Each year, Costco (COST) sells more hot dogs than all the Major League Baseball (MLB) stadiums combined… four times more, in fact.

Maybe that’s because it’s been offering the same trusty deal since 1985: a jumbo hot dog and 20-ounce soda for just $1.50.

In today’s dollars – factoring in inflation – that one-two combo should cost $4.28.

But the price has never changed.

The Costco Hot Dog is a testament to the membership club’s commitment to value. Folks go crazy for it.

And it’s just one of the reasons Costco stands in a league of its own… even as inflation, interest rates, and an end to COVID-era stimulus put the squeeze on consumer spending.

Most retailers are feeling the pinch – and Costco isn’t immune to the spending slowdown. Its latest earnings report missed estimates, bringing in $53.65 billion in quarterly revenue compared to an expected $54.75 billion.

“This is the second quarter that we’ve seen that discussion of lower sales of big-ticket discretionary items,” CFO Richard Galanti told investors.

But despite all that, its stock price is up over 20% year-to-date.

Because for Costco – and its investors – it’s not about merchandise sales.

THIS is the secret to Costco’s success, even in challenging times…

Why Costco Reigns Supreme

Memberships are Costco’s bread and butter, generating a supersized $4.2 billion for the company last year in fees alone. That revenue keeps it bolstered, even if overall spending slows down.

For $60 to $120 a year, folks can come in – enjoy a hot dog and a coke – and shop to their hearts content in one of 856 Costco Warehouses around the world.

Costco boasts 124.7 million cardholding members as of May with a sky-high renewal rate: 93% of American members re-upped in 2022 so they could keep coming back for more.

Bulk food items, a new laptop for your departing college student, furniture… just about anything you can imagine, Costco has – for an unbeatable warehouse price.

Members love it: Costco holds the highest Consumer Happiness among comparable retailers in the LikeFolio universe. And if you go to Costco, you know why.

Its Kirkland Signature in-house brand has redefined consumer expectations and set a high bar for other store brands. You can even find Kirkland Signature products on Amazon.com (AMZN) and at Walmart (WMT).

Many of those products are supplied by consumer favorites, like coffee from Starbucks, or jellybeans from Jelly Belly – which Costco is able to sell at much lower prices.

It’s also got an “in” with fine wines, which it can afford to sell at a member discount because it deals directly with the wineries (no middleman involved).

And at just $4.99, you can’t find a rotisserie chicken cheaper than Costco.

The secret to keeping the price so low? The chickens come from Costco’s own chicken farm, which it built to bring down its own production cost by 35 cents per chicken.

Controlling the supply chain was a drastic move – but it meant it wouldn’t have to raise prices for members. And considering the Costco Rotisserie Chicken Facebook fan page has a whopping 19,000-plus followers…

…it was a savvy move to keep those customers happy.

Also: the hot dogs.

Costco does just about everything in its power to avoid raising prices for members.

In fact, rather than have to raise the price of membership – or even consider raising the price of its beloved hot dog combo – Costco announced in June it would be cracking down on membership IDs in the self-checkout line.

So don’t even try to sneak one of those $4.99 chickens through self-checkout if you conveniently “forget” your ID.

Just join the Costco cult… like the rest of us.

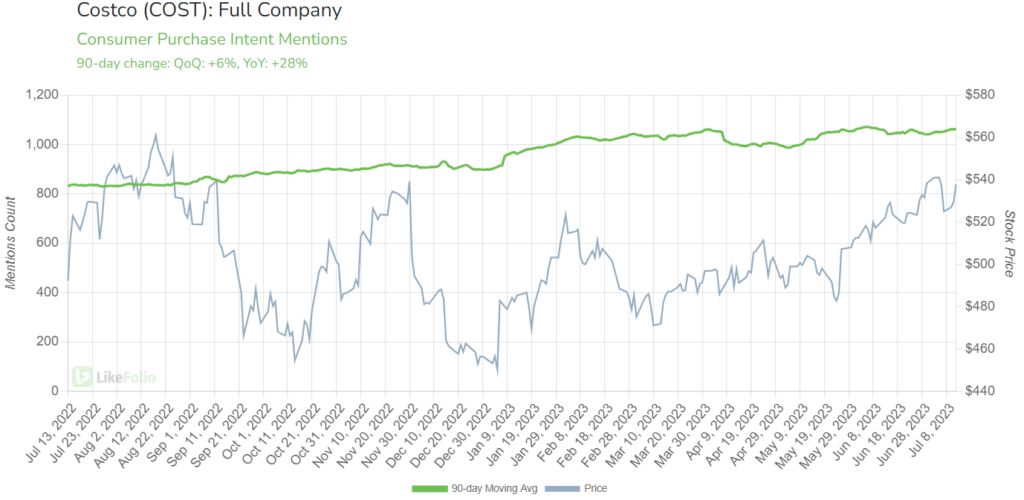

Costco Purchase Intent has held relatively steady, currently pacing 28% higher year-over-year – and we expect demand to stay strong.

By continually focusing on delivering quality, value, and satisfaction, Costco doesn’t just beat the competition. It creates a league of its own.

And it’s rewarded shareholders handsomely along the way – returning 137% over the last five years, and 21% in 2023, as of this writing… even facing a challenging economic environment.

We love “Steady Eddie” stocks like Costco that pad your portfolio with profits year after year.

But there’s always room in our portfolio for a “moonshot” bet: you know, one of those lesser-known stocks trading for just a few bucks… but with the potential to skyrocket?

We saw one tiny company riding the artificial intelligence wave before Wall Street had even caught on.

And since we first flagged this “undercover” AI opportunity in March at just $1.20, its stock price has doubled.

You can still grab shares for under $3. But not for long.

Get the details on this “moonshot” stock here… before it doubles again.

Until next time,

Andy Swan

Founder, LikeFolio