Home Depot (HD) came out with its first-quarter earnings this morning and the results sent my news feed into panic mode.

The home improvement retailer reported revenue for the quarter ended April 30 about a billion short of what Wall Street was expecting. Mainstream news outlets like CNBC painted it as the “worst revenue miss in 20 years.”

The headlines I’m seeing today are steeped in pessimism.

Germans have a word for this kind of doom and gloom: Weltschmerz, which translates to “world pain.” It’s that sense of dread that comes on when one realizes reality will never live up to expectations.

But I’m not falling for it.

As a trader, I actually feel empowered. You should too.

We have LikeFolio consumer insights to help us cut through the noise and measure changes in consumer behavior as they’re happening.

This real-time data is exactly how our team saw Home Depot’s disappointing earnings looming on the horizon.

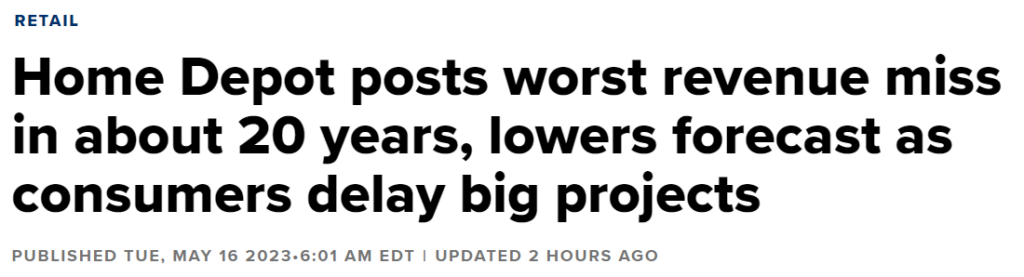

Analysis of Purchase Intent mentions – our measure of consumers talking about purchasing products from Home Depot – clearly displayed a downward slide in demand:

Today’s earnings results confirmed that HD demand is in fact cooling as consumers postpone projects and put off big-ticket purchases.

Are all retailers in the same boat with Home Depot?

With our consumer insights machine, we’re able to stack retailers against each other to see how they compare in key metrics.

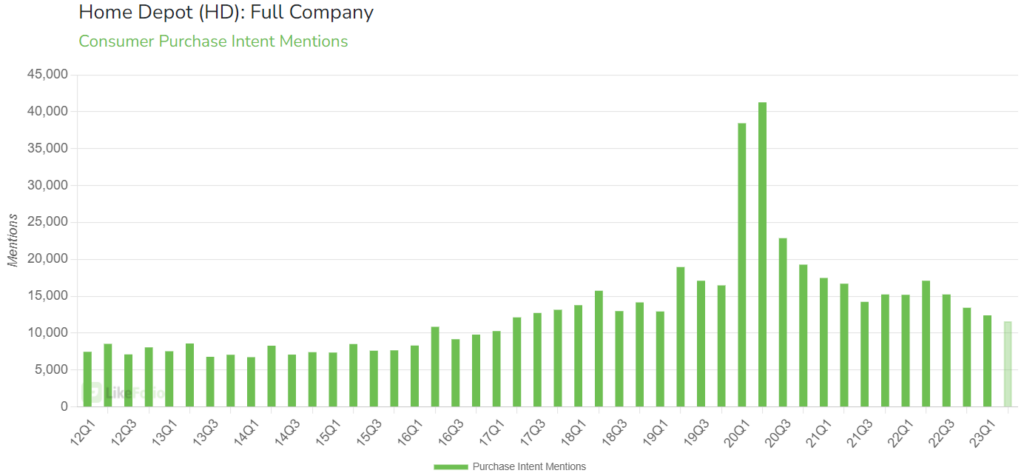

To help answer that question, we looked at year-over-year growth in consumer mentions (aka overall “buzz”) for HD, Walmart (WMT), Amazon (AMZN), Target (TGT), Lowe’s (LOW), and Costco (COST):

We dug deep into our consumer database to get the full story and came out with five big takeaways for investors.

Find out which of these retailers could be next to miss, which could surprise, and which could really be opportunities in disguise…

Walmart Is Emerging as a Positive Outlier in Retail Earnings

You can see in the chart above that WMT is the only company seeing positive growth in consumer mention volume (+4%).

Much of this can be attributed to strength in consumer staples, like groceries. Higher-income shoppers made up nearly half of the gains Walmart posted in the U.S. last quarter – and this behavior was also present in its bulk retail arm, Sam’s Club.

