Teladoc (TDOC) was one of those pandemic darlings: It quintupled in value in about a year and a half – and its BetterHelp remote therapy app was a big reason why.

Stuck at home because of the deadly COVID virus (and stressed to the max), about 2.5 million folks were able to access much-needed mental health services – without risking a trip to the doctor’s office.

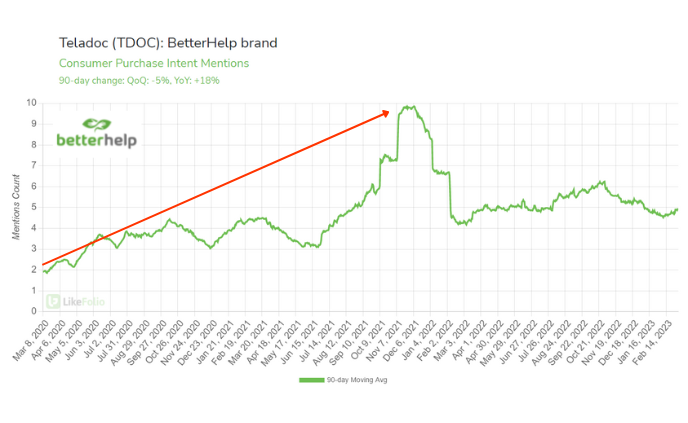

Just take a look at that surge in consumer demand LikeFolio captured in BetterHelp Purchase Intent (PI) Mentions:

That was then, this is now.

That once-stellar BetterHelp brand has been tarnished by a heinous patient betrayal and a Federal Trade Commission (FTC) investigation that could end its pandemic-era dominance – maybe for good.

For the last three years, BetterHelp was allegedly sharing its patients’ sensitive mental health data with companies like Facebook and Snapchat – so those social-media players could cash in on that vulnerability by delivering targeted ads.

All to help Teladoc bolster its own bottom line.

The Prime Directive in healthcare is “first, do no harm.” And a big part of doing no harm is keeping private information private. With BetterHelp’s misdeeds, Teladoc violated that in an unforgivable way.

And it’s now facing the consequences – banned from sharing patient data and hit with a $7.8 million fine to settle the charges.

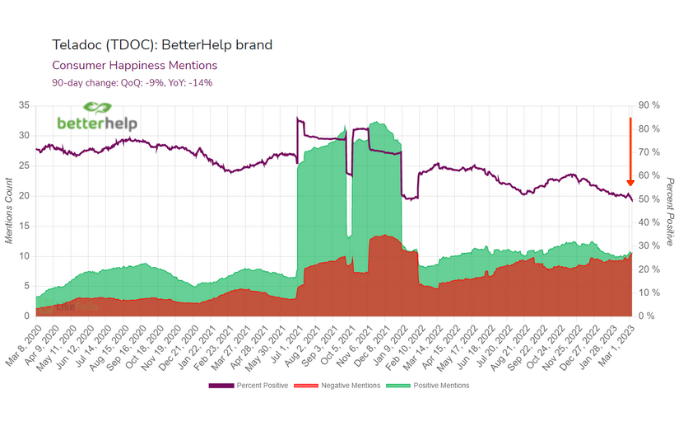

The blowback from BetterHelp users has been visceral. Complaints of poor customer service, high pricing, and unprofessional therapists are rolling in on social media:

And we’re seeing this play out in real-time in LikeFolio data, which shows BetterHelp’s Consumer Happiness sinking by 14 points to where it currently sits at only 49% positive:

Ouch.

But BetterHelp isn’t the only uphill battle Teladoc is fighting.

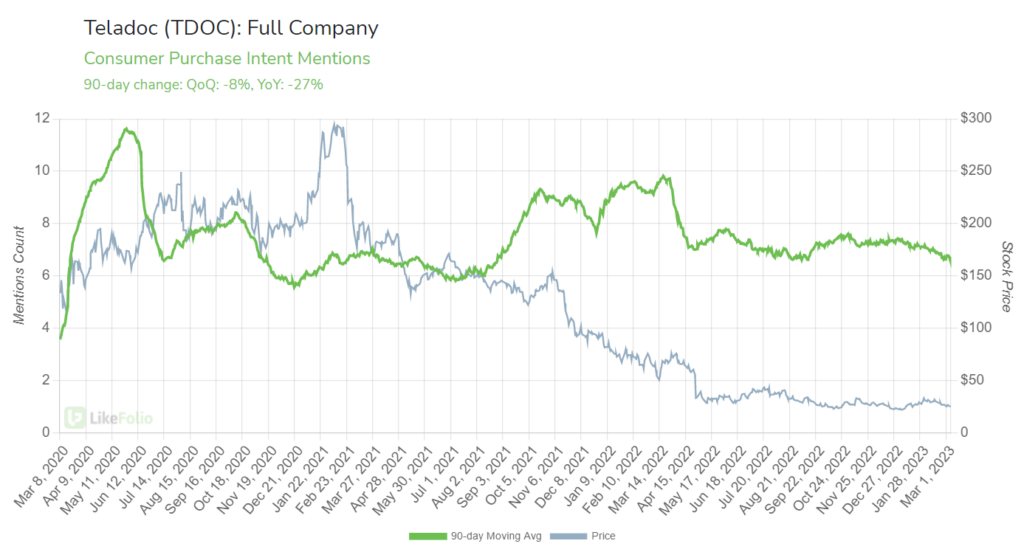

Teladoc demand across all its businesses is fading, particularly among first-time users who are most likely to tweet about their experience.

