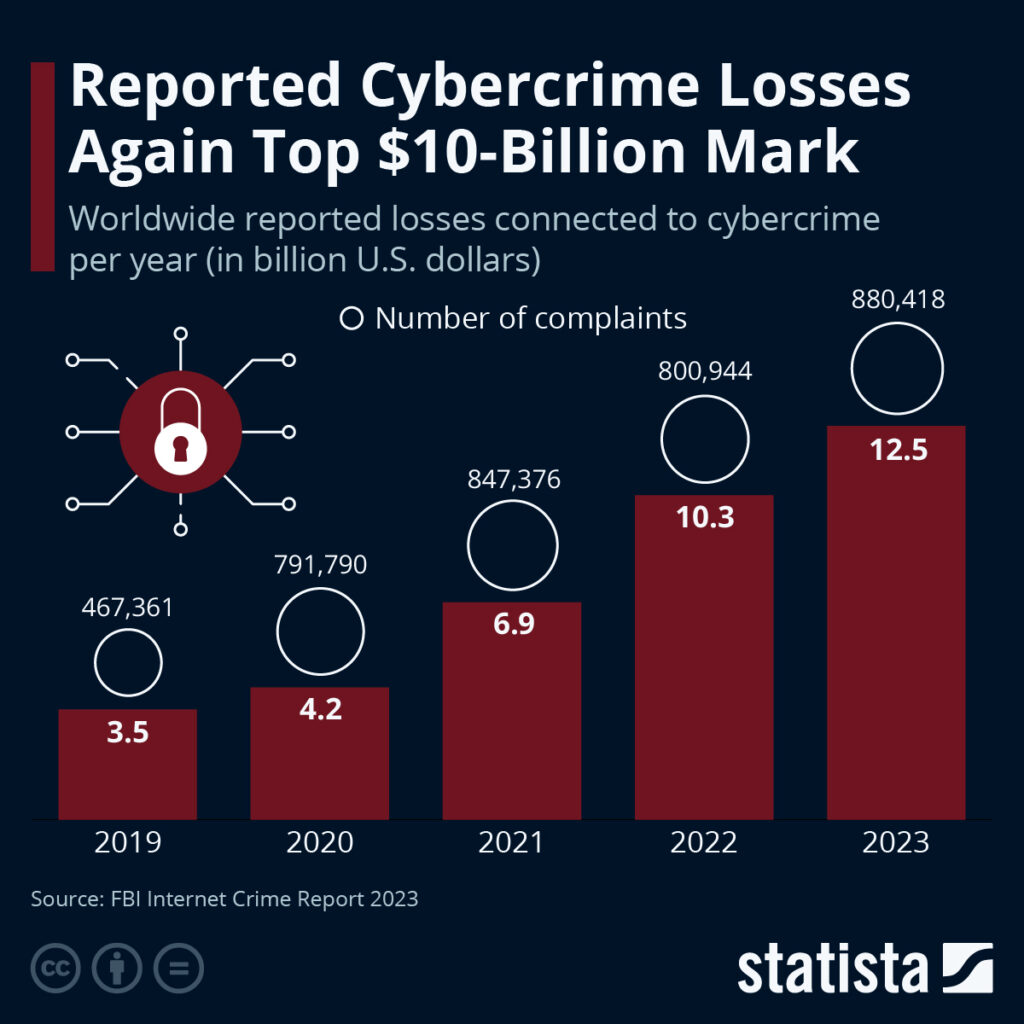

$12.5 billion was lost to cybercrime in 2023.

That’s triple the amount lost in 2019. And we’re just talking about complaints reported to the FBI. The real damage was likely far bigger.

Hacked emails, nefarious advertisements, cryptocurrency scams, and now dangerous deepfake fraud, thanks to the rise of artificial intelligence (AI)…

Urgent Notice: A new kind of AI that most folks have never heard of could soon spark the biggest financial mania since 1994 dot-com era. It could devastate some and make millionaires out of others. To make sure you’re on the right side of history, watch this – and get four free recommendations – before midnight on Tuesday.

As technology advances, so do the tactics used by hackers and tech-savvy criminals.

Cybercrime is surging faster than law enforcement can keep up, leaving it to private-sector cybersecurity firms to find a solution.

Enter SentinelOne (S), an American cybersecurity company fighting AI-powered cybercrime with the only tech that can take it down: AI.

The market for AI in cybersecurity is still young, but like everything else AI, it’s growing at a rapid clip. According to new research from SkyQuest Technology, this market could be worth a whopping $114.3 billion by 2031.

As if that weren’t enough of a reason to pay attention, let me show you why else SentinelOne should be on your radar today…

Why SentinelOne Is One to Watch

SentinelOne leverages machine learning to monitor PCs, Internet-of-Things (IoT) devices, and cloud workloads. Its AI-driven Singularity platform enables enterprises to detect, prevent, and respond to cyber-attacks.

