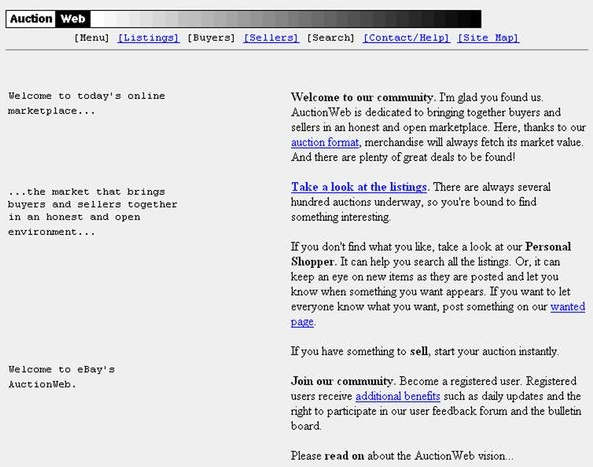

When Pierre Omidyar launched eBay (EBAY) in 1995, it was nothing more than a side hustle. The computer programmer was looking to make some extra cash.

He set up AuctionWeb – a minimalistic, monochromatic website “dedicated to bringing together buyers and sellers in an honest and open marketplace.”

The first item sold, a broken laser pointer for $14.83, symbolized the unique marketplace eBay would become, where even the most unusual items could find a value and audience.

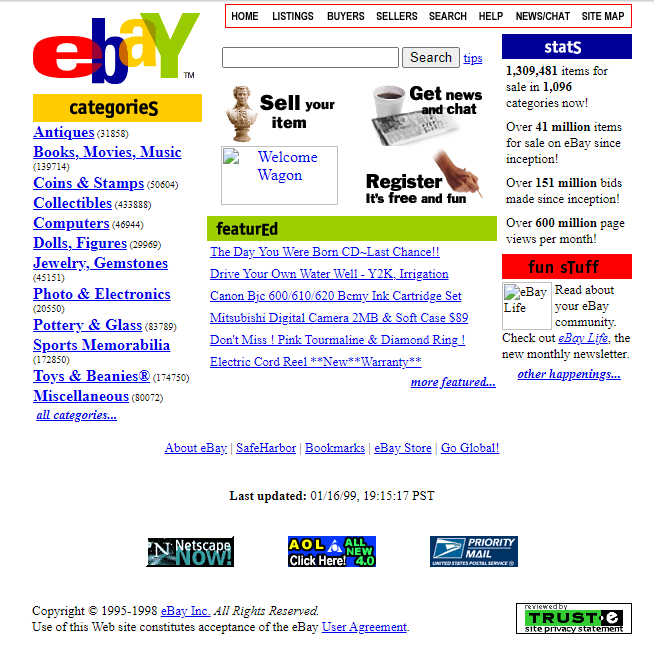

Throughout the late 1990s and early 2000s, eBay experienced rapid growth, expanding its services and market reach through strategic acquisitions and international ventures. It became a symbol of the dot-com era’s potential, with its IPO in 1998 catapulting its founders to billionaire status. And eBay’s acquisitions, including PayPal (PYPL) in 2002, diversified its offerings and strengthened its position in the global e-commerce ecosystem.

But competitors like Amazon.com (AMZN) and Alibaba (BABA) emerged, challenging eBay’s position in an evolving online shopping landscape. The company’s split from PayPal in 2015 didn’t help matters.

And post-pandemic, eBay experienced a slowdown in growth, a common trend among e-commerce platforms as the exceptional surge in online shopping during the pandemic normalized.

Now, EBAY appears to be returning somewhat to its roots and making efforts to streamline operations as competition continues to press.

EBay Pivots Focus

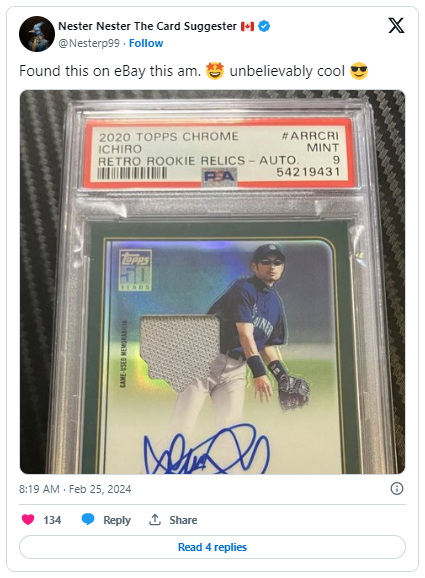

Ebay is honed in on what it calls “focus categories.” These segments – including luxury, refurbished goods, collectibles, and parts & accessories (P&A) – grew seven points faster than the remainder of eBay’s marketplace in Q3.

