Streaming officially overtook cable in 2024 – but ad dollars still have a lot of catching up to do.

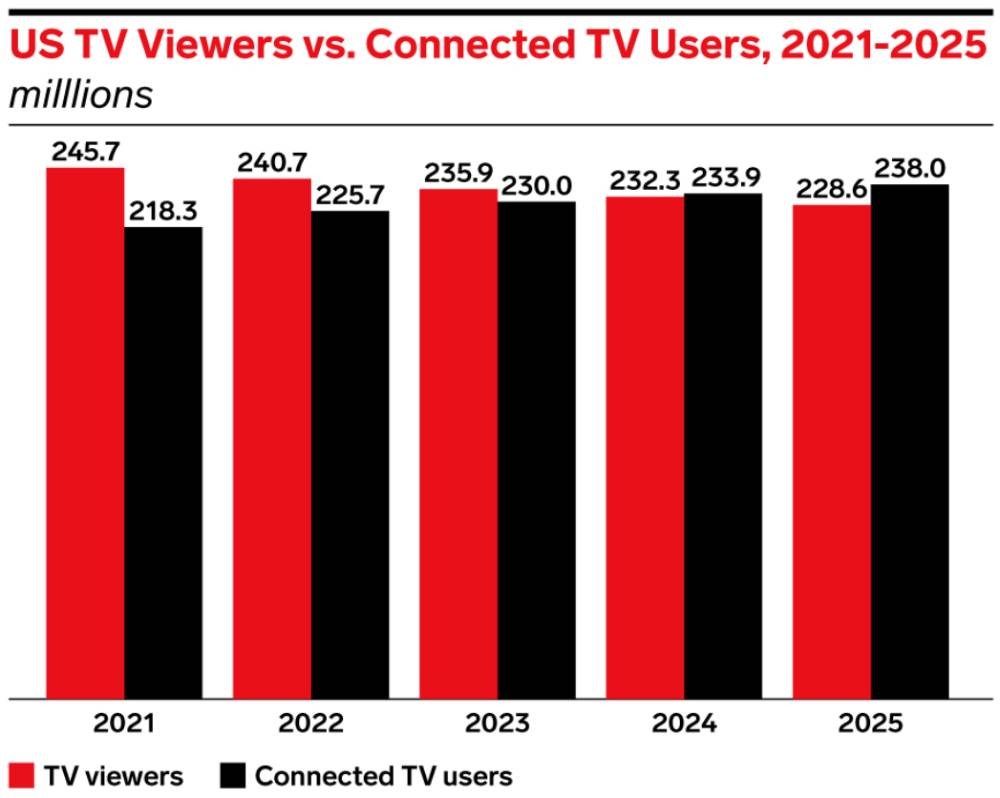

Connected TV (CTV) viewers surpassed traditional linear TV viewers over the last year, and by all accounts, this trend will only accelerate in 2025.

While viewers rapidly migrate to streaming platforms, advertising dollars remain anchored in traditional linear TV due to decades of established infrastructure, measurement standards, and buying practices.

One company has built the technology to unlock this trapped value, positioning itself at the center of television’s advertising migration: The Trade Desk (TTD).

TTD should be a familiar name. It was one of our first Derby City Daily picks two years ago and has paid off handsomely for our readers ever since, delivering a 115% gain to date. More recently, in our 2025 Predictions series, we highlighted TTD as a top pick for the AI resurgence and showed you the exact date of the year TTD could make its biggest potential jump using TradeSmith’s new seasonality tool.

(Fair warning: Your opportunity to learn about TradeSmith’s seasonality tool closes at midnight tomorrow – so if you haven’t yet done so, go here now. That’s where you’ll get all the details on how this new breakthrough pinpoints the biggest potential jumps on 5,000 different stocks, down to the day, and how YOU can put it to work to potentially double your portfolio in 2025. Watch the video here before it goes offline for good.)

TTD’s secret to success lies in its innovative approaches to digital advertising.

Its Kokai AI platform harnesses data with sophisticated algorithms to ensure ads reach their desired audiences with pinpoint accuracy. Meanwhile, Unified ID 2.0 addresses privacy concerns by using encrypted identifiers, such as email addresses or phone numbers, to target users without compromising personal data.

As television advertising makes a decisive transition, this streaming ad juggernaut is in prime position.

CTV Spending Set to Skyrocket

Brands have already reported plans to redirect advertising budgets to digital platforms (including streaming), rather than traditional search ads.

In fact, Wedbush Securities found that 43% of U.S. advertisers plan to increase their digital ad spend by more than 10% year over year in 2025, with more than half of businesses surveyed reporting intent to increase spending with TTD specifically.

