Donald Trump has officially taken back the White House… and he’s bringing the powerful megatrend of deregulation with him.

Now that he’s sworn in, we’re taking a deep dive into the tailwinds that will follow in the next four years.

Trump is expected to pursue sweeping deregulation during his second term – and it could be one of the most powerful megatrends of the 2020s.

He’s wasted no time enacting this vision, signing a flurry of executive actions on day one that include withdrawing the U.S. from the Paris Climate Agreement and World Health Organization and freezing all federal workforce hiring.

Over the next four years, we’re talking about turbocharging the U.S. economy more powerfully than during the Reagan Revolution.

But investors must stay alert to capitalize on these shifts. That’s where LikeFolio gives you an edge.

In this special report, we’ll give you an inside look at what investors can expect under the Trump administration, and three actionable ways to profit as he slashes red tape — backed by our cutting-edge consumer insights.

Trend Watch: Deregulation Is Agenda Item #1

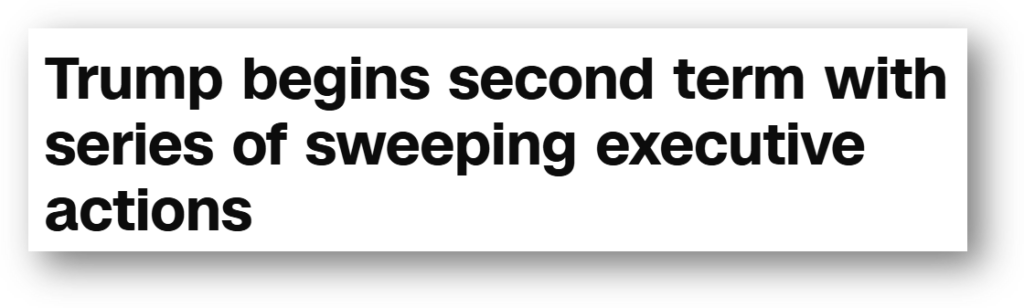

If there’s one thing Donald Trump hates, it’s government red tape. The Office of Information and Regulatory Affairs oversees the federal regulatory process, and as you can see, the number of new rules it reviewed plunged during Trump’s first term:

With Trump back in the White House, deregulation is now back on the table. In a 2024 campaign speech, he promised to continue the “historic deregulatory agenda, removing unnecessary rules that stifle innovation and economic growth.”

Trump has doubled down on his commitment to cut back on waste in Washington. He’s created the Department of Government Efficiency (DOGE) and empowered Elon Musk and Vivek Ramaswamy to streamline government and reduce inefficiency.

This includes cutting government regulations… getting rid of administrative bloat… slashing wasteful spending… and restructuring federal agencies. Just two days into his administration, and Trump has already ordered a freeze on federal hiring.

Trump set the deregulation megatrend in motion during his first term – nearly a full decade ago. To understand the all-important “what comes next,” we have to take a look back in time at the deregulation efforts during Trump’s last presidency and what he’s already done to cut red tape.

Then, we’ll arm you with three recommendations for playing the deregulation megatrend set to define the next four years.

History Is an Excellent Teacher

In 2017, Trump announced that the U.S. would withdraw from the Paris Agreement as part of his broader strategy to prioritize American economic interests and energy independence over international climate commitments. That year, he signed an executive order to dismantle President Obama’s Clean Power Plan. This eliminated emissions limits on coal-fired power plants.

Under Trump, the U.S. rolled back methane rules and lifted restrictions on offshore drilling across nearly all U.S. coastal waters, declaring this move would “unleash American energy.”

He also carried out significant deregulation in the banking sector. In 2018, he weakened key parts of the Dodd-Frank Act by signing the Economic Growth, Regulatory Relief, and Consumer Protection Act. This increased the threshold for systemically important financial institutions (SIFIs) from $50 billion to $250 billion in assets, meaning they’re no longer subject to the same stringent stress tests and capital requirements.

