We’ve seen massive one-day surges in AI (artificial intelligence) stock prices lately after positive updates from industry players – Nvidia (NVDA) being the prime example.

But online car retailer Carvana (CVNA) didn’t want to be left out of the fun: Shares jolted 35% higher by mid-afternoon Thursday.

The reason?

The company provided Wall Street with a much rosier outlook for the second quarter of 2023.

Carvana reported it now expects EBITDA (earnings before interest, taxes, depreciation, and amortization) to be $50 million, which is massively better than the consensus analyst estimates predicting a $3.6 million loss.

The company also said that gross profit per unit would be more than $6,000 – a record.

This is all much better news than what was shared in the first quarter, when the interest on Carvana’s debt cost the company more than $2,000 per car… and when it recorded a $286 million loss despite gross profit of more than $4,000 for each vehicle sold.

From where Carvana was to where it is today… This is all starting to sound like a true “Comeback Kid” story.

But are investors getting a little ahead of themselves?

Will there still be a profit opportunity here with the massive run-up in the stock price from the past week?

Let’s dive in…

The Bad for Carvana: Weakening Consumer Data

Despite the recent surge in share prices, our data suggests a more cautious outlook is needed for CVNA.

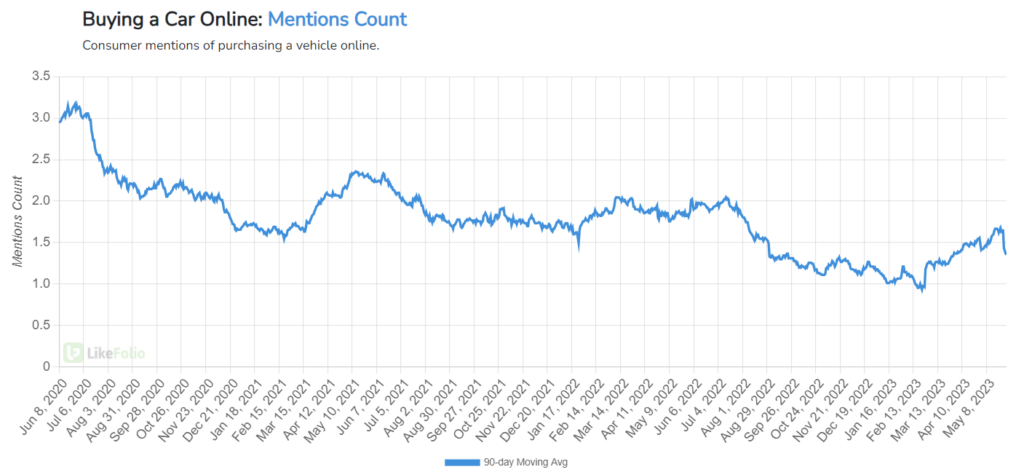

While there’s been a resurgence in online car buying since February, the numbers are still not matching up to the levels we saw in 2021.

Fewer people are talking about buying a car online or having the intention of buying a car online: mentions are down 26% year-over-year.

