Here’s a little critical thinking exercise to think about for today: Let’s say you own a company and everyone loves your product but that product is getting more expensive to manufacture.

You pass those costs on to consumers, as you know they are loyal and willing to pay just a little bit more.

They accept the price hikes and you don’t see a meaningful drop in business.

However, at what point will increasing prices start costing you customers who turn to a cheaper alternative?

How far are you willing to push the envelope?

Well, for many “big brand” food companies, that isn’t a critical thinking exercise: Many have been unwilling to give up their elevated product prices in favor of profits and are pushing their luck.

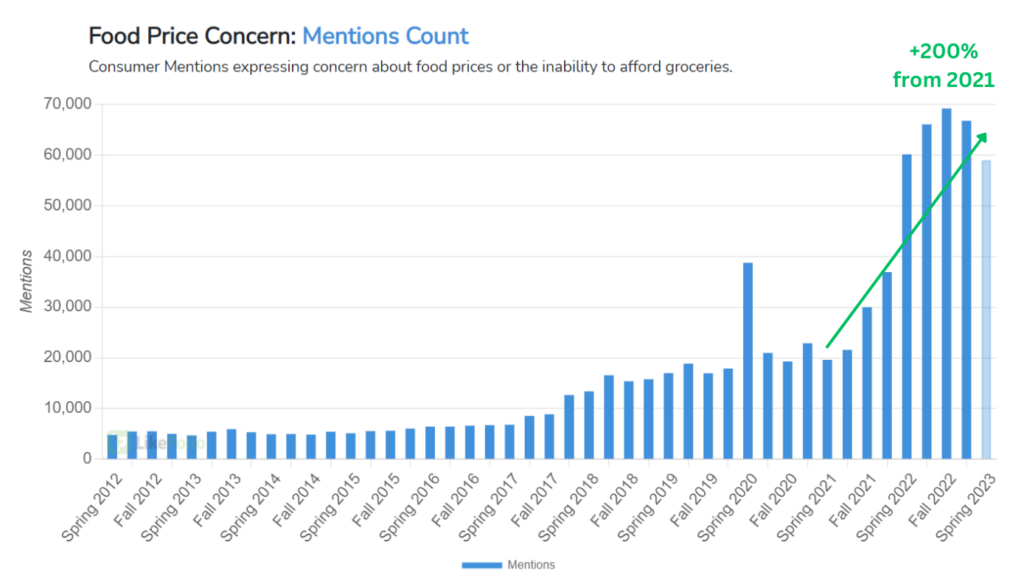

And consumers are largely fed up. Over the last two years, social media posts expressing concern over the price of food have increased a stunning 200%:

