Festive gatherings, twinkling lights, the clinking of glasses…

As families and friends come together during the holidays, the dining table often features a mix of traditional dishes, festive treats, and an array of beverages.

Amidst the sparkling wines and seasonal brews, there’s one constant: the iconic red can of Coca-Cola, ready to be mixed with your favorite spirit or enjoyed on its own.

The Coca-Cola Co. (KO) has been synonymous with the holiday season since its first Christmas ad in 1931. All it took was one jolly, red-faced Santa Claus enjoying a glass of Coca-Cola, and the bubbly brown brew was no longer just a summer beverage.

Coca-Cola has been a Wall Street favorite for decades, delivering dividends to investors for 61 consecutive years and earning it a spot among an elite group of “dividend kings.”

The company went public over 100 years ago, after all, in 1919.

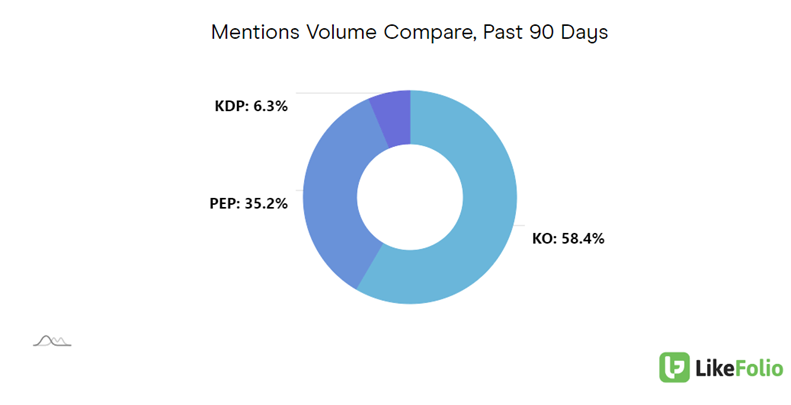

And to this day, Coca-Cola dominates the beverage conversation – even compared to fellow centenarian PepsiCo (PEP), LikeFolio data shows KO in the lead with 58.4% of consumer mention volume versus PEP’s 35.2%.

But Coke doesn’t just want to be the default holiday mixer of choice anymore.

The company is seizing opportunities to expand beyond fizzy drinks by tapping into growing consumer trends in ready-to-drink cocktails, better-for-you beverages, and more.

Take a look at how Coca-Cola’s strategic chess moves are paying off…

Coca-Cola’s Well-Played Game of Chess

- Tapping into the Ready-to-Drink Market

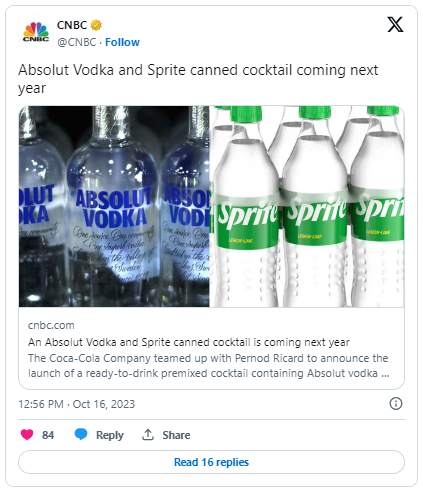

With this first chess move, Coca-Cola is aiming to make the holiday season even more special with its foray into the fastest-growing spirits category: ready-to-drink (aka canned) cocktails.

In collaboration with Pernod Ricard, Coca-Cola plans to launch a cocktail combining Absolut Vodka and Sprite by 2024 in select European markets.

This move comes after it partnered with Brown-Forman (BF.B) on Jack and Coke in a can, which launched in the U.S. earlier this year.

- Better-for-You Brands

Beyond alcoholic beverages, though, Coca-Cola is proving its adaptability by tapping into consumer demand for premium and health-conscious products.

Its expansion into non-soda juice, dairy, and plant-based beverages, has been pivotal – with brands like Fairlife milk and Costa Coffee helping to drive 2% volume growth over the last quarter.

