We’ve got another action-packed week of retail earnings reports lined up.

📅 Week 6 Earnings Sneak Peek

- Dick’s Sporting Goods (DKS): Reports Tuesday, May 23

- BJ’s Wholesale (BJ): Reports Tuesday, May 23

- Elf Beauty (ELF): Reports Wednesday, May 24

- Build-A-Bear (BBW): Reports Thursday, May 25

The main theme we’re watching is the slowdown in discretionary spending and its impacts on retailers.

While some companies are taking a hit in sales, others are outperforming in this environment – either because they cater to a more affluent customer base or have a powerful macroeconomic tailwind playing in their favor.

One of those names is Dick’s Sporting Goods (DKS), which reports tomorrow before the bell…

Dick’s Sporting Goods (DKS): Reports Tuesday, May 23

Outlook: Bullish

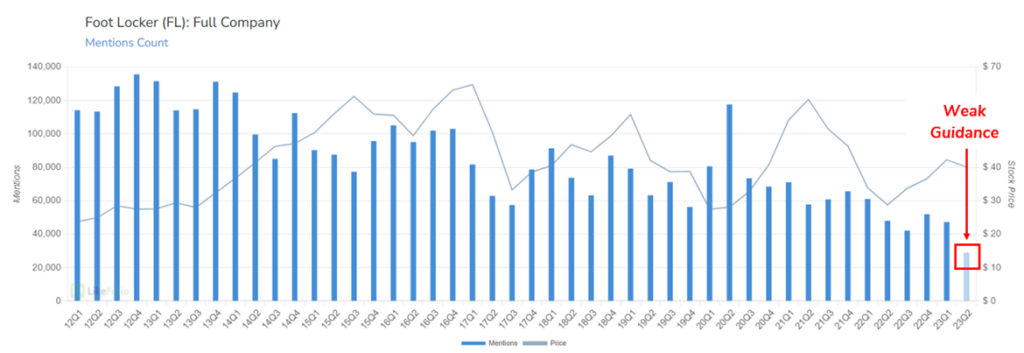

Fellow sports apparel retailer Foot Locker (FL) set an ominous tone last week when it posted a report that missed on the top and bottom lines and issued lowered guidance from two months ago. Its stock price tumbled 27% on the announcement.

The bad news? Middle-to-lower-income shoppers continue to pull back on discretionary spending, impacting a retailer like Foot Locker specializing in trendy athletic shoes.

The good news? LikeFolio data saw it coming.

The chart below highlights the downturn in Foot Locker brand mentions, with the highlighted quarter showcasing the pace volume for the month of May:

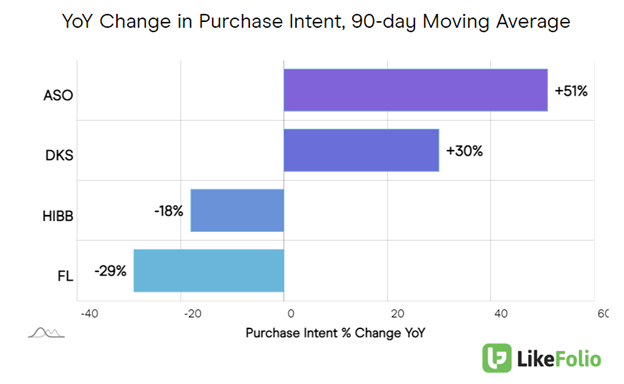

Will Dick’s suffer the same fate?

While the rest of the market waits for the answer tomorrow, we don’t have to wonder…

We know the company is NOT recording the same degradation in demand or mentions as LikeFolio recorded in Foot Locker ahead of its earnings.

In fact, DKS is gaining steam and increasingly becoming a best-of-breed retailer for athletic wear. Purchase Intent mentions are up by an impressive 30%:

Outlook?

Bullish.

BJ’s Wholesale (BJ): Reports Tuesday, May 23

Outlook: Cautiously Bearish

Also reporting Tuesday before the bell is BJ’s Wholesale (BJ), and LikeFolio consumer data paints a bearish outlook.

The company’s report follows a weak April sales report from Costco (COST), with many consumers struggling to support the high costs of bulk purchases.

BJ’s Purchase Intent, which includes mentions of signing up for a membership and shopping at the bulk retailer, has slipped by 19% year-over-year.

