The Golden Opportunity in This Week’s Selloff

The markets started the week in full-blown panic mode as a perfect storm of geopolitical catalysts triggered a selloff for the history books.

A weak U.S. jobs report raised concerns about the economy’s strength… a Japanese “carry trade” unraveled… and fear took over as stock prices plummeted Monday, leading to substantial losses globally.

Virtually no stocks were spared in the meltdown.

Artificial intelligence (AI) darling Nvidia (NVDA) dropped 14% over the last five days alone, with shares now trading more than 25% off June highs.

As the market finds its footing again, it’s best to proceed with caution – sticking to small, risk-defined bets while the dust settles, like we told you yesterday.

But with LikeFolio’s real-time data in your corner, there are always long-term opportunities to uncover in individual companies. And at these prices, NVDA looks too good to pass up.

Here are three reasons why NVDA’s pullback could be the greatest gift to long-term investors…

Reason No. 1: We Know AI Chip Demand Is Hot

Worldwide AI chip revenue is expected to grow 26% to $67.1 billion in 2024 and is projected to double to nearly $120 billion by 2027. And to be honest, these figures may be understated.

Fellow chipmakers Advanced Micro Devices (AMD) and TSMC (TSM) have both reported struggling to keep up with the surging demand for AI chips.

And last week’s exceptional earnings report from AMD proved this market is only gaining steam: AMD’s data center sales more than doubled year over year, raising guidance for the sector ($4.5 billion in 2024 vs. $4 billion expected).

AMD’s strong performance speaks to sustained demand for AI-related hardware and an increasingly positive outlook for the semiconductor industry.

In addition, Microsoft (MSFT) has cited a lack of capacity to match the 60% growth in AI Azure cloud average customer spending in the past quarter, further supporting robust market demand.

This burgeoning demand bodes well for a top performer like Nvidia.

Reason No. 2: Big Tech Can’t Get Enough

Last year, approximately 40% of Nvidia’s GPU sales came from four major tech players:

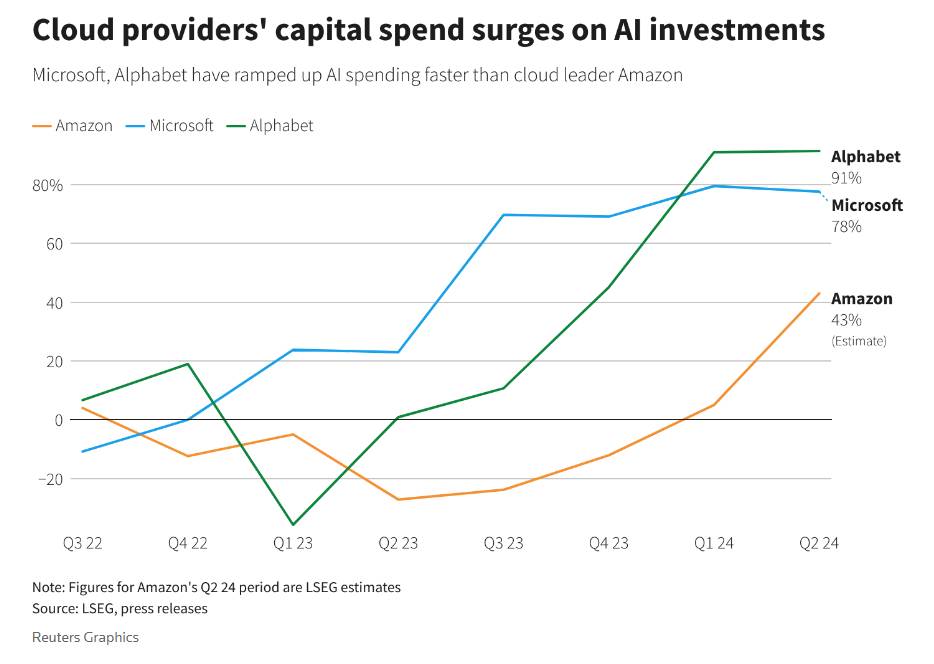

These companies are significantly ramping up their investments in AI infrastructure – and going all in on Nvidia’s AI chips as they do.

