With Netflix (NFLX) releasing its latest earnings numbers on Wednesday, our Earnings Season Pass members are ready to profit with a recommended five-day trade and Week 1 Earnings Scorecard.

But this event should not be overlooked by long-term investors.

Because Netflix is at an inflection point.

And historically, companies at inflection points have either soared to new heights or faltered.

Take Apple (AAPL): About 25 years ago, the company was 90 days from bankruptcy, shares were in a free fall, and the wolves were at the door. It successfully navigated its inflection point by bringing its star player back on – Steve Jobs – who would introduce the iPhone, revolutionizing not only its own future but also the entire mobile industry.

On the other side of the coin, there’s Blockbuster: In 2004, this titan in the video rental industry operated over 9,000 stores. But it failed at its inflection point by refusing to adapt to the rise of digital streaming services… and eventually sank into irrelevance.

Netflix solidified its leadership at the same critical juncture where Blockbuster failed – by pivoting its DVD-by-mail business to streaming and video on demand by 2007.

According to a 2022 Statista survey, Netflix still reigns among streamers, with 78% of U.S. households reporting having a subscription.

But the competition is heating up in the streaming space. Consumers have more choices than ever before. And that’s just one of the challenges Netflix is facing right now.

It’s a make-or-break moment, where the company’s future hinges on how it navigates the following opportunities and challenges…

Challenges

- Increasing Competition

Netflix may still be the biggest fish in the streaming pond, but it faces stiff competition.

In the LikeFolio universe, we’re currently tracking consumer trends for 20 streamers – from behemoths like Amazon Prime Video and Apple TV+ to up-and-comers offering free ad-supported alternatives, like Pluto TV.

The ones generating the most buzz right now? When it comes to new subscriptions, Freevee – Amazon’s free streaming service – takes the cake, with consumer mentions of signing up for the service rocketing 167% year-over-year.

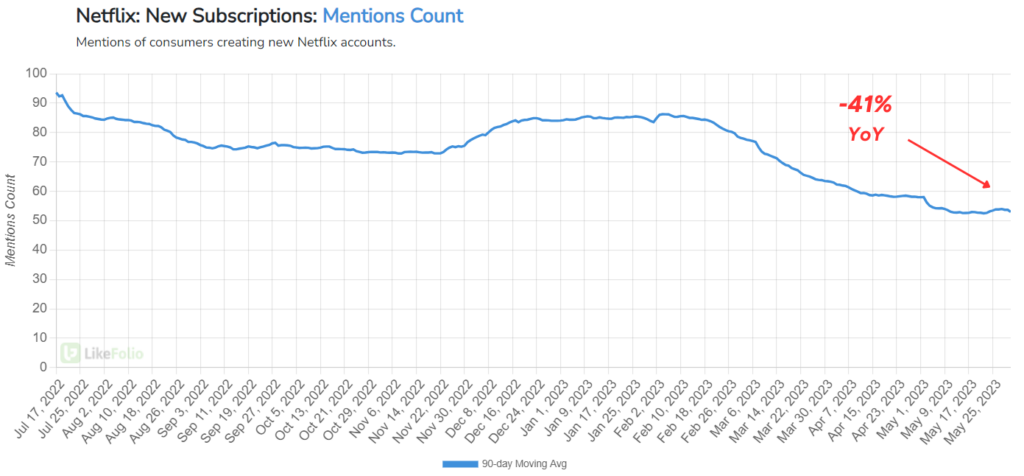

Buzz around signing up for Netflix, on the other hand, is down by 41% year-over-year.

- Slowing Growth

Netflix’s revenue growth has slowed down significantly over the last year. For the first quarter, it fell short of estimates, reporting relatively flat 3.7% year-over-year growth.

The company projected $8.24 billion in revenue for the quarter being reported on tomorrow, which would represent just 3.4% year-over-year growth.

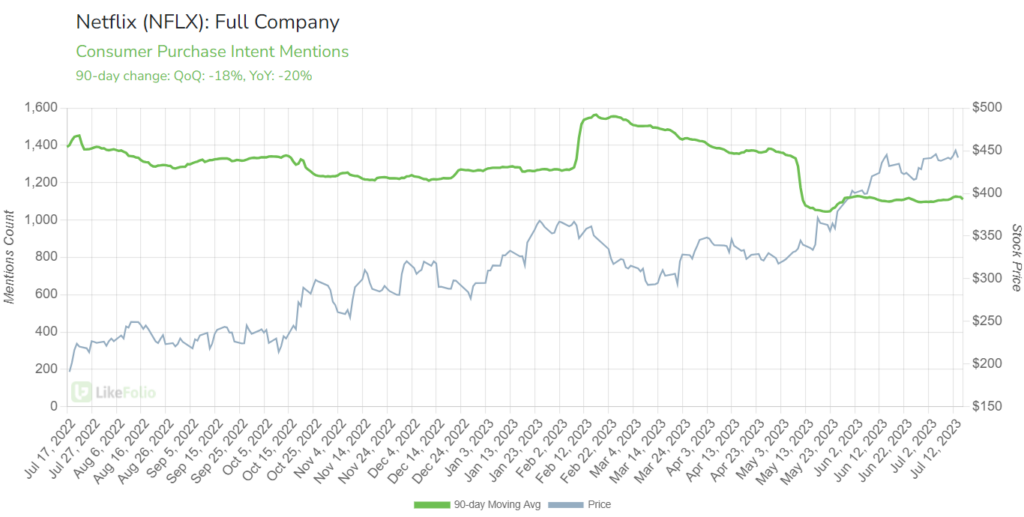

We’re seeing a slowdown in consumer demand reflected in our data as well: Netflix Purchase Intent mentions have slid 20%.

- Dependence on Licensed Content

With a seemingly never-ending stream of Netflix originals, you might be surprised to find out that Netflix is still dependent on licensed content. Of the most-streamed shows on Netflix in April, by number of unique viewers, one of those top five was a licensed show (“Shameless”).

- Macroeconomic Concerns

Broader macroeconomic concerns could also weigh on Netflix. As a company dependent on consumer discretionary spending, any downturn in the economy could negatively impact Netflix’s growth.

But there are opportunities here for Netflix.

Opportunities

- Monetization Strategy

Netflix’s shift from subscriber additions to boosting its monetization is a strategy that could help it increase revenue per user and overall profitability.

- Password-Sharing Crackdown

Netflix’s new policy requiring users to pay an additional $7.99 per month to share accounts outside their households has shown promising early results.

Average daily sign-ups more than doubled in the week after the policy change.

- Ad-Supported Plan

Netflix’s ad-supported plan could play a bigger role in the company’s overall business if executed successfully from here. It’s already acquired 5 million active users, with the average revenue per membership already exceeding its standard plan.

As I write this, Netflix shares are trading around $470 – which is already 7% higher from where they started July.

The stakes are high, and the urgency is real.

The next 18 months could be a crucial turning point for Netflix and its long-term investors.

And we can’t wait to see what tomorrow’s report brings.

If you’re interested in joining Earnings Season Pass to find out how to trade NFLX’s report – and the rest of earnings season, for that matter – click here.

Until next time,

Andy Swan

Founder, LikeFolio