That demand appears to be weakening in the second quarter too in a bad nod for guidance.

Here’s a quick look at some other names we’re watching this week and whether they could be set up for bullish or bearish trade opportunities…

Elf Beauty (ELF): Reports Wednesday, May 24

Outlook: Cautiously Bullish

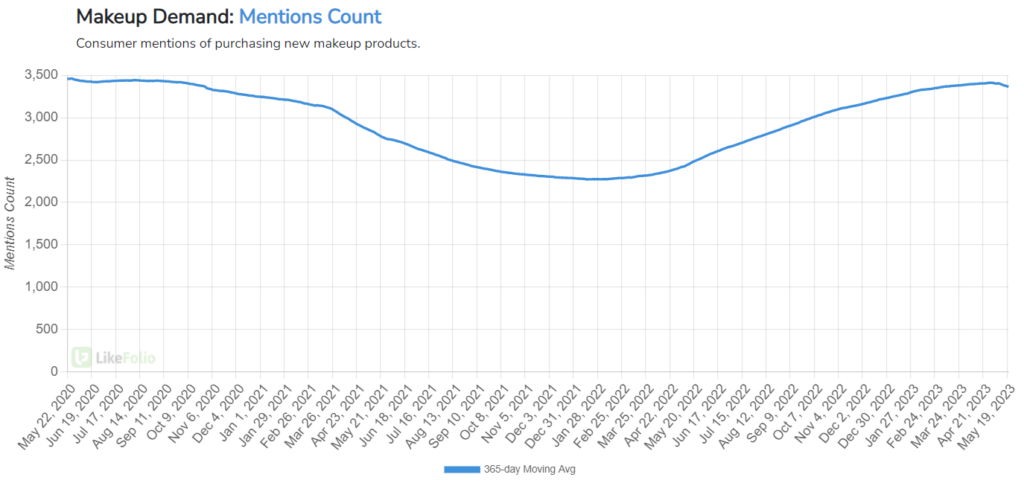

Elf Beauty (ELF) stock has been on a tear over the last year – running from $20 in May 2022 to as high as $97.03 on April 24, 2023.

The value beauty retailer has its products on shelves in Target, Walmart, and other major stores across the country.

And as overall makeup demand has proved resilient in the current economic environment (currently holding 35% higher year-over-year on a long-term basis), so has Elf’s.

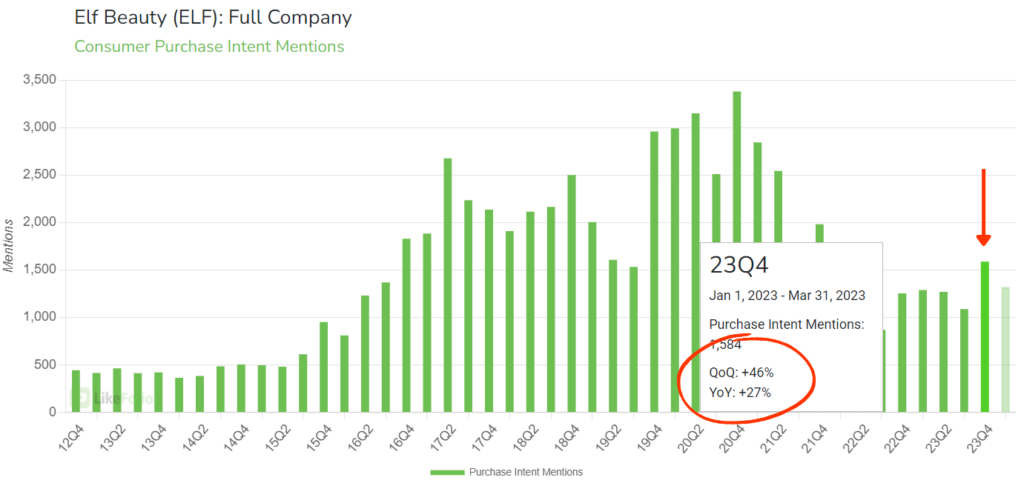

Consumer mentions of purchasing Elf products increased by 27% year-over-year for the quarter that ended March 31:

We’ve seen double-digit gains on Elf’s last four earnings reports, with management raising fiscal-year 2023 guidance three times so far.