Meta CEO Mark Zuckerberg, for instance, has committed to owning 350,000 Nvidia H100 processors by the end of the year, signaling a massive increase in AI capabilities.

And capital expenditures for these tech titans are only expected to accelerate in the latter half of 2024 and into 2025.

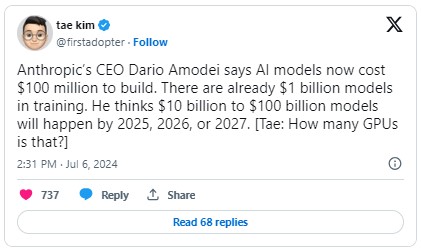

Meta and Anthropic CEOs have emphasized the exponential growth in computing resources required for successive AI models. Anthropic co-founder Dario Amodei anticipates AI models costing up to $100 billion by 2027.

That’s potential dough for Nvidia.

On a July 23 earnings call, Google CEO Sundar Pichai highlighted “tremendous momentum” from every dollar spent on AI, underscoring the strong ROI potential that comes with investing in Nvidia’s AI chips.

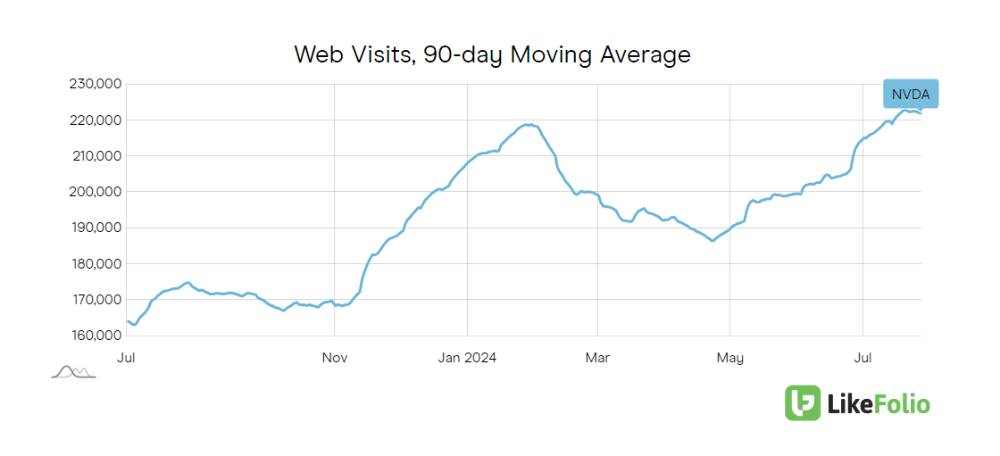

Reason No. 3: Nvidia Digital Traffic Is Building

LikeFolio data puts this growing interest and demand into perspective. Web traffic to Nvidia’s site is up significantly, gaining 35% year over year:

Bottom line: Despite the broader market weakness and valuation concerns, Nvidia’s potential growth remains underappreciated.

This company claims the pole position in a red-hot AI market. With major tech companies accelerating investments in AI, demand for Nvidia’s top-of-the-line chips should only ramp from here.

While the market may be underestimating Nvidia’s growth potential, this near-term stock pullback could present the ultimate moneymaking opportunity for long-term investors.

Nvidia may be gearing up for a bullish run leading into its next earnings event on August 28. We expect another home-run report.

Until next time,

Andy Swan

Founder, LikeFolio

P.S. If you have money in NVDA – or any of the other AI stocks we talked about today, for that matter, including MSFT, GOOGL, or META – then you need to see this urgent briefing from our colleague Tom Gentile. We’re about to enter a critical period for AI stocks. But most folks have no idea what’s coming. Watch this to make sure you’re prepared. (Spoiler alert: He’ll give you the names of his top 10 AI stocks – free.)

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

LikeFolio Fear Index Update: How to Approach the Market from Here

Why stock prices crashed – and what LikeFolio data reveals about investor sentiment now…

These 3 Stocks Could Win Big at the Paris Olympics

LikeFolio’s 2024 Paris Olympics Watchlist Is Here…