We don’t want to miss out on a single opportunity to make money, which is why the LikeFolio coverage universe is enormous.

We’re tracking consumer sentiment for nearly 500 companies – mostly public, some private, and even a few cryptocurrencies – and within those companies, thousands of brands.

But just as important to our investment strategy are the trends consumers are buzzing about on social media.

Because those behaviors affect buying decisions, we end up tracking twice as many “macro trends.”

I hear you saying, “But Andy, you can’t trade a consumer macro trend.”

Well, actually – you can… If you’re LikeFolio.

Major shifts in consumer behavior can serve as enormous headwinds or tailwinds for companies operating in related industries, like adding lighter fluid to a fire.

The trend-to-company connection may not seem obvious at first glance.

But when you dig in it’s impossible to ignore.

More importantly, consumer trends are invaluable tools to have on hand when hunting for opportunities.

So today, I’m going to show you how shifting consumer behavior on Main Street helped us spot two investable opportunities that you can take advantage of…

High-Protein Diets = Surging Demand for This Small-Cap Company

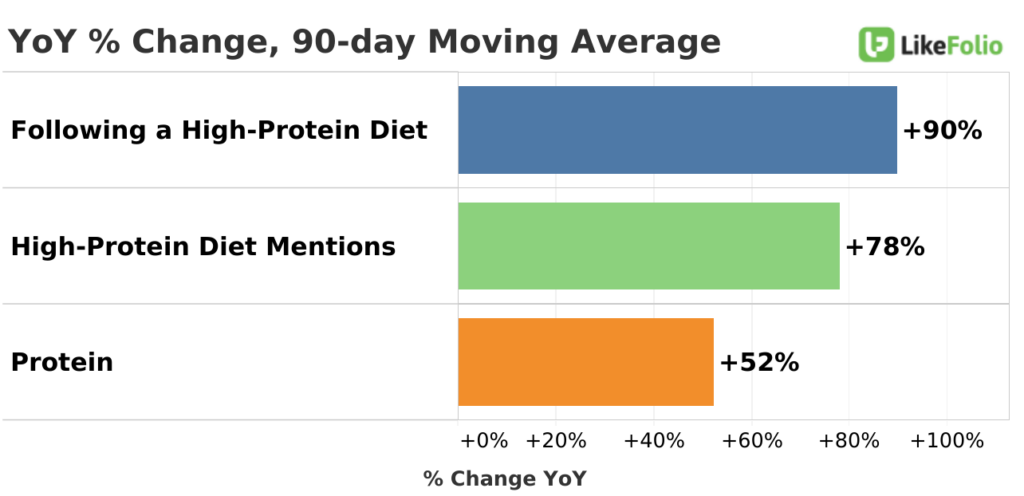

Consumer demand for protein is surging in 2023. Sounds random, I know – but the data doesn’t lie:

Turns out, after a COVID-induced break from eating well, consumers have decided it’s time to rein in their calorie consumption and focus on getting healthy – and with a known affinity for promoting weight loss and health, protein is just the ticket.

As more individuals turn to a protein-rich diet, brands and companies who operate in this space are benefitting in a big way.

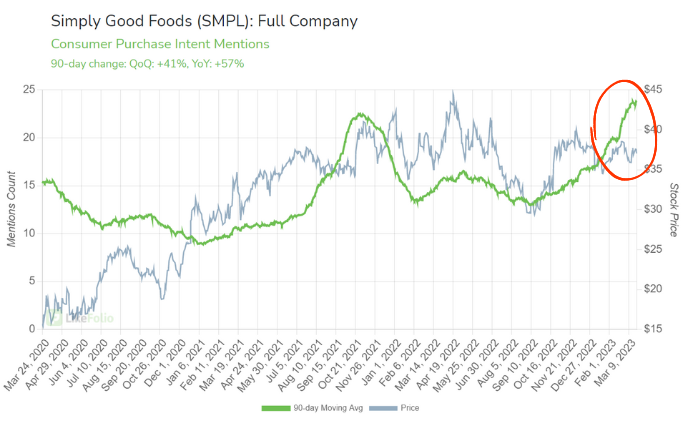

Check out consumer demand for Simply Good Foods (SMPL), the parent company of high-protein snack brands Quest and Atkins:

Demand for Simply Good’s offerings is nearing all-time highs, currently pacing 57% higher compared to last year – and showing signs of acceleration just in time for earnings, which Simply Good Foods will report on April 5 before the bell.

