Over the past five years, Nvidia’s (NVDA) stock price has soared by an astonishing 1,250% as the company leads a technological revolution in artificial intelligence (AI).

It was the top-performing S&P 500 stock in the first half of the year by a mile, returning 190%; year-to-date, NVDA shares are up 214%.

If you figure that the stock market returns an average of 10% a year, we’re talking about more than 20 years of gains, in less than one year, from a single stock.

For our MegaTrends subscribers who got in early last September, we’re talking about an incredible 257% win.

We know the NVDA profit opportunity was ignited by the high expectations for its AI prowess.

But what does all this actually mean, in layman’s terms?

More important for you… are those profits poised to continue?

We’ll answer that question today using LikeFolio’s unique consumer insights. Because as you’ll find out, Nvidia is still on fire.

And despite its meteoric rise, its stock price likely has more room to grow…

Empowering the AI Revolution

At the heart of Nvidia’s success lies its transformation from a gaming-focused GPU manufacturer to a key driver of the AI revolution.

(GPU stands for graphics processing unit, the specialized part of your computer that makes video games, streaming, and any other graphics effects go.)

Since its dot-com days, Nvidia has created some of the world’s most advanced computer chips and graphics cards. Those have evolved to become the brains behind AI, capable of processing vast amounts of data at incredible speeds.

This capability is crucial for “inferencing” – where AI models, trained on large datasets, make real-time decisions based on new data.

For example, Nvidia’s GPUs enable self-driving cars to interpret complex traffic data and virtual assistants to process human speech with remarkable accuracy.

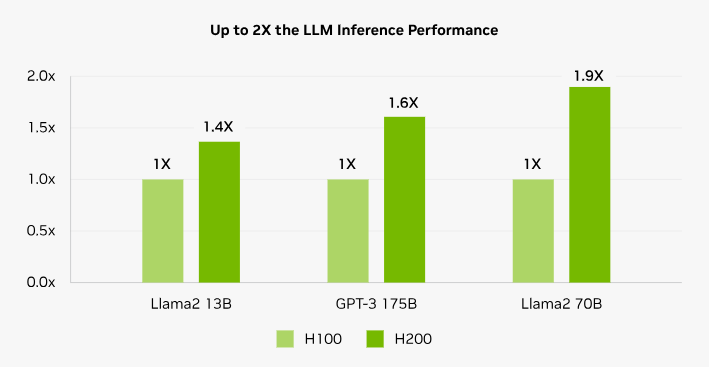

The company’s latest H200 AI GPUs represent a significant leap in AI processing power, promising nearly double the output speed of their predecessors.

These GPUs are not just chips; they’re the engines powering AI models like OpenAI’s ChatGPT, transforming industries from health care to finance with their advanced capabilities.

Competitors Agree

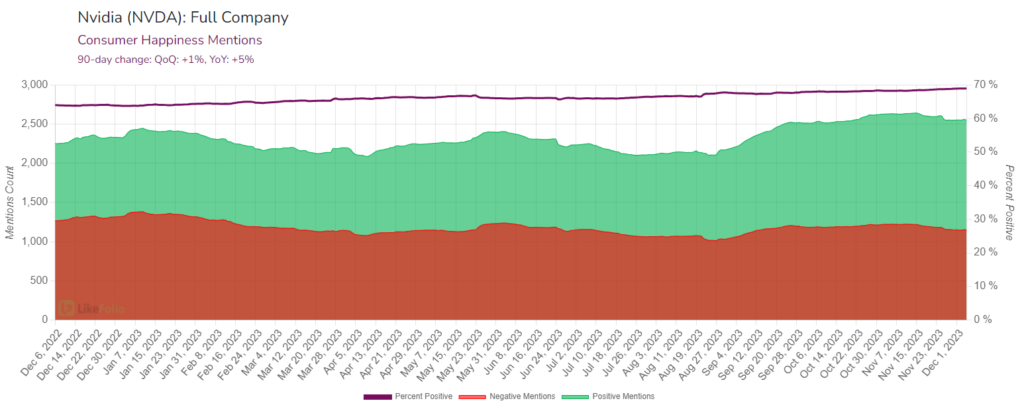

Nvidia’s Consumer Happiness stands at 70% positive, gaining 5% year over year in a testament to the quality of its products.