Its new luxury consignment service connects users looking to sell designer handbags to experts who can verify and sell on their behalf. It’s also building up its reputation in fine jewelry – partnering with Gemological Institute of America (GIA) to expand its Authenticity Guarantee. And it’s investing in its trading card offerings – launching a submission service for collectors, partnering with sports trading card company COMC to expand its listings, and more.

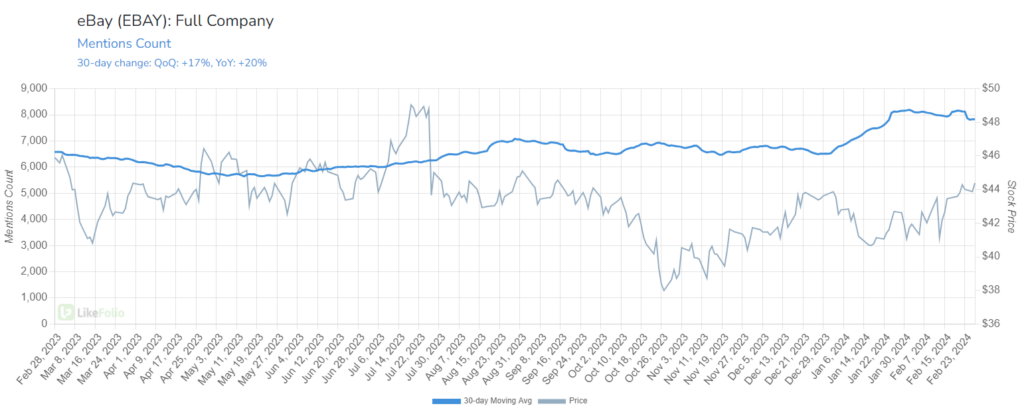

LikeFolio data does show eBay gaining traction on Main Street:

Mention buzz is up as much as 20% year over year on a 30-day moving average.

This transition back to its collectible roots seems to have paid off for eBay during the holiday season.

For the fourth quarter, it reported $2.6 billion in revenue, topping Wall Street expectations of $2.51 billion. CFO Stephen Priest cited “consumers looking for value to stretch their limited holiday budgets” as a key driver of those sales. The company beat on adjusted earnings per share (EPS) as well at $1.07 compared to $1.03.

Shares are up more than 7% on the results, to their highest level so far in 2024.

But Consumer Happiness is declining, currently down 4% year over year as some consumers report quality issues with the collectible items they ordered.

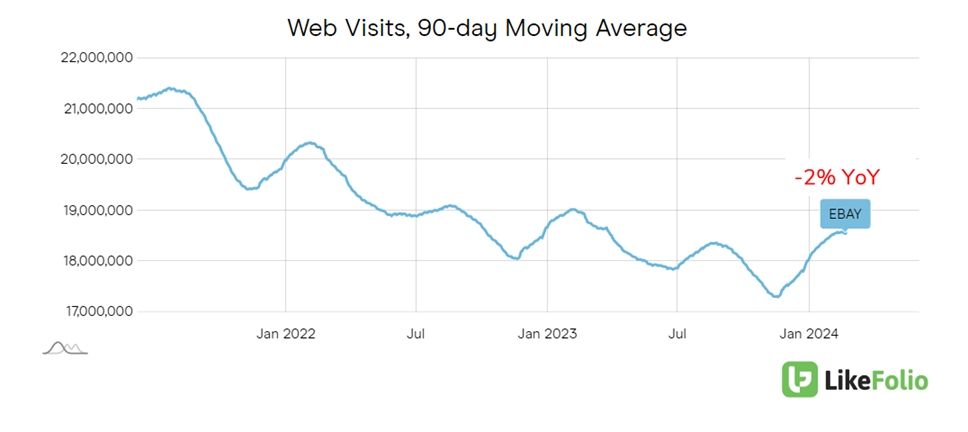

And web visits have slipped by 2% year over year.

The Takeaway

eBay buzz is picking up as it doubles down on its niche position in the collectibles market. But considering relatively flat web traffic and declining sentiment, collectibles aren’t enough to place a bullish bet on this name just yet.

Besides… We like other plays in e-commerce much more.

Until next time,

Andy Swan

Founder, LikeFolio

🚨 Profit Alert: This Stock’s Next Breakout Is Days Away 🚨

While EBAY won’t be joining the list of “LikeFolio All Stars” anytime soon, this little-known AI play earned a coveted spot among our most elite winners. And with web traffic doubling over the last year, we believe this tiny $2 stock is on the verge of an epic earnings-fueled breakout. Get the details before its report drops on Friday.

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

Is This the AI-Fueled Comeback Zoom Needs?

Here’s why we’re not betting on Zoom’s AI comeback just yet…

Walmart Enters the Streaming Wars: Is Roku in Trouble?

As streaming competition mounts, some stocks are feeling the pressure more than others…