A few weeks ago, I was at a local watering hole when I saw a guy order a Bud Light for his friend.

The whole table burst into laughter.

This prank would have been really odd a few months ago – both were diehard Bud Light loyalists; now, the mere mention of the brand was an insult.

It was a light-hearted moment. But it underscored a serious shift in consumer sentiment toward Bud Light.

I caught up with a bar owner friend in Louisville more recently and learned more of the same:

Usually, he’d have to order five or six kegs of Bud Light for Memorial Day weekend. But this year? He only had to order one.

That’s a significant drop.

And these aren’t one-off instances.

The distaste for Bud Light is happening on a massive scale – and the shift is captured crystal clear in LikeFolio data.

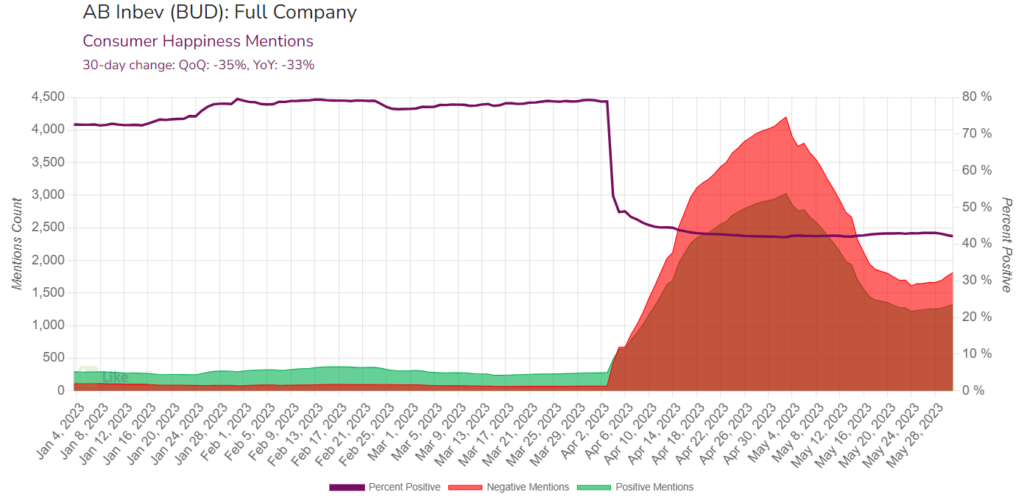

You can see Consumer Happiness levels for Bud Light’s parent company, Anheuser-Busch InBev (BUD), quite literally fall off a cliff in the chart below:

And unfortunately for Bud Light, sentiment is still holding at that new, red level.

The reason consumers have turned on Bud Light is well known by now.

While saying it wanted to promote inclusion through a partnership with trans activist Dylan Mulvaney, the company also down-talked its current clientele by saying it wanted to get away from a “fratty” image with “out of touch” humor.

The brand has faced backlash and boycotts ever since that have significantly impacted its market position.

We’ve been keeping you updated on the fallout and now have a surprising twist to share.

A new “King of Beer” has been crowned – and it’s not Coors (TAP)…

Modelo Takes the Crown

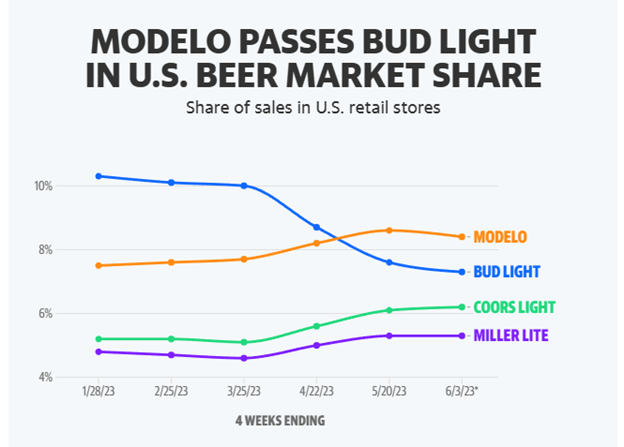

According to new data from consulting firm Bump Williams, Modelo Especial has taken the crown in the U.S. beer market for the four-week period ending June 3…

Pushing Bud Light to the runner-up spot.

Here’s the breakdown:

- Modelo now commands 8.4% of total retail sales in the U.S. beer market.

- Bud Light, on the other hand, is trailing at 7.3%.

This beer battle has also spilled over into the stock market:

- Anheuser-Bush InBev (BUD), the parent company of Bud Light, has seen its shares drop by 5.4% year-to-date.

- Meanwhile, Constellation Brands (STZ), the brewer of Modelo, is toasting to a 6.8% increase in its shares.

Fun fact: While Constellation owns Modelo here in the U.S., its biggest market, AB InBev owns the brand everywhere else it’s sold in the world.

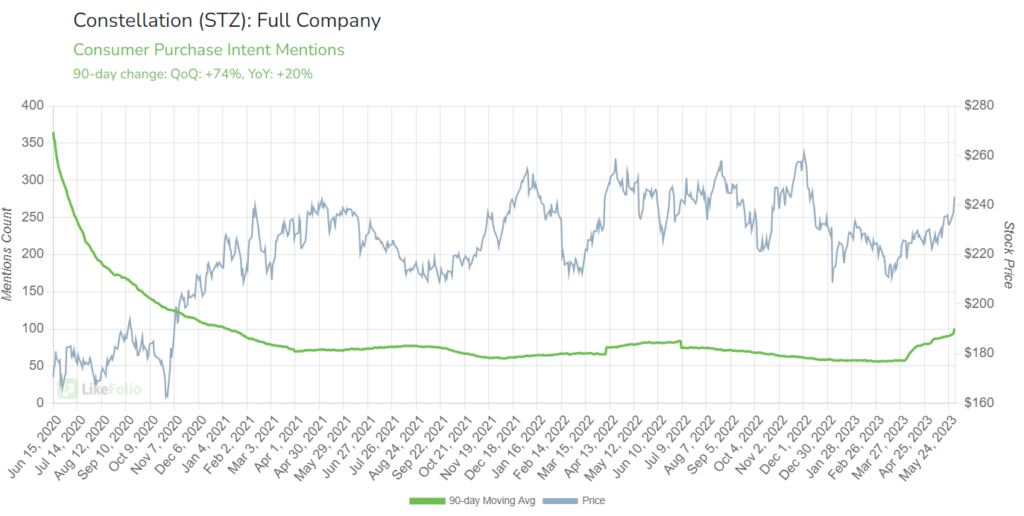

Constellation owns over 100 brands but LikeFolio Purchase Intent data shows overall company demand gaining as much as 74% quarter-over-quarter, while demand for the Modelo Especial brand surges along with it:

As always, we’ll continue to monitor these trends and keep you updated.

It’s an interesting time in the beer market, and we’re excited to see how it unfolds.

Until next time,

Andy Swan

Founder, LikeFolio