In a market where Tesla (TSLA) already commands half the sales, the race to take second place among electric vehicle (EV) makers is front and center.

This was a record quarter for EV sales across the board – EV market share in the U.S. climbed to a record high of 8.9%.

And as General Motors (GM), Ford Motor Co. (F), and Hyundai Motor Company (HYMTF) battle it out for market share steal, GM is in prime position.

The 116-year-old automaker is distinguishing itself by bringing BIG vehicles to the EV market – something Tesla only recently accomplished with the hyper-futuristic Cybertruck.

With a starting price of $80,000, Tesla’s flashy Cybertrucks aren’t exactly accessible to the average Joe.

GM is filling that gap by offering electrified pickup trucks and SUVs at a variety of price points and styles, including the affordable Chevy Equinox EV, which starts at $33,600, Chevy Silverado EV, GMC Hummer EV, GMC Sierra EV, and even the luxury Cadillac Lyric.

Each of these offerings is gaining notable attention from U.S. consumers – especially the Hummer. You can see the spike in “hummer EV” interest loud and clear on the chart below, represented by the skyward blue line:

EVs for Everyone

GM’s diverse portfolio of EVs is working in its favor. The company’s share of the U.S. EV market hit 9.5% in the third-quarter, up from 7.1% in Q2.

In fact, according to third-quarter sales reports, GM is now outpacing rival Ford among American EV manufacturers:

- GM EV deliveries grew 60% year over year to 32,095, bringing its 2024 total to 70,450.

- Ford reached 23,509 EV sales during the same period, representing 12% year-over-year growth and bringing its total to 67,689.

Looking ahead, GM anticipates its EV gains to continue through the end of the year. Its current lineup includes eight Ultium battery-powered EVs, with two additional models, including the electric Escalade and Optiq crossover, set to launch by year’s end, bringing the total to 10.

And our data supports this bullish outlook.

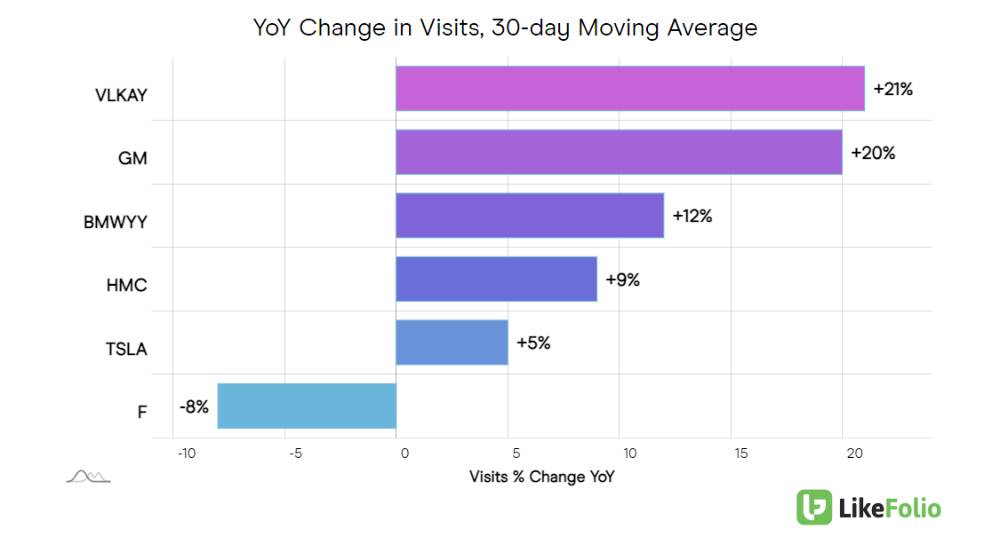

LikeFolio website data shows serious traction in consumer interest for GM, with visits up 20% year over year and accelerating over the last month:

(Compare that to Ford’s 8% year-over-year decline.)

GM’s Ultium Advantage

GM has an ace up its sleeve. Its Ultium platform uses modular battery configurations, enabling the company to tailor battery sizes and shapes for various designs while maximizing energy density and cost efficiency. Some models offer over 400 miles of range with fast-charging capabilities that can add up to 100 miles of range in just 10 minutes.

The system also supports front-wheel drive, rear-wheel drive, and all-wheel drive setups, allowing GM to use the platform for everything from compact cars to large trucks.

This proprietary battery platform is a critical part of GM’s transition to an all-electric lineup by 2035, with its standardized components helping reduce production costs and speed up development.

The batteries use nickel, cobalt, manganese, and aluminum chemistry, engineered to reduce the expensive cobalt content and drive down costs.

Let the Profits Continue

Growth in the EV sector isn’t the only tailwind driving GM forward.

We already know that GM saw some improvement in its China business over the last quarter, logging 14.3% growth, the highest rate since the third quarter of 2022.

In addition, GM CEO Mary Barra stated earlier this month that profit margins on traditional gas-powered vehicles had not yet peaked as EV sales were gaining momentum.

This morning’s earnings results proved the company is making strides here – not only did GM best expectations in revenue and earnings per share (EPS), but it also raised full-year earnings guidance across the board.

GM Q3 Highlights:

- Revenue of $48.8 billion, up 10.5% year over year (compared to the $44.69 billion expected)

- Adjusted earnings of $2.96 per share, up 29.8% year over year (compared to the $2.44 expected)

- EBIT-adjusted profit of $4.115 billion, up 15.5% year over year

Expectations were lofty heading into GM’s report today – and these outstanding numbers led the company to raise its full-year 2024 guidance for the third consecutive quarter.

Wall Street praised the results, sending GM shares nearly 8% higher as of this writing. The stock is now up an impressive 80% from last year’s levels but still remains well below pandemic-era highs.

Bottom line: Bullish LikeFolio data suggests GM’s gains could continue. But if you decide to take a bullish bet on GM for the remainder of 2024, stay risk defined.

The bar just got even higher.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Will Airbnb Be the Next Travel Stock to Surprise the Market?

A comeback attempt is underway – offering investors a glimmer of hope in an otherwise dour travel industry…

How LikeFolio Data Spotted United Airlines’ Earnings Liftoff

UAL just delivered the first of many earnings season victories. Here’s how we called its ascent – and what comes next…