Despite record-high inflation in 2022, the luxury industry – including both goods and experiences – grew by 20%.

Surprisingly, Gen Z and millennials led the charge, way outpacing Gen X and Baby Boomer shoppers in luxury purchases: Over 60% of those younger folks paid up for a premium brand over the past year.

We’ve been keeping close tabs on the younger generations’ penchant for luxury for over a year now.

With our ears to the ground and a real-time read on social data, we were early to spot the potential winners of this cultural shift – with On Holding (ONON) and Lululemon (LULU), two that have paid off in double- and triple-digit gains for our MegaTrends subscribers. (You can get in on the next round of profits here.)

But while On and Lululemon are the brands these younger folks are spending big on, there’s another angle to this “mega” trend that could make us money.

I’m talking about the means with which they’re paying up for those luxury goods.

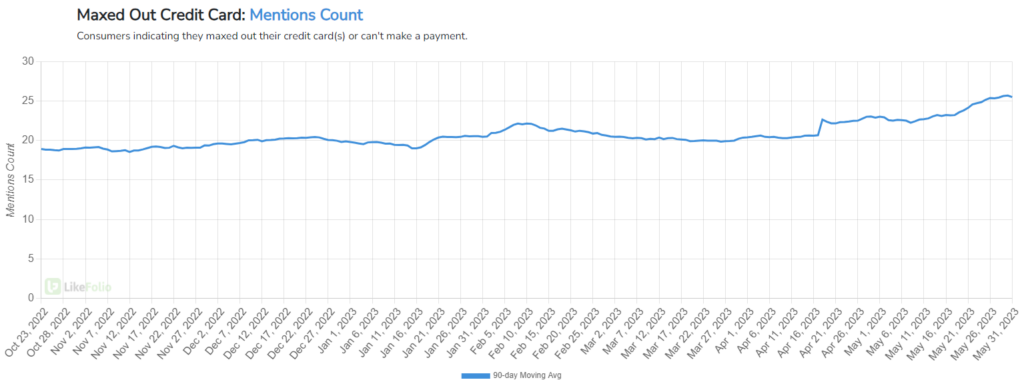

As prices go up, LikeFolio data shows consumer buzz around maxing out credit cards climbing 26% higher year over year.

But these younger folks aren’t just reaching for any old credit card. They want a card with benefits.

Our consumer insights show American Express (AXP) resonating powerfully with the younger and affluent demographics.

Does that make AXP the ultimate luxury play? Take a look…

The New Status Symbol

During a time when Americans are looking for value, American Express is impressing consumers with an array of perks that cater to their desire for high-quality experiences.

Perks vary by membership level but typically range from cash back on everyday purchases like groceries to discounted hotel reservations, rental cars, plane tickets, and anything else the wanderlust-filled traveler may need.

American Express isn’t just a credit card.

It’s a lifestyle.

And earnings for the most recent quarter prove just how much AmEx has become a status symbol for these younger generations.

Earnings per share flew 34% higher from last year. At $15.4 billion, this was the company’s sixth-straight quarter of record revenue.

This success is directly tied to their affluent cardmembers, a 7% hike in card spending, and a significant uptick in travel and entertainment spending.

What’s more exciting for long-term investors is the traction AXP is gaining with millennials and Gen Z. These younger demographics made up the fastest-growing segment last quarter, accounting for 60% of American Express’s new customers – and spending by this cohort? Up by an impressive 18% year-over-year.

Shares stumbled on Friday’s report, but LikeFolio data speaks volumes on AXP’s long-term prospects.

