BJ’s Wholesale Club (BJ) is delivering convenience and value to loyal members at just the right time.

The Eastern U.S. warehouse club chain has found a winning lane between traditional grocers and fellow members-only retailers Costco (COST) and Sam’s Club (WMT) by accepting manufacturer coupons, offering smaller package sizes, and stocking a wider assortment of fresh foods.

In the most recent quarter, BJ’s reported its largest quarterly member count growth since the pandemic. Net sales grew 4.4% year over year to $5.09 billion, while membership fees surged 9% to $113.1 million – all beating Wall Street’s expectations.

But its own growth initiatives look to be its Achilles heel. A ramp-up in new store openings (plans for 12 in FY24) put a damper on fiscal-year earnings guidance – and sent shares spiraling.

As the stock struggles to gain traction, we’ve got a close eye on this name.

Here are five reasons BJ’s deserves a place on your moneymaking watchlist – and what we’ll be watching for next…

No. 1: Bulk Stores Are Big Growers

The U.S. warehouse club channel is growing faster than grocery stores and grabbing market share in the process. From 2018 to 2023, clubs grew sales 9.5% annually versus 5.7% for grocery stores.

No. 2: Lower Costs + Fewer Stops = A Winning Formula

Digital conveniences like deli pre-ordering, in-club coupons, and price scan are resonating with BJ’s younger, wealthier customer base. The metro New York City area accounts for almost one-fourth of sales – and digital “Inner Circle” members spend ~90% more than club-only members.

Gas, tires, eyeglasses, wireless plans, and other services are giving hustle-minded Americans more reasons to make BJ’s a one-stop trip.

No. 3: It’s a Good Time to Be in the Deals Business

A basket of 100 brand name products sells for 25% less at BJ’s than at supermarkets. The company’s expanding mix of affordable, more profitable private brands, including Berkley Jensen and Wellsley Farms, represent 25% of sales compared to 10% a decade ago.

Consumers are also enjoying the club’s treasure hunt experience featuring limited-time deals on electronics, furniture, clothes, sporting goods, and gift baskets.

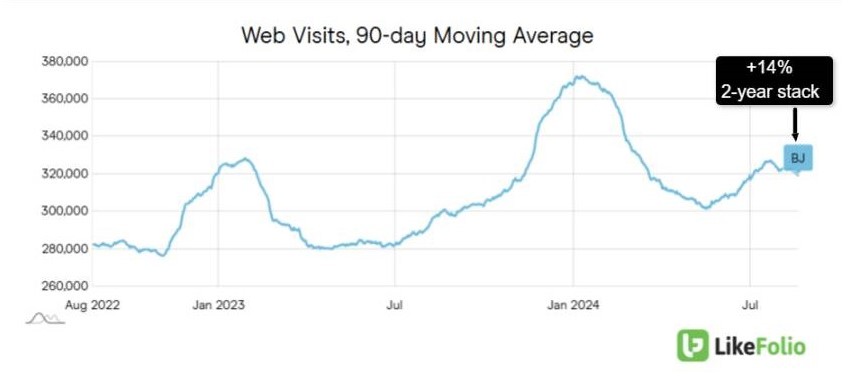

No. 4: BJ’s Digital Strategy Is Driving Customer Traffic

LikeFolio data shows BJ’s website traffic trending higher as consumers discover this growing lineup of money-saving private-label items and time-saving services. Web visits are up 14% on a two-year stack:

No. 5: BJ’s Valuation Is in the Bargain Aisle

In the second quarter, BJ’s digital sales grew 22% year over year, and earnings of $1.09 per share topped expectations. But management guided to the low end of its earnings per share (EPS) range for the full year — prompting the near-sighted selloff of a company that has delivered five straight earnings beats.

At 18x next year’s earnings, BJ trades at a steep discount to COST (49x) and WMT (28x).

What to Watch Next

We’ve got a few months until the company reports earnings again, and we’ll be watching consumer metrics and the stock closely for an opportunity. Members will be the first to know when BJ’s Social Heat Score triggers a buy alert.

In the meantime, check out three other “value” plays on our watchlist for fall right here.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

What’s Next for NVDA After Its Earnings Stumble?

Here’s our new long-term outlook on the “most important stock in the world.”

800% in Two Years: This Apparel Stock Is Beating NVDA’s Gains

And this dip is a perfect opportunity to get in on the action…