As Trump put it, “We’re going to be doing a big number on Dodd-Frank. The banks are going to be able to lend again.”

This time around, reduced regulation under the incoming Trump administration will open business opportunities, cut operational costs, and drive new booms in the sectors of the economy most affected. So it’s important you act now to position yourself to profit.

Here are our three picks for the best way to play the deregulation megatrend under Trump’s administration…

[TOMORROW] Learn how you could turn Trump’s honeymoon period into The Most Profitable 100 Days of Your Life – sign up for this free event now.

3 Ways to Profit as Trump Slashes Red Tape

Trump Trade No. 1: Bitcoin (BTC)

To say crypto investors welcomed Trump’s win is an understatement. Bitcoin (BTC) is up more than 50% since Trump triumphed over Harris – a surge fueled by expectations of a crypto-friendly administration.

Bitcoin was trading at about $69,000 on Election Day. Today, it’s surging toward $106,000.

Altcoins – cryptos other than Bitcoin – have ridden the tailwind, too. Dogecoin (DOGE), a meme coin Elon Musk has championed, has more than doubled since Trump’s win. Ripple (XRP) – a crypto project that was mired in a legal battle with the U.S. Securities and Exchange Commission (SEC) – is up a stunning 500%. Investors are hoping that, under Trump, the SEC will drop its case.

Trump’s campaign promises to establish the U.S. as the “crypto capital of the planet” are materializing, with proposals like a strategic Bitcoin reserve gaining traction. This would make Bitcoin a strategic asset, much like the gold in Fort Knox or other foreign currency reserves. Like gold, Bitcoin has limited supply and is therefore a better store of value than government issued fiat currencies.

That brings us to the second driver acting like a flywheel and accelerating this trend: Wall Street’s recognition and embrace of Bitcoin as “digital gold.”

In the meantime, major companies are adding Bitcoin to their balance sheet. In February 2021, Elon Musk’s Tesla (TSLA) added $1.5 billion worth of Bitcoin to its balance sheet. And Michael Saylor’s MicroStrategy (MSTR) now owns about 402,100 bitcoins, acquired at a total cost of about $23.4 billion.

But the explosion in value comes from sovereign nations adding Bitcoin to their reserves.

If the U.S. gets in on that action, that’s a game changer. It’s the world’s largest economy and the issuer of the de facto global currency, the U.S. dollar.

In short, a race to acquire Bitcoin has begun. And the largest players in the world – sovereign states – are getting involved.

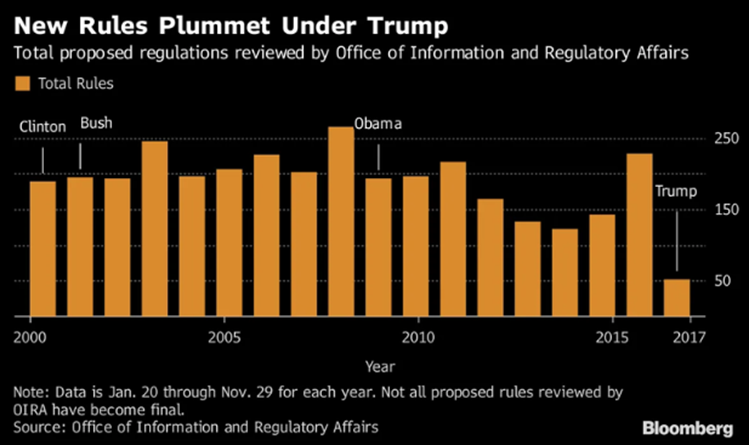

Our proprietary social metrics at LikeFolio show Bitcoin mentions surging in a pattern matching the 2020 run from $15,000 to $60,000:

That move represented a 4x gain.

From today’s level near $106,000, a similar percentage move points toward unprecedented heights for Bitcoin.

Trump Trade No. 2: Nvidia (NVDA)

Deregulation in the U.S. tech sector will unleash a wave of innovation and expansion. Easing antitrust scrutiny will pave the way for major mergers and acquisitions, allowing tech giants to rapidly scale their operations.

