You’ve probably heard a couple of your buddies complaining about the same thing recently: their office is requiring them to return to in-person work. In a building. That isn’t their home.

Return-to-office, or RTO for short, is a major trend unfolding in 2024 as companies realize that loose policies led to lower productivity among employees for several years post-pandemic.

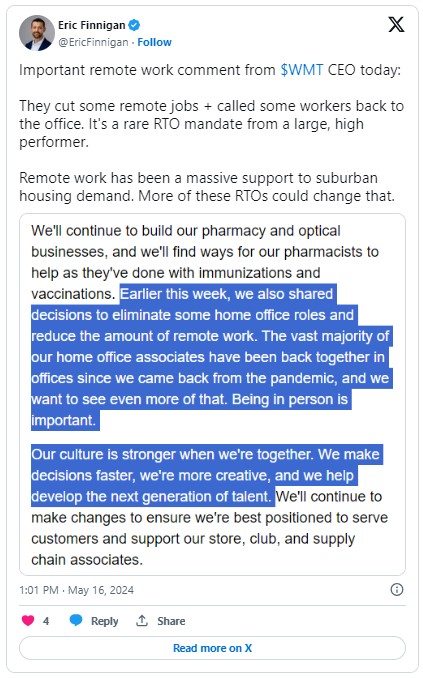

Walmart (WMT) cracked down on its remote workers this week, requesting that its corporate employees return to office and slashing hundreds of remote jobs in one fell swoop.

The Boeing Company (BA), United Parcel Service (UPS), Nike (NKE), Amazon.com (AMZN)…

Heck, even Philadelphia’s mayor joined the growing chorus this week, ordering all city workers to come back to the office full time by July 15.

The list goes on, but you get the picture: The hybrid work model isn’t cutting it anymore, and remote work definitely isn’t.

This return-to-office trend could have serious implications for consumer-facing stocks.

How do I know? Because LikeFolio was there in March 2020, when COVID-19 hit and remote work was just starting to become the norm.

We saw how consumer behaviors were changing in response to shutdowns, saw adoption sparks underway for no less than a dozen companies, and issued trade alerts accordingly.

Twelve out of 12 of those trades turned into winners for our MegaTrends subscribers, with than half delivering triple-digit gains:

- Chewy (CHWY): +160.28%

- Microsoft (MSFT): +100.38%

- Peloton (PTON): +107.22%

- Redfin (RDFN): +189.20%

- Roku (ROKU): +151.45%

- The Trade Desk (TTD): +127.17%

- Zoom Video Communications (ZM): +192.24%

This is our specialty. We designed a powerful consumer insights machine to separate the winners from the losers – and deliver those opportunities straight to our members.

And for one of those companies that thrived on work-from-home demand in the pandemic era, the return to “normal” life, and now, the return to office, has been a particularly difficult headwind to overcome.

Zoom’s Headwinds Just Won’t Let up

At the height of the COVID crisis, Zoom was recording triple-digit revenue surges, quarter after quarter. Its stock price zoomed to an eye-popping $568.34 in October 2020.

Fast forward to today, and triple-digit revenue growth has tempered to single-digit: In the most recent quarter, total revenue grew just 3.2% year over year.

The company is capitalizing on the artificial intelligence (AI) “mega” trend with its Zoom AI Companion tool and attempting to right its ship through cost-cutting measures, like the rest of tech.

Unfortunately for Zoom, RTO is just the first trend working against it…

The other is related to how large enterprises work.

If you work for a large company, ask yourself: How much say do you have in the office tools you use? For most, if your company uses Microsoft Teams, you’re using Microsoft Teams. If it uses Slack, you’re on Slack.