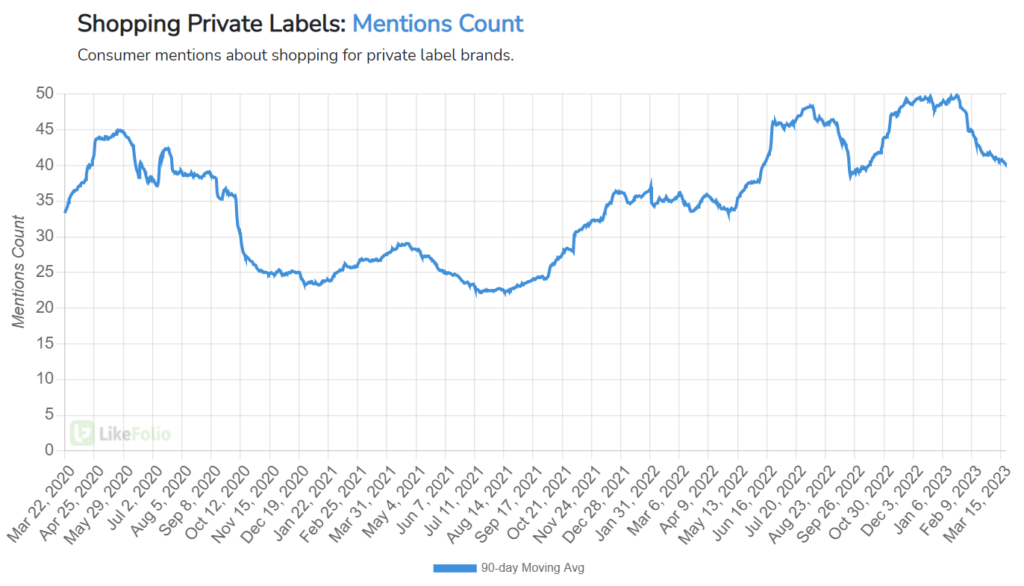

In correlation, social media buzz about shopping for private-label (aka generic) brands is pacing 20% higher after reaching all-time highs at the start of 2023:

So, where does that leave big, iconic brands?

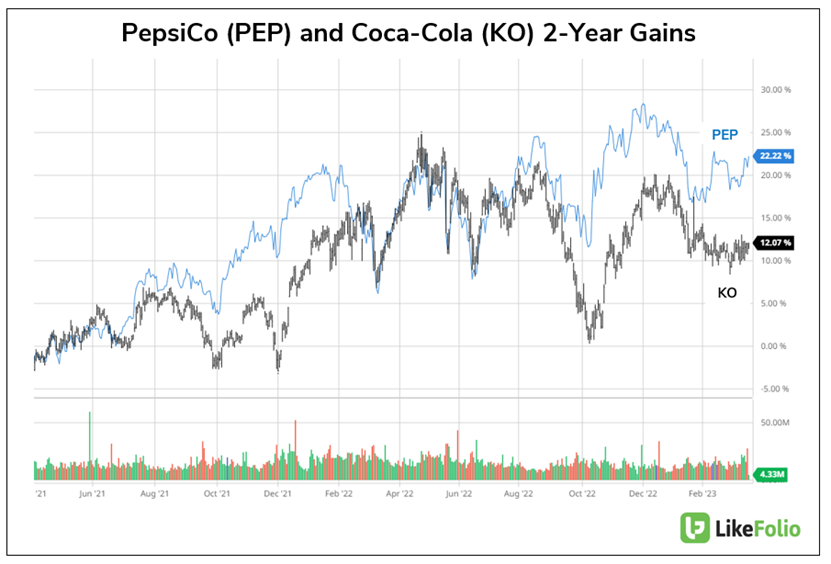

Household names like Pepsi (PEP) and Coca-Cola (KO) have become accustomed to customers paying more – and their share prices have climbed right along with those increases.

PEP and KO have both posted double-digit gains (+22% and +12% respectively) over the last two years:

But again, how much are consumers willing to take?

Each company is betting on different paths: Coke is going to raise prices in 2023 while Pepsi is putting a pause on price hikes.

So, will people continue to buy Coke products, or will the price hikes send them to other alternatives?

Will Pepsi win over Coke fans, or will they get hit hard without raising prices?

KO or PEP? Drum roll, please…

One of These Consumer Staples Is the Better Buy

On the surface, Coca-Cola and Pepsi are quite similar.

From a consumer perspective, their soft drink offerings are virtually identical: Coke vs. Pepsi, Dr. Pepper vs. Pibb Xtra, Mello Yello vs. Mountain Dew… And the parallels go well beyond the soda fountain.

Where Pepsi owns Tropicana orange juice, Coca-Cola owns Simply Orange. Where Coca-Cola has Powerade, Pepsi has Gatorade. Where Pepsi offers IZZE, Coca-Cola offers FUZE. The list goes on and on.

From an investor perspective, PEP and KO both offer steady returns with dividend payouts to boot.

But Pepsi diverges in one key way: Its product offerings have extended beyond the refrigerated section and into the snack aisle since its 1965 acquisition of Frito-Lay.

