What Investors Need to Know After Monday’s Crash

U.S. stocks nosedived this week on the back of several global catalysts that struck fear into investors’ hearts (we’ll break those down in a moment).

The S&P 500 heatmap below gives a snapshot of yesterday’s carnage…

This feels like the start of something big. But how big?

That’s where LikeFolio can provide critical insight. Our Data Engine doesn’t just capture consumer sentiment – it’s taking a real-time read on investor sentiment, too.

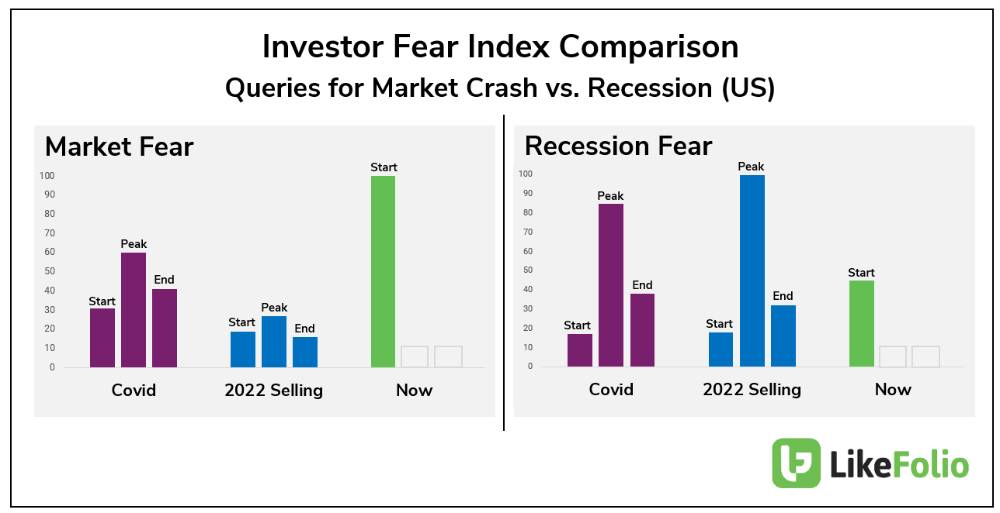

Analyzing LikeFolio’s Investor Fear Index

We used historical data for the two most recent major selloffs as benchmarks alongside real-time data to understand where the investor outlook stands right now in comparison.

You can see a drill down into our Investor Fear Index below, segmenting market fears at large (short-term) versus recession fears (long-term):

Reading the Chart: Two Top Takeaways

1. Short-term fear is extremely high.

Market fear today is much higher than not only the beginning of the 2020 COVID-induced selloff, but also higher than its peak.

2. Long-term fear is building.

Recession fear is still lower than it was during peak COVID selloff and during the 2022 slide but much higher compared to the start of each. Investors were somewhat expecting a recession, but recent sparks have ignited fear.

What’s Sparking Fears Among U.S. Investors?

Earlier last week, the Bank of Japan raised its key interest rate to 0.25% to boost the yen’s value against the dollar.

This coincided with a weak U.S. jobs report, showing only 114,000 jobs added in July versus the expected 175,000, with unemployment rising to 4.3%.

The Dow Jones plummeted 1,000 points yesterday, raising fears about the U.S. economy’s strength.

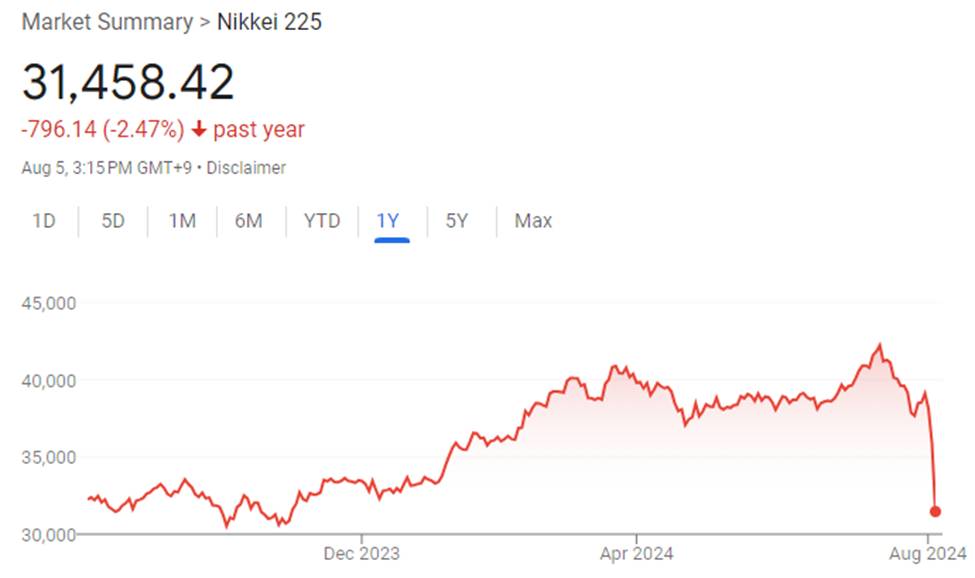

This impacted the so-called Japanese “carry trade,” where investors borrow yen at low rates to invest in higher-yielding assets abroad. The strengthened yen made these trades unprofitable, causing a massive unwinding.

Investors reversed trades, sold assets, and repaid yen loans, leading to significant market declines, including a 12% drop in Japan’s Nikkei 225 and substantial losses globally.

And we haven’t even touched on the fears arising from the potential geopolitical conflicts involving Iran.

What to Do Now

Now for the big question – how are we approaching the market from here?

Staying on the sidelines at a time like this is perfectly justifiable. But if you’re brave enough to trade in this volatility, going against the grain in these conditions is generally the best move.

Earnings Season Pass members are armed with our best earnings trades of the week, including a hand-picked contrarian play designed to capitalize on this market mayhem. You’re always welcome to join us for those quick-hit opportunities. (Learn how here – we’d love to have you.)

Our best recommendation is to stick to small, risk-defined bets – with a strong emphasis on risk defined. Never enter a position that has the potential to destroy your account.

We’ll be tracking the follow-on effects of this market crash and keep our members ahead of any opportunities that arise in the wreckage.

Stay tuned to this space.

LikeFolio’s “edge” comes from understanding consumer behavior – what “real Main Street people” are doing – before it becomes news on Wall Street. And regardless of the macro environment, there are always big profit opportunities in individual companies and assets.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

These 3 Stocks Could Win Big at the Paris Olympics

LikeFolio’s 2024 Paris Olympics Watchlist Is Here…

4 Surprising Takeaways from the 2024 Bitcoin Conference

Inside an Electric Bitcoin Event: Senators, Visionaries, and the Future of Finance…