Is Zoom Video Communications (ZM) the next big AI winner?

That’s the question Wall Street is asking itself today on the back of the company’s fourth-quarter and FY24 earnings report, which sent shares soaring more than 7%.

Forward-thinking funds like Cathie Wood’s Ark Invest are betting big on this name.

ZM is currently the seventh-largest holding in the Ark Innovation ETF (ARKK), behind Coinbase (COIN), Tesla (TSLA), Block (SQ), Roku (ROKU), Crispr Therapeutics (CRSP), and UiPath (PATH) – all stocks LikeFolio members should be very familiar with by now.

(However, it is relevant to note ARK has been decreasing its ZM position, selling the equivalent of $16.8 million in ZM shares earlier this month.)

The bet: Zoom can effectively leverage AI to retain (and grow) its customer base.

Zoom Goes All in on AI

Zoom is leveraging AI technology with its AI Companion (formerly Zoom IQ), a generative AI digital assistant.

And that AI was front and center during last night’s earnings call.

“We’re committed to democratizing AI accessibility, offering it to all our customers regardless of business size, included at no extra charge with a paid license,” said Zoom CEO Eric Yuan in a statement.

Available at no additional cost for customers with paid services, AI Companion is designed to increase productivity, enhance skills, and improve team effectiveness across the entire Zoom platform.

- For Zoom Meetings, it enables users to catch up on missed meetings through automated summaries and next steps and even provides real-time feedback on presence and conversational skills.

- In Zoom Team Chat, it assists in drafting messages and summarizing chat threads.

- And Zoom Whiteboard users will benefit from AI-powered idea generation and organization, with upcoming features that include draft email suggestions and the ability to generate new images for whiteboards.

Qualitative mentions show mixed reviews… and competitive callouts.

Beyond the AI Hype

Aside from AI hype, Zoom is taking cost-cutting measures much like the rest of tech. Earlier this month, the company announced it would cut 150 jobs (or 2% of its workforce). This comes on top of 15% workforce layoffs in February 2023.

We saw ZM reap the benefits of its operational efficiency improvements last quarter: While revenue increased 2.6% year over year, adjusted earnings rose 16%, sending shares higher.

But Zoom is still recovering from its pandemic-era highs – and subsequent crash. And at today’s price of $67 per share, it still has a long way to go.

ZM peaked in October 2020 at $568.34. At the height of the COVID crisis, the company was thriving – recording triple-digit revenue surges, quarter after quarter.

I know because we recommended Zoom to our MegaTrends subscribers in February and March of 2020, right as the work-from-home reality was setting in, and Zoom’s video conferencing platform had become a necessity.

Purchase Intent mentions spiked an impressive 63% that February, so we seized the opportunity to issue an early buy alert on Zoom. By March, those mentions had accelerated a jaw-dropping 1,300%.

We doubled down. And the folks who followed our lead walked away with hefty 192% and 164% gains from those Zoom trades – a prime example of the LikeFolio “edge” in action.

(And I’ll show you how you can tap into that edge today.)

But as a remote work solution in today’s post-pandemic world, Zoom finds itself in a much different position.

Putting Things into Perspective

Triple-digit revenue growth has tempered to single-digit.

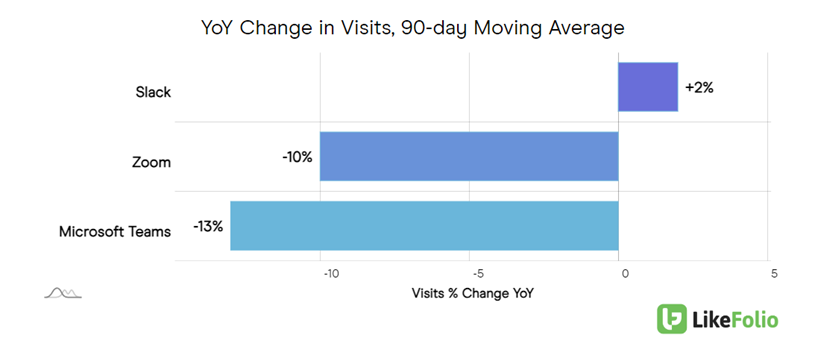

And when it comes to consumer momentum, LikeFolio data now places Zoom in the middle of pack compared to other WFH darlings like Slack (now CRM, formerly WORK) and Microsoft Teams (MSFT).

Zoom web visits have slipped by 10% year over year:

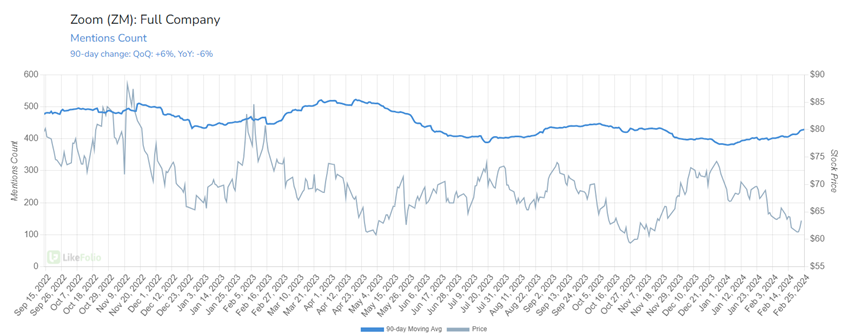

In fact, LikeFolio data shows a loss of momentum across all major metrics, with mentions at large down 6% year over year:

CFO Kelly Steckelberg noted on last night’s earnings call, “Zoom AI Companion has grown tremendously in just five months with over 510,000 accounts enabled and 7.2 million meeting summaries created as of the close of FY ’24.”

As for whether Zoom’s AI improvements are enough to spur growth going forward, we’re not so sure.

When it came to guidance, Zoom said it expects to bring in approximately $1.125 billion in total revenue next quarter, which would mark a sequential decline from this quarter’s $1.15 billion. For the year, it’s expecting a small uptick from $4.52 billion in FY24 to $4.6 billion in FY25.

Those figures beat analysts’ expectations.

But let’s be honest… the bar was low.

We’re not betting on Zoom’s AI-fueled comeback quite yet.

The artificial intelligence “mega” trend is here to stay, though. Already valued at nearly $100 billion, the global AI market is expected to grow to 20x its current size by the end of this decade. And it will mint millionaires along the way.

Not every company will be a big winner. But stick with us, and you could be among the first to know about the under-the-radar stocks seeing huge traction with consumers on Main Street before they become Wall Street news.

Take a look at the explosive AI opportunities we’re targeting next.

Until next time,

Andy Swan

Founder, LikeFolio

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

Walmart Enters the Streaming Wars: Is Roku in Trouble?

As streaming competition mounts, some stocks are feeling the pressure more than others…

NVDA Earnings Preview: Here’s What to Expect Tonight – and Beyond

It’s been a tough road if you’ve bet against this tech titan over the past few years…