We’re anxiously awaiting tomorrow’s quarterly earnings report from Darden Restaurants (DRI).

As the parent company of eat-out mainstays like Olive Garden, LongHorn Steakhouse, Cheddar’s, and Capital Grille, Darden’s results could serve as a potentially important barometer on the health of the economy.

We’ll get to see if persistent inflation has set its scope on casual (and fine) dining – and just how much it’s weighing on consumers.

We know that during its last quarterly earnings report, Darden reported growth and even outperformance compared to restaurant peers as consumers clung to eating out as an “affordable luxury.”

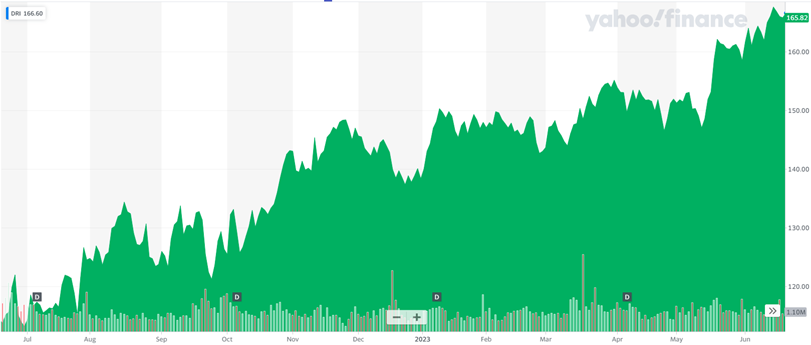

We also know DRI shares are currently trading near all-time highs, up nearly 43% from this time last year.

But a few weeks back, we issued an early warning on sit-down restaurant stocks – DRI included.

For the first time in this post-pandemic inflationary economy, a May BLS report showed restaurant menu prices running hotter than grocery prices.

LikeFolio data also revealed a slowdown in social media chatter around going out to eat, along with a decline in consumer mentions around popular restaurant names… like LongHorn Steakhouse and Olive Garden.

Tomorrow’s earnings report from Darden comes at a big moment in the company’s history, too – days after the company completed its acquisition of Ruth’s Chris Steak House.

You can see why the stakes are high for Darden.

And we haven’t even gotten to the meat of the story yet…

Before Darden’s numbers hit Wall Street, here’s an inside look at how the company’s doing on Main Street – and one factor that could take the market by surprise…

High-Stakes Steak

Let’s start with the good news for Darden.

The latest consumer demand data from LikeFolio reveals that Olive Garden, which drives nearly half of Darden’s revenue, shows continued strength and resilience.

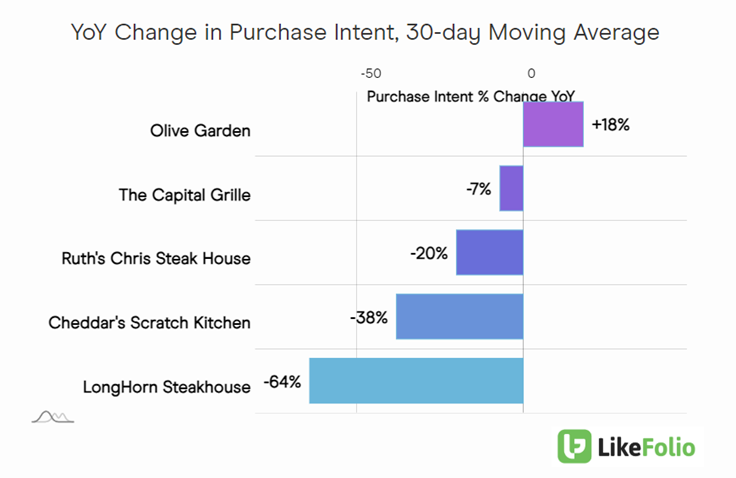

Compared to what we saw in May, Olive Garden Purchase Intent mentions have improved – now up by 18% year-over-year:

These consumer demand mentions reveal that many consumers may finally be trading down from higher-end dining excursions.