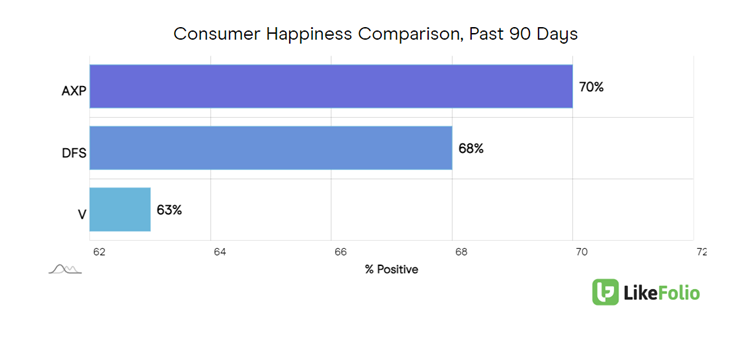

- Consumer Happiness Outshines Peers

At a 70% positive rating, AXP’s consumer happiness is not only impressive on its own, but also stands two points higher than Discover Financial Services (DFS) and a substantial seven points higher than Visa (V).

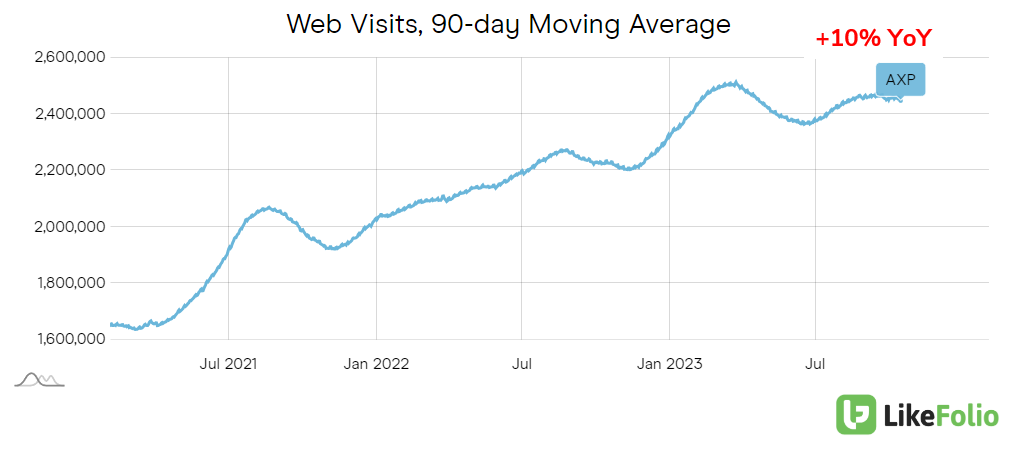

- Web Traffic Building

In a digital age where online presence is everything, American Express is killing it. Web traffic is up by 10% year over year and a staggering 25% on a two-year stack.

- The Power of Partnerships

American Express has become synonymous with unbeatable benefits by partnering with big-name brands like Hilton (HLT) and Delta Air Lines (DAL).

Hilton and AmEx recently extended their partnership another 10 years, underscoring the power and longevity of its partnerships, a cornerstone of its business strategy.

This, coupled with a business model heavily focused on fee-based premium products, sets AXP apart in the financial services landscape.

Sure, there’s been chatter about recent changes to the Delta/AmEx branded cards, particularly around Delta Sky Club access.

But let’s flip the script: Could the Sky Clubs be brimming because of high AmEx adoption and perk utilization? That’s a quality problem, indicating brand strength and customer engagement.

And guess what? Even with these tweaks, AmEx’s Consumer Happiness metric still reigns supreme in the LikeFolio universe.

The Bottom Line

American Express shares are down around 15% since July. But here’s the deal: Big picture, American Express is a global symbol of affluence, luxury, and premium service.

The company’s strategic moves, backed by LikeFolio’s positive consumer insights, suggest that any current market hurdles are just that — temporary hurdles.

The long-term outlook for American Express looks promising, especially as it continues to resonate with the luxury preferences of younger, affluent consumers.

So, is AXP a tried-and-true luxury play? All signs point to a resounding yes.

AXP’s current Social Heat Score sits at a robust +68, just on the verge of our “buy zone,” and paid-up members will be the first to know when it’s time to make a move.

But you don’t have to wait until then: Find out the next under-the-radar stocks our Social Heat Score is targeting right here.

Until next time,

Andy Swan

Founder, LikeFolio

Up Next: Generative AI Could Kill These Freelance Stocks

As generative AI gets better and better, our outlook on these two stocks gets worse and worse…