If we described an artificial intelligence (AI) company that, in 2024 alone:

- Is posting double-digit buzz growth…

- Debuted the world’s first desktop processor with a dedicated neural processing unit (NPU), allowing users to keep generative AI project in house and self-sufficient from a third-party cloud.

- Launched two new devices aimed to enhance AI features in vehicles, from safety and autonomous driving to “infotainment” capabilities.

- Is dropping a new line of APUs expected to triple AI performance. These APUs, or Accelerated Processing Units, combine a CPU (central processing unit) and a GPU (graphics processing unit) on a single chip to improve processing efficiency and graphics, especially in compact devices where space and power consumption are significant considerations.

- Is not Nvidia (NVDA).

Would you guess we were talking about Advanced Micro Devices (AMD)?

The Overlooked AI Chip Maker

In the high-stakes world of semiconductor giants, AMD has long been the scrappy underdog, nipping at the heels of industry titans like Nvidia and Intel (INTC).

The company produces microprocessor chips, GPUs, and APUs for data centers, gaming, PCs, and enterprises under the brands Ryzen, Radeon, and others.

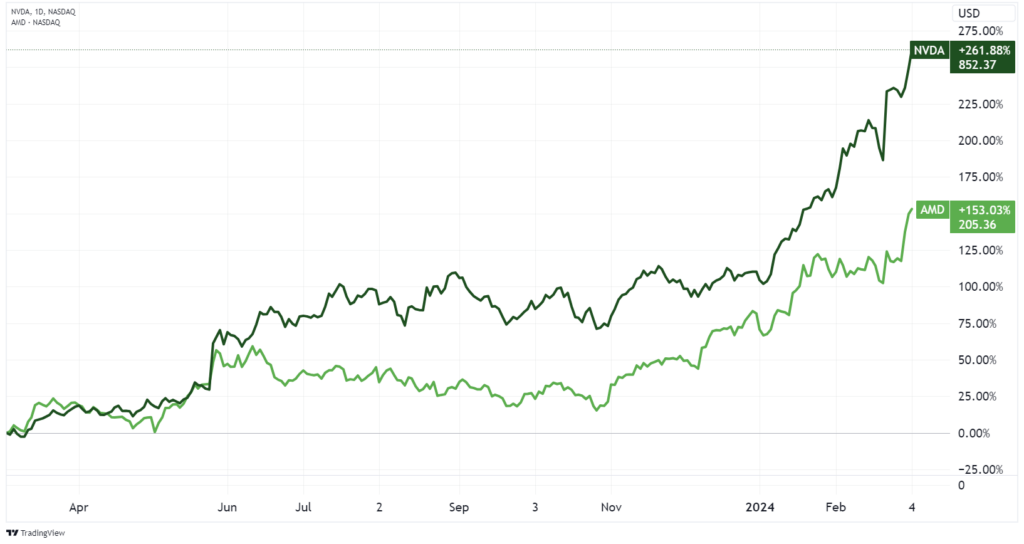

While NVDA shares have raced 261% higher over the last year, AMD has been quietly chugging along behind it, logging a 153% gain over the same period.

That’s a commendable performance, don’t get me wrong. But LikeFolio data suggests Wall Street may still underestimate AMD.

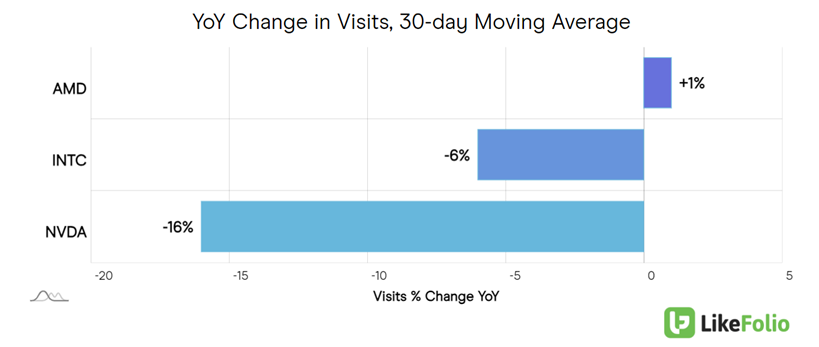

Web visits show interesting over-performance versus industry titans NVDA and INTC:

Despite a broader slowdown in PC sales, AMD’s Q4 earnings exceeded expectations. The company grew revenue 10% year over year, bringing $6.17 billion in revenue compared to the consensus $6.12 billion. Gross profit was up 21% for the same period.

AMD’s Data Center business is booming: Quarterly revenue surged 38% year over year in this segment, driven by strong demand for its AI chips.

However, the company anticipates a 10% revenue decline in Q1 2024, expecting drops in its Client and Gaming segments amid broader challenges in the PC industry’s post-pandemic growth.

At LikeFolio, we see any short-term pullbacks as major entry opportunities for long-term investors.

MegaTrends subscribers have made 74% and 101% on AMD by following our lead this way. In less than a year.

Bottom line: AI is just getting started and the tide is likely to lift many ships… AMD’s included.

In fact, we’ve got our sights set on something that could give you significantly more upside potential than even a multitrillion-dollar behemoth like NVDA could offer.

We’re talking about small- and micro-cap stocks that, by successfully tapping into the power of AI, can start producing record quarter after record quarter in the blink of an eye… getting everyone’s attention on Wall Street and juicing stock prices higher.

Here’s the story on a few of our favorite picks.

Until next time,

Andy Swan

Founder, LikeFolio

More Insights from Derby City Daily

Stay ahead of the investing curve with the latest consumer demand insights from Derby City Daily. Here’s what’s new…

You Don’t Need to Buy Bitcoin to Ride This Rally

This publicly-traded stock could be your ticket to DeFi profits…