It’s Memorial Day weekend. Pools are opening their gates. Hot dogs are sizzling on the grill. And people have been hitting the gym in anticipation of showing off their work from the treadmill and bench press.

But while fitness has once again become a top priority, the landscape has changed.

We’re in a new post-pandemic era for fitness trends where:

- Working out at home is out.

- Guided fitness classes and weight training are in.

This transition back to the gym spells trouble for at-home fitness players like Peloton (PTON), which is now facing a steep downhill ride.

But it’s great news for other fitness stocks that now fit the mold consumers are craving, like Xponential Fitness (XPOF) with its boutique fitness classes StretchLab, CycleBar, and Pure Barre.

We brought you XPOF last week as a potential winner of shifting consumer preferences.

And today, we’re back with two more – winners, that is:

- One value fitness franchise that presents a lucrative “double-down” opportunity…

- And one “moonshot” bet trading under a dollar – with plenty of upside potential.

Let’s jump right in…

Planet Fitness (PLNT): Double-Down Opportunity?

The long-term pandemic ripple effects have proven to be tailwinds for Planet Fitness (PLNT).

Namely, a renewed consumer interest in health and fitness, the bankruptcies of 24-hour gym competitors like Gold’s Gym and 24-Hour Fitness, and increased real estate opportunities allowing for lower-cost expansion.

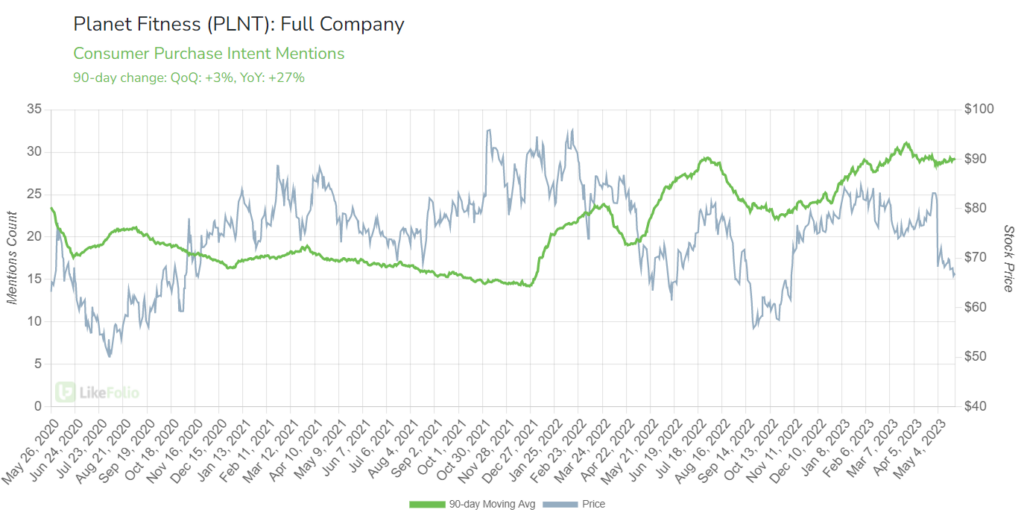

LikeFolio data confirms Planet Fitness is effectively attracting new members into its low-priced model – which features flexible, “no frills,” easy-to-cancel membership options.

Purchase Intent mentions, including new sign-ups and membership usage mentions, have risen by 27% year-over-year after a strong New Year’s resolution season.

The “judgment-free” gym boasts an impressive 18.1 million members.

Unfortunately for PLNT stockholders, the bar was high ahead of the company’s first-quarter earnings report (released May 4).

Planet Fitness posted year-over-year revenue and adjusted earnings growth of 19% and 28%, respectively, but failed to clear Wall Street expectations… sparking a post-report sell-off.

But LikeFolio data suggests this may prove to be an ideal entry point for long-term investors.

The company has its sights set on international expansion. And demand growth is holding strong through a typical down-season.

Planet Fitness is also benefitting from deal-seekers hunting a cheap gym membership (10 bucks, yes please) and that renewed consumer interest in weight training we mentioned earlier.

Gymgoers can find certified fitness trainers at Planet Fitness’s 2,400-plus locations along with small group training sessions.

Key Takeaway: LikeFolio featured PLNT as a bullish play in our February MegaTrends report. Though the stock has gained as much as 8% since then, the recent pullback has us in the red.

We’re reiterating our bullish stance and doubling down on our outlook at an even lower price.

But we also want to share a smaller, “moonshot” opportunity mentioned earlier – a brand backed by a beloved Hollywood A-lister and a whole lot of potential…

F45 Training Holdings (FXLV): Still a Moonshot Bet

Sometimes at LikeFolio, we take moonshot bets.

We’re talking about an “all or nothing” wager.

A company bursting with potential – and risk.

If it can hook onto some powerful consumer trends, and execute its business model, investors could be in for a moonshot payoff; if it stumbles, or fails outright, it’ll disappear like smoke on a windy day.

And F45 Training (FXLV) is certainly a shoot-for-the-moon kind of play.

The premise of this opportunity is sound: Consumers have reported rising interest in guided fitness classes and weight training, specifically. F45 is known for its cardio and strength training classes, some of which are designed by Hollywood A-lister Mark Wahlberg, who was promoted to F45’s Chief Brand Officer earlier this year.

With his own hefty social media following, it’s no wonder why consumer mentions of F45 spiked to their highest levels since February 2021.

FXLV class mentions are still trending 40% higher year-over-year – though overall buzz around the brand has tempered slightly from that Wahlberg-induced euphoria:

The company delayed its first-quarter 2023 and 2022 annual reports, so investors are still waiting for confirmation of a potential turnaround.

Key Takeaway: FXLV is trading under $1 and still has much to prove. However, data suggests consumer trends are serving as near-term tailwinds. Mark Wahlberg’s increased involvement is also helping to attract new eyeballs to the struggling brand.

It’s still early in our moonshot bullish play. But it’s important to reiterate elevated volatility in the near term as the company gains its footing (or ultimately fails to do so).

Stay risk defined.

Until next time,

Andy Swan

Co-Founder