Airlines are having a rough go in 2024, and consumer sentiment has never been worse.

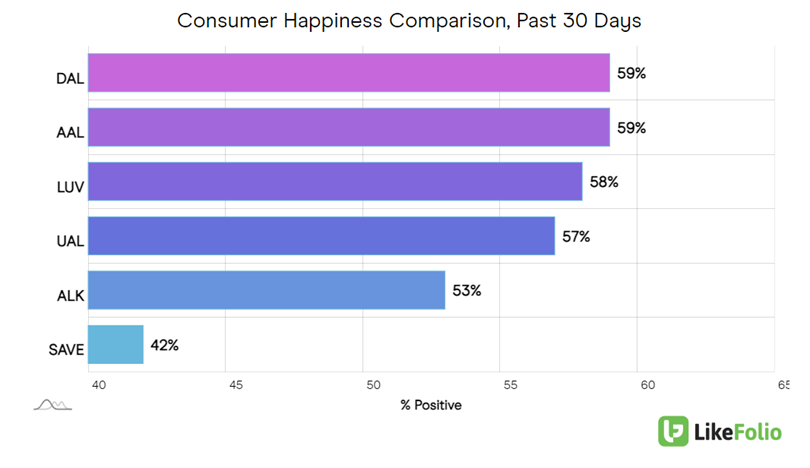

Sure, airlines historically score “low” in Consumer Happiness compared to the rest of the LikeFolio universe.

But right now, the bar is so low that even the “best of breed” isn’t cracking 60% positive on the sentiment scale:

What’s going on?

A Series of Unfortunate Events

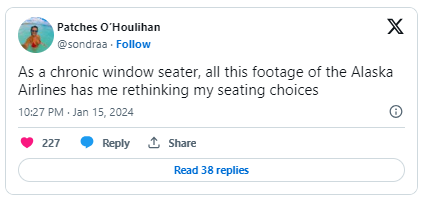

It started with the Alaska Airlines (ALK) Flight 1282 incident on January 5: One of its planes lost a “door plug” mid-flight, tearing open a door-sized hole in the side of the plane at 16,000 feet above sea level while it was carrying hundreds of passengers.

The Boeing 737-9 Max made an emergency landing. And while there were no casualties, the footage captured by terrified passengers was enough to send sentiment and public trust plummeting.

This was a new plane (only eight weeks old). And a commonly used model, at that. The FAA grounded 171 similar Boeing 737-9 planes for immediate inspection. The Boeing Company (BA) shares plummeted just as quickly – currently down more than 17% year to date.

Shortly after, another plane was forced to make an emergency landing due to a door light sensor (and yes, all aboard were triggered).

The United Airlines (UAL) Airbus A319 made an emergency landing at Tampa International Airport – safely and with no injuries reported. The incident occurred because of an open-door light indicator flashing, leading to concerns about a possible door issue.

It was more a precaution than anything else. But less than a week after the first incident, this United grounding could further contribute to concerns regarding the maintenance and safety standards of commercial aircraft.

Meanwhile, Spirit Airlines (SAVE), known for its dirt-cheap fares, is facing a significant setback in its bid to avoid bankruptcy. A federal judge blocked its proposed merger with JetBlue Airways (JBLU) last week, citing concerns over reduced competition. Spirit saw its stock price slashed by more than half on the news.

Spirit and JetBlue filed an appeal on Friday – so the drama isn’t over yet.

But the cumulative impact on consumer sentiment stemming from these events has been so bad that it’s making American Airlines (AAL) look good. AAL traditionally scores at the bottom of the pack in Consumer Happiness. Now, it’s tied for first place at just 59% positive.

A Clear Runway

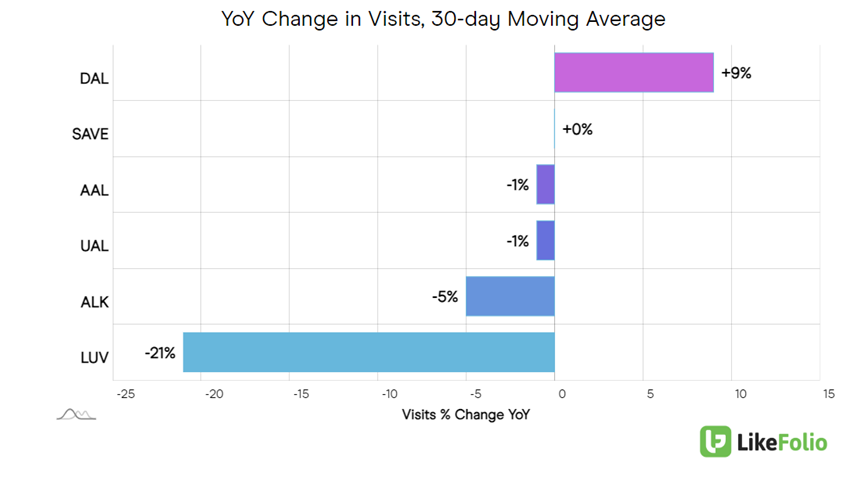

Consumer Happiness is typically LikeFolio’s best indicator for long-term future growth. And right now, the airline industry is so shaken by public safety events and viability concerns that the future bookings of consumers are… pretty much up for grabs.

Website data reveals a clear leader amid the chaos:

Delta Air Lines (DAL) leads with 9% year-over-year growth in web visits, while the rest dip – and Southwest (LUV) trails furthest behind with a 21% decline.

At this point, it’s really Delta’s game to lose.

Airline sentiment might be dismal – but we can show you a tiny AI player rocking 84% Consumer Happiness right now. Considering this metric is a fantastic long-term growth indicator, this could be the best $3 bet you make all year.

Until next time,

Andy Swan

Founder, LikeFolio

📅 Earnings on Deck This Week

AAL, LUV, and ALK are all due to report earnings this Thursday, January 25, 2024, but they’re not the only stocks we’re watching.

Still to come this week: Ethan Allen (ETD), McCormick (MKC), Tesla (TSLA), Sherwin-Williams (SHW), IBM (IBM), Levi (LEVI), Intel (INTC), SoFi Technologies (SOFI)… and we’ll be trading all of them with Earnings Season Pass.

Tesla could be setting up for the biggest surprise, according to our earnings algorithm, and if you act now, you can still get in on our earnings trade of the week for a quick-hit profit opportunity that’ll have you cashing out your profits by Friday.

More Free Insights from Derby City Daily

Stay ahead of the investing curve with free consumer demand insights from Derby City Daily. Here’s what’s new…

Uber Zooms Past Lyft into a League of Its Own

Against all odds, Uber’s bold strategy is… working. Here’s what comes next…

Make Money from New Year’s Resolutions with These 3 Stocks

Add these stocks to your moneymaking watchlist for 2024…