Less red tape around artificial intelligence (AI) will allow faster development and deployment of this cutting-edge technology.

Add the promise of growing chip manufacturing here in the U.S., and AI chipmaker Nvidia (NVDA) is a great stock to own.

Nvidia’s latest Blackwell GPU processors have seen such high demand that the supply for the next 12 months is already sold out. Amazon.com (AMZN), Google (GOOGL), Meta Platforms (META), Microsoft (MSFT), and Oracle (ORCL) have secured all available units.

Companies aren’t forking out money on Nvidia’s AI chips for no reason. Automation and AI-driven production will revolutionize virtually every sector of the economy, including:

Defense: Autonomous drones, surveillance robots, and unmanned ground vehicles increase operational efficiency and reduce human risk in dangerous environments.

Health Care: Surgical robots, automated diagnostic tools, and AI-driven patient monitoring systems are improving surgery precision, hastening diagnoses, and enabling better patient care.

Warehouse Automation: Retailers such as Amazon and Walmart (WMT) are deploying robots to handle tasks such as sorting, packing, and inventory management. These automated systems not only speed up operations, but also reduce human labor dependency.

Manufacturing: Robots have been a manufacturing mainstay for years. With AI advancements, robots are now able to perform complex tasks such as quality control, assembly, and even product customization, drastically reducing production times and costs.

Agriculture: Automation is transforming agriculture with the use of robotic harvesters, drones for monitoring crop health, and automated irrigation systems. These technologies help increase crop yields, reduce waste, and lower labor costs, making farming more sustainable and efficient.

Retail: The retail sector is seeing the rise of automated checkout systems, inventory management robots, and even AI-driven customer service bots.

Transportation and Logistics: Autonomous vehicles (AVs), delivery drones, and AI-driven logistics platforms are revolutionizing how goods and people are transported. Tesla and Google’s Waymo division are spearheading autonomous taxi development to cut transportation costs and improve accessibility.

Looking forward, capex spending by those tech giants we mentioned is expected to approach $200 billion in 2025, driven by the need to expand data centers for AI applications. A large portion of this spending will be directed towards graphics processing units (GPUs) and other data center infrastructure. (Nvidia’s specialty.)

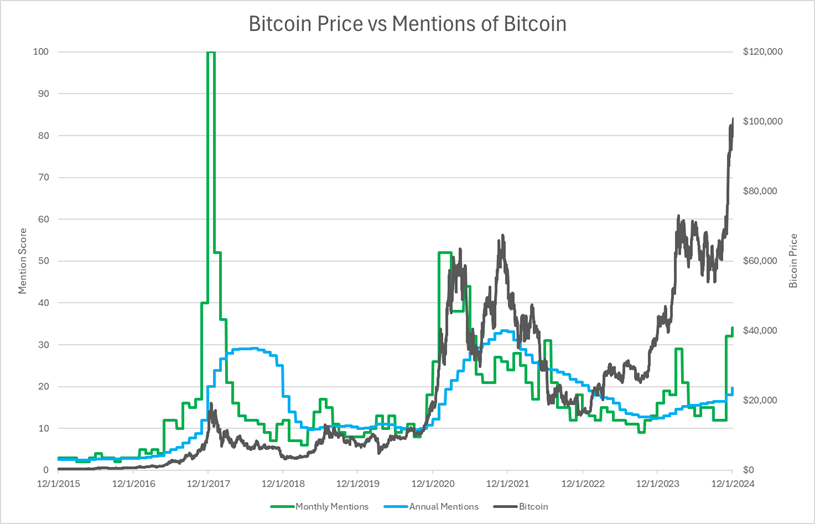

With its leading position in the AI market, Nvidia is well-positioned to benefit from this heightened demand – and LikeFolio web metrics confirm interest on the rise:

Trump Trade No. 3: Tesla (TSLA)

Companies are ramping up efforts to integrate AVs into commercial transportation systems, and deregulation could accelerate the adoption of these AVs nationwide.