And based on this data, we’re expecting a solid report and even stronger guidance.

Consumers can’t get enough. And as traders, we now have an edge.

While SMPL shares remain flat, we know demand is soaring and supported by positive consumer trends.

The market may be in for a surprise in a few weeks.

Cereal Maker Cashing in on Rising Consumer Focus on… Sleep?

Yes, you read that right: The next company that could benefit from a developing consumer trend toward sleep is a traditional breakfast cereal maker.

Here’s how…

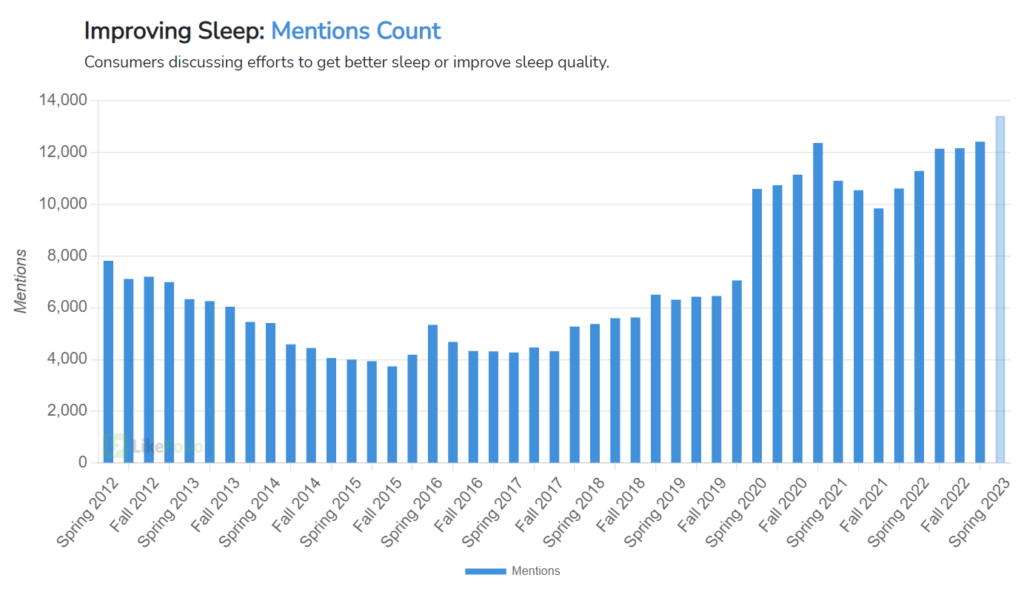

Consumer buzz about improving sleep is at all-time highs, trending 15% higher year-over-year (YoY):

People are trying all kinds of methods to solve their sleeping woes – from taking supplements like Magnesium and Glycine to tiring themselves out with exercise.

But one company realized it could offer consumers an alternative solution: Post (POST), responsible for morning classics like Raisin Bran, just released a line of cereals that consumers can add to their nightly routine in the first cereal of its kind to be marketed as such.

Post’s new cereal looks a lot like a box of sleepy-time tea, and according to the company, contains vitamins and minerals that support natural melatonin production.

The behavior-driven opportunity for traders with POST isn’t as straightforward as SMPL.

Because Post has dozens of brands under its umbrella, it’s unlikely a single cereal brand will materially move the needle.

However, it is an important clue that POST is listening to consumers – specifically to how behaviors are shifting, where their pain points lie, and how it can offer a solution (and therefore increase the odds that consumers will spend money on one of its brands).

That willingness to listen and create products based on demand could serve Post well as it moves into other growing consumer segments, like pet supplies, with its $1.2 billion acquisition of pet food brands from J.M. Smucker.

This is one company that should be on your moneymaking watchlist.

The lesson here: Don’t sleep on consumer trends. Instead, leverage them to spot major opportunities that could be on the horizon.

Until next time,

Andy Swan

Co-Founder