Amazon’s Prime Subscription Model Is Showing Some Signs of Resilience

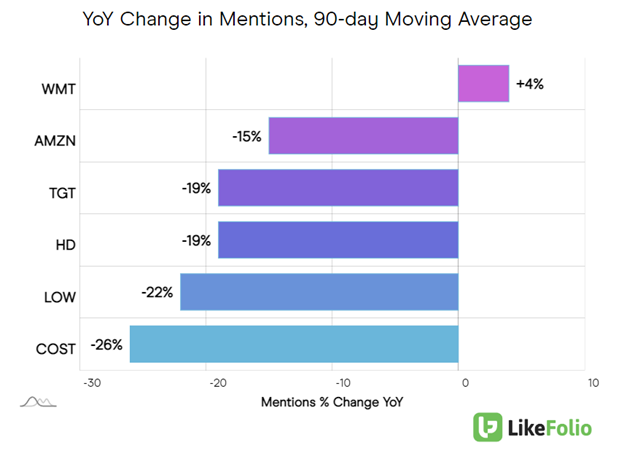

Amazon demand seems to be holding up better than other big box stores because its sales are heavily tilted toward its e-commerce arm – namely, Amazon Prime.

Consumer Happiness levels for Amazon Prime memberships have popped 4% higher on a year-over-year basis as social media posters rave about deals and improved shipping experiences with the app.

Target Is Facing an Uphill Battle

…Especially as consumers report a decrease in spending that once lifted it above peers, like in trendy home décor and high-quality private label clothing brands.

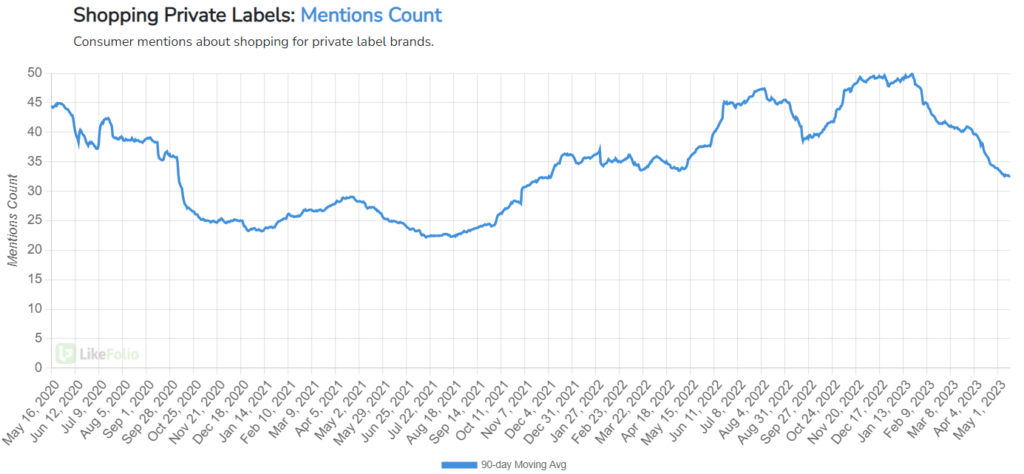

LikeFolio trend data shows consumer mentions of shopping for apparel dropping by nearly 30% on a year-over-year basis, while chatter around shopping for private label brands has fallen 25% quarter-over-quarter.

TGT and HD have near-mirrored data, so we’re not betting on a surprise to the upside tomorrow morning.

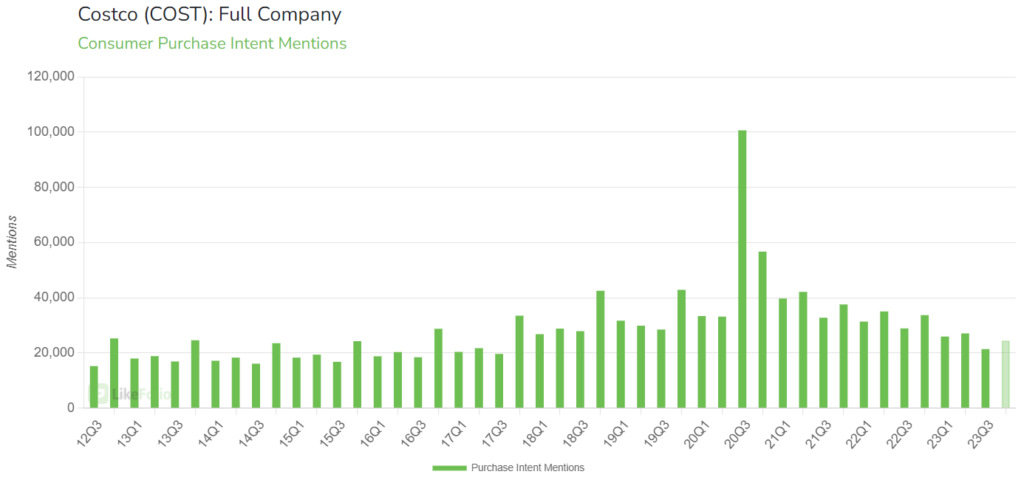

Costco Demand Normalizes from COVID-Induced Highs

While the company’s 26% decline in mention volume appears to be the most dramatic on the chart above, Purchase Intent mentions are showing some signs of improvement – gaining 7% on a quarter-over-quarter basis.