Until now, Pepsi’s snacking division – and therefore its proclivity to pass along price increases to consumers – has helped PEP shares outperform KO (as you saw above).

But that may not be playing in Pepsi’s favor…

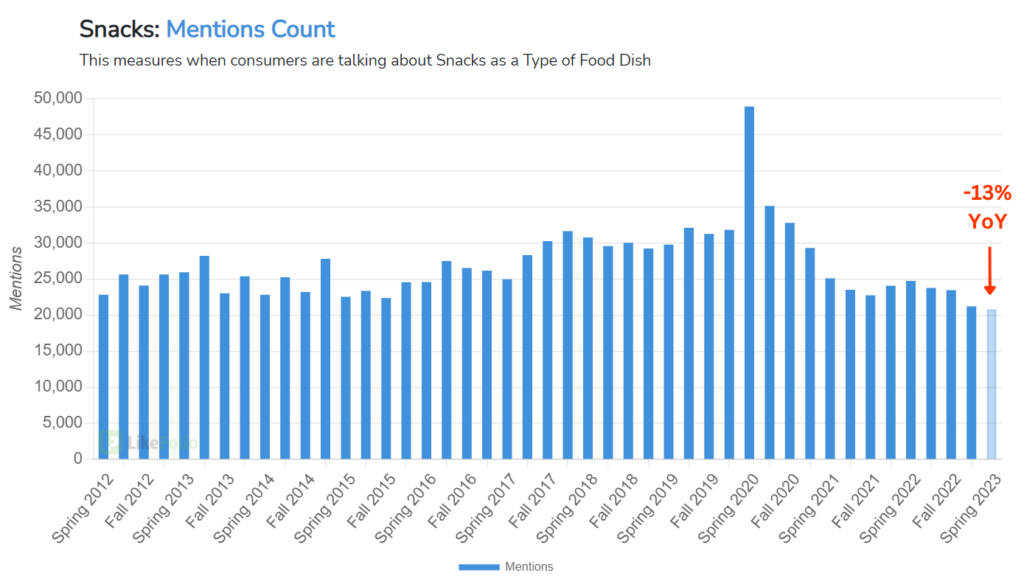

Snacking mentions on social media have slipped by 13% YoY:

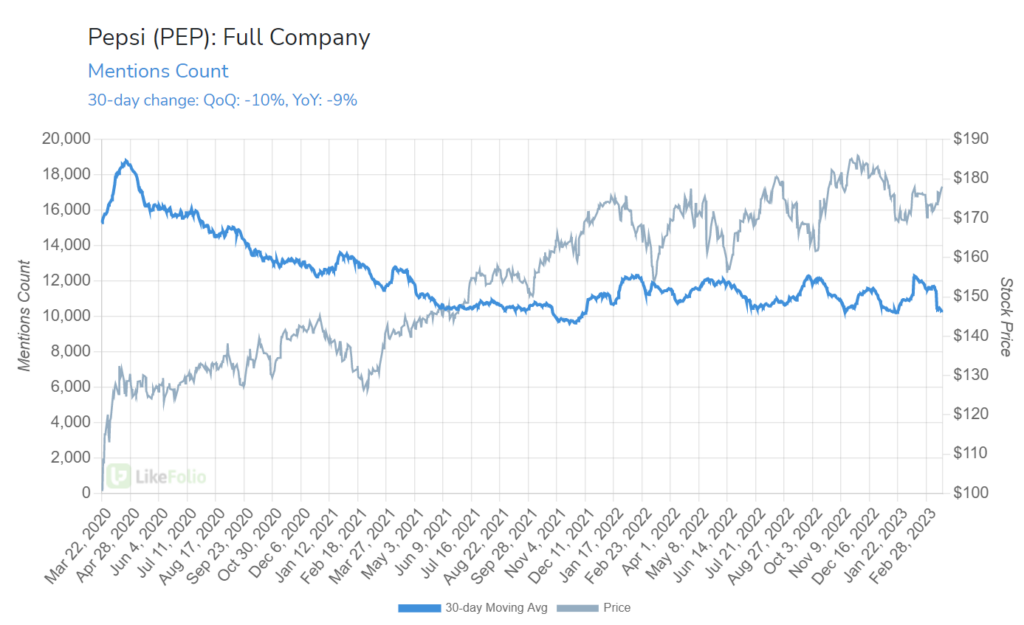

And consumer mentions of Pepsi products are sliding, too, currently sitting 9% lower than last year’s levels on a 30-day moving average:

