Welcome back to a special Real Estate Rebound series we’re following in Derby City Daily this week.

On the back of September’s Fed rate cut – the first federal funds rate cut in four years – consumer interest in home improvement is back on the upswing after a significant drought.

Consumers are refinancing at increasing clips, lowering monthly home payments, and in some cases, pulling out lump sums for needed improvements. Those improvements include home furnishings many were holding out on until the Fed began cutting rates. That’s where we focused Part One of our series.

Refinancing applications have surged as much as 175% year over year in recent weeks as homeowners look to lock in favorable rates.

But the younger generations aren’t heading to a branch to do business, if they can help it. A whopping 71% of Americans prefer digital banking, with mobile apps now the number-one preferred banking method above all others.

In Part Two of our Real Estate Rebound series today, we’ll take a look at a mortgage lender that’s defining the next generation of financing – with a digital platform that converts 3x better than traditional methods.

Stock No. 2: Rocket Companies (RKT)

Formerly Quicken Loans, Rocket Companies (RKT) is primarily a U.S. mortgage lending business that relies on online applications instead of branches. Its expanding fintech platform includes several personal finance and consumer tech brands, including Rocket Mortgage, Rocket Homes, Rocket Loans, Rocket Money, and Amrock Title & Settlement Services.

This company is tapping artificial intelligence (AI) technology to improve the homebuying experience through AI-powered live chat and Rocket Logic, an AI-powered personal assistant. RKT’s AI tools are driving consumer first-call resolution rates of more than 60% and operational efficiency gains.

During its first-ever Investor Day in September, management outlined its “AI-Fueled Homeownership Strategy” for the $5 trillion U.S. home buying market.

RKT’s goal: To double its home purchase share to 8% and boost its refinance its market share to 20% by 2027.

Unlike Williams-Sonoma (WSM), the first stock in our Real Estate Rebound series, RKT impressed on its last earnings call (August 2), sending the stock up 12.3%.

In the second quarter, RKT grew revenue 5% year over year to $1.3 billion, beating Wall Street estimates; better yet, adjusted earnings came in 400% higher year over year to 6 cents per share – well outperforming expectations.

And LikeFolio data looks increasingly bullish, suggesting more gains could be ahead…

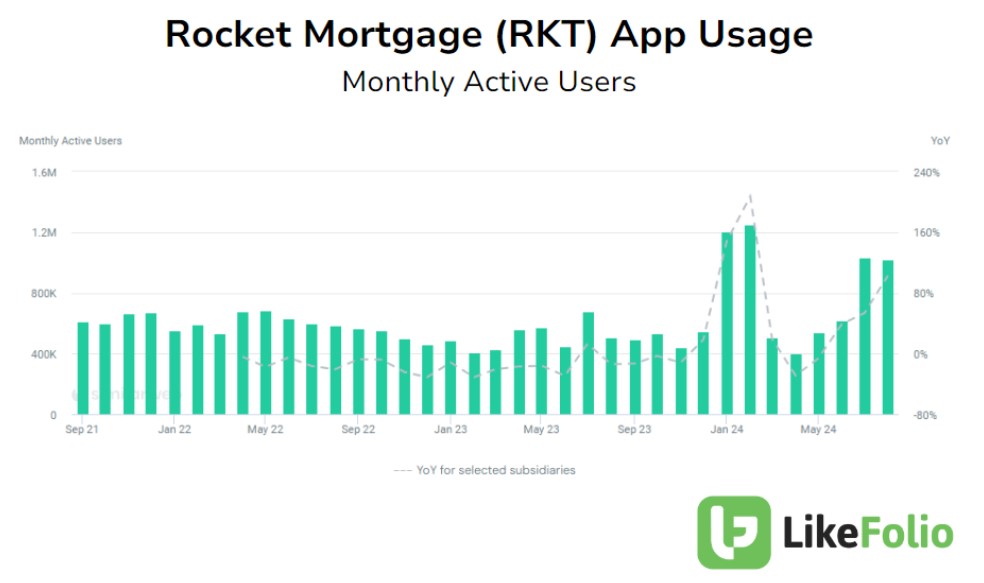

App Users Rising

In August, Rocket Mortgage’s monthly active app users surged over 100% year over year, driven by increased refinance and home buying activity.

RKT doesn’t just benefit from rising refinance/home buying activity; it also offers a Money App that helps users manage finances, track spending, and optimize budgets, creating a broader financial ecosystem that strengthens client engagement beyond mortgages.

This multi-service approach may help RKT win over repeat clients, as many social media mentions suggest.

