Bold statements from PayPal (PYPL) leadership have investors betting on a turnaround – is it too good to be true?

In a CNBC interview last week, CEO Alex Chriss promised to “shock the world” at an innovation day event on January 25 (tomorrow), sparking a near-term rally for the payment giant.

Chriss acknowledged that there “hasn’t been a lot to celebrate in the last few years.” He’s right: PYPL is trading nearly 80% below 2021 highs.

That performance is nearly in tandem with digital wallet peer, Block (SQ), as e-commerce growth cooled and the company struggled a bit to regain its footing after completing its breakup with eBay (EBAY).

But since Chriss’s comments aired, PYPL shares have popped nearly 10%.

Is this a question of buy the rumor, sell the news?

You know, that dance between anticipation and realization, where investors buy up stocks on positive rumors, then sell once the news is officially announced?

Even if the news is great, the stock can plummet once it’s released, leaving unwitting investors in the lurch.

This is when having LikeFolio in your corner really counts.

With critical insights straight from the group that matters most – consumers – we don’t have to speculate on rumors or hearsay.

On the eve of PayPal’s “shock the world” announcement, our data cuts through the noise to reveal where PYPL really stands…

The Cold, Hard Truth About PayPal

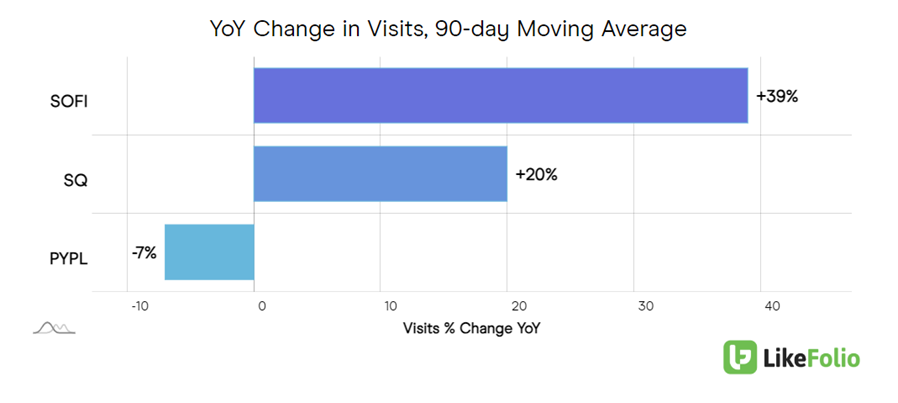

PayPal web visits look concerning.

Not only have visits slipped by 7% year over year, but the company also is trailing competitors like SQ (+20%) and SoFi Technologies (SOFI), which dominates in this metric (+39%).

Even PayPal’s golden child, Venmo, is witnessing a digital traffic drop (though this may be more app-focused than web-focused, to be fair).

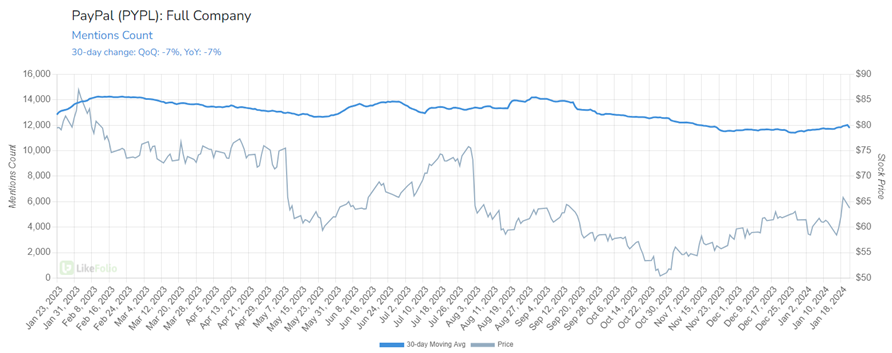

Still, consumer mentions mirror this slope downward, dropping by 7% year over year on a 30-day moving average.

The takeaway: PayPal is failing to generate interest and spark engagement on the consumer front.

The silver lining: Much of this drop is from its namesake PayPal brand, while Venmo buzz is flat year over year, and sentiment is stable.