Tesla (TSLA) will be a clear winner.

Tesla’s venture into robotaxis has the potential to reshape its business and the autonomous rideshare market. In October, at his “We, Robot” event in California, Elon Musk introduced the Cybercab. It’s a two-passenger, fully autonomous EV devoid of steering wheels and pedals. Tesla plans to begin production of the Cybercab by 2026.

Trump’s victory could smooth the path even more. This could lead to streamlined national approvals, removing roadblocks. And Tesla has the infrastructure in place to rollout robotaxis at scale.

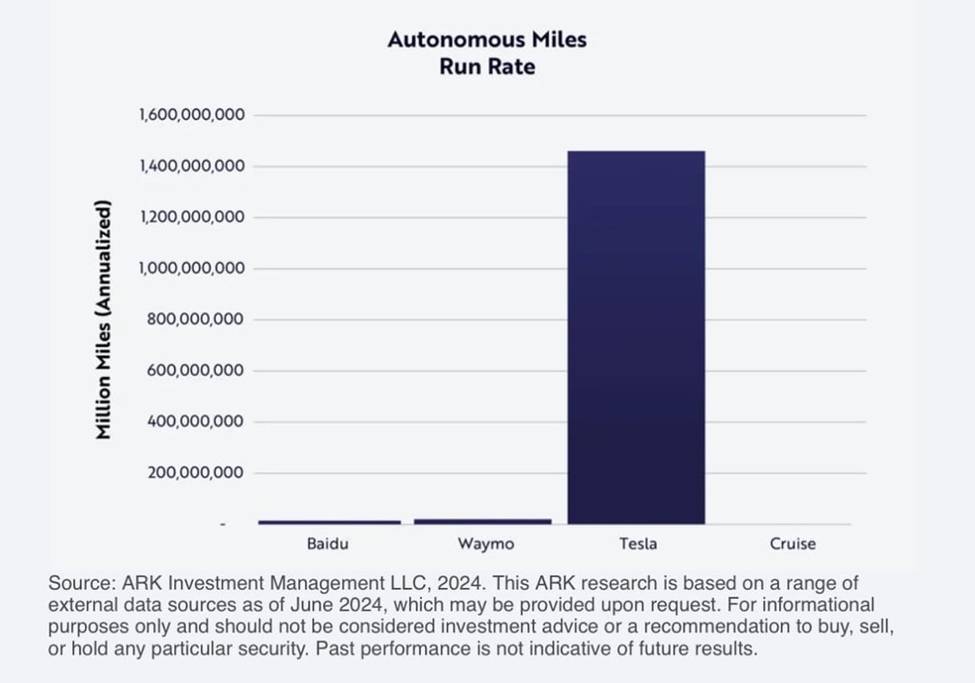

Tesla’s infrastructure has become so dominant, carmakers that have been around for a century are waving the white flag and outfitting their future models with Tesla supercharger adapters. Tesla also has billions of autonomous miles driving under its belt, dwarfing the competition.

Tesla uses the real-world data that this creates to continuously refine its self-driving capabilities. This improves its performance and safety with every mile driven.

