The Chipotle Mexican Grill Inc. (CMG) burrito is a staple for a reason, combining fresh ingredients like grilled chicken, spicy roasted salsa, and crisp lettuce with the convenience of fast food – all wrapped into a soft flour tortilla for the perfect “on-the-go” meal.

But have you ever wondered how much of that $15 you spend on a burrito actually contributes to Chipotle’s bottom line?

Understanding the economics of a single burrito is a fascinating case study into how Chipotle does business. It also gives investors critical insight into the company’s potential for sustained profitability and growth.

In the first quarter, the fast-casual Mexican chain delivered $2.7 billion in revenue and diluted earnings per share of $13.01 (up 23.9% from the year prior).

And when you have a clear picture of the cost structure for each $15 burrito sold, you start to understand how Chipotle has accomplished such an impressive feat.

So today, let’s dive into the details and see where your money goes when you buy a burrito from Chipotle.

Breaking Down the $15 Chipotle Burrito 🌯

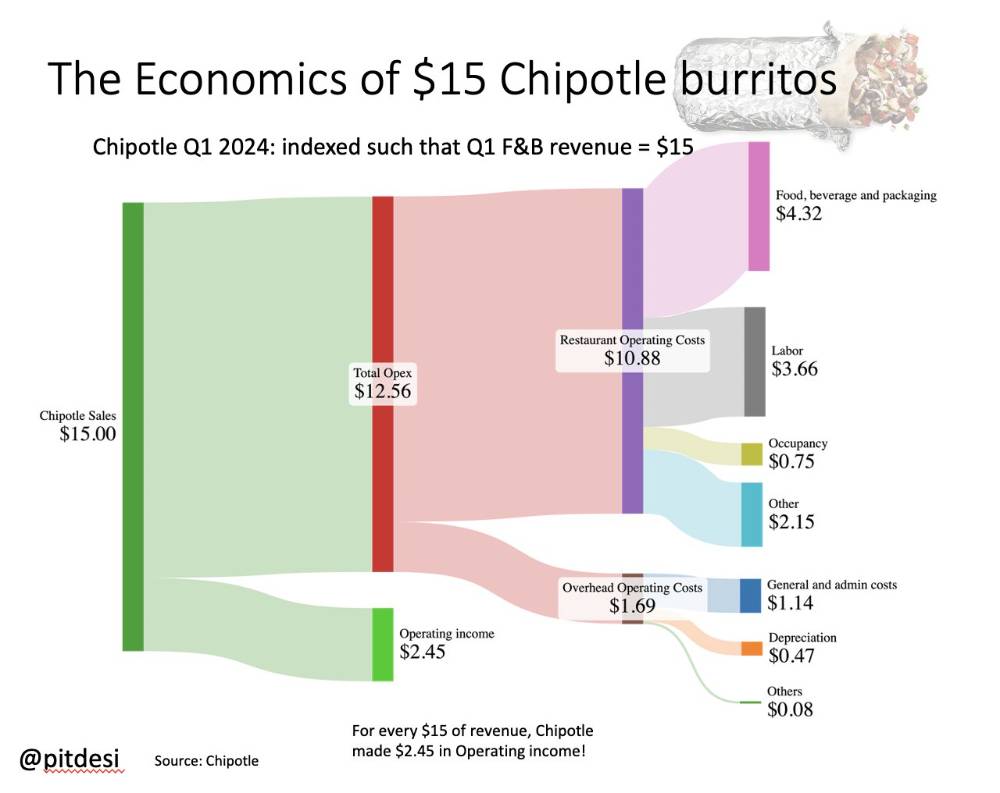

Here’s the detailed breakdown we got from CMG’s last financial report…

- Food, Beverage, and Packaging: $4.32

This covers the cost of ingredients like rice, beans, meat, vegetables, and packaging materials, making up 28.8% of total revenue in the first quarter. Chipotle prides itself on using high-quality, responsibly sourced ingredients, which adds to the overall cost.

- Labor: $3.66

Labor costs include wages for the employees who prepare and serve the food. These costs made up 24.4% of Chipotle’s total revenue in the first quarter. Given the current economic environment, maintaining competitive wages is essential for retaining staff.

- Occupancy: $0.75

This includes rent, utilities, and other occupancy-related expenses, about 5% of CMG’s total revenue. Chipotle’s strategic locations, often in high-traffic areas, come at a premium.

- Other Restaurant Operating Costs: $2.15

These are miscellaneous expenses necessary for running the restaurant, such as supplies, maintenance, and other day-to-day operational costs that make up ~14.3% of Chipotle’s total revenue.

- General and Administrative Costs: $1.14

This category covers corporate overhead, including executive staff salaries, office expenses, and other administrative costs.

- Depreciation: $0.47

Depreciation accounts for the wear and tear on equipment and facilities over time. It’s a non-cash expense but essential for understanding the total cost structure.

- Other Overhead Operating Costs: $1.69

This includes various overheads not covered in the above categories, ensuring smooth restaurant operations.

Total Operating Expenses: ~$12.56

When we sum up all these costs, we get a total operating expense (Opex) of approximately $12.56 for every $15 burrito sold. This leaves an operating income of about $2.45 per burrito.

Operating Income: $2.45

Operating income is the profit Chipotle makes before interest and taxes. It’s a crucial measure of the company’s profitability from its core business operations.

For every $15 a customer spends, Chipotle makes $2.45 in operating income. This translates to a healthy margin, especially in the competitive fast-casual dining sector.

The company’s ability to maintain a strong operating income despite rising costs is a testament to its effective cost management and pricing strategy.

Key Takeaways for Investors

No. 1: High-Quality Ingredients Come at a Cost

Chipotle’s commitment to quality ingredients is evident in the substantial portion of revenue allocated to food, beverage, and packaging. This not only differentiates Chipotle from its competitors but also justifies the premium pricing.

No. 2: Labor Costs Reflect Market Realities

With labor being a significant expense, Chipotle’s strategy to invest in its workforce ensures that it can maintain high service standards, which is crucial for customer satisfaction and retention.

No. 3: Efficient Use of Resources

Despite high occupancy and other operating costs, Chipotle’s ability to generate a solid operating income indicates efficient use of resources and effective cost control measures.

No. 4: Scalability and Profitability

The company’s scalability allows it to spread overhead costs across many locations, enhancing overall profitability. This scalability is a critical factor for long-term growth.

Bottom line: Maintaining this balance between quality, cost control, and efficient operations allows Chipotle to thrive in the fast-casual dining space – even as others succumb to inflationary headwinds.

Next time you enjoy a Chipotle burrito, you can appreciate the intricate economics that make it possible – knowing that with each bite, you’re not just enjoying a meal, but also participating in a well-oiled financial machine that has been meticulously crafted to deliver quality and profitability.

Happy Independence Day. And I hope you have a wonderful long Fourth of July weekend.

Our offices will be closed the rest of this week, but I’ll be sure to deliver another issue of Derby City Daily on Friday to cap off the week.

Until next time,

Andy Swan

Founder, LikeFolio

Get Tom Gentile’s Top 10 AI Stocks (Free)

Legendary trader Tom Gentile doesn’t want you stuck holding the wrong AI stocks when August 1 rolls around – so he’s handing out his list of Top 10 AI Stocks for free. Watch this now to get his picks and hear his urgent warning for investors.

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

Must-Watch Stock: This Firm Hunts Hackers with AI

$12.5 billion was lost to cybercrime in 2023 – but this $20 stock has the AI-powered solution…