Earnings Season Is in Full Swing – Don’t Let These Profit-Packed Weeks Pass You By

Earnings season is our favorite time of year at LikeFolio – delivering hundreds of quick-hit trading opportunities over a scorching 10-week period. And subscribers to our Earnings Season Pass service are off to a hot start in 2025.

During Week 1, our bullish Netflix (NFLX) call proved right, and Earnings Season Pass members who followed our Hand-Picked Trade saw a +112.77% profit in just three days… with an overall Week 1 win rate of 75%.

During Week 2, we made 18 more trade recommendations with a hit rate near 60% – securing wins on Royal Caribbean (RCL), Brinker (EAT), Apple (AAPL), and more.

It’s only Week 3 – so there’s plenty of untapped profits still ahead. To find out how we’re playing this week’s earnings, including highly anticipated reports from Roblox (RBLX), Peloton (PTON), Expedia (EXPE), and Affirm (AFRM), go here now.

“We’re perfectly fine with not being first. As it turns out, it takes a while to get it really great.” – Apple (AAPL) CEO Tim Cook

In the artificial intelligence (AI) race to the top, Apple has taken a contrarian approach.

Cook described Apple’s AI strategy as “Not first, but best,” emphasizing that the company prioritizes quality over speed.

Critics mocked it – claiming Apple lagged far behind tech peers.

No ChatGPT rival, no billion-dollar data center race, no scramble to keep up with OpenAI and Google (GOOGL). Instead, Apple prioritized embedding AI into its ecosystem without the runaway spending its competitors pursued.

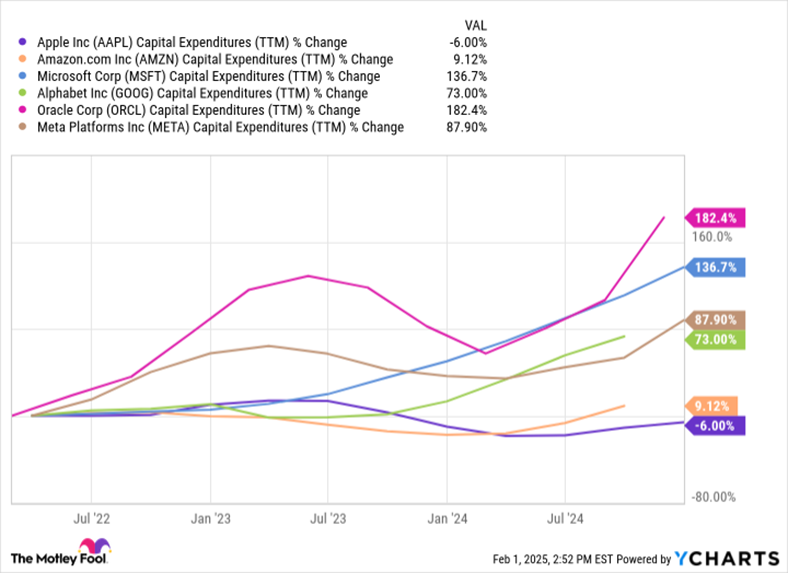

The divergence is striking.

While Google, Microsoft (MSFT), and Meta Platforms (META) poured tens of billions into cloud-based AI, Apple kept its capital expenditures in check – down 6% year over year – even as it expanded AI-driven experiences.

Apple made a bet early on that AI models would become commoditized, shifting the real competitive advantage to integration and user experience rather than pure model performance.

As advanced models become more accessible, differentiation moves to application and efficiency. Apple is positioned to profit by integrating AI seamlessly into its hardware and software without the immense infrastructure costs borne by its competitors.

We see AAPL as a contrarian AI play with upside potential…

A Focused, Efficient, and Profitable AI Approach

Unlike rivals, Apple has avoided the capital drain of AI-specific data centers. Instead, it has embedded AI directly into products, enhancing user experience through features like personalized content recommendations, real-time photo and video enhancements, and an evolving Siri (though Siri still has a long way to go).

Apple Intelligence, its suite of AI tools, is built for efficiency, delivering real-world benefits without requiring massive cloud computation.

One key example: Apple’s on-device AI handles tasks like text generation and image creation locally, reducing reliance on cloud infrastructure while improving speed and privacy.

By leveraging AXLearn, an open-source AI framework, Apple gains access to rapid innovation without locking itself into costly proprietary ecosystems like Nvidia’s (NVDA) CUDA. However, Apple maintains control over the final experience by applying proprietary filtering algorithms and optimizations, ensuring that AI aligns with its hardware and privacy-focused ecosystem.

Apple Intelligence Is Driving iPhone Demand

Apple Intelligence is already driving demand across Apple’s ecosystem. CEO Tim Cook confirmed on the company’s earnings call last week that iPhone 16 models saw stronger sales in regions where Apple Intelligence was available.

AI-powered personalization, enhanced Siri capabilities, and real-time assistance reinforce Apple’s customer lock-in, boosting upgrade cycles and increasing hardware demand.

Apple’s AI extends beyond the iPhone, too. iPads and Macs are expected to receive expanded AI-powered functionalities, further integrating AI into daily workflows.

As more devices receive AI-driven enhancements, the value proposition for upgrading within the Apple ecosystem strengthens.

Building a Profitable Ecosystem

With 2.35 billion active devices and $26.3 billion in services revenue, Apple’s ecosystem continues to scale. The interplay between AI, hardware, and services drives higher engagement, recurring revenue, and long-term profitability.

Rather than chasing AI supremacy, Apple embeds AI where it meaningfully enhances user experience, ensuring monetization through hardware sales, increased ecosystem engagement, and subscription revenue.

This disciplined strategy ensures profitability while competitors burn cash chasing AI dominance.

AAPL: The Contrarian DeepSeek AI Play

Wall street has yet to fully recognize Apple’s AI advantage.

Despite last week’s bullish earnings report, featuring 14% year-over-year growth in services revenue and a double-digit increase in paid subscribers, AAPL shares came under pressure this week amid tariff concerns and near-term underperformance.

Some investors remain singularly fixated on standalone AI companies, yet Apple’s strength lies in embedding AI across its ecosystem, ensuring monetization through hardware, software, and services.

We think it’s important to build a portfolio that capitalizes on all value-driven opportunities created by AI.

Bottom line: Apple’s AI strategy prioritizes efficiency, user value, and ecosystem-driven growth. As AI adoption scales, Apple’s approach positions it as a long-term winner.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Ignoring Tesla’s 10x Value Proposition Is a Fatal Mistake

A muted response to Tesla’s earnings report, coupled with Musk’s once-in-a-generation vision, presents investors with a tremendous opportunity…

Two Ways to Play a Financial Services Divergence

LikeFolio metrics have picked up two bullish opportunities in the financial services sector…