Our data shows overall demand for Teladoc offerings falling 27% from last year:

And Consumer Happiness Mentions portray a similar skid, slipping 11% since last year.

Here’s why we’re sharing BetterHealth’s rise-and-fall saga…

Right now, we wouldn’t touch Teladoc shares with a 10-foot poll. But the telehealth investment story remains highly bullish.

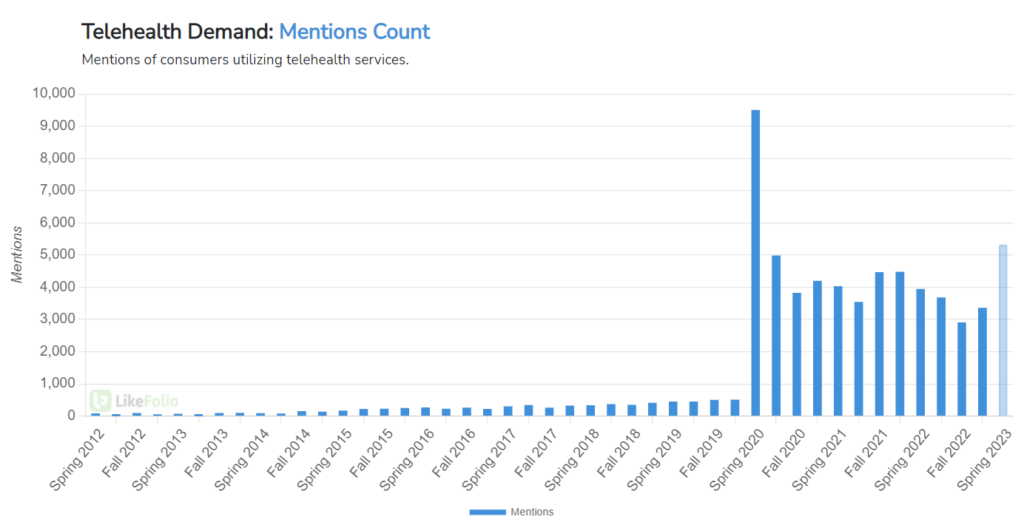

Granted, consumer mentions of virtual health services have eased a lot since their parabolic COVID spike. But they’ve still managed to remain more than 570% higher than where they were in 2019:

Meanwhile, “healthcare is too expensive” mentions are up 14% as consumers continue to struggle with general inflation and rising medical costs.

And with research demonstrating that telehealth appointments are cheaper, on average, than in-person office care, we strongly believe the right telehealth companies have plenty of growth in front of them.

In short: Teladoc’s debacle has kicked open the door for better-run rivals to steal market share.

Let me show you one right now – a player whose surprise move into telehealth this week sent its shares soaring…

Teladoc’s Surprise Challenger

WeightWatchers (WW), aka WW International, is an American icon: Its weight-loss program has been a staple of cable TV commercials since the 1960s.

But this week, with the $106 million acquisition of telehealth provider Sequence, it made a stunning jump into the remote-healthcare space.

The deal caused WW shares to jump more than 50% in a single day:

What’s the big deal?

Sequence gives WW access to a niche digital market of overweight consumers. But more significantly, the acquisition gives WW the ability to connect its users via medical doctors to prescription drugs Ozempic, Wegovy, and Mounjaro.

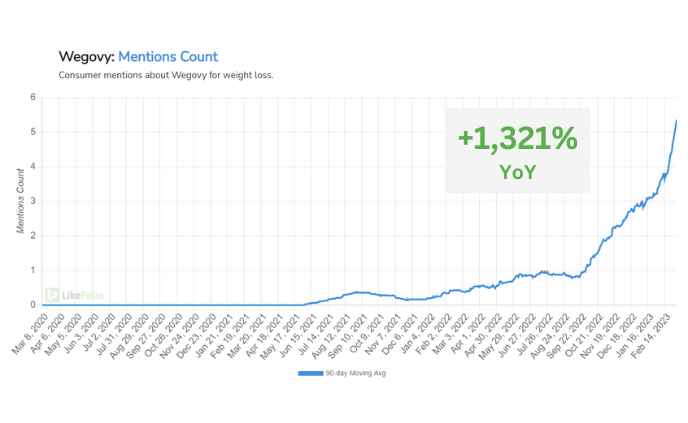

These prescription-weight-loss drugs experienced skyrocketing demand over the last few months. It’s as clear as day in the charts below:

So far, overall Consumer Purchase Intent (PI) for WW is still relatively flat on a year-over-year basis. But we’ve already seen a slight uptick since the announcement:

That’s the beauty of LikeFolio’s real-time data, which powers the insights we bring you here with Derby City Daily.

WW is a company that was ripe for a turnaround – and this acquisition could be just what the doctor ordered.

But there’s another telehealth company at play here – one with even more upside.

And get this… it’s an “underdog” with a much smaller market share – and a bigger potential gain than both Teladoc and WW.

In fact, it can blow both of these rivals out of the water.

It’s one of our favorite high-growth potential opportunities. And we’ll tell you all about it tomorrow…

Stay tuned.

Until then,

Andy Swan

Co-Founder