In its most recent quarterly earnings report, Pepsi acknowledged its elevated pricing plan was hindering consumer demand as volume fell 2% across its foods business worldwide.

But LikeFolio data reveals a more persistent problem: Other than outlier PopCorners, demand is waning across Pepsi’s snack brands.

Quaker Consumer Purchase Intent (PI) Mentions have slipped 17% along with some of its most iconic junk foods, which have fallen by double-digits:

Pepsi expects its brand power to remain resilient in the near term. But at LikeFolio, we’ve got a close eye on consumer sentiment, which shows the balance of power may be shifting away from Pepsi faster than it realizes.

Consumer Happiness levels are consistent for Pepsi at 70% positive, putting it right on par with Coca-Cola.

Two years ago, though, Pepsi had a solid three-point edge.

And as Pepsi shows signs of weakness, Coca-Cola’s branding power just keeps growing stronger…

Coca-Cola’s Brand Power

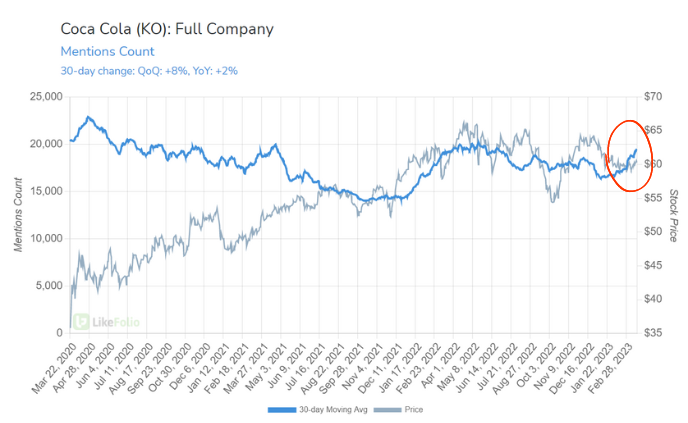

During the same period when Pepsi buzz slid 9%, Coca-Cola buzz climbed 2%. On a quarterly basis, Coca-Cola mentions have increased by an even steeper 8%:

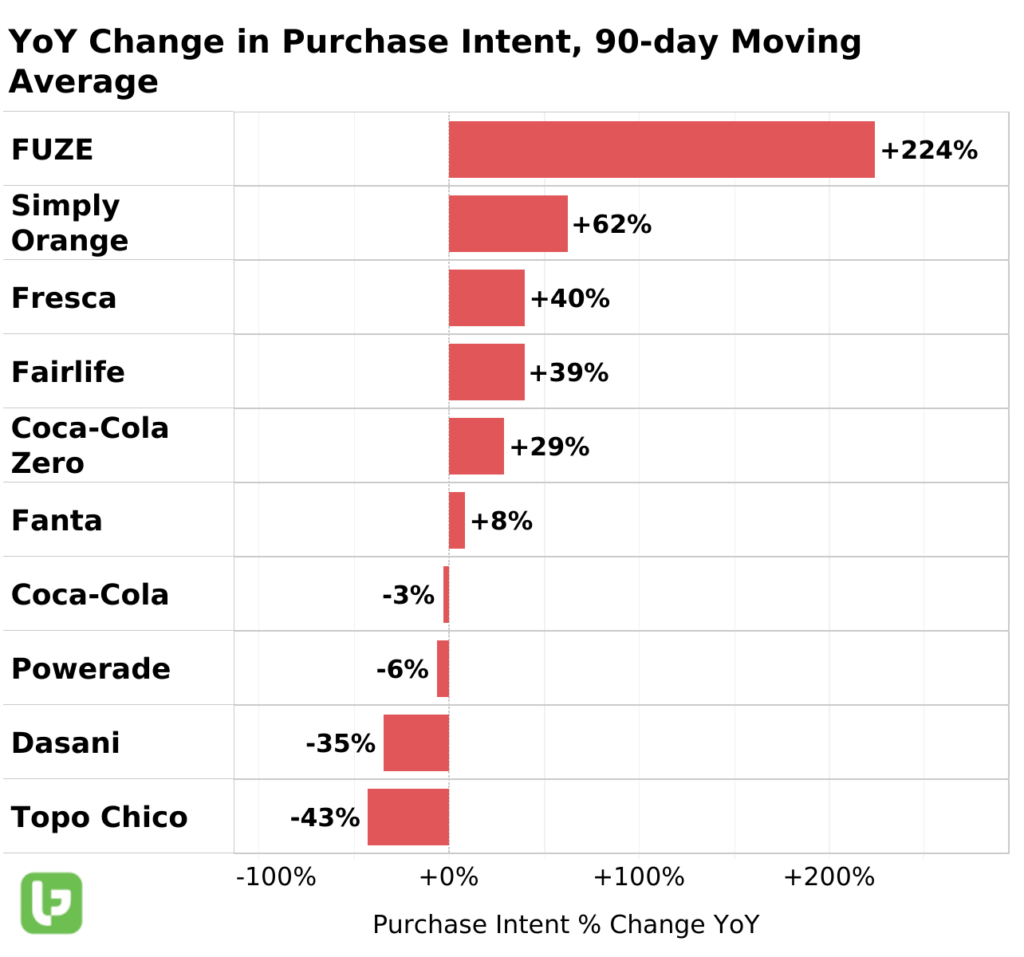

Compared to similar beverage offerings from Pepsi, demand for Coca-Cola brands like FUZE (+224%), Simply Orange (+62%), Fresca (+40%), Fairlife (+39%), and Coke Zero (+29%) are all seeing notable spikes in demand in 2023:

Demand for Coke-Owned Brands

Demand for Pepsi-Owned Brands

It’s not that Coca-Cola is spared from the same inflation-driven problems plaguing Pepsi…

Last quarter, higher prices translated to a 1% drop in volume for Coke products.

It’s that Coca-Cola’s long-term strategy focuses on maintaining volume growth and price mix thanks to affordability measures.

“Within the RGM [revenue growth management], we have, as one of our objectives, to maintain consumers within our franchise by leveraging our pricing and packaging strategies to support affordability around the world to keep the lower — perhaps lower-income consumers in the franchise… We prefer that as a strategy than to have more price and less volume. So, again, our central view is to see continued level of unit case growth in the second half with obviously a moderating price/mix to get to the overall revenue.”

– James Quincey, Chairman and Chief Executive Officer, Q4 2022 Earnings Call

And from what we’re seeing, that strategy is paying off:

- Coca-Cola has closed the three-point happiness gap with Pepsi over the last two years, a long-term bullish tailwind.

- Pepsi’s consumer buzz is dropping at a steeper clip than Coca-Cola’s as consumers show less interest in snacking (-13% YoY) and more interest in private label brands (+20% YoY).

- And when it comes to operating margins, KO has the edge: Coca-Cola’s operating margin was roughly 29% of sales in 2022 compared to Pepsi’s 13%.

Together, we believe these factors could translate to a larger long-term opportunity for KO versus PEP in 2023.

We’ll be monitoring for continued signs of volume slides and any sentiment degradation through the end of the first quarter to see if the playing field shifts.

But for now, Coca-Cola (KO) wins this round.

Until next time,

Andy Swan

Co-Founder