After starting his business in 1949 by selling school and sports team apparel, if Rufus Hibbett saw his company today, it would be unrecognizable to him.

Not only has Hibbett Sports (HIBB) grown from one store to over 1,000 but looking at the products from a 1940s lens would make it seem like you were looking at something from a futuristic sci-fi movie.

Like the Nike “Panda Dunks.”

When these sneakers started hitting stores a few months ago, the social media buzz it garnered among sneaker aficionados was enough to put HIBB on our radar.

At a fraction of the market cap of competitors Dick’s Sporting Goods (DKS) and Academy Sports (ASO), this Alabama-based sporting goods company falls right into LikeFolio’s wheelhouse.

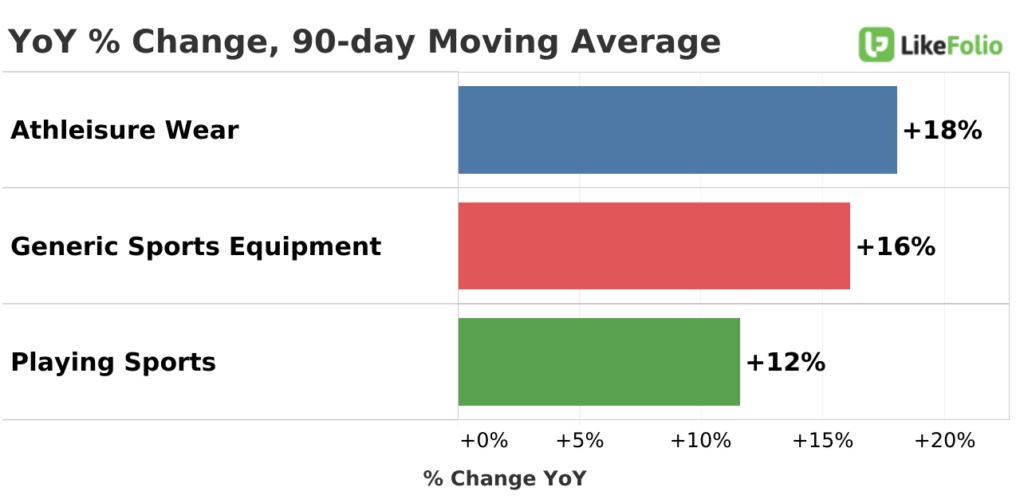

Our predictive consumer insights machine is particularly adept at tracking lesser-known, small-cap names benefitting from macro consumer trend tailwinds. And Hibbett has several of those playing in its favor as pandemic-fueled trends in athleisure wear and sports prove persistent in 2023:

Social media mentions of athleisure wear (+18%), generic sports equipment (+16%), and playing sports (+12%) are all trending higher by double-digits.

Add in a rapidly expanding retail footprint of more than 1,100 Hibbett, City Gear, and Sports Additions stores across the country, and on the surface, HIBB might look like a potential opportunity.

Not so fast.

With access to what real people are saying about Hibbett, we’re able to spot consumer shifts on Main Street in real-time – giving us a huge edge when it comes to investing.

And our predictive consumer insights signal trouble brewing for this sports apparel player.

Let me show you what has us running away from HIBB and toward its competitor that’s playing the game like a pro…

Hibbett Is Losing the Sporting Goods Game

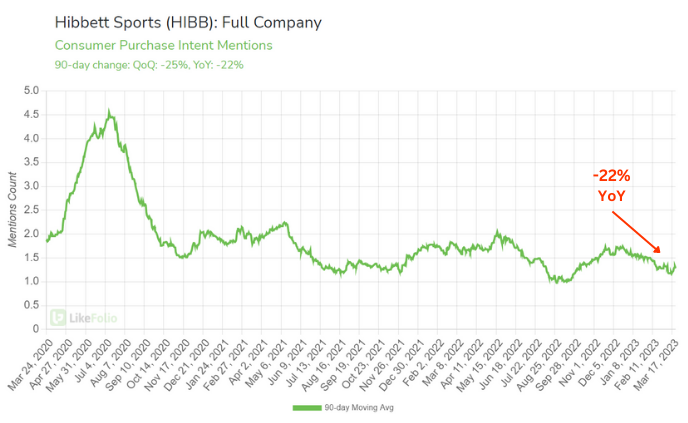

As of today, HIBB Purchase Intent (PI) Mentions are down 22% from last year’s levels — and on pace for their third-worst quarter ever:

