When you hold the keys to a database that tracks consumer metrics on 500 publicly traded companies – and that data can provide insight on whether a stock is due for a breakout or pullback – you get popular. Fast.

Folks love to ask us what LikeFolio data reveals about their favorite brands, the stocks they’re holding, and the investments they’re considering.

But one name that shows up in our inbox more than any other is Apple (AAPL).

And for good reason.

As the top holding in the S&P 500 Index, most investors have at least some exposure to AAPL – whether they own the stock outright or indirectly through an exchange-traded fund (ETF).

As the top smartphone maker in the world, most consumers have some skin in the game, too. They go gaga anytime Apple releases – or even teases – a new product.

The last time we shared an Apple update in our December 13, 2023, issue of Derby City Daily, early LikeFolio data showed demand building on Main Street ahead of the critical holiday season.

But with Apple earnings coming up on February 1, and the Apple Vision Pro release set for February 2, it’s time for another pulse check – to see what LikeFolio data can tell us about the tech behemoth’s prospects in 2024.

We’re here to make money, after all, and what I’m about to share can provide critical insight into how you play this stock from here.

Take a look at the new notes I just got on Apple – straight from the LikeFolio Research Desk…

New Apple (AAPL) Research Notes

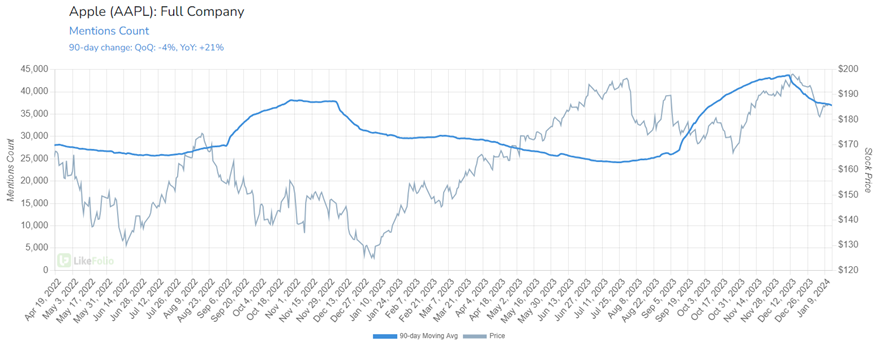

- Overall Apple mentions are up by 21% year over year.

This supports the stock’s bullish 50%-plus run in 2023.

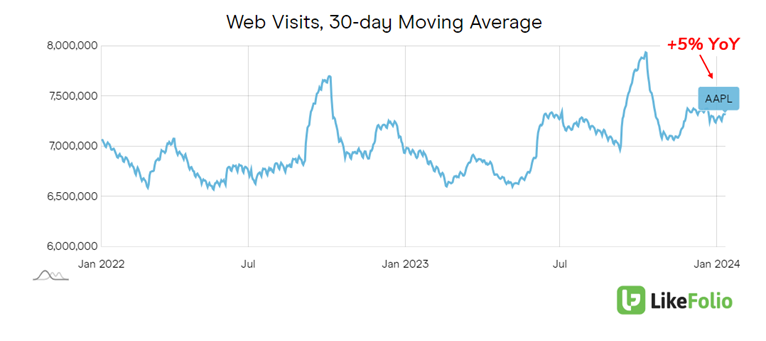

- Web visits are accelerating 5% year over year on a 30-day moving average.

When compared to the 3% year-over-year growth we’re seeing on a 90-day moving average, this indicates that momentum is building.

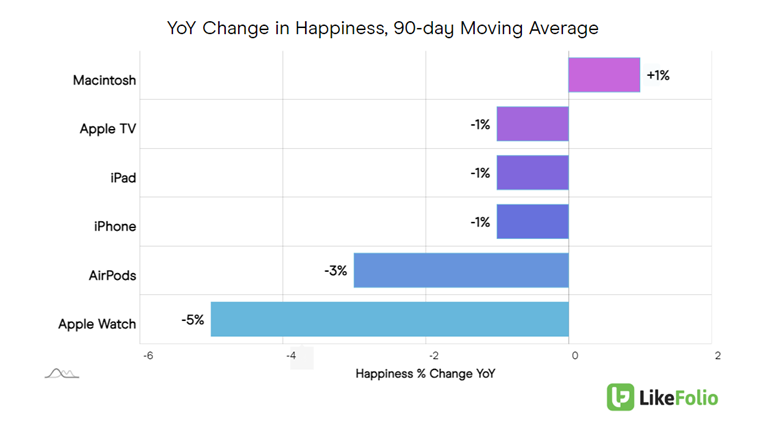

- Consumer Happiness around the Apple Watch has dipped five points year over year, suggesting the recent ban had a real impact on consumer sentiment.

