When it comes to turning social media chatter into investable opportunities, we’ve yet to meet a system that can compete with our predictive power.

We’re constantly working behind the scenes to expand the universe of companies and brands that we cover to keep you ahead of the curve.

The more data our system analyzes, the stronger its predictive power becomes – and the better it gets at spotting stocks ready for liftoff.

In 2023, we’ve initiated coverage on dozens of publicly-traded companies – from names our hedge fund and institutional clients are interested in, to consumer-facing companies that aren’t getting a lot of attention (yet).

Every new data point we feed our database helps us identify the up-and-coming players that could be poised for major growth – and bring them to you right here in Derby City Daily.

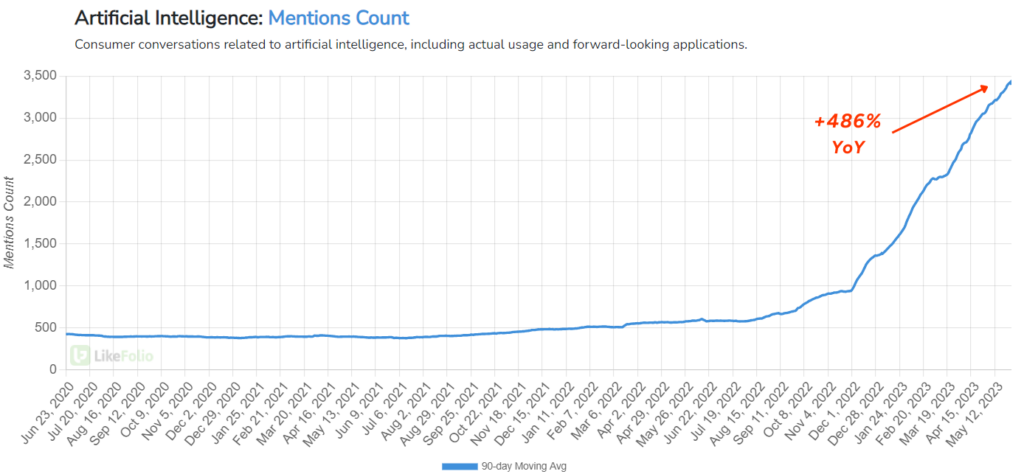

One industry where we’ve been hunting for opportunity is artificial intelligence (AI).

There’s no doubt that AI is the hottest investing trend of 2023.

So we’ve made it our business to scour every corner of the market to understand what companies are leveraging AI – and more importantly, which are doing well with consumers on Main Street – so we can bring them to you here before Wall Street catches wind.

One of the “AI stocks” we recently added is a software provider seeing massive upticks in social media chatter as it helps organizations like Xerox (XRX) and Spotify (SPOT) reduce costs and improve efficiency with AI.

That’s big.

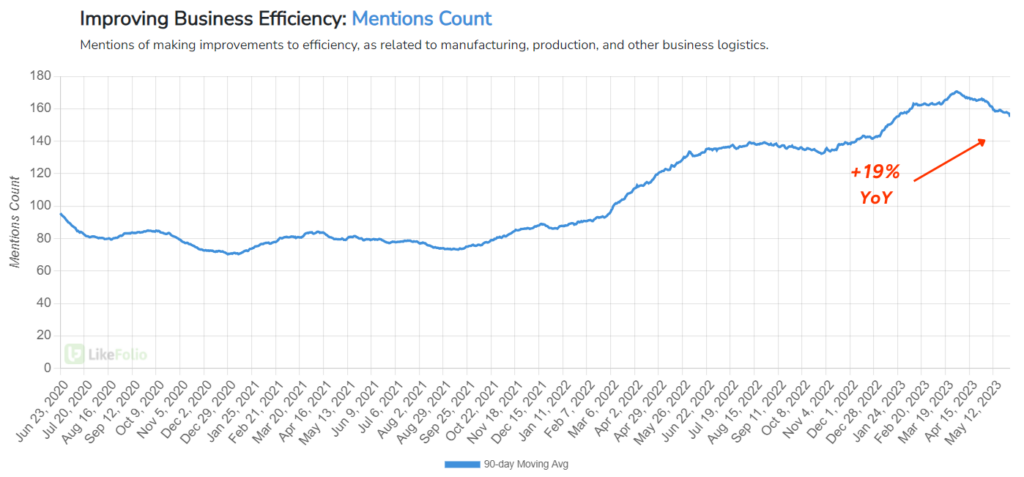

LikeFolio trend data shows increased interest in improving business efficiency, with mentions pacing 19% higher year-over-year.

In fact, within the next three years, global market intelligence firm IDC estimates that 85% of enterprises will combine human expertise with some form of AI to improve efficiency and worker productivity.

And this company is positioning itself to be the platform of choice that gets us there…

PATH Is Poised for AI-Powered Growth

- Company: UiPath (PATH)

- Industry: Automation Software

- Stock Price: $16.32 (as of market open June 23, 2023)

The company I’m talking about is UiPath (PATH). Its specialty: developing robotic process automation (RPA) solutions for businesses.

UiPath describes robotic process automation as “a software technology that makes it easy to build, deploy, and manage software robots that emulate human actions interacting with digital systems and software.”

Its platform combines AI with desktop recording, data mining, and visualization tools to help businesses discover repetitive and low-skill tasks that can be automated to improve efficiency and productivity.

For Xerox, UiPath was able to automate all of its customer invoicing, freeing up those workers to focus on the more creative, knowledge-based aspects of their job.

For Spotify, UiPath’s platform was a game-changer during the COVID-19 pandemic – allowing the company to create a fully-virtual training and service center for its employees stuck at home, among other things.

📖 Related reading: How Spotify nailed doing AI the right way.

And for Heineken, UiPath has helped save 14,000 hours monthly – adding up to an estimated 1 million hours by 2025 – through automation.

UiPath is a win-win for organizations – increasing efficiency across virtually all aspects of the business while improving job satisfaction for the folks who work there as it eliminates time-consuming, “mundane” tasks.

LikeFolio data supports that positive sentiment around UiPath’s services: The company boasts a notably high Consumer Happiness level at 90%.

At the same time, buzz around UiPath is reaching all-time highs, soaring 129% year-over-year and 99% quarter-over-quarter:

Most mentions are academic in nature and include case studies on its successful technology applications.

But what’s important for investors to note here is that mentions are ramping as the stock consolidates – making PATH a classic example of a divergence opportunity.

For more opportunities in AI, check out our stock watchlist.

Until next time,

Andy Swan

Founder, LikeFolio