All that bodes well for Elf’s earnings prospects.

Build-A-Bear (BBW): Reports Thursday, May 25

Outlook: Bearish

That’s right… We’re bearish on Build-A-Bear (BBW).

I remember a time when heading to the mall was an all-day family event: the toy stores, the endless options to choose from at the food court, the sweet smell of Auntie Anne’s pretzels permeating the halls…

Going to the mall was a special treat. And for many families, Build-A-Bear’s custom stuffed animal workshop was the highlight of the day.

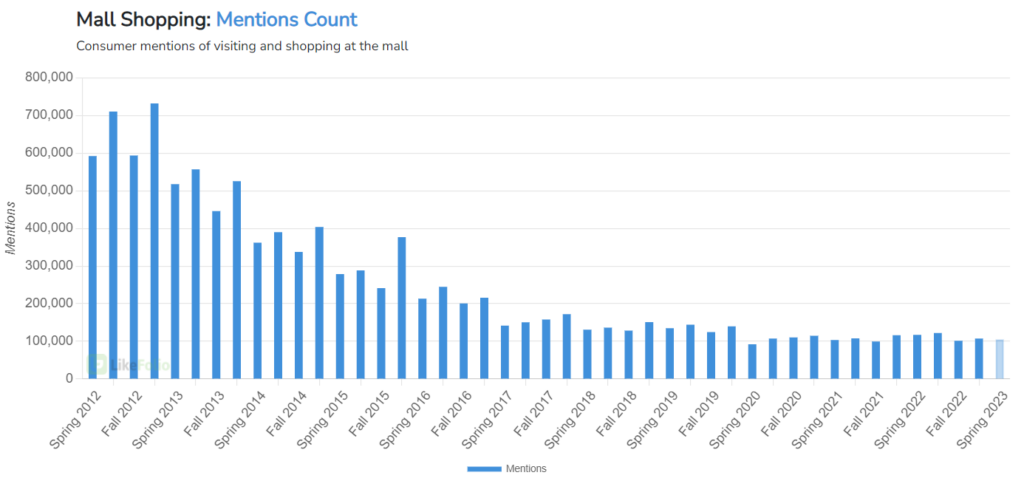

But heading to the mall has fallen out of favor in a big way amid an overwhelming shift to online retail.

Take a look at the steep drop-off our database recorded in consumers talking about shopping at the mall over the years:

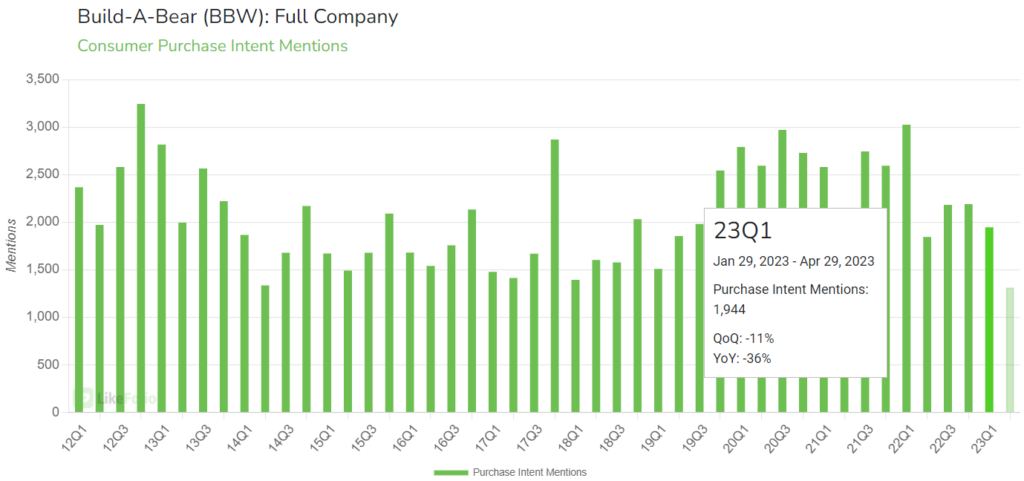

Add in the effects of a discretionary spending slowdown, and demand for creating a custom Build-A-Bear is down 36% for the quarter.

This toymaker’s pricey stuffed animals simply aren’t making the cut with consumers right now.

Until next time,

Andy Swan

Co-Founder