The U.S. moved to ban imports on the Apple Watch Series 9 and Ultra 2 late last year following a patent dispute with medical device manufacturer Masimo. The International Trade Commission (ITC) found that the blood oxygen sensors in these devices infringed on Masimo’s patents, leading Apple to pause sales on December 21, 2023, less than a week before the holiday.

A new update that removes the blood oxygen monitoring capability is expected to allow Apple to circumvent this ban. We’ll be keeping close tabs on this metric for any improvements.

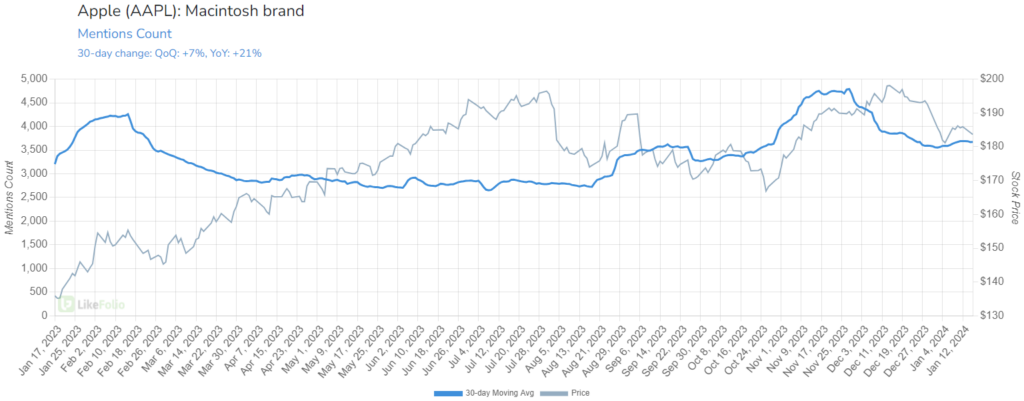

- Mac data looks particularly promising: Consumer Happiness ticked a point higher from last year, while mentions have risen 21% over the same period (on a 30-day moving average).

From a 90-day moving average, Mac mentions data looks even more promising than it did during the holidays, now up 39% year over year (compared to +38% in December).

Time to upgrade those desktops purchased during the pandemic? We’re seeing a recovery in the overall PC market, so this makes sense, and could reflect an unexpected boost from the upgrade cycle.

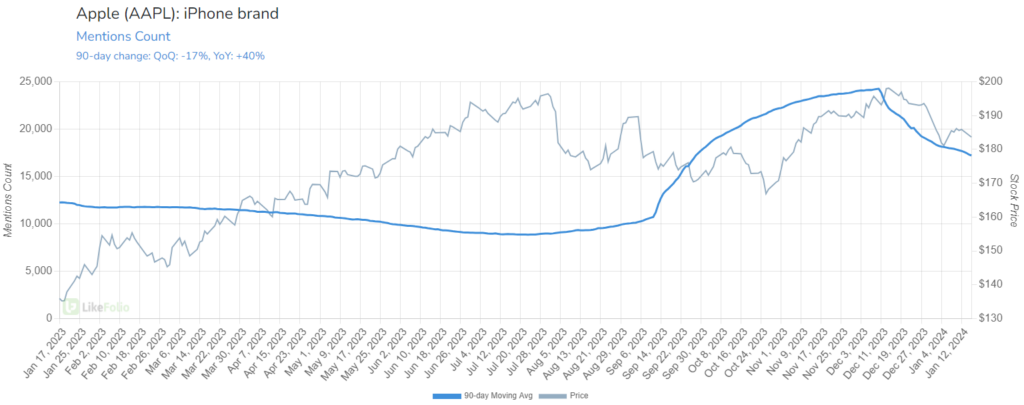

- iPhone data looks strong, despite warnings of lackluster sales from analysts. iPhone mentions are up 40% year over year.

While iPhone Consumer Happiness is down a point, it’s clear that Apple has the U.S. consumer hooked… until something better comes along.

Playing AAPL from Here

Apple is slated to report earnings on February 1, 2024, and the Apple Vision Pro is set to hit shelves the very next day.

Shares are down around 3% since the start of the year. But considering these events could serve as catalysts for AAPL, the near-term pull back looks nice right now.

Depending on how the stock trades over the next two weeks, it may be an excellent setup for a bullish surprise…

Apple always has a way of overdelivering.

Anything could happen between now and then. But one thing’s for sure: When the time comes, Earnings Season Pass members will be armed and ready to play AAPL earnings with our exclusive Earnings Score, analysis, and hand-picked investor and trader strategies.

Current members can expect that exclusive AAPL earnings coverage in their Week 3 Earnings Scorecard on Sunday, January 28.

If you’re not yet a member, you have a chance to change that right now.

Simply click here to get started.

Until next time,

Andy Swan

Founder, LikeFolio