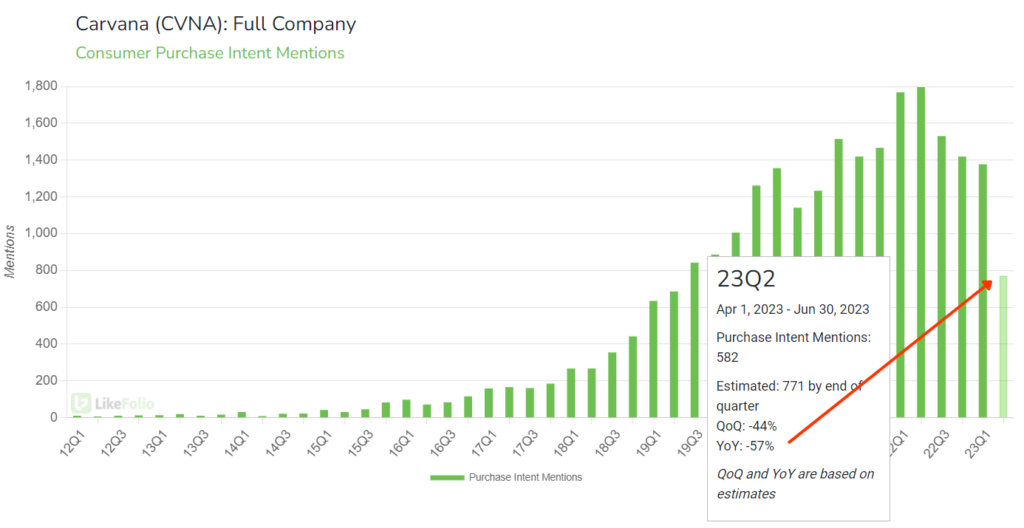

Worse still, our data shows that Purchase Intent mentions for Carvana are pacing over 50% lower in the current quarter compared to one year ago.

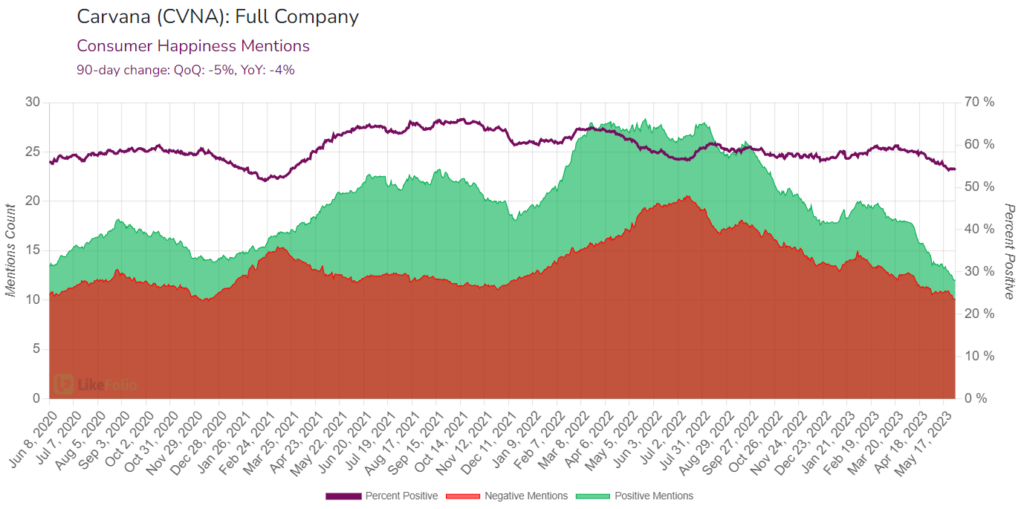

And on top of all of that, Consumer Happiness levels for Carvana have fallen by 5% quarter-over-quarter to just 54%.

Putting all of that information together…

It’s not a great outlook.

But there is a “wildcard” potential scenario out there to keep in mind for CVNA shares.

The Wildcard for Carvana: A Potential Short Squeeze

The “wildcard” in this scenario is the potential for a short squeeze.

A short squeeze is a situation where a stock’s price skyrockets due to high demand and limited supply: a positive feedback loop where higher prices force short-sellers to cover their position by buying shares… sending the price even higher.

To understand the significance of this and what it can do to stock prices, all we need to do is take a step back to 2021.

Remember the GameStop (GME) battle between retail investors and big institutions?

The “Big Money” was betting against GameStop while retail investors – led by the Reddit army – were purposely trying to force those short-sellers to cover their positions.

Interestingly, Bloomberg data shows that 50% of Carvana’s float is short (as of this writing).

Could we be in for another wild ride?

We don’t have a crystal ball, but this is certainly something to watch as it could continue to affect what goes on with the Carvana stock price.

Putting it all together, while Carvana’s recent financial report has stirred up some excitement, and a short squeeze is in the cards, it’s important to look at the data.

And so far, we’re not seeing any reason to jump onto the “comeback story” bandwagon just yet.

But we’ll be watching the data for any future profit opportunities in Carvana’s stock.

Until next time,

Andy Swan

Founder, LikeFolio