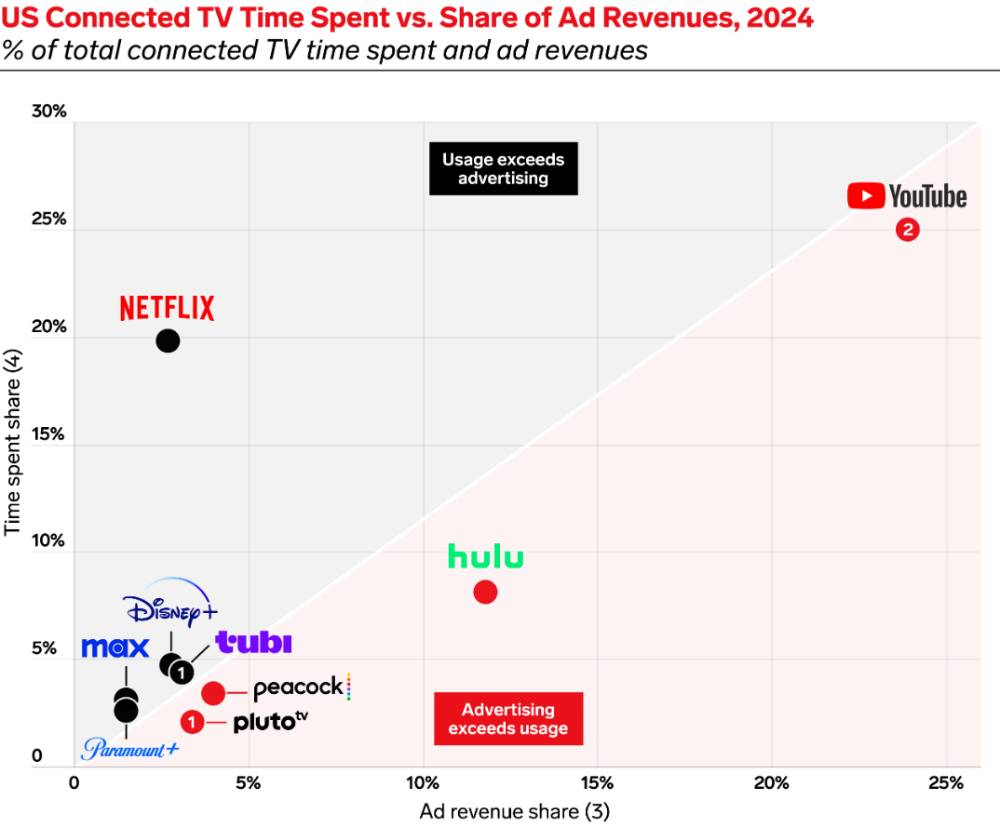

To understand TTD’s opportunity in ad migration, take a look at the chart below. This shows the relationship between time spent on connected TV platforms and their share of ad revenues in 2024:

Notice Netflix (NFLX), a streaming partner of TTD, capturing 20% of streaming viewing time but only a fraction of connected TV advertising revenue. Disney+ (DIS) and other premium streaming platforms cluster similarly, indicating significant under-monetization relative to their audience share.

Only YouTube (GOOGL) approaches equilibrium between its viewer time and advertising revenue at significant scale.

This disconnect presents a massive window for TTD to capitalize.

While ad spend on connected TV is rising, it still hasn’t caught up with shifting consumer behavior.

CTV ad spending increased by nearly 20% in 2024 and made up for ~18% of total time spent with media but comprised only 7% of total ad spending.

Advertising budgets haven’t followed this viewer exodus for several structural reasons.

Linear TV’s advertising resilience stems from its predictable infrastructure. Nielsen ratings, despite their limitations, provided a trusted measurement standard for decades. The scarcity of traditional TV ad inventory – limited by fixed commercial breaks – helped maintain pricing power even as viewership declined. Long-term contracts and upfront buying commitments, where advertisers lock in spending months or years ahead, further preserved linear TV’s advertising base.

Subverting Traditional Ad Sales Models

The Trade Desk’s technology systematically dismantles these barriers.

Its platform addresses the core challenges that previously prevented advertising dollars from following viewers to streaming. Here’s how:

1. Fragmentation prevented efficient ad buying across multiple streaming services.

TTD’s demand-side platform provides a single interface to purchase ads across platforms, simplifying campaign management. When Netflix and Disney+ launched their ad-supported tiers, both partnered with TTD to access this consolidated demand.

2. Identity and targeting suffered without cookies or consistent user IDs across streaming platforms.

TTD developed Unified ID 2.0, an open-source identity framework enabling privacy-compliant targeting across services. This solution provides advertisers the precision they expect from digital advertising while respecting viewer privacy.

3. Measurement complexity stalled ad spending shifts, as traditional TV ratings don’t translate to streaming.

TTD’s platform provides cross-platform measurement and attribution, helping advertisers understand campaign performance across services. This transparency encourages advertising experimentation in streaming.

What Comes Next for TTD

In the second half of 2025, TTD will launch its Ventura platform, bringing additional efficiency to connected TV advertising.

Unlike Google or Meta Platforms’ (META) closed ecosystems, TTD’s open internet approach enables advertisers to reach audiences across multiple streaming services while maintaining transparency and control over their campaigns. This becomes increasingly valuable as streaming platforms work to maximize their inventory value without surrendering control to larger tech companies.

The market has begun to recognize TTD’s potential – shares have risen more than 84% over the past year. But a recent ~12% pullback could present investors with an appealing opportunity to participate in streaming’s monetization evolution.

Bottom line: For investors, the combination of TTD’s recent share price pullback and accelerating industry momentum presents a compelling bullish setup.

The data points to a tremendous opportunity as advertising technology bridges the gap between viewership and monetization.

TTD has systematically built the infrastructure to facilitate and benefit from this transition, and we expect more gains through 2025 and beyond.

Digital ad spending will be a key trend over the next 10 weeks of earnings season – one that will separate the leaders from the laggards.

Ad dollars follow eyeballs, and with our consumer insights, we can show you which platforms are garnering the most views. Look for a few of the early winners later this week in our earnings season preview.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Lululemon Crushed Christmas – Here’s Your Next Window of Opportunity

See how LULU finished the holiday season strong. Plus: Has the government already cashed out its Bitcoin?

Fixing Starbucks’ 3 Big Problems Won’t Be Easy

Brian Niccol has his work cut out with these mounting challenges. Don’t expect a miraculous SBUX turnaround anytime soon…