Darden’s higher-end brands – like The Capital Grille (-7%), LongHorn Steakhouse (-64%), and now Ruth’s Chris Steak House (-20%) – are all seeing declines in Purchase Intent.

That’s bad news…

Especially as the stock trades near all-time highs, helped along by investor excitement around the Ruth’s Chris acquisition.

Ruth’s Chris joins Darden’s fine-dining portfolio alongside The Capital Grille and Eddie V’s. This segment has driven growth for Darden alongside affluent consumer resilience post-pandemic, with average weekly sales more than doubling pre-COVID levels.

Translation: The bar is high.

And there’s one more factor we’re tracking heading into this earnings release that could deal a surprise blow…

The cost of beef.

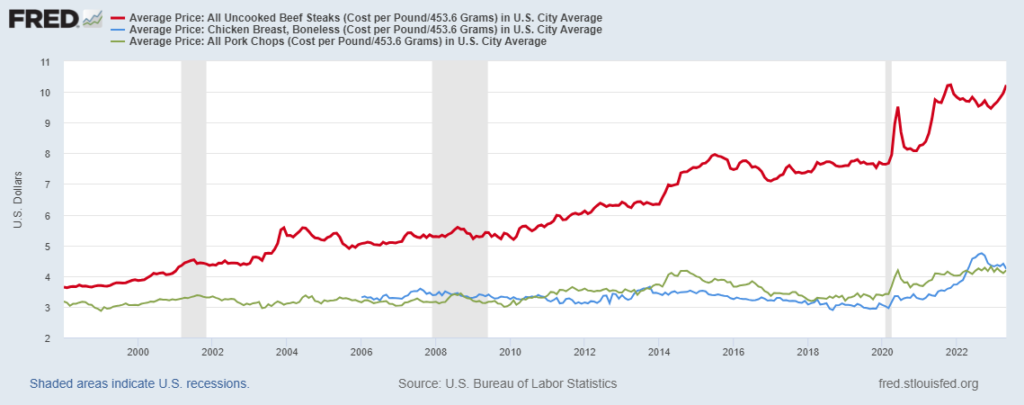

Check out the red line on the chart below – which represents the average price per pound for raw beef steaks in the U.S. over time (compared to chicken breast in blue and pork chops in green):

As of May 2023, the cost per pound for steak was $10.22. That’s up over $2 from 2021.

According to reports by the Wall Street Journal, “The number of cattle in the U.S. is at its lowest level in nearly a decade. U.S. beef production is on track to drop by more than 2 billion pounds in 2024, the biggest annual decline since 1979…”

Meaning beef is only expected to get more expensive.

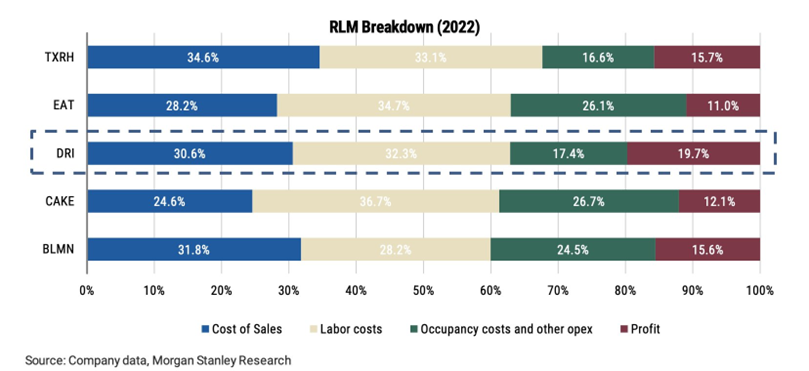

The soaring cost of steak could impact an area where our consumer data doesn’t give us an edge: margins.

Among restaurant operators, Darden led the pack in 2022 with the largest profit margins (19.7%), according to data from Morgan Stanley.

But rising prices – just as Darden expands its beef exposure – could hamper margin growth in the near term.

We’re neutral on Darden ahead of earnings, with an Earnings Score of –12…

And watching a long-term bearish divergence form.

Until next time,

Andy Swan

Founder, LikeFolio