After a long holiday weekend, it didn’t take long for bullish activity to shake off the rust for rental car company Avis Budget Group (CAR).

CAR shares zoomed past the 💲220 mark today on an upgraded price target from Morgan Stanley.

The premise: Avis Budget operates a larger fleet than other rental car peers – as of the first quarter, Avis averaged 620,833 rental cars in operation at any given time – and gets more value back for every single one of those vehicles.

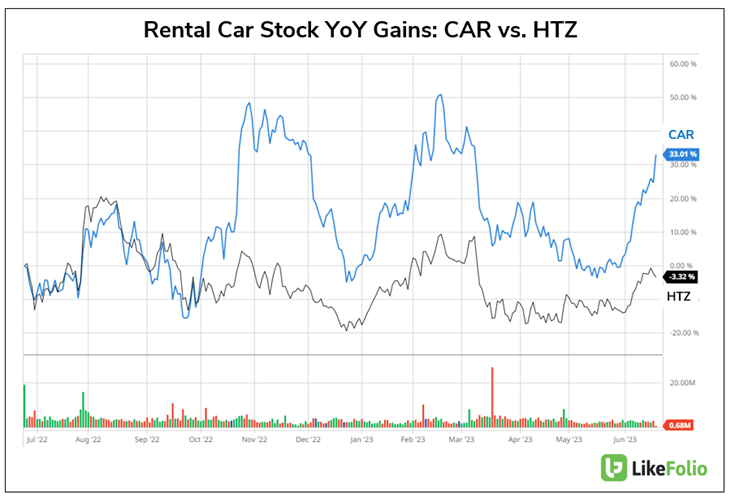

This only fanned the bullish flames for CAR shares, which have significantly outperformed competitor Hertz (HTZ) over the last year:

We’re talking 33% gains for CAR versus a 3% loss for HTZ year-over-year.

As a contrarian, alarm bells start going off anytime I hear a stock get a sudden boost like this… Telling me to look into whether or not this upgrade, and the 9% rally it ignited, are justified.

Because we here at LikeFolio – and you at home through Derby City Daily – have intel that Wall Street doesn’t.

We can see in real-time how consumers are “voting” with their wallets.

And once you see how consumer momentum is shaping up for Avis under the surface, you’ll see why a little healthy skepticism – backed by a powerful social media database – can save you from a potentially painful decision…

Q: Is This CAR Rally Justified?

A: Based on consumer momentum… not necessarily.

LikeFolio data shows CAR is facing an uphill battle when it comes to consumer demand.

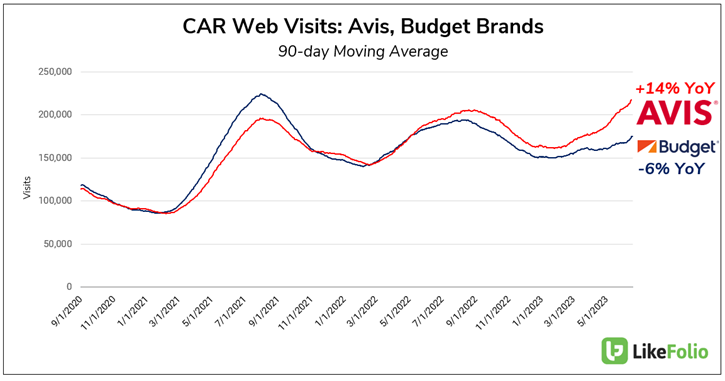

Its Avis brand is showing some signs of traction when it comes to web visits, with the number of consumers logging on to check prices and rent a car climbing 14% year-over-year.

But beneath the surface, we can also see the company’s Budget brand is recording comparative weakness, down 6% over the same period:

Web traffic combined across both brands is pacing 2% higher than it was last year. But a quarter ago, that metric was 10% higher year-over-year.

For us, that could be a warning of a slow-down in demand on the consumer side.

Purchase Intent data supports this theory too, with Avis overall demand mentions – across all its brands – currently down 33% year-over-year:

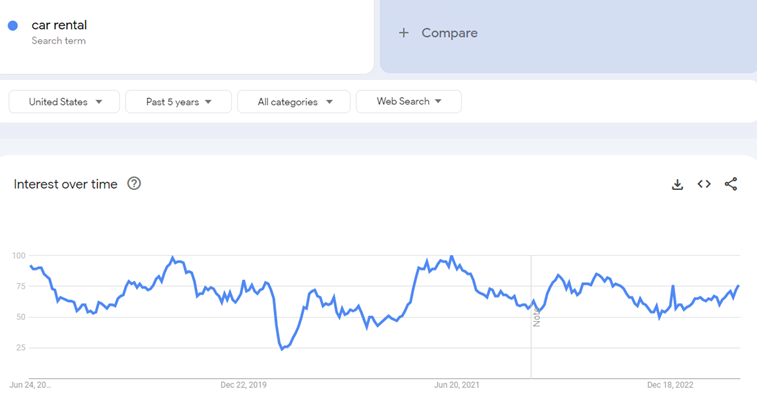

If we zoom out to look at the rental car industry overall, we find consumer searches for car rentals appear relatively flat on a year-over-year basis:

This is in line with some softening in consumer travel trends we’ve noted in recent months, like weakening demand for cruises.

Bottom line: While we can’t speak to the company’s cost mitigation, high-level consumer metrics for CAR don’t support this price rally.

In addition, news from earlier this month suggests the long-standing car rental model could be getting a bit more complicated: Uber (UBER) is piloting a new peer-to-peer carsharing model in Toronto and Boston, which we’ll be keeping a close eye on.

We’re sidelined on CAR for now – and watching for a bearish divergence ahead of the company’s next earnings release later this summer.

Until next time,

Andy Swan

Founder, LikeFolio