Cutting my teeth at TD Ameritrade, I quickly learned that Main Street investors normally had just one move when it comes to breaking news – overreact.

It’s not a surprise since investing and finance largely leave you to your own devices and have you stumbling along… hopefully learning from your bumps and bruises to make better decisions along the way.

But some people never do.

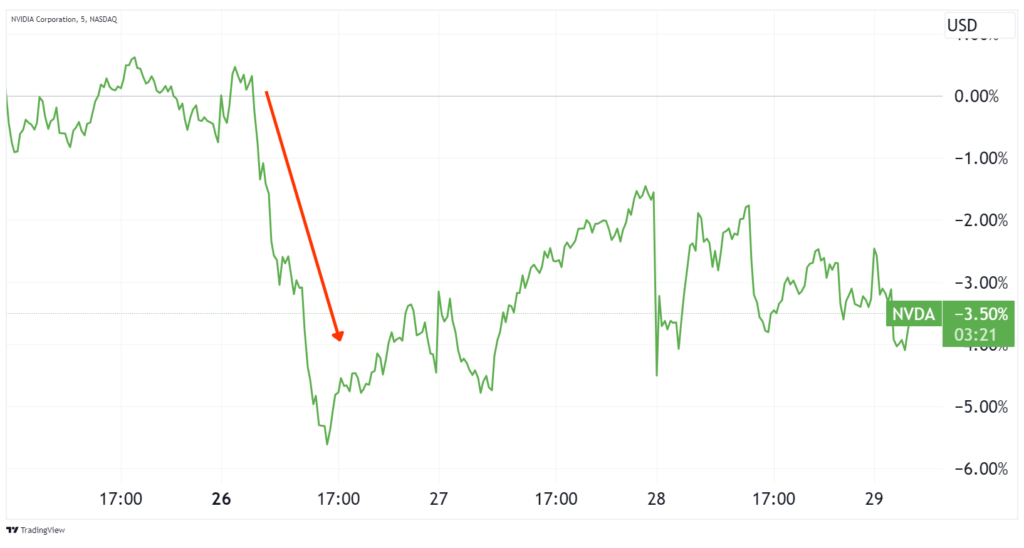

I saw that “overreacting mindset” go into full swing recently when the news headlines were dominated by the United States government potentially creating export restrictions on artificial intelligence (AI) chips to China.

And when it came to the AI-chip superstar Nvidia (NVDA) and the $7.1 billion in revenue it attributed to China and Hong Kong in 2022, folks started to panic-sell their shares.

Earlier restrictions about the chips that could be shipped to China had already been announced in September. Nvidia found a way around that rule by essentially creating “workaround” chips that fell below the performance thresholds created by the United States Commerce Department.

But these new restrictions – which could be released at some point in July – could potentially even ban those workaround chips.

Again.

I understand the knee-jerk reaction that followed the news.

It’s natural.

But I have a much different view.

The minor tumble AI chipmakers like Nvidia faced wasn’t a negative event – it was a light-shining moment on the tremendous power and potential of AI technology.

Just take a look at the incredible investment opportunities AI has already created… And keep in mind: We’re just getting started…

The Future of AI Is Still Shining Bright

Think about this.

AI is so groundbreaking…

So transformational…

A true once-in-a-lifetime moment…

That it’s now a matter of national security.

Don’t think for a second that these restrictions are a death sentence for growth; they’re simply a sign of the rapid rise of a technology that’s upending industry norms.

AI is weaving itself into the fabric of our digital existence.

From the algorithms that curate our social media timelines to the voice assistants that keep our lives in order to the predictive analytics driving business strategy…

AI is omnipresent.

And as it continues to evolve, it’s paving the way for a gold rush of investment opportunities.

If this moment doesn’t spell “investment potential” in neon lights, I’m not sure what does. And of course, myself and the rest of the team will be here to guide you through the bright spots to make money and the traps to avoid.

Just like we have been with some of our most recent reports:

- Video Game Industry Levels up with AI Upgrade

- PATH Is a Must-Watch AI Stock

- Elon Musk’s AI Vision Is Taking Shape

- Nvidia’s Rally Ignites AI: 4 Other Stocks to Watch

The Bottom Line

We’ll still be following what happens with this potential ban.

But rest assured: While this short-term news event may send AI chip stock prices a bit lower, the long-term outlook is still bullish.

Extremely bullish.

It’s not the time to panic and hide in the corner.

This is the era of AI… and we’ll be here to show you how to make it your own personal era of wealth.

Until next time,

Andy Swan

Founder, LikeFolio