Integrating AI into cybersecurity enhances SentinelOne’s capability to provide advanced threat detection and response solutions, especially as AI-powered cybercrime increases in severity.

We can see this uptick in demand in SentinelOne’s most recent earnings: Revenue surged 40% year over year to $186.4 million.

S shares are down more than 24% over the past six months…

…even as the company makes significant strides in amping up its AI protection.

In February 2024, SentinelOne completed a $100 million acquisition of India-based cloud security upstart, PingSafe. The move gives SentinelOne access to PingSafe’s cloud native application protection platform (CNAPP), allowing it to create a fully integrated, AI-powered cybersecurity platform capable of comprehensive enterprise protection.

SentinelOne’s new Purple AI security analyst product is using natural language to give customers streamlined threat investigations, AI-powered analysis, and actionable insights. It’s basically a form of generative AI capable of hunting cybercrime. Early adopters have reported 80% faster threat hunting and investigations.

And earlier this month, SentinelOne partnered with New Zealand cybersecurity firm Advantage to integrate Purple AI into Advantage’s managed detection and response (MDR) service, further expanding its international customer base.

Clearly, there’s a big opportunity ahead of SentinelOne. So we dug into LikeFolio’s Data Engine to see where it stands today.

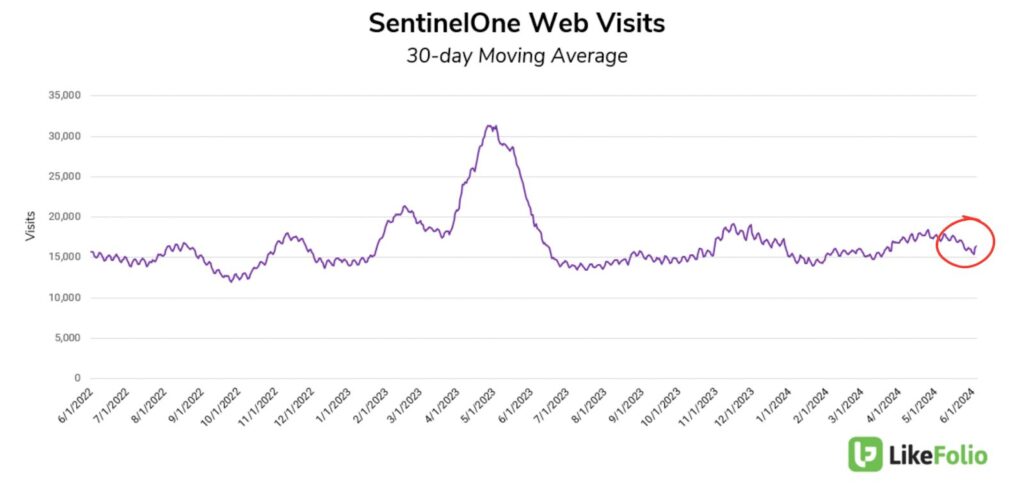

We found that SentinelOne’s web traffic is down by 15% year over year – not great. But on a quarterly basis, it does show signs of revival, with visits gaining 7% on a 30-day moving average:

So while SentinelOne’s web momentum isn’t massively improving, it is relatively stable.

Bottom line: We’re not rushing out to buy shares just yet. But with a huge opportunity in front of it as cybercrime escalates, there’s no doubt S deserves a spot on your moneymaking watchlist.

We’ll be watching our data for an inflection point – and members will be the first to know when the opportunity strikes.

In the meantime, check out some of the other must-watch AI stocks we’ve covered in Derby City Daily this month, like Reddit (RDDT) with its growing userbase and data licensing deals, Apple (AAPL) with its newly-announced Apple Intelligence integration, and Nvidia (NVDA) as demand surges for its AI chips.

Until next time,

Andy Swan

Founder, LikeFolio

P.S. I recently started following a daily trading e-letter that I think you might enjoy, too: It’s called Patterns & Profits by a guy named Tom Gentile, who’s known in the industry as “America’s Pattern Trader.” He spots hidden patterns in the market (not the same old ones you’re used to), and even developed a handy calendar system for profiting on a schedule. It’s pretty cool if you’re a trader like me. You get to see these patterns play out five days a week, learn his strategies, and every once in a while, you’ll even get an actionable trade idea. I grabbed you a link to sign up if you’re interested: Click here to check it out.

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Rivian Just Evolved into a True Tesla Competitor

Here’s how a $5 billion Volkswagen alliance will supercharge the EV competition…

John Deere: The Ambitious AI Play in Your Own Backyard

This unexpected AI winner is 187 years in the making…