Imagine for a moment you’re the head of a company facing imminent bankruptcy: Drowning in debt, facing liquidity issues, and burning through cash at an unsustainable rate.

With interest expenses rising and profitability in question, shares of your company have lost nearly all of their value – plummeting over 98% from their peak… erasing the wealth you spent a decade building.

Even your loyal investors jump ship, doubting your ability to survive as a company. And can you blame them? A growing debt burden exceeding $6 billion is a tough hole to climb out of. Some would say impossible.

That’s the situation Carvana (CVNA) CEO Ernest Garcia III found himself in a few short years ago.

Carvana was the culmination of Garcia’s entrepreneurial dream: A fleet of skyscraper-sized vending machines full of shiny – and very real – cars.

The novel concept landed Garcia a place on Fortune’s 40 Under 40 list in 2017 and made Carvana a Fortune 500 company by 2021.

By 2022, suddenly, it was sink or swim. Take drastic measures or lose everything.

Garcia and his leadership team took aggressive cost-cutting initiatives to right the ship. Workforce reductions, operational efficiencies, and tightening inventory management helped Carvana reduce its expenses by over $1 billion.

In mid-2023, the company negotiated a crucial debt restructuring deal that extended maturities and eased financial pressure, preventing the company from running out of cash.

These actions, combined with an improving used car market and rising consumer demand, laid the foundation for a stunning reversal.

Carvana is back to being profitable. The company has exceeded earnings expectations with triple-digit surprises, forcing many who doubted its viability to reassess. Us included.

At LikeFolio, we bet against Carvana too soon – taking a tough loss on a bearish earnings trade last July. We thought the bar was too high for Carvana to clear. We were wrong.

Carvana taught us a powerful lesson: Don’t bet against the consumer.

We won’t be making that mistake again.

Remember This Age-Old Investing Wisdom

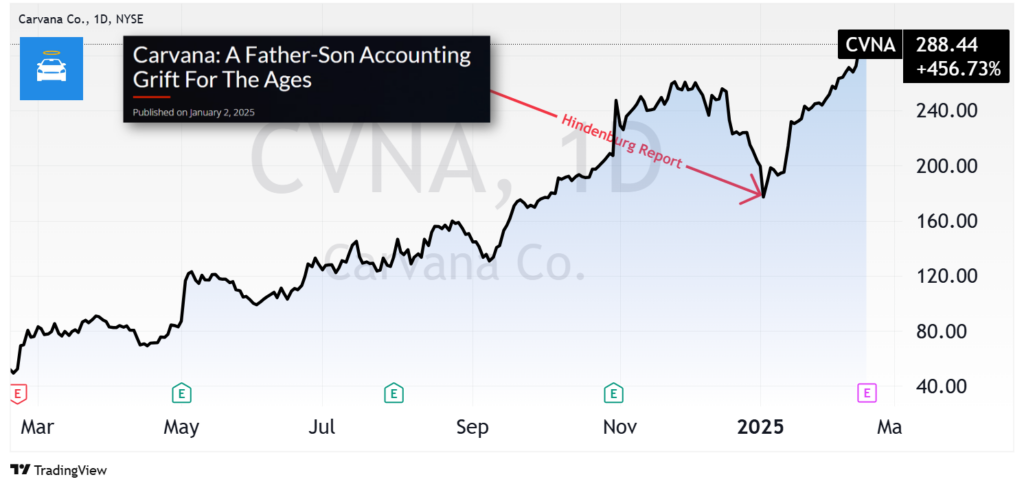

In early January, Hindenburg Research tried to sandbag Carvana with a report that alleged 26% of its gross profit comes from selling customer auto loans to third parties.

“Carvana’s turnaround is a mirage,” the report claimed. It questioned the sustainability of Carvana’s revenue stream, arguing that it masked fundamental weaknesses in the company’s business model.

This wasn’t the first time Garcia’s company was targeted in a short-selling attack. And it likely won’t be the last. Still, concerns over Carvana’s debt load and prior financial struggles led to a sharp decline in the stock:

Carvana swiftly countered Hindenburg’s misleading and biased claims. But for us, there’s only one way to get to the truth – by following LikeFolio’s real-time data.

The next day — as shares continued to fall — we went live on Schwab armed with valuable consumer insights: This time, Carvana was not a name we would bet against. Consumer interest was rising!

Follow the Data. Tune Out the Rest.

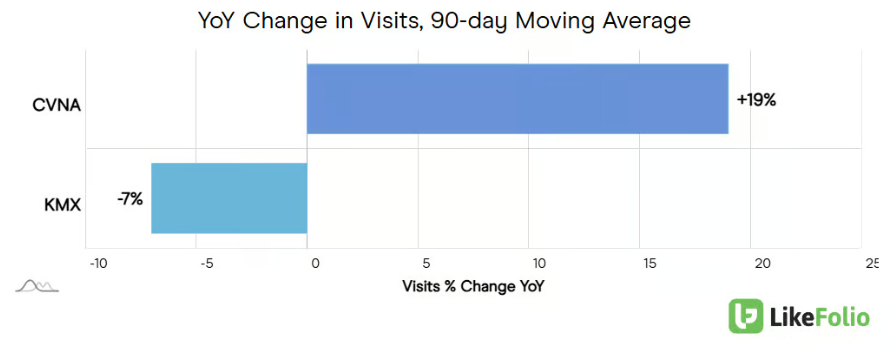

Our data confirms CVNA is effectively stealing market share from its larger used-car peer, CarMax (KMX). Carvana’s web traffic is up 19% year over year compared to CarMax’s 7% decline:

Increased engagement signals growing demand. More visitors translate to more transactions, reinforcing Carvana’s growth trajectory.

The company is also earning more per sale. Carvana’s gross profit per unit has improved 24% year over year to $7,427, far outpacing CarMax’s $2,306 per retail unit and $1,015 per wholesale unit.

This ability to maximize per-unit profitability through pricing optimization and cost efficiency sets Carvana apart from competitors.

“With just 1% share in an enormous market, significant capacity to support growth, and a business that generates positive feedback as it scales, we are just getting started,” Garcia noted on its last earnings call.

Fast forward a month and some change… CVNA shares are up 63% (and Hindenburg Research has been disbanded).

Following the data paid off.

Carvana has proven its ability to attract consumer eyeballs. Consumer demand is holding strong, and operational execution continues to drive results. Expectations are high. But given the company’s track record over the past year, another surprise isn’t out of the question.

Bottom line: Betting against Carvana has not worked well in the past. And until the consumer data shifts, we see no reason to change course.

Tune out the noise. Follow the data. And don’t bet against the consumer.

Remember this age-old wisdom – and consult LikeFolio’s data – before you hit the buy or sell button on ANY investment, and you’ll find success.

Until next time,

Andy Swan

Founder, LikeFolio

Discover More Free Insights from Derby City Daily

Here’s what you may have missed…

These Luxury Retail Trends Bode Well for ONON and LULU

Despite concerns about a slowing consumer, the latest earnings reports show high-end shoppers are still spending…

Shopify’s Next Growth Era: AI-Powered Commerce

Shopify is leveling the commerce playing field with AI – and changing the game for good. Here’s how…