It’s all-out turmoil for American banks right now after Silicon Valley Bank went down and sparked mass panic in the markets.

As of this writing, some $70 billion in stock market value has been wiped from U.S. banks – and that’s just counting Monday’s losses.

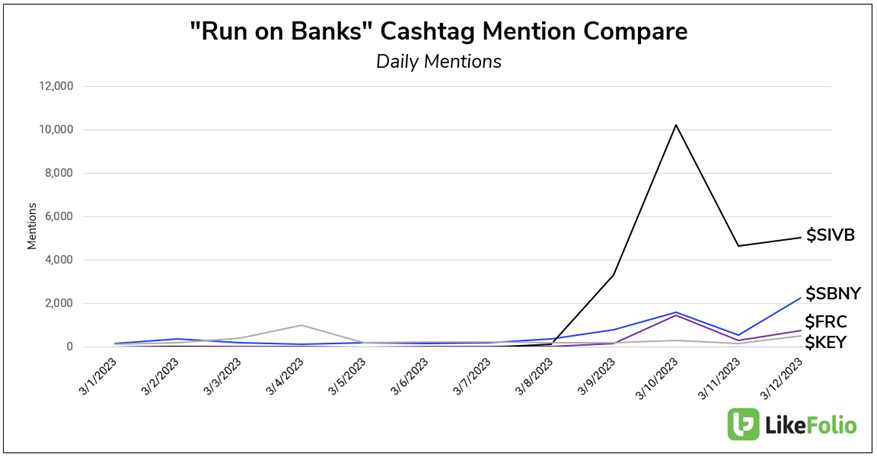

Stock chatter on social media picked up by our consumer insights machine hinted which banks would fail – so far.

It started with unusual upticks around Silicon Valley Bank parent company SVB Financial Group (SIVB) early last week… Just before the stock went into a free-fall that tanked shares from $266.86 to $100 in a matter of hours.

Then, we saw a similar surge in mentions for Signature Bank (SBNY), the New York-based real estate lender that became the next bank to collapse – dropping to zero and entering FDIC receivership by Sunday.

Now, we’re picking up similarly unusual chatter around two other bank stocks that you need to be aware of…

Because it has us asking: Will these names join SIVB and SBNY in the bank graveyard?

Here’s what we know…

Bank Watch: SIVB, SBNY… Could FRC and KEY Be Next?

Right now, we’re keeping close tabs on First Republic Bank (FRC) and KeyCorp (KEY), both of which have each seen their stock prices fall dramatically today on investor concerns about their viability.

As you can see from the chart below, FRC and KEY are experiencing upticks in daily social media mentions – following an eerily similar trend to SIVB and SBNY:

If stock chatter mentions continue to be a leading indicator, we wouldn’t be surprised to see these two banks go under as well.

