It’s official: Super Bowl LVIII holds the record for the most-watched television broadcast of all time.

According to Nielsen, 123.7 million people tuned in to watch the Kansas City Chiefs defeat the San Francisco 49ers in overtime.

That figure represents a 7.4% boost over last year’s Big Game, making it not only the most-watched Super Bowl – but the most-watched TV event. Period.

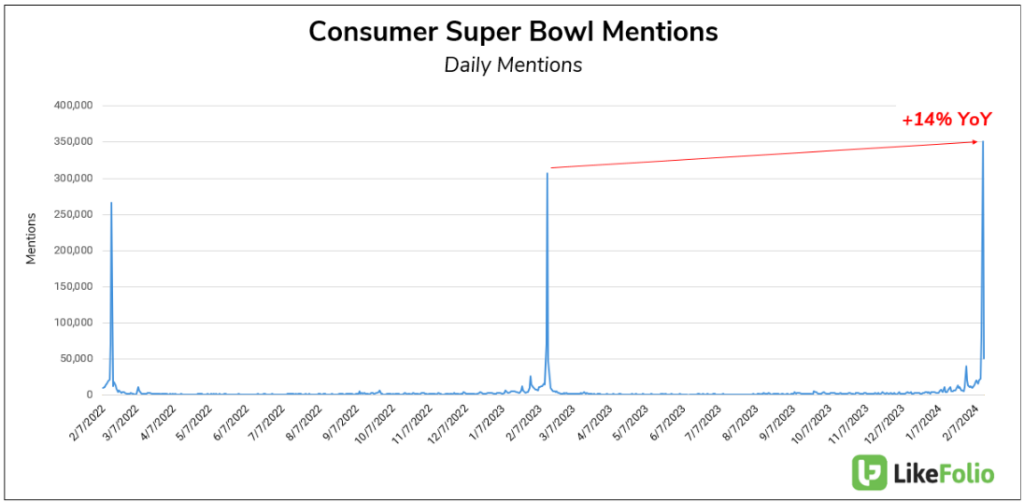

LikeFolio social media and web data confirms this surge in consumer interest. We found that Super Bowl mentions were up significantly year over year and reached the highest level in our coverage history.

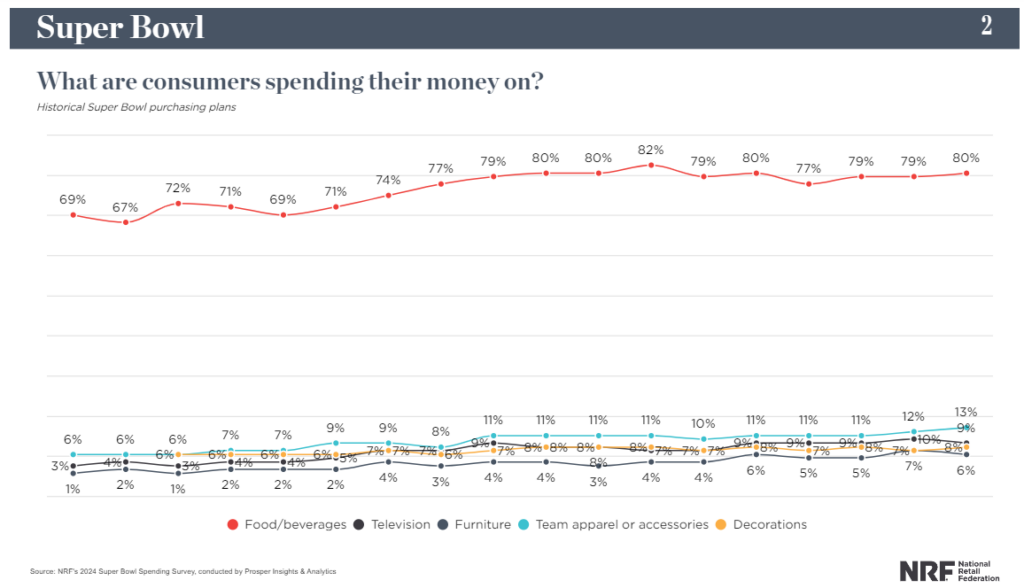

As fans stocked up on provisions for their game day festivities, the National Retail Federation estimates they spent a record $17.3 billion – on everything from snacks to team apparel to decorations, and even furniture.

But the biggest portion of 2024 Big Game budgets by far went to food and beverages at 80%.

Salty snacks remain the snack of choice for consumers settling in to watch the big game. In fact, more than 90% of football fans indulge on game day.

Last year’s Super Bowl festivities catapulted savory snack consumption to a record-breaking 118 million pounds, driving sales up by 29% from 2022, and amassing nearly $800 million, capping off the largest snacking week of the year.

This year surely broke that record, too.

