“History doesn’t repeat itself, but it often rhymes,” Mark Twain once astutely observed.

And in the tumultuous financial saga of 2023, we’re seeing familiar patterns dance to a new tune.

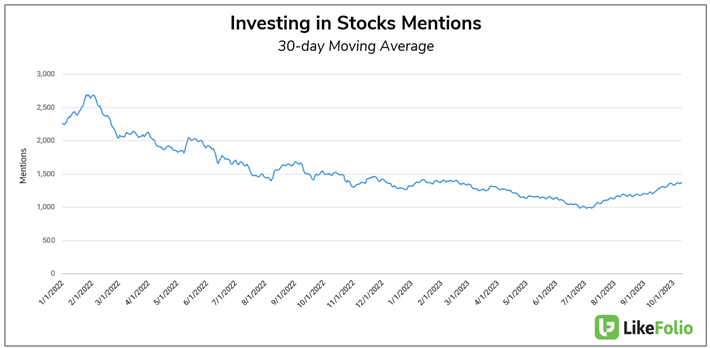

The love affair with stocks is enduring – but not without its ups and downs.

After a sizable year-over-year drop in mentions of investing in stocks, the old investor favorite seems to be showcasing a hopeful rebound.

Is this the sign of renewed faith, or a mere hiccup? Only time will tell.

But as we peel back the data layers at LikeFolio, one recent shift in consumer preference surprised us.

While stocks still serenade many, the chorus of safety grows louder. And it’s not just hearsay.

These numbers tell the story.

Discover the latest trends shaping the investment landscape…

Stocks, Bonds, and The Rise of High-Yield Savings

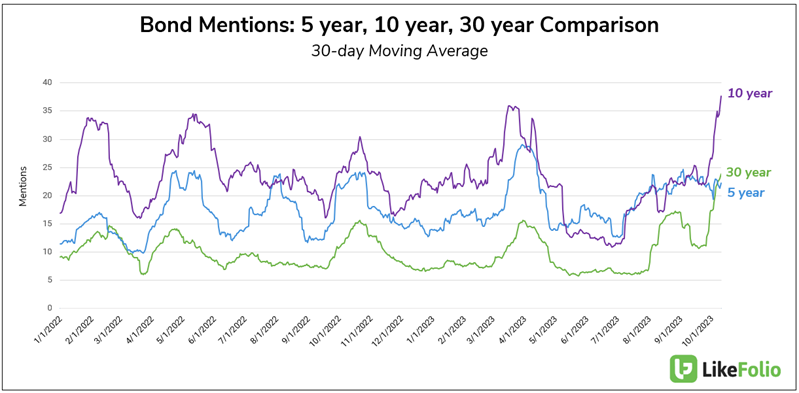

Long-term bonds, particularly the 10-year and 30-year variants, have emerged as the stalwarts in these unpredictable times.

Check out the chart below – which highlights how mentions of these bonds have skyrocketed in comparison to their 5-year counterpart.

Are bonds the new “risk-off” sanctuaries for the anxious investor?

Not just bonds.

Another investment vehicle is rising in prominence…

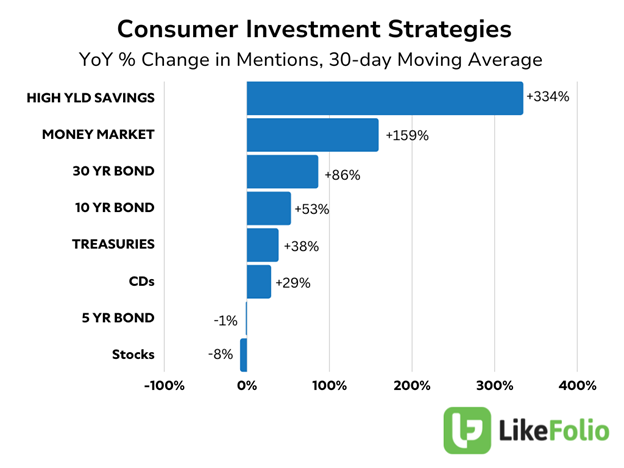

Bonds might be the buzzword on the street, but mentions of high-yield savings accounts are surging among individual investors.

See for yourself how they’re not just leading, but dominating the pack, showcasing unparalleled 334% growth.

Between the third quarter of 2022 and the same period in 2023, the buzz around these accounts didn’t just increase; it exploded from 4% of investor mindshare to a staggering 23% (at the behest of individual equities).

Fueling this seismic shift is a blend of protection and lucrative returns in an era of measly interest rates.

The investor’s playbook is getting a fresh rewrite in the near-term.

And we are constantly looking for big winners when consumer behavior shifts.

We have one company in our sights that stands to be an enormous beneficiary from rising consumer interest in low-risk investment vehicles.

In fact, MegaTrends members just received an urgent buy alert on one tiny fintech stock – what we’re calling a “penny stock in disguise” poised to climb 200% over the next two years.

Current members can access their trade details here.

But if you’re not yet a member, don’t worry. You can go here now to get started.

And stay tuned for more opportunities in this space as we head into 2024.

Until next time,

Andy Swan

Founder, LikeFolio

Top Stocks to Watch in October 2023

This Dividend King Is the Gift That Keeps on Giving

Take a look at how Coca-Cola’s strategic moves are resonating with consumers ahead of the critical holiday season…

Why We’re Seeing Green on American Express

Is American Express the ultimate luxury play? Gen Z and millennials would answer “yes.” Here’s what the data says…

This Overlooked “Weight-Loss” Play Is a Golden Opportunity

There’s more than one way to play the weight-loss “mega” trend – and this is a tried-and-true classic…