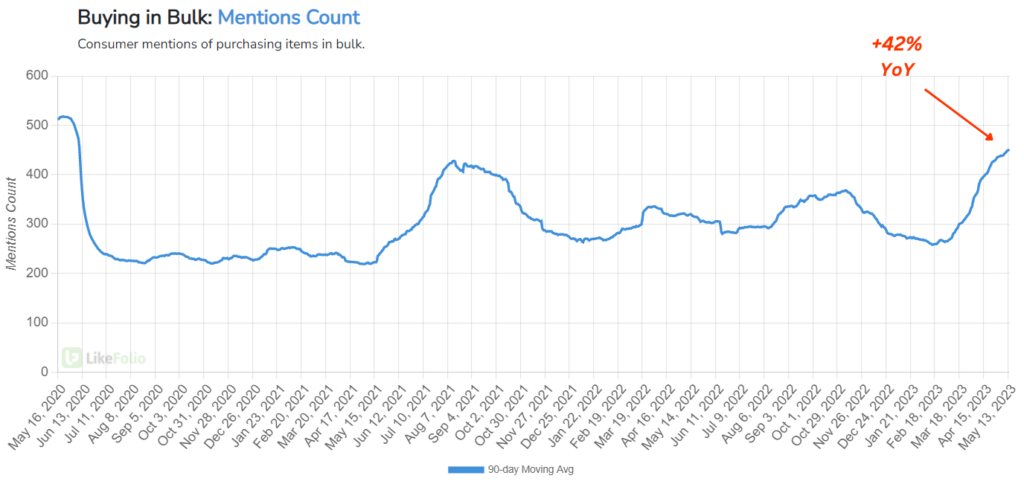

Consumer mentions of bulk purchases are also on the rise, pacing 42% higher year-over-year, which could serve as a tailwind for Costco.

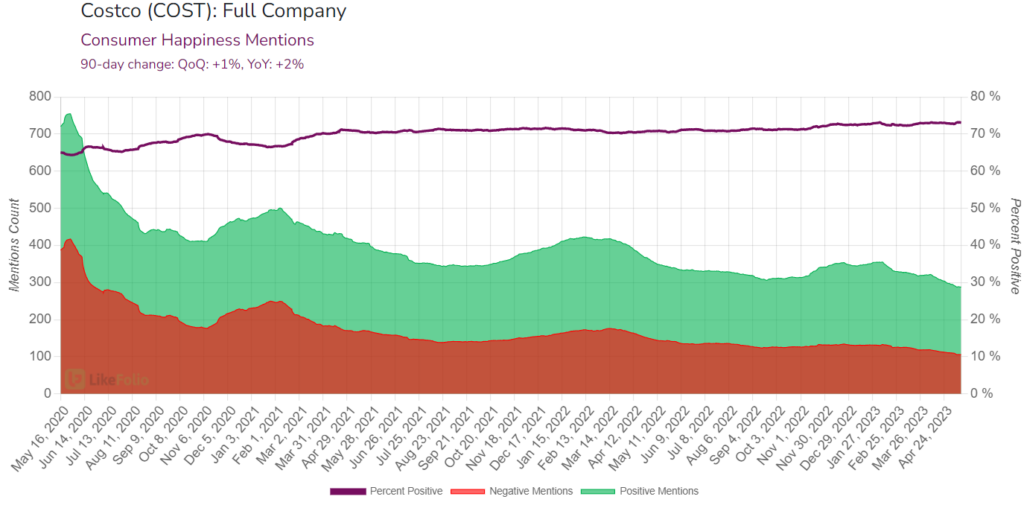

And with the highest Consumer Happiness level of the retail group at 73% positive, we believe Costco may be in the best position for a long-term recovery.

Lowe’s Is in the Same – or Worse – Boat as Home Depot

As a rival home reno company, Lowe’s is likely to suffer from the same pull-back in consumer projects that hit Home Depot’s bottom line – though its stock is already trading in sympathy.

LOW shares sank from $201.55 as of last night’s close to as low as $193 today (as of this writing).

Bottom line: Discretionary spending is being tested… But that’s not news for Derby City Daily readers.

By understanding how retailers stack up, traders can make informed decisions on potential surprises (WMT), likely disappointments (TGT), and convincing long-term bets (COST).

Until next time,

Andy Swan

Co-Founder