And among the titans of the snacking world, LikeFolio data reveals opportunity in one Big Game Winner.

This company’s products are consumed more than 1 billion times daily across 200 countries.

Its snacking portfolio includes the most popular chips cited on social media during the game – those “eetos” we all crave, Tostitos, Cheetos, Doritos, and more.

Dominating the Super Bowl Snacking Frenzy

That’s right: We’re talking about global beverage and snack powerhouse PepsiCo (PEP).

Pepsi owns the classic munchies you find in vending machines, kids’ lunch boxes, and gas stations – the kind that satisfy those late-night cravings.

The kind that make for perfect game day snacks.

So, it’s not a real surprise that PepsiCo leaned heavily into Super Bowl LVIII with its advertising exposure.

It kicked off its “Taste of Super Bowl” campaign with a commercial featuring Rob Gronkowski, Marshawn Lynch, and Troy Polamalu that showed confetti bursting from bags of Lay’s, Cheetos, and Tostitos.

That one 30-second ad spot has garnered 1 million views on YouTube alone.

The company also created an immersive fan experience right on the Las Vegas Strip: The Chip Strip.

At the Frito-Lay Chip Strip at New York Hotel, fans could try to win a Frito-Lay Snackpot, ride the Big Apple Coaster, and even get married at the “Cheetos Chapel.”

At one point, The Luxor even turned into a giant Dorito.

PepsiCo’s Super Bowl campaign garnered tons of attention on social media.

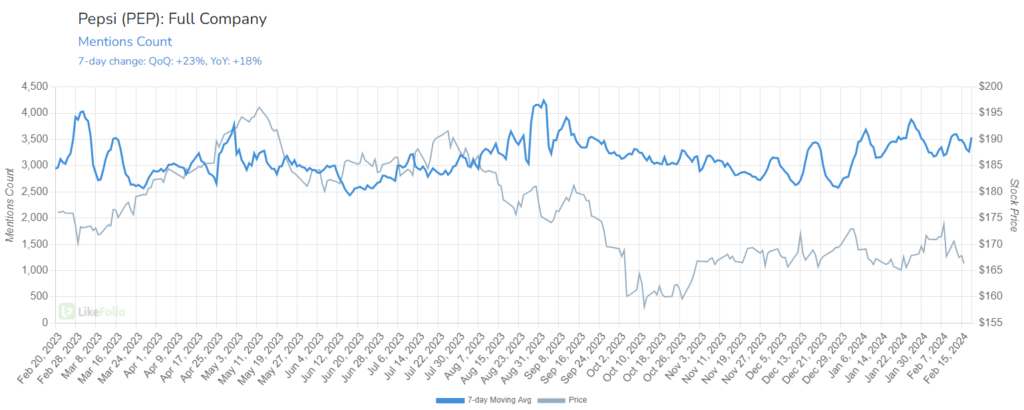

LikeFolio recorded an 8% year-over-year pop in PEP mentions during Super Bowl week. And from a short-term view, those mentions are still gaining traction.

The Real Favorites on Main Street

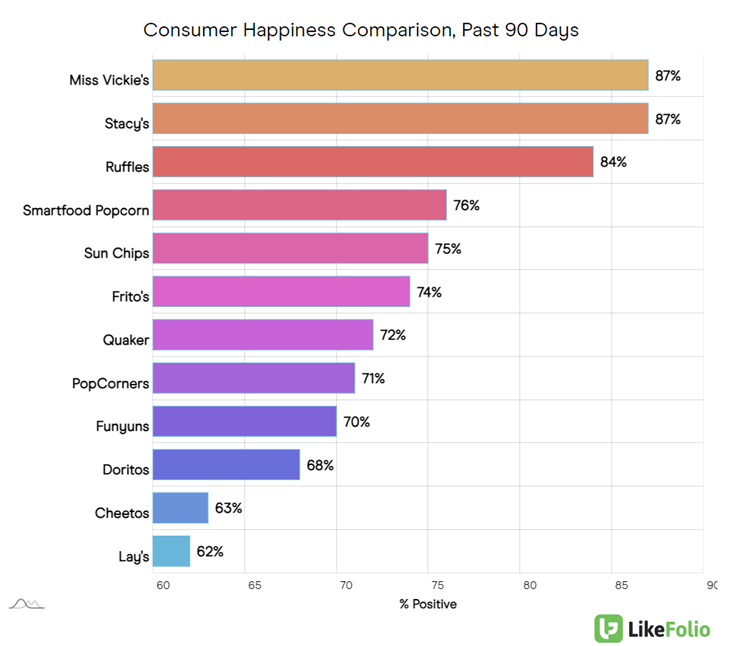

While the “eetos” claimed the Super Bowl spotlight, Pepsi’s real edge lies in the smaller, more niche brands in its diverse snacking portfolio.