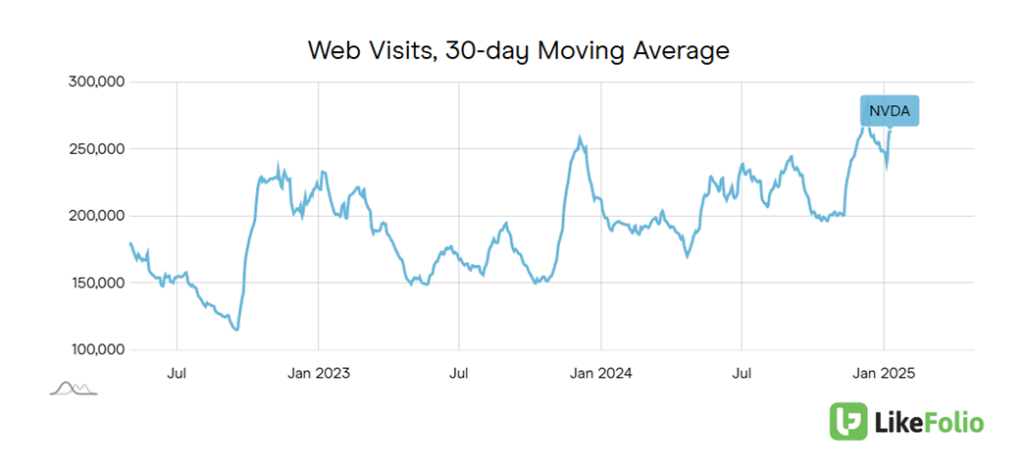

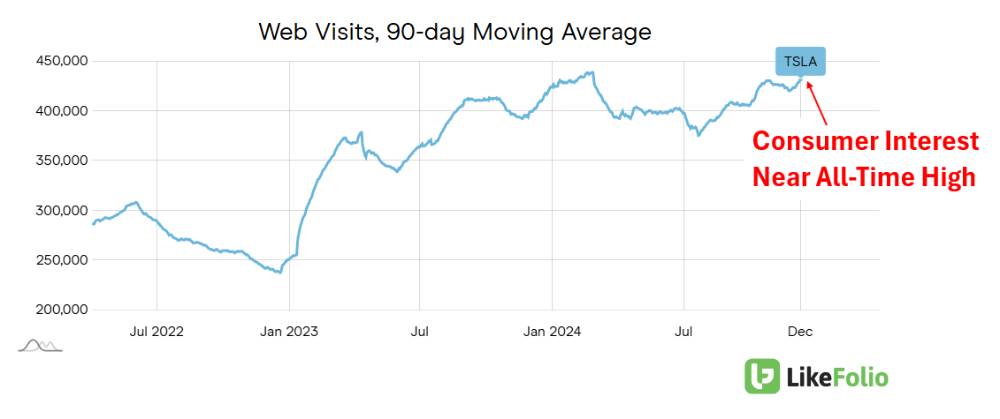

Musk has defied his critics and turned skeptics into reluctant admirers time and time again. Despite the doom-and-gloom headlines suggesting his political involvement will tarnish the Tesla brand, LikeFolio data suggests just the opposite.

According to our analysis, Tesla consumer interest in nearing all-time highs – fueling our bullish outlook under a Trump administration:

If robotaxis are the future – and there’s every reason to believe they are – Tesla stands to benefit tremendously.

The Bottom Line

So, there you have it. Our three plays riding the tailwinds of Trump’s deregulation megatrend in his second administration are:

- Bitcoin (BTC)

- Nvidia (NVDA)

- Tesla (TSLA)

These are all already popular investments. But as Trump continues to slash government red tape, they all have a lot more room to run.

One thing’s for sure: Trump’s aggressive policies are poised to send shockwaves through the market. And NOW is the time to get in the game.

That’s why I want to introduce you to another veteran trader who thrives in chaotic markets – Jeff Clark. During Trump’s first 100 days back in the Oval Office, he predicts there could be at least one trade every week that has the potential to double your money.

To make sure all our Derby City Daily readers take full advantage of this historic profit window, Jeff’s inviting you to a special live event happening TOMORROW, January 22, where he’ll show you how to make Trump’s honeymoon period the most profitable 100 days of your life.

It’s free to attend – all you have to do is claim your spot here.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

3 Bullish Plays to Kick off a Red-Hot Earnings Season

Earnings season is here – and our data reveals three compelling opportunities set to play out in just a few days…

Premiumization: The Trend Boosting Travel Profits in 2025

Delta won’t be the only premium travel winner this year. This hotel is going all-in on 2025’s hottest travel trend…