With high-profile events like the Super Bowl and Q4 earnings on the horizon, DoorDash (DASH) expectations are mounting…

DoorDash wants to make sure you know it’s not just a food delivery service anymore – and it’s leveraging the single-biggest TV broadcast of the year to do it.

An estimated 115 million folks tuned into last year’s Super Bowl faceoff between the Kansas City Chiefs and Philadelphia Eagles, making it one of the most-watched broadcasts of all time – second only to the Apollo 11 Moon landing. (Fair enough.)

But with high-profile megastar Taylor Swift on the roster, this weekend’s Super Bowl LVIII in Las Vegas could easily surpass that record. (And that could spell great news for our favorite $2 AI moonshot.)

DoorDash is taking full advantage of that captive audience with a savvy new promotion: From Popeyes to “all the vehicles,” the company promised to deliver “all the ads” to a lucky winner who can crack a hidden code revealed in this year’s Super Bowl commercials.

DoorDash is looking to bring awareness to its expanded offerings: The company recently evolved from a food delivery service to a “just-about-anything” delivery service with a massive update to its platform in June.

Users can now search categories like alcohol, flowers, pets, health, retail, beauty, and more.

The company’s long-term goal, according to head of product Rajat Shroff, is “bringing the entire city to the consumers’ fingertips.”

For consumers, convenience is still king, says DoorDash. And it capitalized on that demand in the third quarter of 2023.

Revenue increased 27% year over year to reach $2.2 billion, while Total Orders and Marketplace Gross Order Value (GOV) both saw a 24% year over year boost. The company also saw a substantial reduction in losses, narrowing to $75 million from $296 million in the same quarter of the previous year.

The market gobbled up the results: DASH shares soared more than 15% higher immediately following the report and has sustained that momentum ever since.

But as we gear up for DoorDash’s Q4 earnings (due next Thursday, February 15), LikeFolio data suggests reason for caution…

DoorDash: Not so Fast

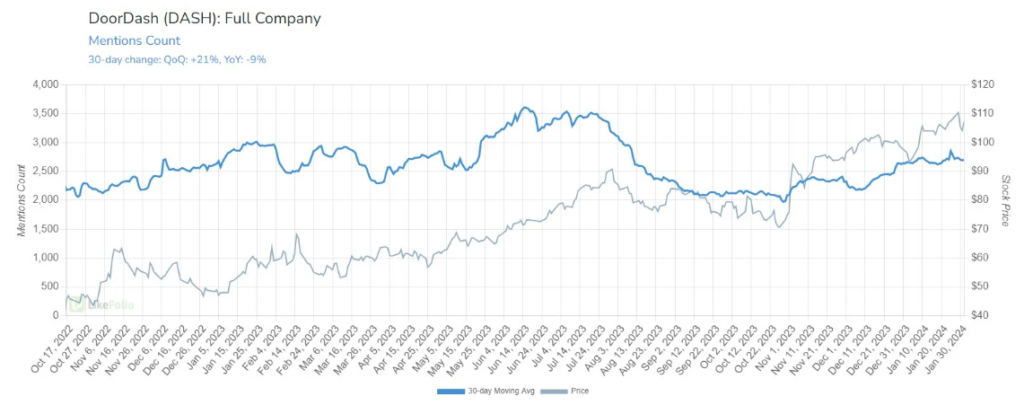

Several critical consumer metrics point to a potential slowdown in growth and engagement for DoorDash that Wall Street might not see coming.

The company’s mention volume has slipped by 9% year over year on a 30-day moving average, worsening from a 5% dip on a 90-day view.

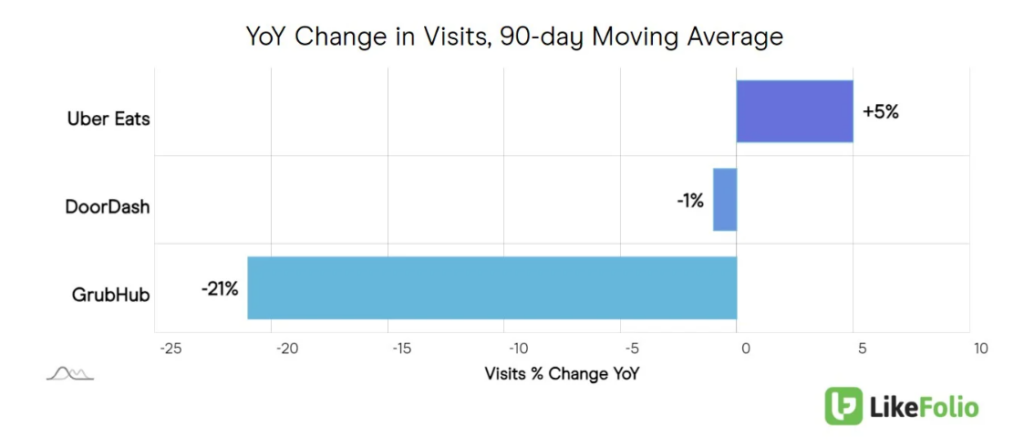

This trend is mirrored by consumer web traffic analysis, which indicates Uber (UBER) is capturing some of DoorDash’s market share.

While DoorDash’s web traffic has posted a slight one-point decrease year over year, Uber Eats has seen a five-point increase in traffic:

GrubHub remains significantly behind its competitors in this metric.

[RELATED] Stock Showdown: Who Will Win the Last-Mile Delivery Race?

A High Bar to Clear

Despite these challenges, DoorDash has successfully distinguished itself within the sector of growth-oriented companies by maintaining a debt-free balance sheet.

This is particularly remarkable among its peers, who often carry a significant level of debt relative to equity.

It’s a financial strategy, supported entirely by shareholder funding, that eliminates the burden of debt obligations – mitigating concerns regarding repayments and presenting DoorDash as a comparatively less risky investment.

As DoorDash approaches its next financial report, and with high-profile events like the Super Bowl on the horizon, expectations are mounting.

The stock is currently trading more than 80% higher year over year, reflecting investor optimism about the company’s growth trajectory and operational improvements.

Bottom line: On the consumer front, LikeFolio data suggests room for caution ahead of this report. Slowing momentum may hinder this company from clearing a high bar.

We’ll be watching over the next few weeks for any significant changes in momentum.

But there are a few Super Bowl stocks we ARE placing bets on today. In fact, paid-up members received three top game day picks in today’s Founder’s Call, an exclusive perk of LikeFolio Investor. (Must be logged in to access.)

This tiny $2 AI stock could also see an unexpected Super Bowl surge – and you can get the details on all of these picks today. Simply go here now to get started.

Until next time,

Andy Swan

Founder, LikeFolio

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

Perks, Points, and Profits: American Express’s Winning Formula

Here’s why our long-term outlook on AXP just gets better and better…

Winners and Losers in the Future of Banking

With our real-time read on social media, we can show you the early winners – and losers – of the digital banking era…