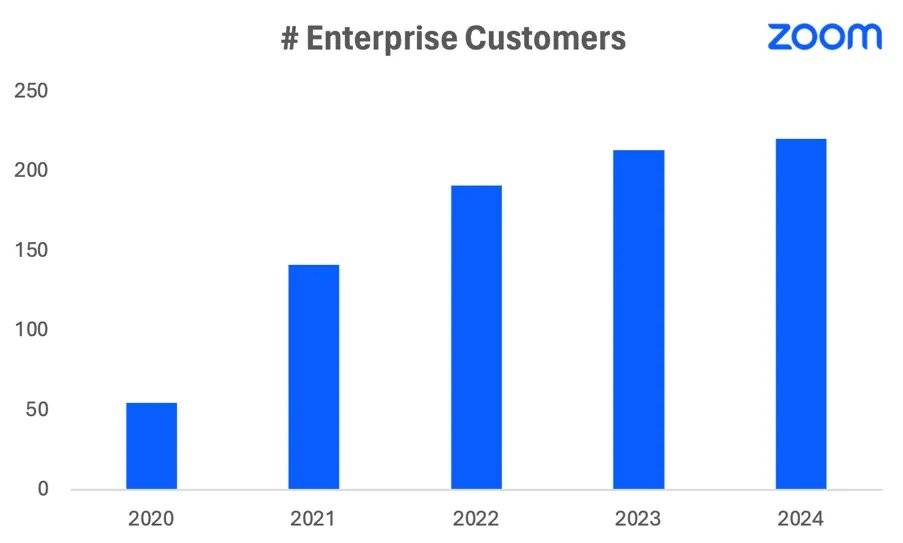

Zoom has done a good job of courting some large names – Diageo, for instance, a leading global beverage company.

But its enterprise growth is slowing down.

More Than a Remote Video Tool?

Zoom’s growth hopes are now hinged on its ability to convince users it is more than just a video conferencing app.

For instance, its contact center boasts more than 700 customers and now offers an AI companion to reduce friction and provide summaries. ZM expanded its generative AI assistant to six products at no extra cost to licensed users.

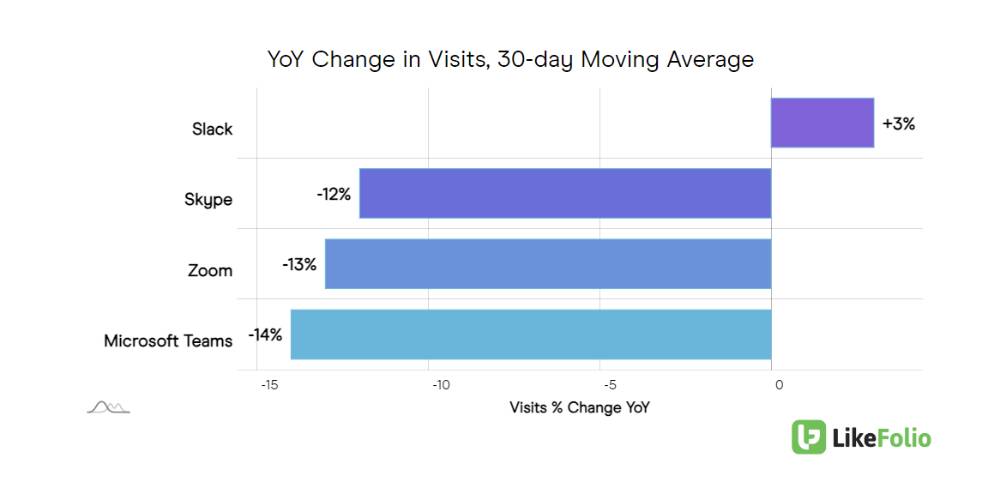

The problem is, Zoom isn’t gaining traction in two major LikeFolio metrics: web visits or mention volume.

Zoom web visits are down by 13% year over year:

And mention volume is stagnant, ticking just 1% higher year over year.

Bottom line: A slowdown in growth and lackluster LikeFolio data has us sidelined on Zoom for the foreseeable future. If the company can continue to onboard large enterprises and encourage product adoption, we’ll buy into the “bigger than a remote video” tool storyline. But for now, Zoom still finds itself on the losing side of the return to office trend.

Our next MegaTrends report is due out this week and will feature a basket of under-the-radar AI stocks that should be on every investor’s watchlist right now. You can go here now to make sure you’re on the list for that report.

That’s where you’ll also get your hands on another five small-cap AI picks we believe could be next to surge – each identified by the same stock-picking system that led to those 12 pandemic-era winners you heard about earlier.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Persistent Inflation Could Rock This Sector of the Market

Consumer warning signs suggest one sector could be in for a rude awakening…

A Surge in Retail Investment Is Creating New Opportunities

Here’s what’s driving an influx of retail capital – and how you can capitalize on the trend…