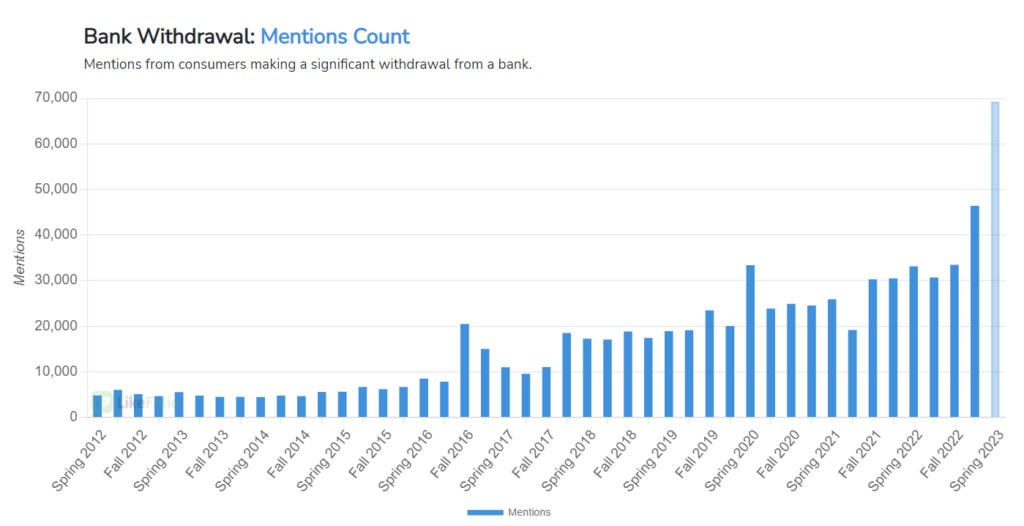

LikeFolio data shows social media mentions of consumers withdrawing their money from banks revving higher over the past week, rising 62% from last year’s levels and 49% from last quarter:

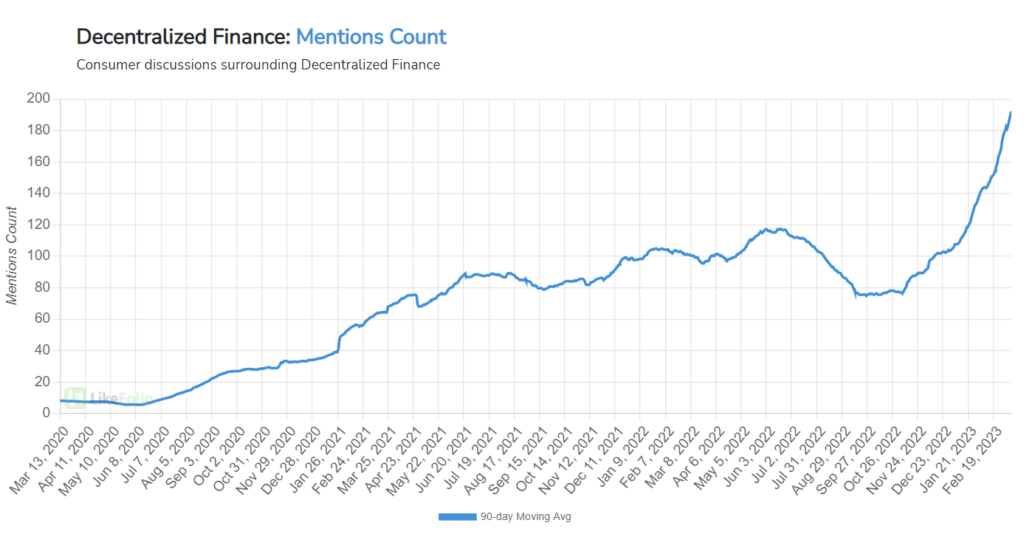

As banks go bust, cryptocurrencies are getting an unexpected boost. Just over the last 24 hours, the price of Bitcoin (BTC) has gained 13%.

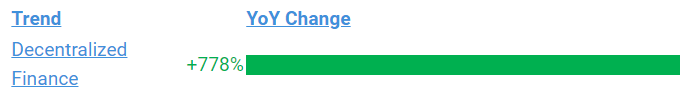

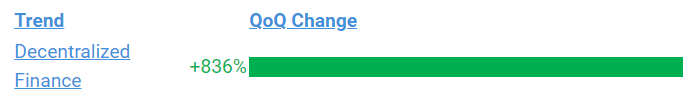

And more broadly, social media mentions around Decentralized Finance (DeFi) are looking red-hot – up 778% from last year and an eye-popping 836% from last quarter:

As a leader in the crypto space, and the only publicly-traded cryptocurrency exchange, could Coinbase (COIN) turn out to be a long-term winner from this shock to the system?

COIN shares have gained over 10% since this morning – and you can bet we’re watching this as an investment opportunity.

We’ll continue to monitor both consumer and investor reactions to the banking sector in real time.

For now, make sure you check out my segment on the TD Ameritrade Network earlier today for more in-depth coverage of the banking turmoil:

Until next time,

Andy Swan

Co-Founder