Today, Levi Strauss’s name is more synonymous with denim than digging for gold. But the American businessman’s legacy started with selling dry goods and tools to miners during the California Gold Rush.

While there was no guarantee of striking it rich in the Gold Rush, the folks manufacturing the necessary tools to unearth precious minerals — picks and shovels — were making money, regardless of the miners’ luck.

Strauss made a fortune outfitting miners. And when the Gold Rush came to an end, he reinvested his revenue into a new venture: denim pants with a unique feature called rivets that strengthened points of strain, making them more durable for workers.

The company Strauss started in 1853 is now worth more than $7.5 billion.

In the American investing lexicon, Levi Strauss’s story is the classic example of a “pick-and-shovel” play – the companies that provide the tools and services that are the building blocks of a larger industry.

But Nvidia (NVDA) may go down as the greatest pick-and-shovel play of all time…

The Building Blocks of the Modern-Day Gold Rush

Just a few short years ago, Nvidia was known only in gaming and IT circles, creating the advanced graphics processing units (GPUs) that make video games, streaming, and other graphics effects “go.” CEO Jensen Huang realized he was sitting on a once-in-a-lifetime opportunity – and evolved his chips to become the brains behind artificial intelligence (AI), capable of processing vast amounts of data at incredible speeds.

Nvidia is now the dominant supplier of a soon-to-be trillion-dollar AI industry. And the folks who recognized the opportunity early – our members included – the chance to make a fortune.

Our Social Heat Score device flagged NVDA as a buy in September 2022. In less than two years, the stock has rocketed more than 800%.

Don’t feel like you missed out, though. Because we have our Data Engine tuned to finding the next big AI pick-and-shovel play – a smaller, or “under the radar” name doing the same things as a larger, more prolific one like Nvidia, that Wall Street hasn’t caught wind of yet.

The next breakout star.

Let me show you one stock on our shortlist…

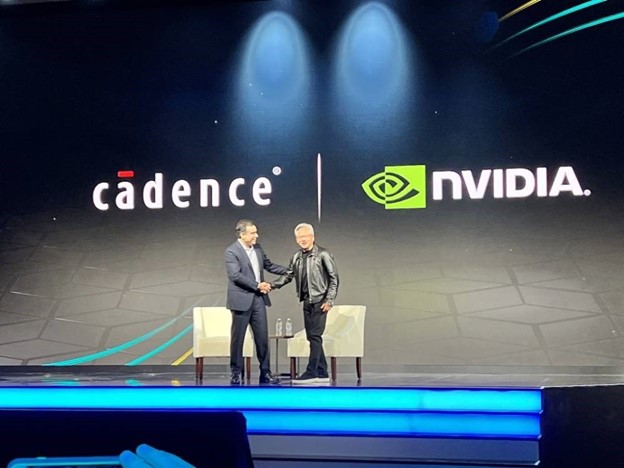

NVDA Partnership Boosts This Pick-and-Shovel Software Co.

Today, I’d like to introduce you to Cadence Design Systems (CDNS), a software company that provides digital tools for designing electronics, including AI chips, with a strong position in the growing AI market.

Cadence and Nvidia have an extensive history of partnerships, having expanded their relationship earlier this year to help scale AI across various industries. This also helps to reinforce Cadence’s position in the AI supply chain, considering Nvidia is THE dominant supplier.

Cadence services assist a broad spectrum of markets including automotive, aerospace, and industrial applications, providing software to high-profile clients such as Tesla (TSLA), Apple (AAPL), and Intel (INTC).

Continuous innovations have supported its market position through increased development to its AI portfolio as well as advanced verification for high-performance systems.

But its strength lies in its analog chip production, of which Cadence claims 80% market share. Analog chips are notably strong in the natural language processing branch of AI.

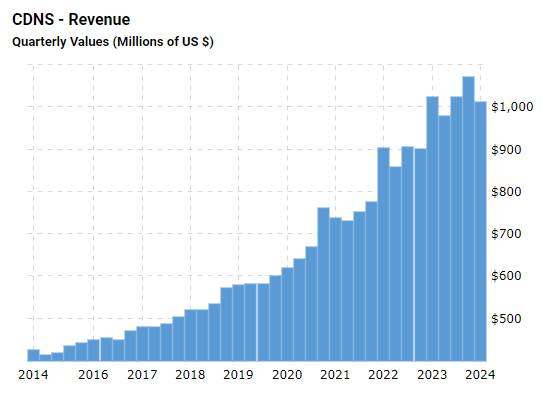

The company has performed very well in a key metric – revenue growth – as you can see below.

Cadence’s strategic focus on AI and its robust financial health position it well for continued success in the rapidly expanding AI market. But our Social Heat Score doesn’t place it in “buy” territory just yet. Those real-time alerts are reserved for our members.

But if you’d like to learn more about our Social Heat Score and how you can harness its stock-picking prowess to discover the next NVDA, go here now.

And don’t forget to add CDNS to your AI watchlist.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed from Derby City Daily this week…