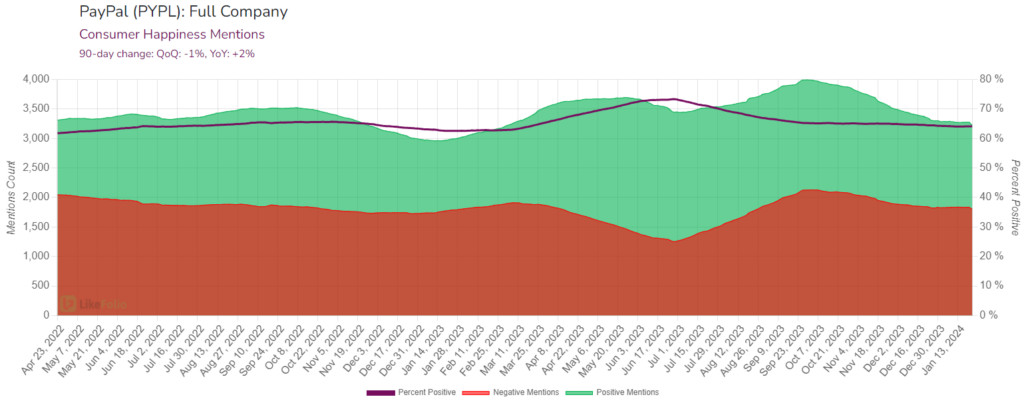

Consumer Happiness levels provide a glimmer of hope for PayPal’s future prospects.

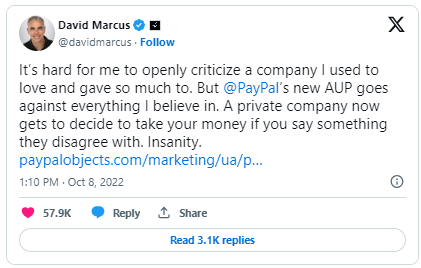

Sentiment has risen by two points year over year to 64% positive, marking a full recovery from the “woke” blunder from 2022. (Remember its policy to fine users for “misinformation?”)

Could PayPal Be Ripe for a Turnaround?

It’s not out of the question.

PayPal demonstrated the first signs of a potential turnaround last quarter, when Q3 2023 earnings exceeded analyst expectations:

- Adjusted earnings per share (EPS) rose 20% year over year to $1.30, surpassing the anticipated $1.23.

- Revenue increased by 8% to $7.4 billion, meeting forecasts.

- The company also raised its full-year earnings forecast and appointed a new CFO, Jamie Miller.

- Despite a decline in total active accounts, total payment volume grew by 13%.

This performance indicates a positive trend in PayPal’s business for the first time in several quarters.

Now, let’s talk about this big news coming tomorrow.

On PayPal’s last earnings call, CEO Alex Chriss described himself as “maniacally focused” regarding innovation, execution, and value delivery for customers.

He’s thinking globally, leveraging artificial intelligence (AI) where possible (think consumer profile and payment data), and noted that moving forward, “we will make it abundantly clear why choose PayPal.”

Some analysts speculate about a true super app, combining PayPal and Venmo, while others are focused on the global expansion possibilities or potential AI developments.

We aren’t speculating here. Instead, we’re relying on real-time insights to understand if the company is gaining traction with consumers – a powerful tool for investors, regardless of what news is released.

Looking Ahead

The bar for PYPL is low, and the opportunity for improvement is high.

Venmo is leading positive momentum – its new teen account is a great way to get the younger generation in the door. And company-wide sentiment improvements are positive for long-term growth. But less-than-exciting mention buzz and declining web traffic give us room for pause in the near term.

On the horizon, we do see building tailwinds on the macro front: digital wallets are the future. Some 69% of consumers used digital wallets for payments over the last year.

MegaTrends members can tell you firsthand the kind of profits up for grabs: The “Poor Man’s PayPal” stock we recommended in October has soared 35% in a few short months. (Note: You have to be a paid-up member and logged in to access that alert.) Oh – and our forecast says that tiny fintech player could climb 200% over the next two years, so it’s not too late to claim a piece.

PayPal, on the other hand, still has some catching up to do.

We can’t wait to see what “shocking” news tomorrow brings.

And when PayPal’s next earnings event rolls around on February 7, we’ll reassess our real-time predictive insights, evaluate if PYPL is due for a surprise to the upside or downside, and place our trades accordingly.

Until next time,

Andy Swan

Founder, LikeFolio

More Free Insights from Derby City Daily

Stay ahead of the investing curve with free consumer demand insights from Derby City Daily. Here’s what’s new…

As Airlines Falter, One Stock Has a Clear Runway

Airline sentiment is plummeting, and leaving consumer dollars up for grabs…

Uber Zooms Past Lyft into a League of Its Own

Against all odds, Uber’s bold strategy is… working. Here’s what comes next…