On November 28, Nvidia announced it is expanding its partnership with Amazon.com (AMZN) to offer Nvidia’s latest H200 AI graphics processing units through AWS (Amazon Web Services).

To showcase how good these chips are, even Amazon competitor Microsoft (MSFT) said its Azure cloud will have Nvidia H200 GPUs by next year.

Setting the Industry Standard

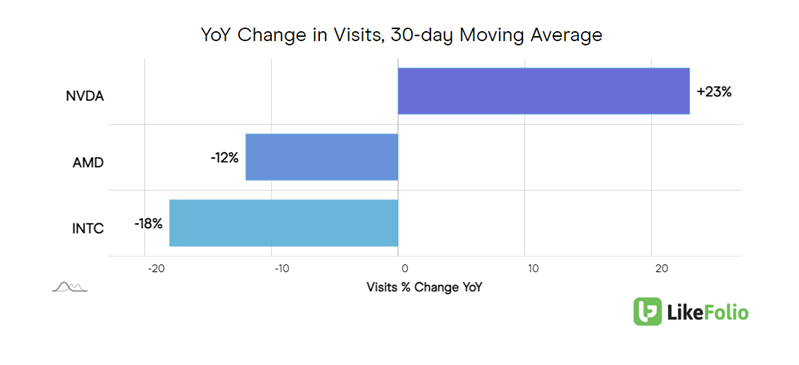

Nvidia’s dominance in the tech market is evident in LikeFolio’s consumer mindshare metrics.

The company commands a significant portion of web traffic in the tech sector, outpacing competitors like Intel (INTC) and Advanced Micro Devices (AMD), with 55% of web visits and double-digit year-over-year growth.

Its HGX platform with InfiniBand has become the benchmark for AI supercomputers and data center infrastructures, powering major AI applications across various industries.

Tech So Good It’s Prompting Government Intervention

Nvidia’s technological advancements have implications beyond the tech industry – and have drawn the attention of governments worldwide.

The U.S. government’s decision to restrict the export of Nvidia’s advanced AI chips to strategic rivals like China underscores the chips’ immense power and potential.

The need for intervention here means Nvidia’s tech has significant geopolitical implications, marking it as a key asset in the global tech landscape and a matter of national security.

Financially, Nvidia’s performance is as impressive as its technological achievements. Despite export restrictions, the company’s revenue has surged, driven by robust growth in its data center segment.

For the most recent quarter, it achieved record revenue of $18.12 billion – representing 206% year-over-year growth and a 34% boost from the previous quarter.

This growth, outstripping its gaming revenue, underscores Nvidia’s strategic pivot towards AI and cloud computing.

As these sectors reshape the tech landscape as we know it, Nvidia stands at the forefront.

If you feel like you missed out on Nvidia’s meteoric rise, don’t worry. There are smaller players out there ready to break out… if you know where to look.

We can show you: Our consumer insights machine helped us spot what we believe could be one of the biggest undercover AI opportunities of the decade.

With a market cap under $1 billion, this player looks downright tiny compared to a trillion-dollar giant like Nvidia. And that’s part of what makes it so lucrative.

See, this hidden AI gem has already more than doubled since it first hit our radar. But at just $3, its profit potential is only just getting started.

Until next time,

Andy Swan

Founder, LikeFolio

P.S. Miss yesterday’s issue? In our latest Stock Showdown, we stack up DoorDash (DASH), Uber (UBER), and Tesla (TSLA) to see who will win the last-mile delivery race. Read it here.

Don’t forget: You can access the full Derby City Daily archive at any time through our “Newsletter” page.