing appetite for the voice of the athlete,” Fubo is expanding the distribution of live sports programming, original series, and other athlete-focused content for sports fans.

In addition to being available on free ad-supported streaming TV services (FAST) like Roku, Xumo, and Tubi, network content is also available on such social media platforms as Instagram, TikTok, Twitch, Twitter, and YouTube.

And Fubo’s growth — both in terms of its catalog of content and its reach — seems to be showing up…

The Proof Is in the Profits

Fubo reported its first-quarter earnings yesterday with better-than-expected results:

- Revenue for North America came in at $316.5 million for 34% year-over-year growth, exceeding previous guidance of $295 million to $300 million.

- Its rest-of-world business brought in $7.8 million in revenue.

- The number of paid North American subscribers grew 22% year-over-year to 1.285 million.

- For the quarter, the net loss came in at $83.4 million, with the net-loss margin narrowing to -25.7%.

- And ad revenue remained flat year-over-year ($22.5 million) amid a tough advertising market.

Yesterday’s earnings announcement was a great way to kick off the year: Within North America, Fubo raised its 2023 full-year guidance to $1.235 billion to $1.265 billion in revenue.

Achieving that “moonshot” status will be all about longer-term execution.

But that long-term growth outlook remains upbeat… which insiders seem to see, given the insider buying that has taken place.

Fubo insiders have bought shares during the past year – more than $167,000 worth – on the open market.

The biggest insider purchase was by David Gandler, the CEO and co-founder, for $137,000 worth of stock – back when it was trading at $2.98 per share.

There’s still plenty of untapped potential.

Building “the Future of Live TV with AI as Its Centerpiece”

The company tapped into artificial intelligence (AI) with its 2021 acquisition of Edisn.ai, which gave Fubo access to computer vision technology that can track and identify specific athletes.

According to Gandler, “With Edisn.ai, we will be able to create new experiences that integrate interactivity and data directly within our live TV feeds, pushing the boundaries of innovation even further.”

In yesterday’s Q1 shareholder letter, the company reiterated its intent to use Edisn.ai to “build the future of live TV with AI as its centerpiece.”

Fubo believes it can grow its North American subscribers by at least 8% this year as the decline in cable TV continues and as the company adds more sports programming to its lineup.

If it does that – while reining in costs and keeping those customers happy – the Fubo chat we have five, eight, 10, or 12 years from now will be focused on happy shareholders.

But with the stock meandering just above the $1-a-share level – down from more than $60 during the pandemic peak – Fubo has a lot to prove for that moonshot wager to pay off.

Until next time,

Andy Swan

Co-Founder