Miss Vickie’s and Stacy’s Pita Chips, for example, command the highest levels of overall sentiment among consumers, compared to those flagship brands:

And this balance between indulgent and health-conscious options is driving improvements in PepsiCo’s overall levels of Consumer Happiness, up 7% year over year.

That’s a promising sign for long-term growth.

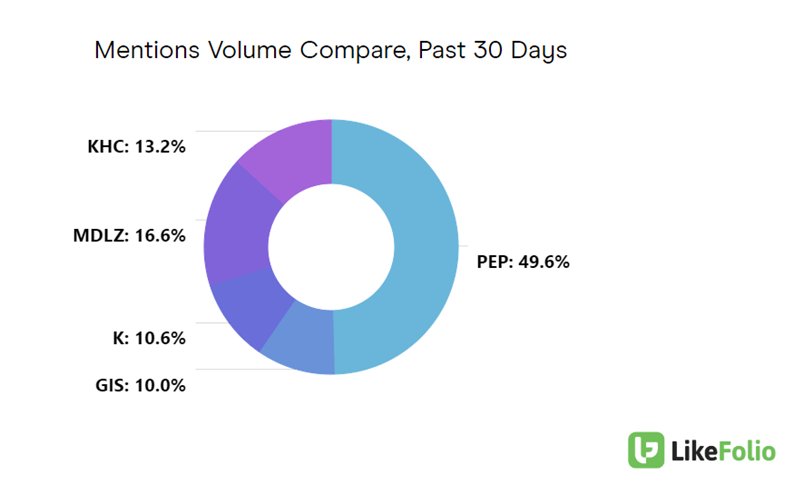

Especially considering PepsiCo already secures about half of the consumer mindshare when compared to competitors such as The Kraft Heinz Company (KHC), WK Kellogg (KLG), General Mills (GIS), and Mondelez International (MDLZ).

But there is a caveat.

Consider the Cost

Higher food prices are once again top of mind for consumers.

On its last earnings call, PepsiCo noted, “we’re seeing a bit of a slowdown in the U.S. both the food category and the beverage category in the Q4. Part of that is slowdown due to pricing and disposable income situation.”

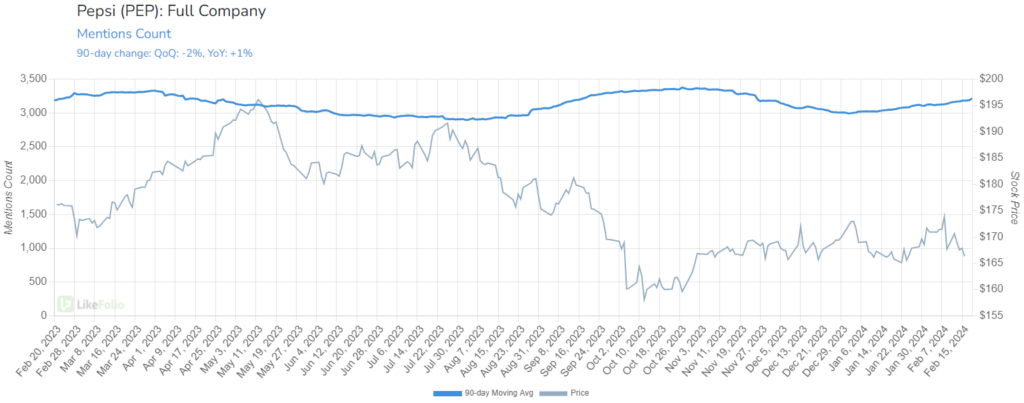

And looking at PEP mentions from a zoomed-out scale suggests consumers are hitting a wall.

Mentions are relatively flat on a 90-day moving average (+1% year over year) and down 2% quarter over quarter.

Keep an eye on this, as higher prices have previously helped to boost PEP.

Bottom line: PepsiCo dominated the Super Bowl snacking frenzy. We’ll be watching to see how consumers’ shift towards cost-conscious shopping could impact PEP going forward – and whether it can harness this positive momentum from the Super Bowl into sustained growth.

Ready for the next game-day winner? I can show you right now.

See, consumers reached for something a little stronger than cola to wash down their munchies on game day.

And with Bud Light (BUD) no longer the fan favorite beer, another has taken its place – triggering a time-sensitive buy alert for our LikeFolio Investor subscribers earlier today.

Consider this your chance to get in on the profits.

Go here now to learn how to join for immediate access to this just-released trade alert.

Until next time,

Andy Swan

Founder, LikeFolio

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

This Trend Rocketed 14,000% in Just Two Years 🚀

The AI landscape is buzzing on the back of technology advancements that are sending chatter to all-time highs…

Inflation Is Still Hot: What This Means for Consumer Spending in 2024

Sustained pressure could have significant implications for consumer buying power…