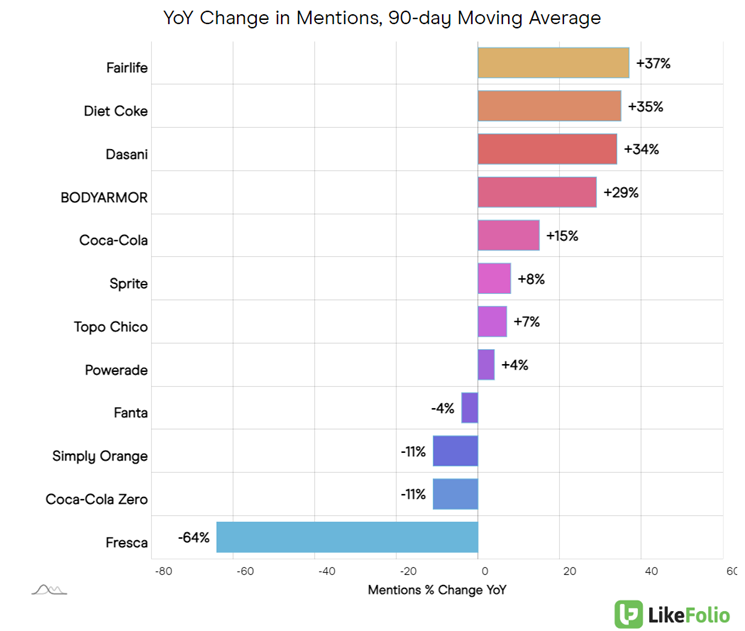

LikeFolio data shows the brands gaining traction among consumers. Check out the leaderboard:

Fairlife (+37%), Diet Coke (+35%), Dasani (+34%), and BODYARMOR (+29%) all sit at the top when it comes to buzz growth.

- Streamlining Operations

In addition, Coca-Cola has streamlined its beverage line from 400 to 200 brands over recent years. This optimization ensures that each product is poised for success, allowing the company to reduce costs and focus on its most profitable offerings.

The company handily beat earnings estimates at 74 cents per share (compared to 69 cents per share) and bringing in $12 billion in revenue, representing 8% year-over-year growth.

LikeFolio Insights: Bullish on Coca-Cola

Coca-Cola’s strategic moves, combined with its enduring appeal as a beverage staple, have us bullish both in the short and long term.

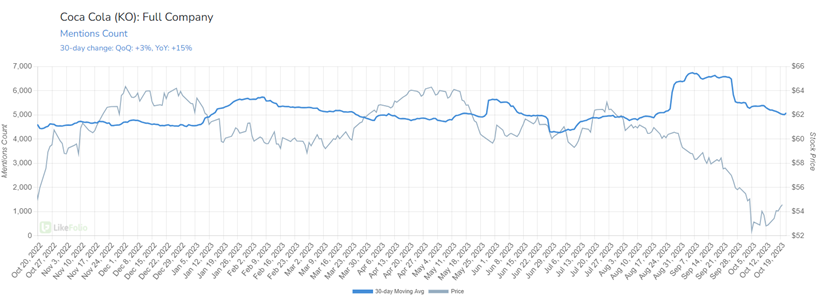

While its positive sentiment trails competitors at 65%, Coca-Cola still dominates consumer mindshare. Overall buzz around its family of brands is up by 15% year-over-year.

The company’s robust free cash flow has facilitated consistent shareholder dividends, with an impressive track record of increases for 61 consecutive years. And active engagement in share repurchase programs further underscores its financial strength.

Bottom line: As we head into the festive season, Coca-Cola is not just a drink of choice but a stock with room to grow.

While this dividend king pads your portfolio with profits year after year, we always leave room in our portfolio for a “moonshot” bet.

You know, one of those lesser-known stocks trading for just a few bucks… but with the potential to skyrocket?

We saw one tiny company riding the artificial intelligence wave before Wall Street had even caught on. And since we first flagged this “undercover” AI opportunity in March at just $1.20, its stock price has doubled.

You can still grab shares for under $3. But not for long.

So check out this “moonshot” stock here before it doubles again.

Until next time,

Andy Swan

Founder, LikeFolio

Up Next: Holiday Stock Showdown: FedEx vs. UPS

FedEx and UPS share the same end goal – getting Santa’s presents under the tree by midnight. But they take two drastically different paths to get there. Find out which we’re betting on for the holidays…