Pizza chains use a multitude of promotions and gimmicks to sell more pies. And as the top dog, it stands to reason that Domino’s (DPZ) is king of those promotions.

Whether it’s offering its customers a “tip” in the form of a few bucks off the next order when they tip their drivers… or giving engaged couples the opportunity to set up a wedding registry (yep, that’s a thing)… Domino’s is always thinking of a creative way to sell pies.

But top of mind is always how best to monetize and streamline their day-to-day business and remain the top pizza chain.

Pizza with a Tech Touch

And in the era of AI, keep in mind that Domino’s is a tech company.

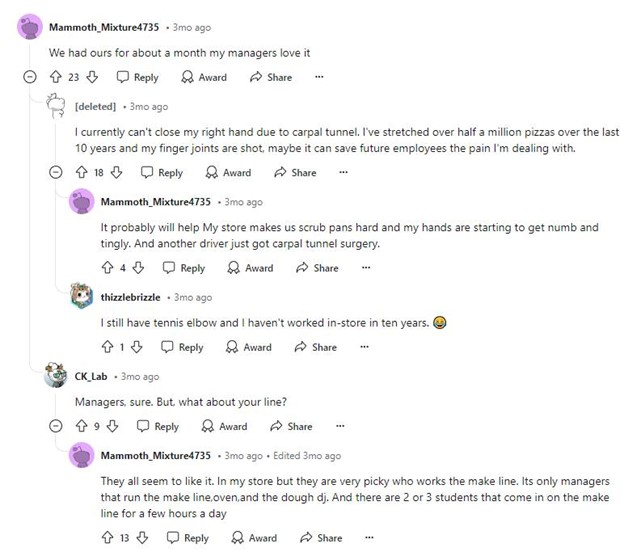

The company rolled out a robotic dough stretcher named DJ this year that is saving time, providing dough consistency, and according to this mention on Reddit, eliminating employees’ repetitive stress injuries:

The consistency point is huge — it’s part of what made McDonald’s (MCD) a sensation. Every time you get a cheeseburger, no matter which store it’s from or who is making it in the back, it tastes the same. Domino’s knows customers crave this predictable experience.

While a robot tosses the dough, AI is ironing things out in the back of the house via its proprietary Dom.OS system that orchestrates the flow of operations as soon as an order is placed.

AI Is in the Mix

Domino’s is also partnering with Microsoft Cloud and Azure OpenAI services to leverage generative AI to facilitate seamless customer ordering, both in-store and on the app. On the back end, Dom.OS enables store personnel to track inventory and schedule staff.

All of these tech improvements, alongside those creative promotions we mentioned earlier, are creating a re-emboldened loyalty base. On its last call, leadership referenced Domino’s “Emergency Pizza” promo in particular, noting:

“Emergency Pizza performed better than any Buy One, Get One Free I’ve done in my career, with a meaningful driver to our comps in both Q4 of ’23 and in Q1. And it not only drove increased orders, but also the acquisitions of members into our loyalty program.” — CEO Russell Weiner

In last week’s quarterly earnings release, Domino’s Rewards was the key driver of strong U.S. comp performance.

As for store openings, the outlook there was less than ideal, so DPZ stock stumbled. But orders, deliveries, and income were all up in Q1. Net income surged 30% from the prior year and global retail sales were up 7.2%.

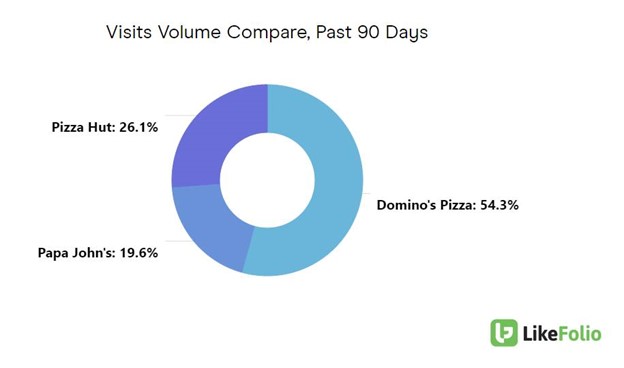

LikeFolio data shows direct web visits to Domino’s are down a bit: -9% YoY. But we also know last quarter, Domino’s benefited from its partnership with Uber (UBER) – finally – and has high app loyalty, which is not necessarily reflected in website traffic.

We also expect DPZ’s focus on tech improvements to continue to bolster the company’s bottom line. But we’re not “buying the dip” just yet.

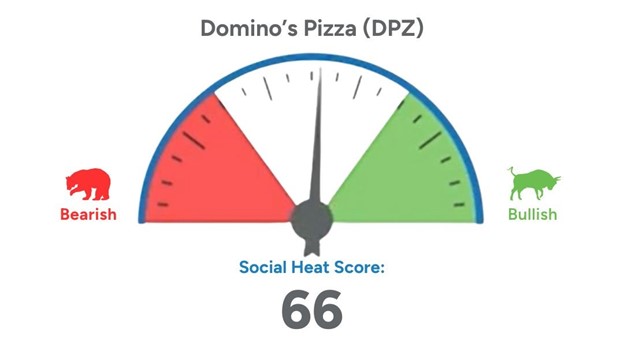

Our stock-picking algorithm puts DPZ right on the verge of bullish, with a Social Heat Score of 66 – neutral.

To issue a trade, we’re looking for stocks to hit the 70 threshold, with 100 being the highest possible score. The Social Heat Score factors in all of the consumer data we have on a company – social media mentions, Consumer Happiness, website visits, even the more “traditional” metrics like stock price performance – and boils it all down into a single number that tells our members where the hottest opportunities lie.

While we are bullish long-term on Domino’s ability to provide customers with value – and all the “Emergency Pizza” their hearts desire — we need to see how it can deliver profits. Keep an eye on DPZ as it scales back new store openings and continues to implement automation and AI to help the bottom line.

In the meantime, I’d love to show you the recent upgrades we’ve been making to the Social Heat Score, leveraging machine learning to improve its targeting accuracy, among other things.

Here’s a brand-new inside look.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed from Derby City Daily this week…