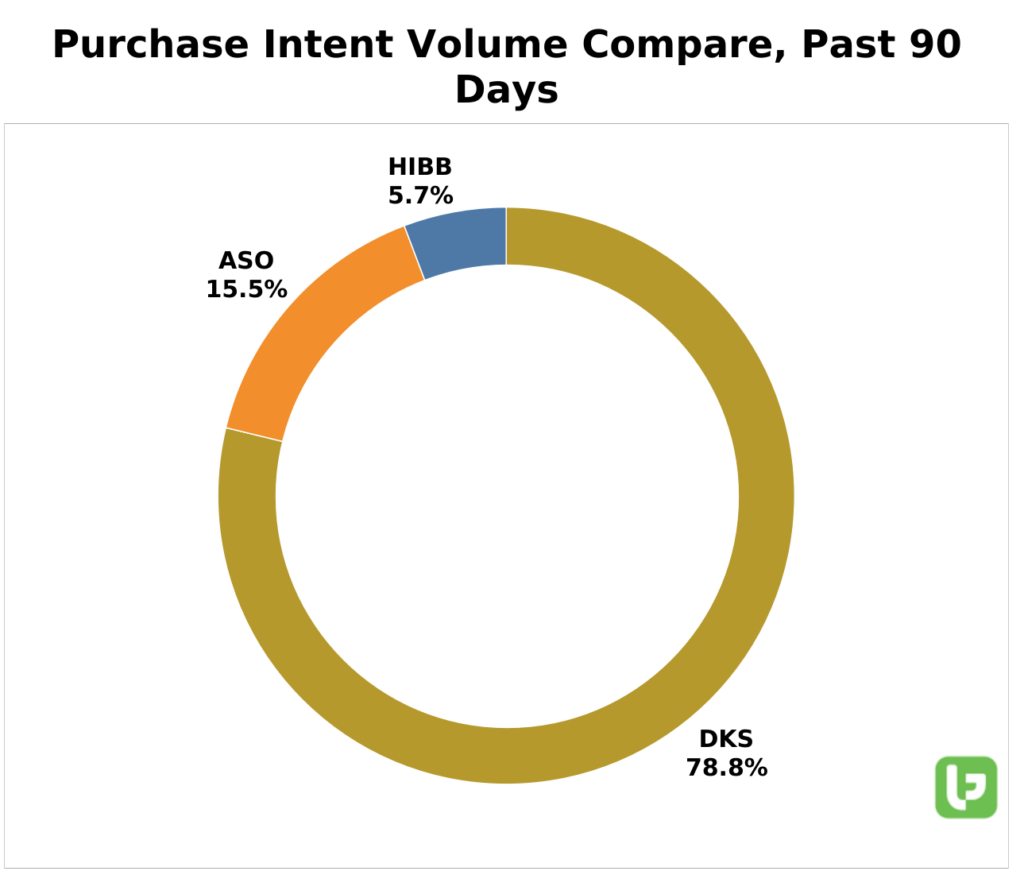

And while Hibbett gets the cold shoulder, shoppers are actually visiting its competitor’s stores and websites more frequently. Purchase Intent volume for Dick’s Sporting Goods and Academy Sports are crushing Hibbett:

Are inflation and higher interest rates having a greater impact on Hibbett’s customers? Buying the latest Jordan kicks and Adidas joggers is getting harder for the company’s low-middle-income customer base.

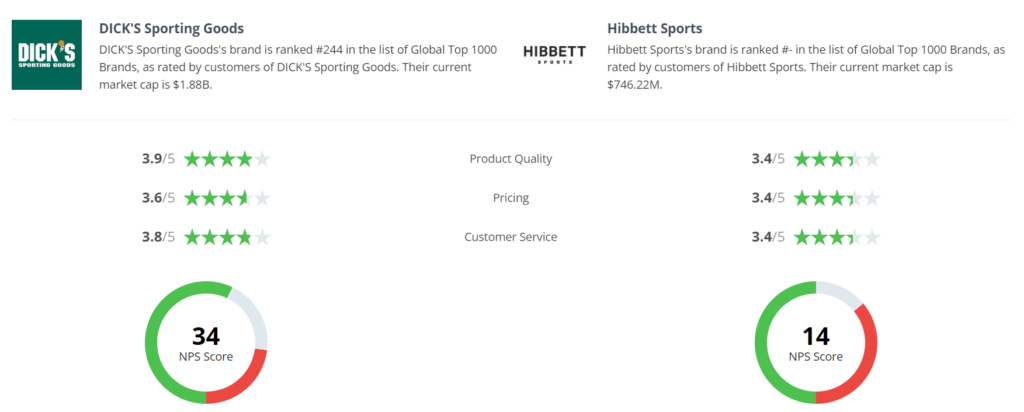

Then again, a recent Comparably survey shows it’s not just the product quality and customer service that customers are finding superior at Dick’s Sporting Goods… It’s the prices, too:

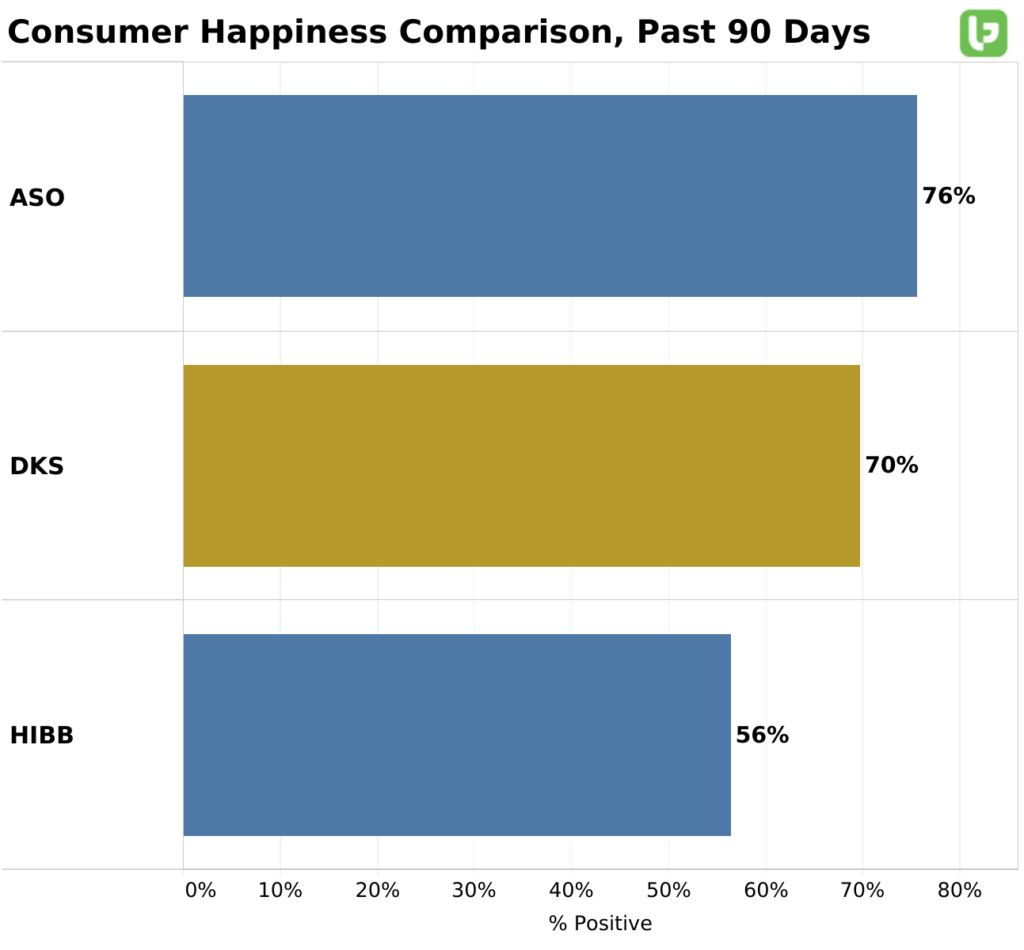

LikeFolio sentiment data confirms that Consumer Happiness levels for Dick’s and Academy Sports are miles ahead of Hibbett, which sits at just 56% positive:

Now, to be fair, Dick’s owns a sizable 14% of the $76 billion U.S. sporting goods market… So gaining market share is already an uphill battle for Hibbett. But with key customer metrics lagging so far behind, that climb just gets steeper and steeper.

And Hibbett’s struggle with cost inflation puts it further behind: For the quarter ended January 31, the company missed on adjusted EPS (earnings per share) due to high freight, fuel, and wage expenses along with increased promotional activity.

Dick’s is facing the same macroeconomic pressures tied to supply chain disruption and a tight labor market. But it’s managing them far better, beating earnings expectations for the last quarter on both revenue ($3.6 billion) and EPS ($2.93).

Looking ahead isn’t much better. Hibbett’s management is anticipating sales growth of 20% or more for each quarter but the same cost pressures are weighing down profit growth.

Consensus FY24 forecasts imply:

- DKS +20% EPS growth 📈

- HIBB -10% EPS growth 📉

Bottom line – HIBB is losing favor with consumers AND struggling with economic headwinds where its competitors are not.

DKS and ASO are both up approximately 20% in 2023 while HIBB lags behind with a 12% loss… And based on LikeFolio data, we wouldn’t be surprised to see HIBB fall even further behind in the athletic gear race.

Until next time,

Andy Swan

Co-Founder