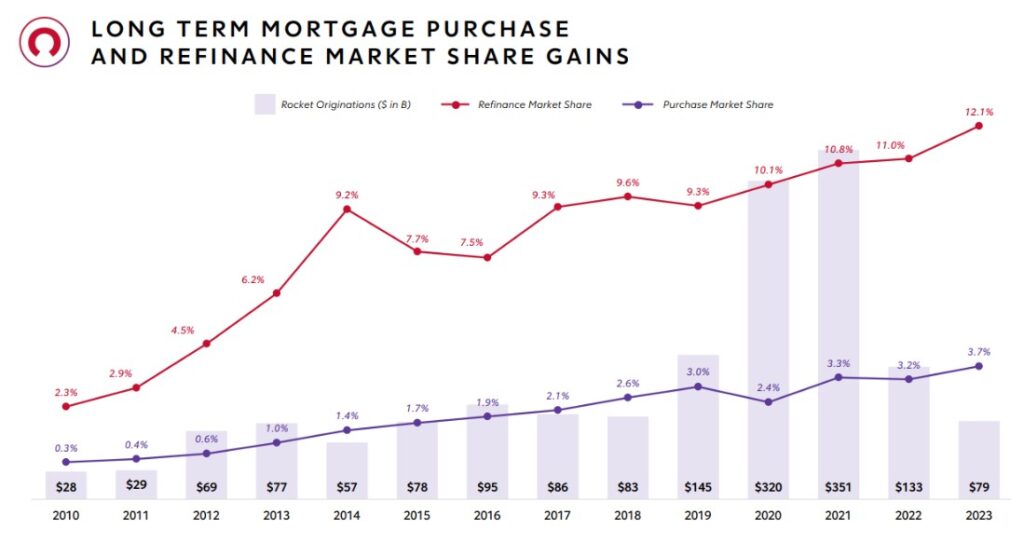

Market Share Growth

Rocket’s market share continued to push higher in both the refinance and purchase market in 2023, even as originations fell in a weakened housing market with high rates.

And the company has plenty of room for growth, commanding 12.1% of the refinance market and 3.7% of purchase market share.

We expect this share capture to continue and for a large rebound in originations in 2024, driven by lowered mortgage rates and Rocket’s extremely high levels of Consumer Happiness.

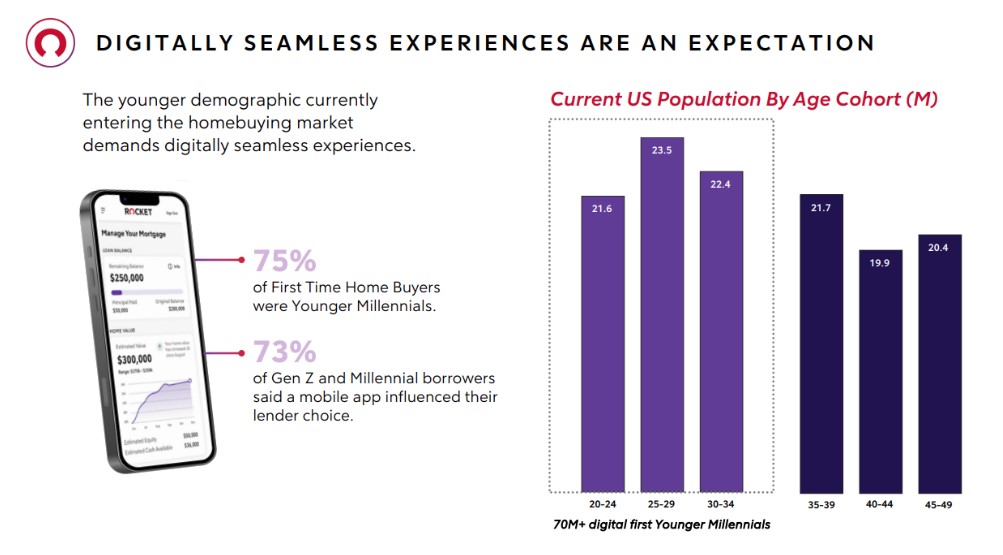

The Future Is Digital

The next wave of homebuyers prefers to conduct business online, and a fully digital platform like Rocket Mortgage is well-positioned to capture this shift.

In its second-quarter earnings report, Rocket noted that 80% of its clients prefer chat for mortgage interactions, with those using digital tools converting three times higher than others.

This focus on AI and digital engagement is not only improving client satisfaction, but also building capacity without increasing fixed costs.

RKT: The Bottom Line

With a streamlined digital platform that makes the mortgage and refinancing process more accessible for consumers, RKT is in prime position to capitalize on a Real Estate Rebound.

We see the potential for a recovering real estate market and lower interest rates to significantly elevate Rocket’s loan origination volumes, translating to higher revenue from both new mortgages and refinancing activity.

Look for the final installment of our three-part Real Estate Rebound series on Friday. We’ll dive into a home listing site seeing renewed signs of life as consumers revisit its popular app for the first time in years.

Until next time,

Andy Swan

Founder, LikeFolio