Here at LikeFolio, we often focus on the singular power of the consumer, whose spending drives nearly 70% of everything that happens in our economy. We tap into that power with our social media-driven insights to help retail investors like you beat Wall Street.

But you, as a retail investor, have your own power.

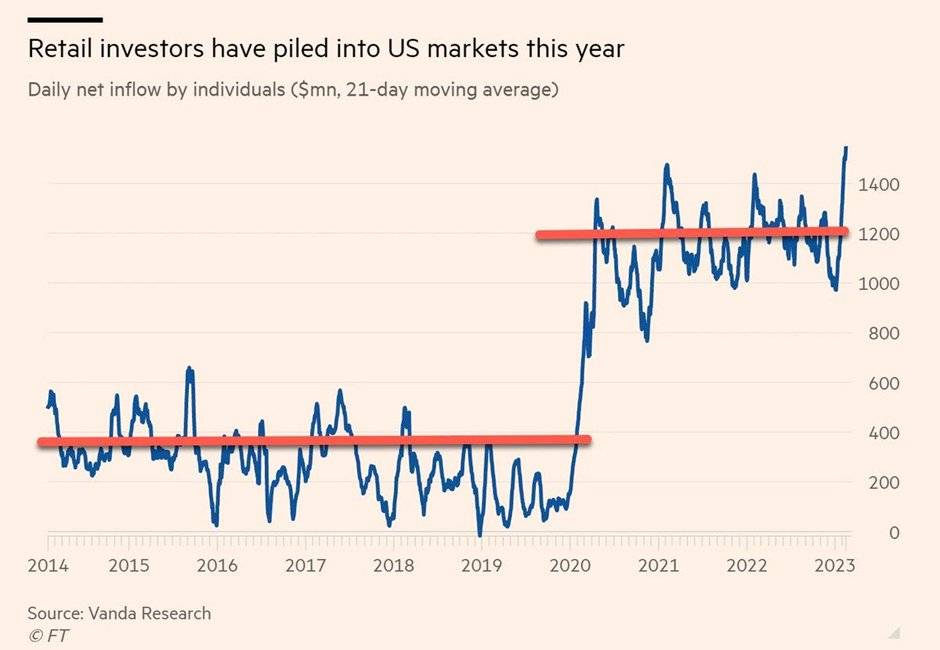

Over the past year, we’ve witnessed an unprecedented influx of retail capital that’s reshaping the investment landscape and creating new opportunities to capitalize on emerging trends.

Take a look.

This Chart Tells the Story:

The chart above puts this “power” into perspective. It shows the daily net inflow by individuals, measured in millions of dollars, on a 21-day moving average.

The sharp increase in retail investment is unmistakable – reaching levels not seen in the past decade.

This surge signifies more than just numbers; it represents a paradigm shift driven by technology, access to information, and your own collective desire for greater financial independence.

Let’s take a closer look at how you can put this power to good use today…

The Drivers Behind the Retail Boom

Social Media and Community

Social media has played a crucial role in this retail renaissance. Platforms like X, Reddit (RDDT), and TikTok have become hubs for financial discourse, where ideas are exchanged and investment strategies are shared.

The rise of communities like r/WallStreetBets has shown the power of collective action, with retail investors banding together to influence stock prices and challenge institutional norms.

And emerging technologies have made trading more accessible than ever before.

Technology and Accessibility

I’m talking about trading platforms like Robinhood (HOOD) and SoFi Technologies (SOFI), which have revolutionized the way individuals engage with the stock market.

Robinhood, with its user-friendly interface and commission-free trading, democratized investing, attracting millions of new users. SoFi, with its comprehensive suite of financial services, made it easier than ever for retail investors to manage their money, trade stocks, and invest in cryptocurrencies.

These platforms are not just capturing market share; they are creating new markets by engaging a demographic previously underrepresented in the investment world.

And they’ve seen tremendous growth as a result.

Economic Factors

The desire for financial independence and wealth creation has driven many to seek opportunities in the stock market. But larger economic conditions are also ushering in this retail boom: Low interest rates and government stimulus measures, for example, have given individuals additional capital to invest over the past few years.

Opportunities for Investors

There are endless opportunities for investors to capitalize on this ongoing influx of retail capital. You can buy shares in the companies that make retail investing possible – those recommendations are reserved for our paid-up members. (You’re welcome to join our ranks at any time. We’d love to have you.)

SoFi is one name we keep coming back to: It has a holistic approach to financial services, providing everything from student loan refinancing to personal loans, and, of course, investing.

The company’s acquisition of Golden Pacific Bancorp was a strategic move to obtain a national bank charter, allowing it to offer even more competitive financial products. We see this name being well-positioned to capture a significant share of the retail investment market… if it can recover its growth momentum. (More on that here.)

But there are also the platforms you can use as a consumer:

- Charles Schwab (SCHW), known for its comprehensive financial services and strong customer support, remains a favorite among retail investors. The acquisition of TD Ameritrade has further strengthened its position.

- Fidelity Investments, another giant in the financial services industry, offers a wide array of investment options and tools, making it a top choice for retail investors.

- Or E*TRADE (acquired by Morgan Stanley), which provides a robust trading platform with a wide range of investment options.

The Bottom Line: It’s Your Time to Shine

The retail investor’s resurgence is not just a fleeting trend; it’s a transformative movement with long-term implications for the U.S. markets.

As technology continues to lower barriers and provide access to financial markets, retail investors will play an increasingly significant role in shaping market dynamics.

The companies offering innovative solutions that empower individuals to take control of their financial futures stand to benefit the most as they help fuel this retail investment boom. We arm our members with the best and brightest of those opportunities, backed by real-time data.

In fact, one of our most recent members-only picks is riding a retail wave as I write this, gaining more than 10% just since the market open. And there are plenty of profits to come.

Stay informed, leverage the tools and platforms available to you, and you’ll be in prime position.

Until next time,

Andy Swan

Founder, LikeFolio